[ad_1]

Current weeks have seen the Federal Reserve monitoring the impacts of its fee hikes intently, with chatter round chance of an ever-impending recession.

Homebase information from the US and Canada exhibits that, regardless of regulators’ finest efforts, wages have continued to rise at SMBs.

In financial circumstances the place forecasts and expectations can change seemingly each day, real-time information on exercise throughout North American companies exhibits that hotter climate is bringing consumers and diners out and about. Homebase seeks to know how the broader financial surroundings is affecting small companies and their staff throughout the starting of Q2 by analyzing behavioral information from greater than two million staff working at multiple hundred thousand SMBs.

Abstract of findings: From wages to financial exercise, issues have heated up a bit at small companies – however not essentially throughout the board.

- Employment progress is behind historic seasonal traits; SMBs have proven a modest progress in employment metrics; pushed by service-sector companies, month-to-month traits aren’t fairly as rosy as we’ve seen in earlier years.

- Service sectors noticed a return to employment progress. Workers working elevated within the leisure trade (+3.0%), however trended down for caregiving and hospitality (-1.4% and -1.1%, respectively), reversing latest traits.

- Regionally, the Northeast has seen the very best progress. This follows an unseasonably heat winter and spring.

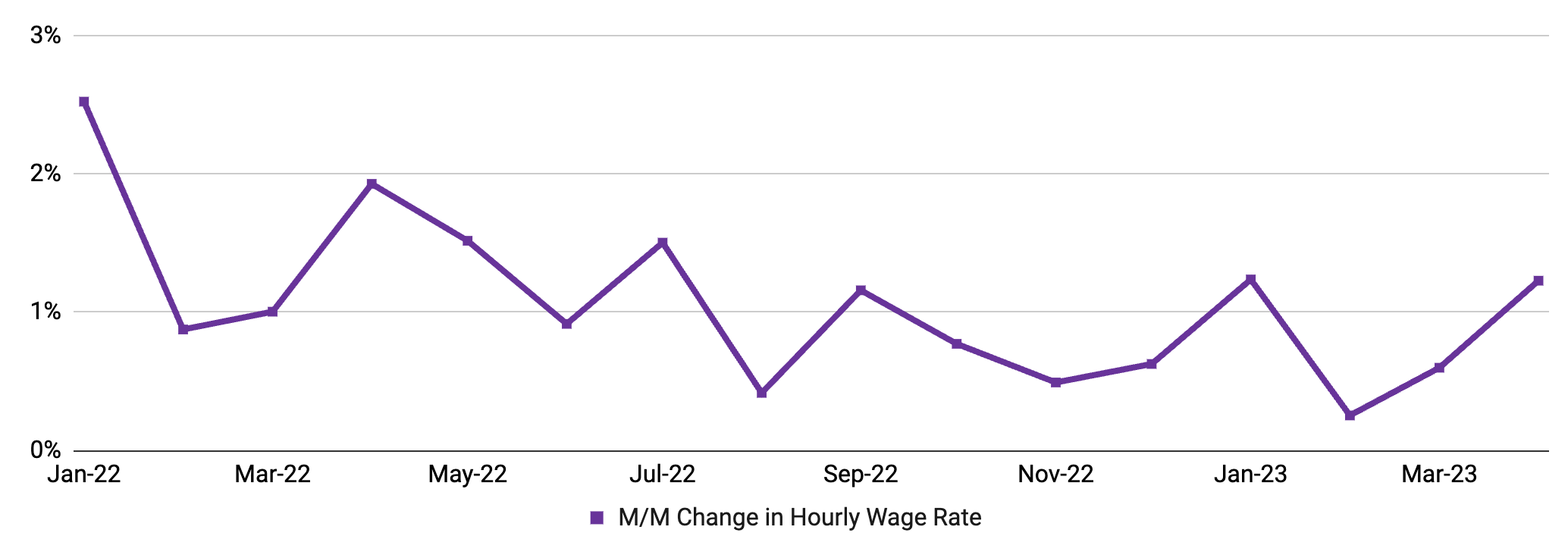

- Wage inflation elevated from March, leaping 1.23% m/m regardless of efforts from fiscal policymakers to curb its progress.

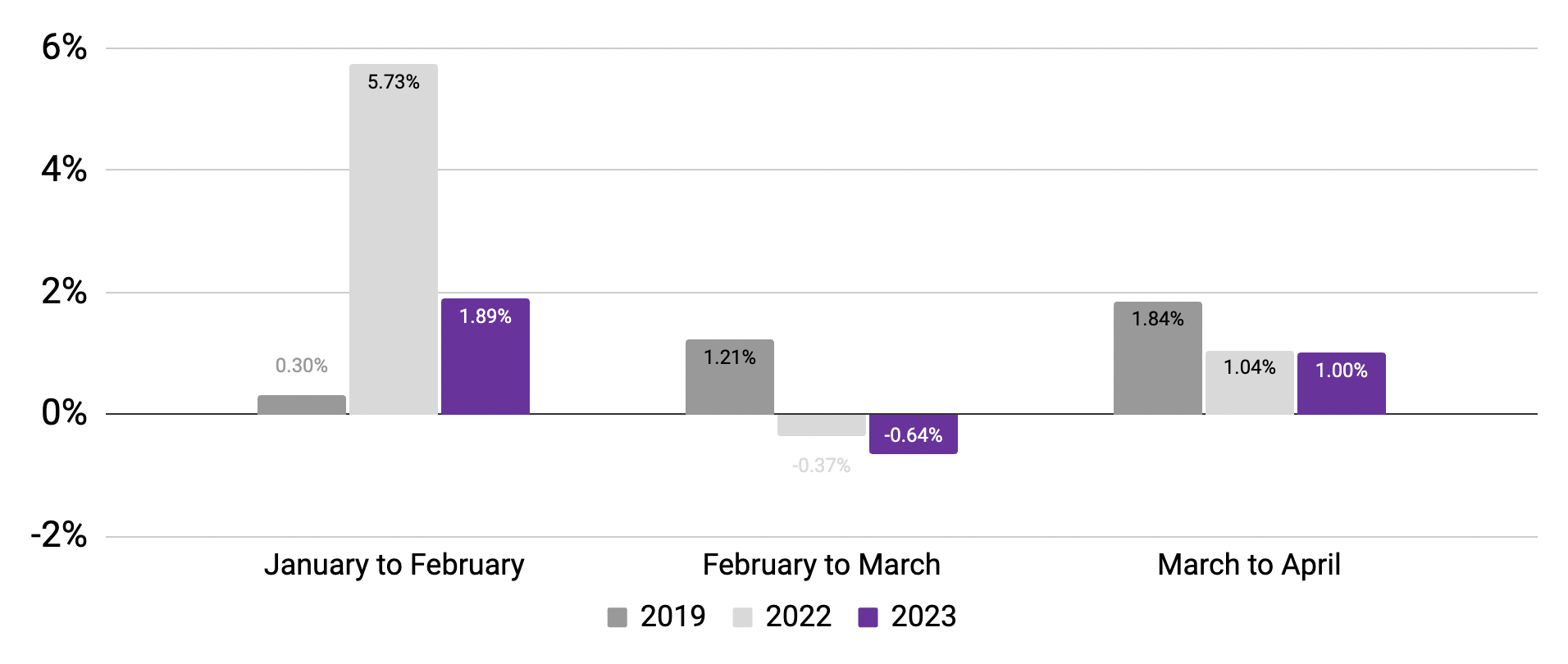

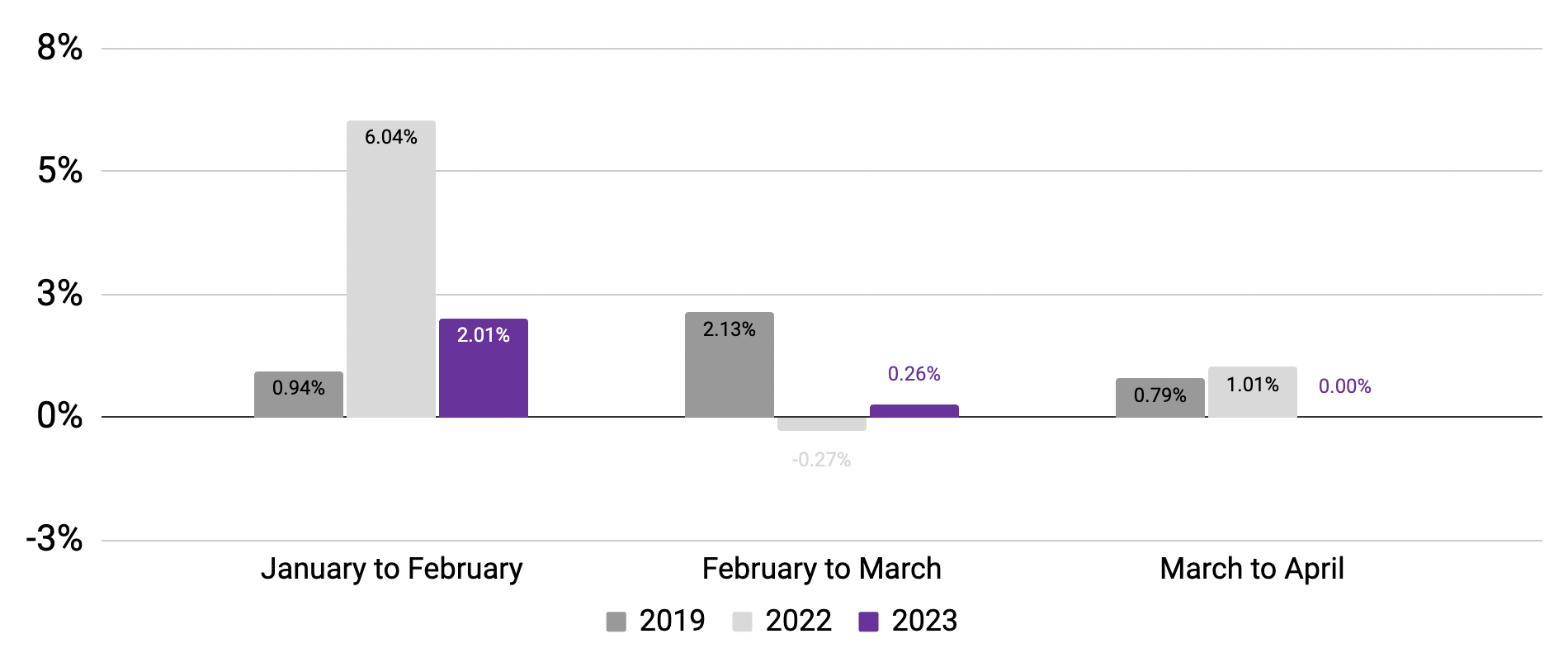

Employment progress is behind historic seasonal traits

SMBs have proven a modest progress in employment metrics; pushed by service-sector companies, month-to-month traits aren’t fairly as rosy as we’ve seen in earlier years.

Workers working

(Month-to-month change in 7-day common, relative to January of reported yr)

Hours labored

(Month-to-month change in 7-day common, relative to January of reported yr)

Knowledge compares rolling 7-day averages for weeks encompassing the twelfth of every month; April information encompasses the following week to account for Easter vacation. Supply: Homebase information.

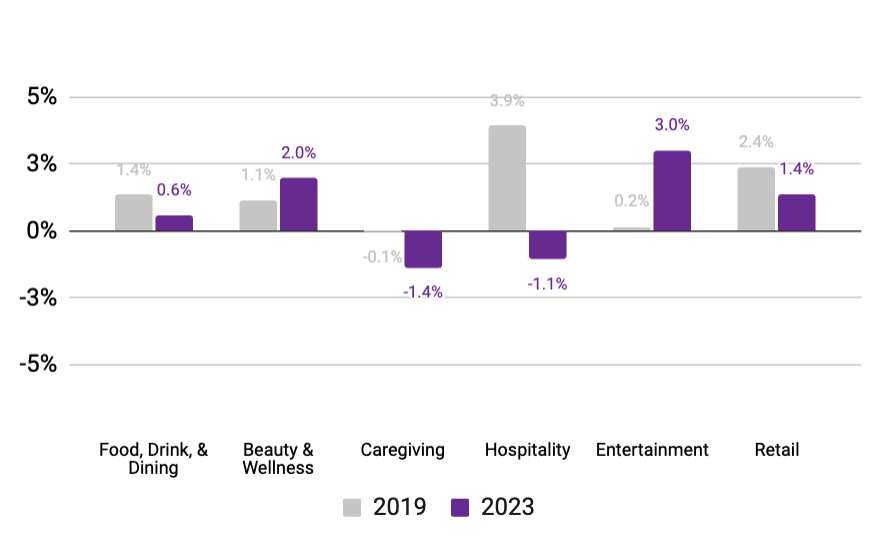

Service sectors noticed a return to employment progress

Entertainment¹ noticed the most important month-to-month progress in staff working (3.0%), outperforming different industries relative to pre-COVID ranges.

Caregiving and hospitality took a success (-1.4% and -1.1%, respectively), reversing latest traits and indicating that exercise and spending is concentrated on service sectors.

% change in staff working

(Mid-February vs. mid-January, utilizing Jan. ‘19 and Jan. ‘23 baselines)²

1. Leisure contains occasions/festivals, sports activities/recreation, parks, film theaters, and different classes.

2. April 8-13 vs. March 10-16 (2019) and April 15-22 vs. March 12-18 (2023). Supply: Homebase information

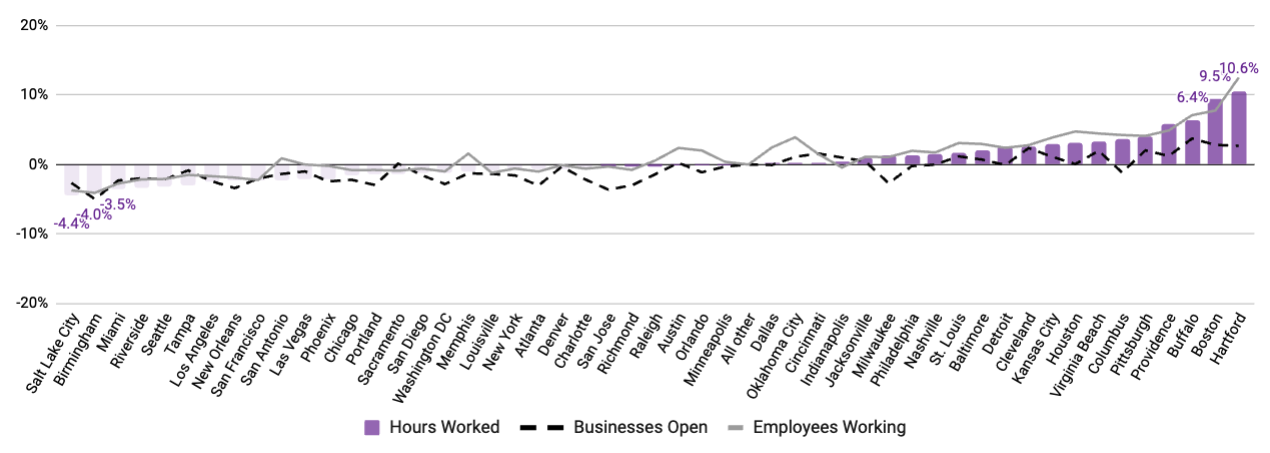

Regionally, the Northeast has seen the very best progress

This follows an unseasonably heat winter and spring.

Be aware: April 15-22 vs. March 12-18. Supply: Homebase information

Wage inflation elevated from March, leaping 1.23% m/m regardless of efforts from fiscal policymakers to curb its progress

Wage inflation

Month-over-month change in common hourly wages

Worker Pulse Verify

An April pulse survey of almost seven hundred staff exhibits a barely reducing optimism in direction of job prospects.

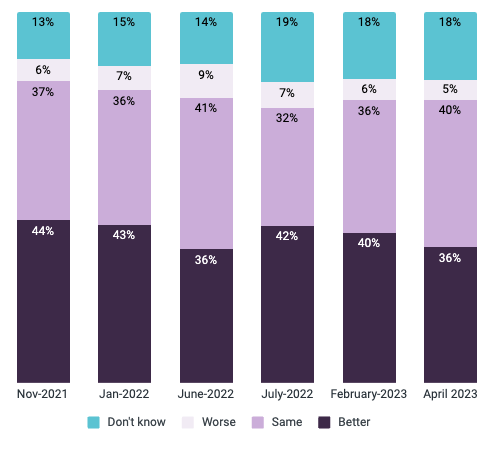

Trying forward, staff see a plateau of their prospects transferring ahead

A plurality of staff surveyed see their job prospects remaining the identical (40%) in a yr, and 36% foresee them bettering. Whereas we see comparable ranges of pessimism (5%) and uncertainty (18%) as in prior months, we’ve seen a decline since mid-2022 within the share of surveyed staff who assume that the job market will choose up for them a yr out.

The downturn in reported optimism coincides with elevated hypothesis a few market that isn’t as favorable to labor, and exhibits that small enterprise employees are internalizing that doubt.

Survey query: Do you assume your job choices can be higher, about the identical, or worse in 12 months in comparison with at present?

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. 2023)

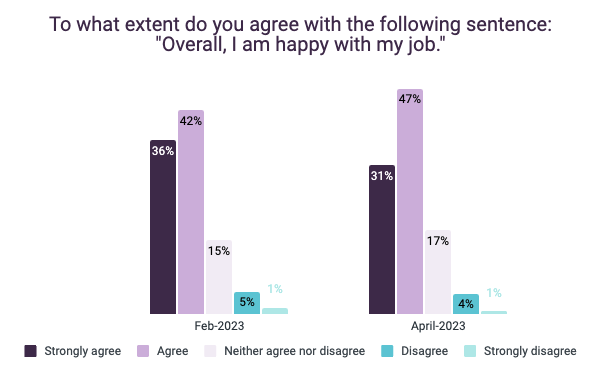

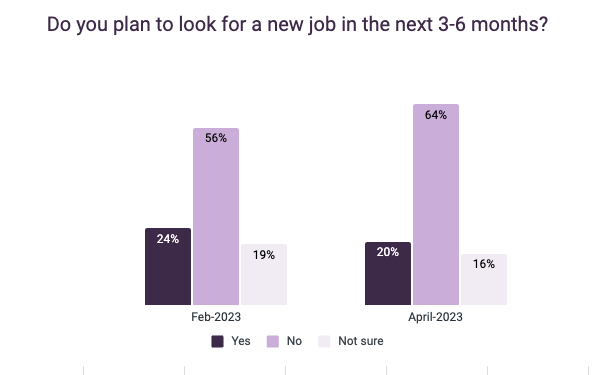

Whereas happiness on the job has remained constant, SMB staff are much less prone to seek for a brand new position within the short-term

As in February, a majority of employees report being pleased with their job (78% of these surveyed in each months); nonetheless, we noticed an 8% improve in reported curiosity in re-entering the job hunt. 64% of SMB staff report no plans to search for a job within the subsequent 3-6 months, up from 56% in February and a robust indicator that satisfaction is much less tied to voluntary separation.

It seems that the macroeconomic fears of an impending recession are working their solution to the frontlines, as employees present much less urge for food for threat and alter.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. 2023)

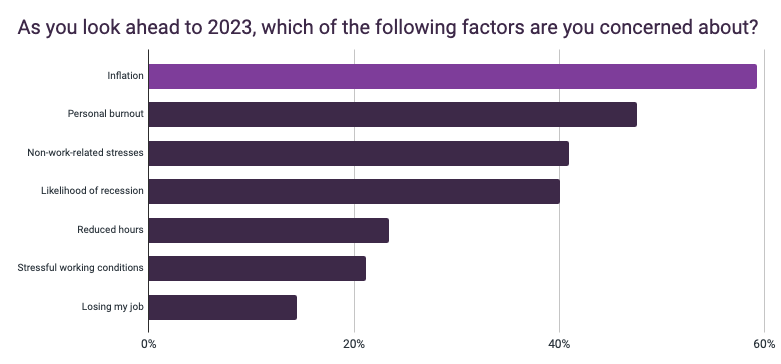

Inflation stays high of thoughts, as different stress components improve for employees

As in our February survey, April confirmed a majority of employees surveyed cited inflation as a high concern via the rest of 2023 (59%). We’ve additionally seen an uptick in fear about private burnout (48%, up 3%) and the chance of recession (40%, up 3%) because the final time we requested.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. 2023)

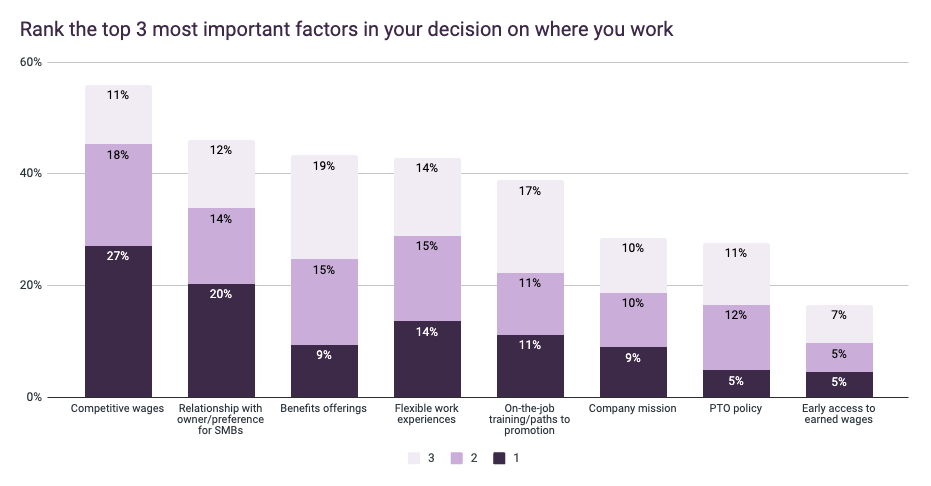

Aggressive pay as essential as ever for the typical worker

Wages stay essentially the most compelling think about employees’ choice on the place they work, with 56% of these surveyed citing it as a high 3 standards (vs. 53% in February). In unsure financial circumstances, constant pay is a key device to draw and retain expertise.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. 2023)

For a PDF of our April report, please go to this hyperlink; should you select to make use of this information for analysis or reporting functions, please cite Homebase.

[ad_2]