[ad_1]

Have you ever ever stood on the fringe of the Grand Canyon and puzzled about all of the historical past of every cave or ridge? What in regards to the a number of valleys that finally drain to the Colorado River? It’s a daunting website to behold, however, because the winds blow previous you and the hawks soar overhead, you’ll be able to rapidly see that only one viewpoint would not do it justice.

Picture: Greg Schnell

Picture: Greg Schnell

This week’s value motion within the inventory market jogs my memory that there are a number of views of the place we’re within the inventory market journey. Everybody’s viewpoint is completely different, and that is what makes a market. Know-how buyers see one perspective. Commodity buyers see one other. Financial institution dividend buyers are seeing a brand new view as properly.

I went to look and see what had been the top-performing industries during the last week whereas the banks had been imploding, and it was journey and leisure, lodges, and gaming. I had no concept that the resilience of these teams might maintain up a market.

Financials:

Financials are breaking down, each large and small. Financials was vital, however apparently they don’t matter, because the $SPX touched a contemporary 2023 excessive final week.The charts of C, WFC, and BAC do not look practically as wholesome as JPM. The regionals are bombing out, and some may get merged this weekend. I believe we now have all seen the KBE and KRE ETF charts. The principle level of the image under is that JPM is holding up; the others aren’t.

Right here is the banking index. That 2010-2023 pattern appears damaged. Even by simply ignoring the COVID state of affairs, this appears broke, and a take a look at of $60 would not be onerous to think about. The underside panel exhibits 15-year relative energy lows.

The dealer sellers, normally thought of as one of many main industries, appears higher than the banks. Does the pattern line maintain? The PPO goes under zero once more. This can be a chart that implies, to me, that this downside will get greater.

Industrial Metals

The economic metals commodity index by Goldman Sachs is making decrease lows and decrease highs since January. Is that this simply China managing commodity demand to load up on low cost commodities earlier than the subsequent run begins? That might be no completely different that the US authorities managing oil pricing by releasing the strategic petroleum reserve. So this is not taboo, however different nations do it on much more commodities than simply oil.

Crude Oil

Crude oil continues to battle. That rally final Friday was simply that. It was so-o-o final week, as crude slid under $65 this week. Earlier than market open on Might 5, this chart exhibits crude down 10% on the week, and that is not even the underside of the candle.

$SPX Value Incomes Ratio

The worth/earnings ratio for the inventory market, sitting up close to among the most stretched extremes in historical past, was barely mentioned on the CMT Affiliation assembly. Purple is present, and the opposite three traces are the place it might be primarily based on decrease P/E ratios. We’ve lived in a stretched world since 2014, so why would that view matter now? I present this chart to reveal that, if we reverted to twenty, we’d be under 3500, and if we reverted to a P/E of 15, 2600 is in play. It isn’t unusual for recessions to trigger a valuation reset of the market broadly.

Bonds and the Yield Curve

On the CMT Affiliation assembly, the yield curve or the historical past of the yield curve was by no means talked about in any of the conversations and displays I sat in on. It did not match with the bullish narrative of the $SPX and $NDX at 2023 highs. By the best way, most portfolio managers suppose we’re going a lot larger (however do not point out the yield curve).

Really, I used to be amazed that nobody even talked about it, regardless that the entire financial institution valuation difficulty proper now’s maintain to maturity (HTM) bonds. Bonds are the issue, not the fairness market.

The actual deal is bonds add one other perspective, very similar to the Grand Canyon viewpoints. Change anybody viewpoint and it appears completely completely different. We discover a wholly completely different view over within the yield curve. Bonds are one of many 4 main asset courses, however solely Louise Yamada ventured there, displaying a 40-year break of the rate of interest pattern line for lengthy bonds.

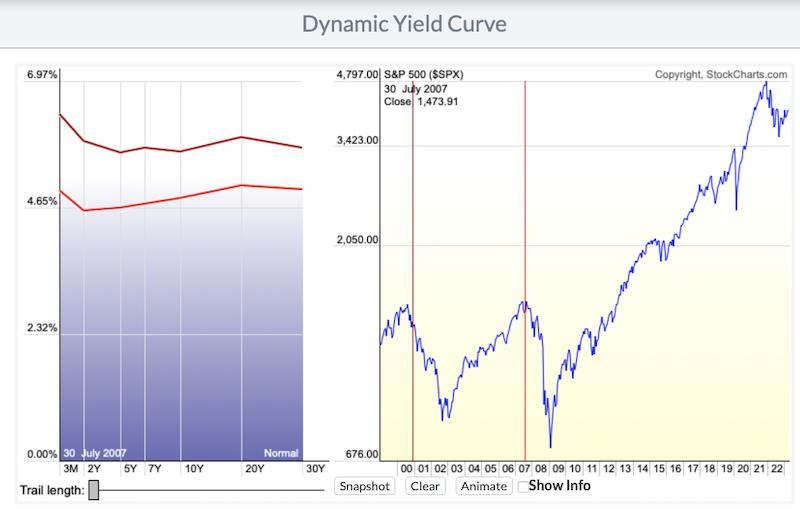

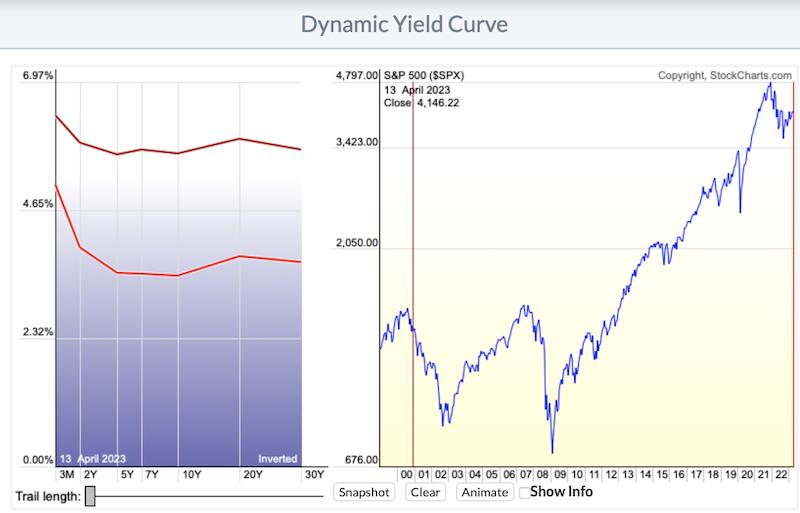

The present yield curve didn’t appear to matter, nor did the historical past of the yield curve. So let me add just a few yield curve charts right here. The vertical line on the best aspect at 12 months 2000 is the highest yield curve line on the left. The vertical line at 2007 is the underside yield curve line on the left.

So what does the yield curve line appear to be proper now? It’s the backside line on this chart under, evaluating with the 2000 high. They appear much like me.

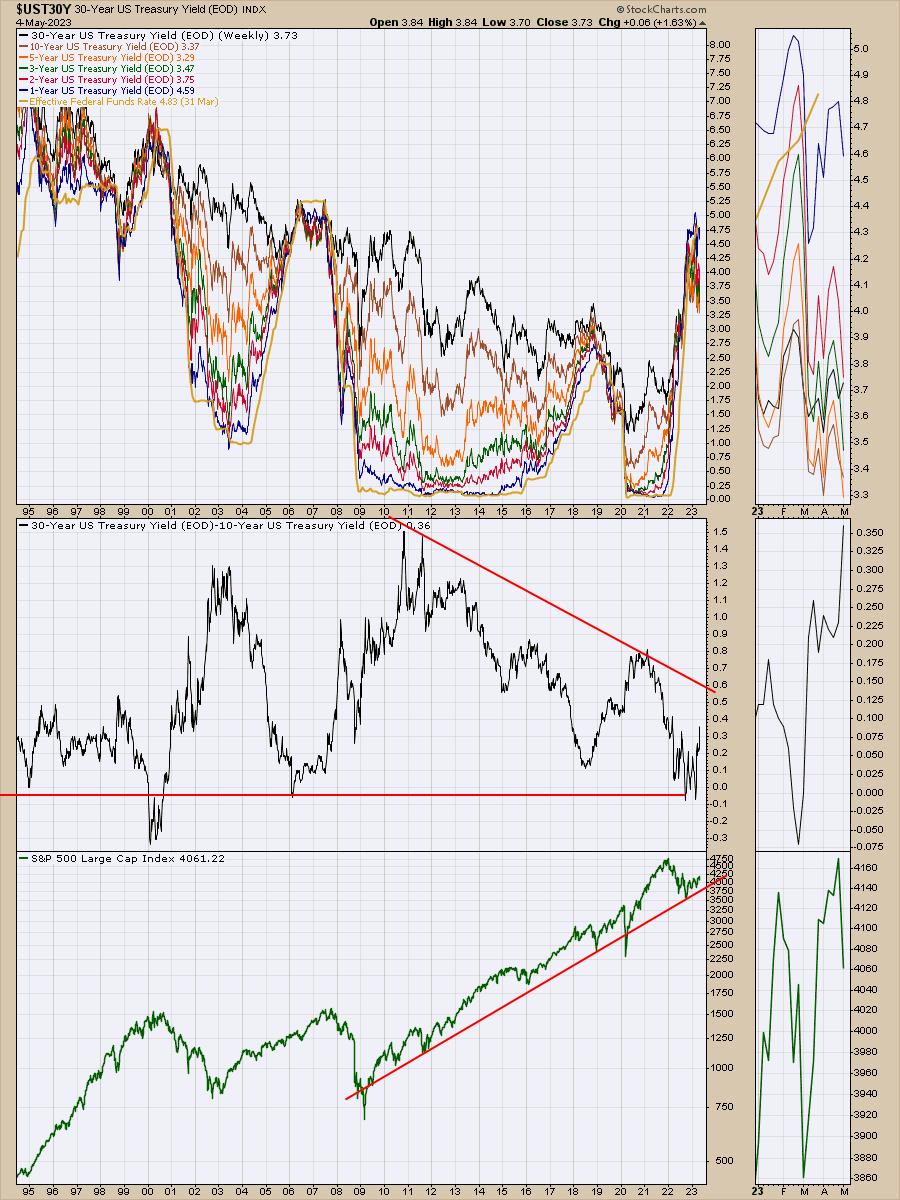

Why does that matter? Let me use one other chart to clarify what is occurring. The 30-year yield is now larger than the center or the stomach of the curve. That is altering quickly because the yield curve begins to realign. In the event you look on the best aspect within the zoom panel, the 30-year yields are beginning to maintain above the center of the curve yields. The 30-year yield could cross above the 2-year quickly. However have a look at the congestion zones when the yields get tight. The fairness market response is proven as this begins to broaden out. $SPX is on the decrease panel.

Fed Fee

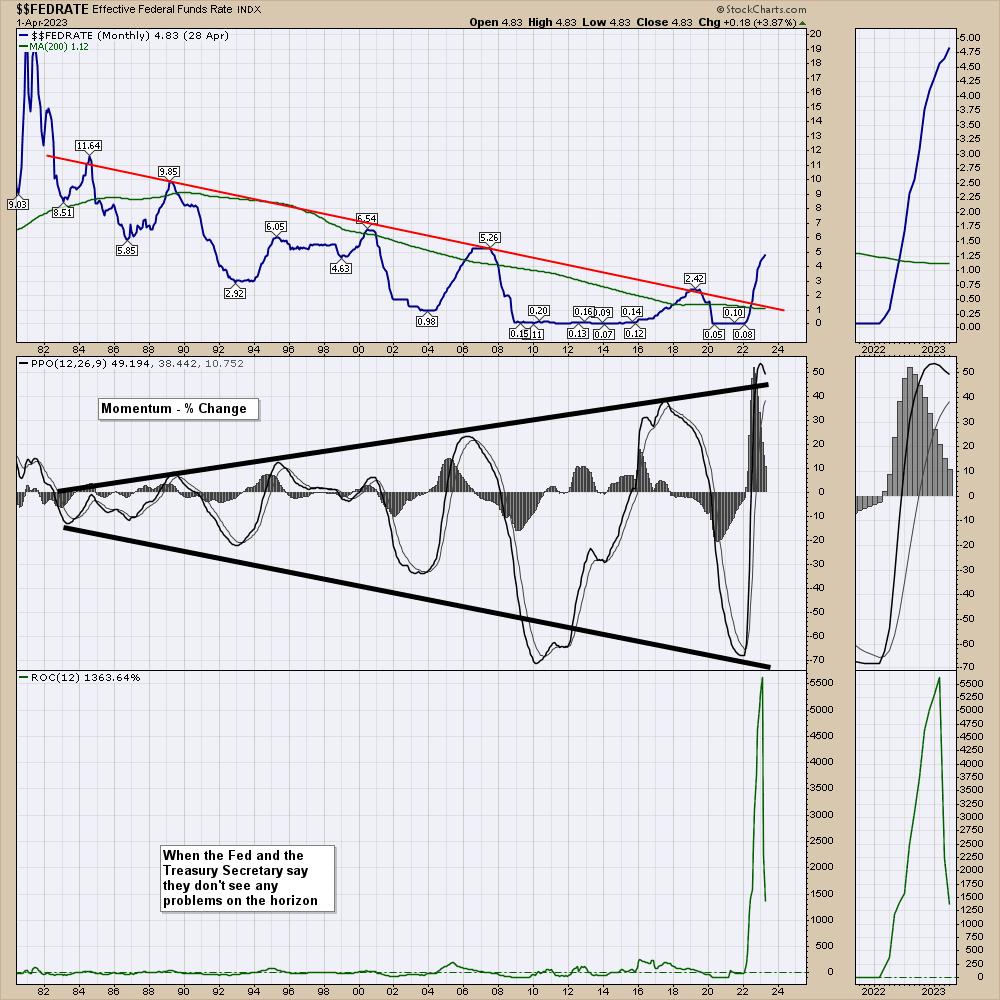

Now that a big portion of cash managers assume the Fed is completed elevating charges, the place does this depart us? The chart that makes a giant impression on me is the speed of change of the Fed funds charge, proven in inexperienced within the decrease panel. This is not the speed of change of one thing like lumber. That is the speed of change for some of the tracked rates of interest on the earth.

The idea that the complete enterprise world can adapt quickly to soak up one of many quickest charge modifications ever doesn’t appear believable to me. As this rolls by means of boardrooms internationally, when will it crack the fairness market buyers? To date, the fairness markets aren’t blinking.

I’m on one other viewpoint — wide-eyed, staring over my view, suggesting one thing is amiss and about to fall sharply. Will it occur in Might or June? Or will it take till October? I do not know, however I do not see this figuring out ‘completely’ as we attempt to go to take out the 2021 highs.

To me, it appears like a setup we ought to be cautious of. When the market continues to battle to make larger highs right here after six weeks, is that this only a consolidation? Or is it a closing realization that it is about to get messy?

If you want extra views on this, I will be holding a month-to-month convention name for shoppers on Sunday. At Osprey Strategic, you’ll be able to check out our providers for simply $7 for the primary month. I am a giant fan of defending capital till the time is correct to step again in. Day merchants needn’t take a look at the waters. They will not discover something they like there. That is for buyers with massive quantities of capital with the knowledge and persistence to attend for a greater backdrop.

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Based mostly in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an energetic member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).

Subscribe to The Canadian Technician to be notified each time a brand new submit is added to this weblog!

[ad_2]