[ad_1]

Visitor publish from Jim Quinn on the Burning Platform:

“We’ve bought sturdy monetary establishments…Our markets are the envy of the world. They’re resilient, they’re…modern, they’re versatile. I feel we transfer in a short time to handle conditions on this nation, and, as I mentioned, our monetary establishments are sturdy.” – Henry Paulson – 3/16/08

“I’ve full confidence in banking regulators to take applicable actions in response and famous that the banking system stays resilient and regulators have efficient instruments to handle the sort of occasion. Let me be clear that throughout the monetary disaster, there have been traders and house owners of systemic massive banks that had been bailed out . . . and the reforms which have been put in place means we aren’t going to do this once more.” – Janet Yellen – 3/12/23

With the current implosion of Silicon Valley Financial institution and Signature Financial institution, the biggest financial institution failures since 2008, I had an awesome feeling of deja vu. I wrote the article Is the U.S. Banking System Protected on August 3, 2008 for the Searching for Alpha web site, one month earlier than the collapse of the worldwide monetary system. It was this text, amongst others, that caught the eye of documentary filmmaker Steve Bannon and satisfied him he wanted my perspective on the monetary disaster for his movie Technology Zero. After all he was fairly unknown in 2009 (not a lot anymore) , and I proceed to be unknown in 2023.

The quotes above by the mendacity deceitful Wall Avenue managed Treasury Secretaries are precisely 15 years aside, however are precisely the identical. Their sole job is to maintain the arrogance sport going and to guard their actual constituents – the Wall Avenue bankers. And simply as they did fifteen years in the past, the powers that be as soon as once more used taxpayer funds to bailout reckless bankers. Two hours earlier than the one resolution the Feds know – print cash and shovel it to the bankers – Michael Burry defined precisely what was about to occur.

When Biden, Yellen, and the remainder of the Wall Avenue safety crew inform you the banking system is secure they usually have it below management, they’re mendacity, simply as I mentioned fifteen years in the past.

“Our economic system and banking system is so complicated and intertwined that nobody is aware of the place the subsequent shoe will drop. Politicians and authorities bureaucrats are mendacity to the general public once they say that every thing is alright. They have no idea. Do you have to consider a governmental company that wishes the general public to stay at midnight to keep away from financial institution runs, or an unbiased evaluation primarily based upon stability sheet evaluation?”

Again within the days of The Huge Brief, earlier than the general public knew about poisonous subprime mortgages issued by felony bankers and packaged into derivatives given a AAA ranking by the grasping compliant ranking businesses, the Wall Avenue cabal knew time was rising quick, however that didn’t hold the mendacity bastards like John Thain (Merrill Lynch), Dick Fuld (Lehman Brothers), Angelo Mozilo (Countrywide), Kerry Killinger (Washington Mutual), and others from pretending their establishments had been wholesome and worthwhile – proper up till the day they collapsed. Mendacity is within the DNA of each monetary govt, politician, authorities bureaucrat, and Federal Reserve hack.

The quote from Hemingway appeared pertinent in 2008 and is simply as pertinent immediately.

There are numerous similarities between what was taking place in 2008 and what’s taking place immediately. Bear Stearns went belly-up in March 2008 and was taken over by JP Morgan in an organized marriage by Bernanke and the Fed. The same old suspects assured the nation this was a one off scenario and the banking system was sturdy. The Wall Avenue banks had been reporting large income as a result of they had been hiding the huge losses on their stability sheets. In the event that they didn’t foreclose, they didn’t need to write-off the mortgages. The poisonous debt simply stored constructing.

In the summertime of 2008 the banks began to report losses, however assured traders it was solely a one time hit. All was properly. The week I wrote my article Wall Avenue financial institution shares had soared 20% or extra as a result of their reported losses for the 2nd quarter had been lower than anticipated. My article minimize by means of all of the BS being shoveled by the likes of Larry Kudlow, Jim Cramer, the Wall Avenue CEOs, and the supposed analyst consultants who nonetheless had purchase scores on these bloated debt pigs. My evaluation was considerably opposite to the CNBC lies:

“I might estimate that we’re solely within the early innings of financial institution write-offs. The write-offs will not less than equal the earlier peaks reached within the early Nineteen Nineties. If a big financial institution comparable to Washington Mutual or Wachovia had been to fail, it might wipe out the FDIC fund. If the FDIC fund is depleted, guess who can pay? Proper once more, one other taxpayer bailout. What’s one other $100 or $200 billion amongst buddies.”

Merrill Lynch was reporting billions in losses and issuing new inventory to try to survive. They had been clearly in a loss of life spiral and I noticed the writing on the wall:

“How lengthy will traders be duped into supporting this catastrophe? You possibly can make certain that the opposite suspects (Citicorp, Lehman Brothers, Washington Mutual) shall be asserting extra write-downs and capital dilution within the coming weeks.”

By the tip of September Lehman Brothers and Washington Mutual had been gone. Merrill Lynch and Wachovia had been acquired for pennies, and Citicorp turned a zombie financial institution sustained by the Fed for years. My article was dire and my evaluation confirmed we had been in for years of ache and the worst drop in housing costs in historical past:

“There are $440 billion of adjustable mortgages resetting this 12 months. Which means that almost all of foreclosures won’t happen till 2009. Which means the banks will nonetheless be writing off billions of mortgage debt in 2009. The reversion to the imply for housing costs and the continued avalanche of foreclosures shouldn’t be a recipe for a banking restoration. Residence costs have one other 15% to go on the draw back.”

“The patron is being compelled to chop again on consuming out and buying. The marginal gamers will fall by the wayside. Huge field retailers, eating places, mall builders, and industrial builders are about to seek out out that their large growth was constructed upon false assumptions, a basis of sand, and pushed by extreme debt.”

It appears I used to be fairly correct in my evaluation, as house costs went down greater than 15%, not bottoming till 2012. This world monetary collapse introduced an finish to the large field growth part, as many went below, and the survivors targeting their current shops. We entered the worst recession because the Thirties. Probably the most fascinating half in going again to my 15 12 months previous article was the psychology of the gang revealed within the remark part. Regardless of my use of unequivocal info, I used to be branded a doomer, overly pessimistic, and an fool. Many commenters mentioned the Fed would save the day and it was time to purchase the dip. If that they had purchased the dip on the day of my article, they’d have misplaced 44% over the subsequent 8 months throughout a relentless bear market.

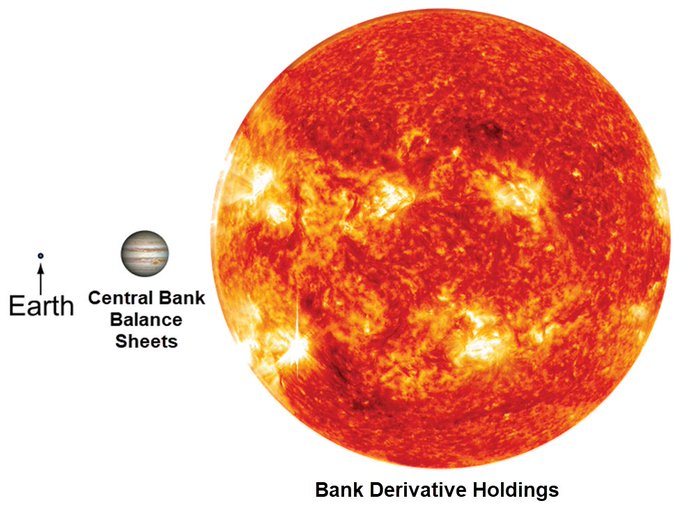

The query now’s whether or not the present scenario is best or worse than the scenario we confronted in 2008. There are some factual objects which can assist in assessing the place we’re. In August 2008 the nationwide debt was $9.5 trillion (67% of GDP). At the moment it’s $31.5 trillion (130% of GDP). Whole family debt was $12 trillion in 2008 and stands at $17 trillion immediately. The Fed’s stability sheet was $900 billion in 2008 and now stands at $8.3 trillion. Inflation was at a 17 12 months excessive in August 2008 at 5.9% and stands at 6.0% immediately. GDP was rising at 3.2% in 2008, versus 2.7% immediately. An neutral observer must conclude our financial scenario is way worse than 2008.

However all you hear is glad speak and false bravado from Wall Avenue analysts protecting their very own bancrupt business. They always harp on the very fact mortgage lending is way more threat averse and safe. After all the subsequent liquidity pushed disaster isn’t pushed by the identical precise components because the earlier liquidity pushed disaster. However the important thing components are all the time the identical. Free financial insurance policies by the Fed result in extra threat taking by grasping bankers, hedge funds, and company executives. Then one thing blows up and the billionaires get bailed out on the expense of the taxpayers who’ve been getting devastated financially by the inflation brought on by Powell and his printing press.

To this point, this newest banking disaster “that nobody might see coming”, besides any trustworthy monetary analyst who understands math and historical past, is following the identical path as 2008. The narrative about banks not taking credit score threat and peddling unhealthy mortgages is being blown up as we converse. As an alternative of the chance being centered on poisonous mortgages like 2008, the chance has permeated each crevice of the monetary system attributable to years of 0% charges by the Fed. Nearly every thing is overvalued by 30% to 50% as a result of low cost debt was accessible to everybody for every thing. Extraordinarily low rates of interest led to excessive threat taking by bankers, firms, house consumers, auto consumers, and politicians. The unleashing of inflation by Powell’s insurance policies has led to the tide going out and revealing who was swimming bare.

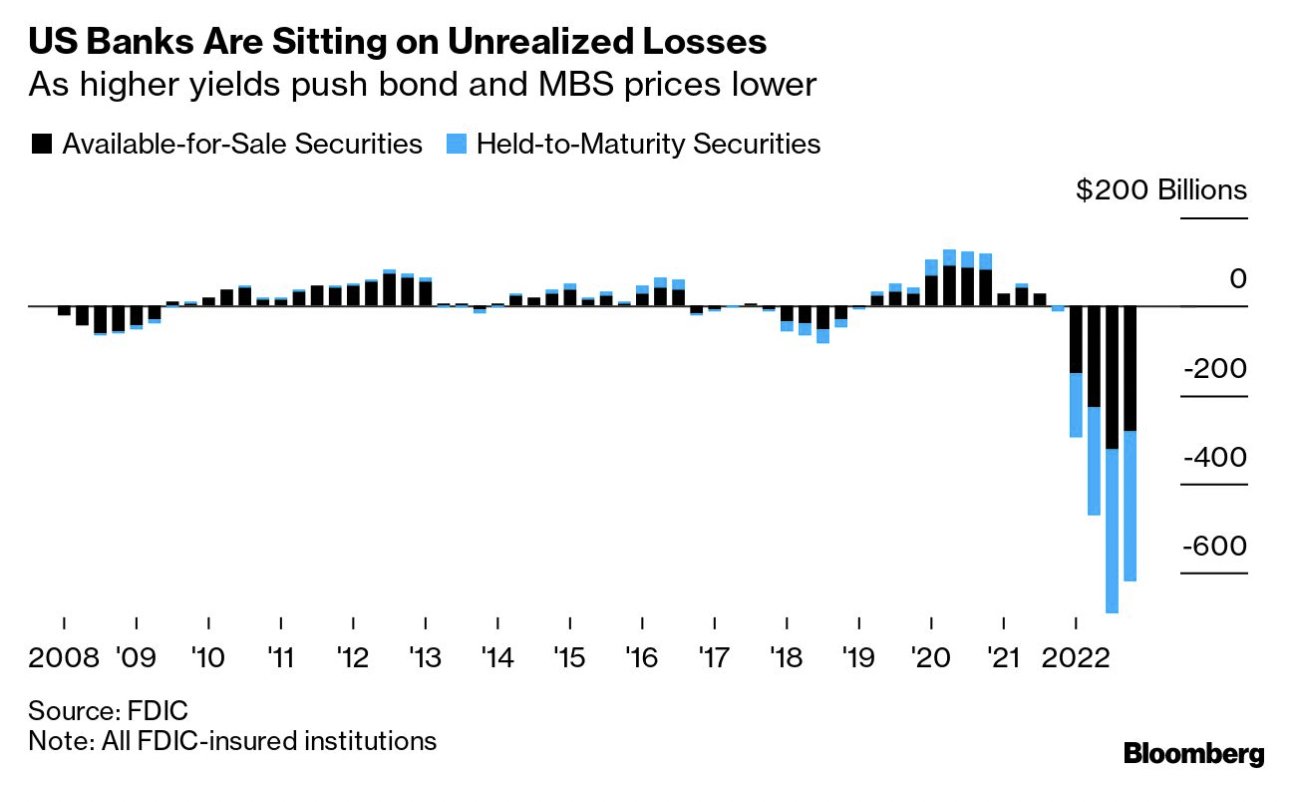

Whereas threat managers at banks internationally have been concentrating on variety and pushing woke agendas about transgender rights, local weather change and working towards ESG investing, they ignored the straightforward idea that bonds they acquired at 1% lose cash when rates of interest go to 4%. Simply because the banks in 2008 had been sitting on billions of unrealized losses from the poisonous mortgages on their books, the identical banks at the moment are sitting on billions of unrealized losses from the most recent poisonous asset – U.S. Treasuries. Everybody is aware of it. It’s simply math. They’ve been relying on Powell to reverse course, however with reported inflation nonetheless at 6%, he’s trapped. Silicon Valley Financial institution and Signature Financial institution had been swimming bare and when depositors realized that truth a financial institution run ensued. Poof!!! Sudden Disaster.

The narrative being spun is this can be a regional banking disaster confined to smaller banks. This narrative is being spun by the large Wall Avenue banks and their captured media mouthpieces, with the intent that depositors at smaller banks would panic and shift their deposits to the “secure” Wall Avenue banks. The reality is that the Wall Avenue banks have large ranges of unrealized losses and desperately want deposits to maintain them from dealing with the identical destiny as Silicon Valley and Signature. These unrealized losses aren’t going away and must be realized within the close to future.

Credit score Suisse has been the loopy uncle of the monetary business, stored within the basement for years. Their demise is a foregone conclusion, however that has been coated up and ignored by these within the know. They look like the brand new Lehman Brothers, which is able to blow up the already bancrupt European monetary system and unfold a contagion of losses throughout the monetary world. These quadrillions in obscure derivatives are an unknown factor within the coming meltdown. However you might be positive they received’t have a optimistic affect.

Each small and enormous banks have little to no reserves left to lend. Debt issuance is the Potemkin ingredient in preserving this farce of an financial system operating. With out debt to finance overextended shopper existence, funding wars in Ukraine, and the woke agendas of firms and politicians, your complete facade collapses.

Actual wages have been detrimental for 23 consecutive months. A banking disaster means banks will cut back lending dramatically. Customers have been compelled to dwell off their bank cards for the final two years, as their financial savings dried up and their wages purchased much less. A deep recession is within the playing cards. Customers are already pulling again and spending much less. With credit score drying up and spending taking place, employers throughout the globe will begin laying folks off. As unemployment rises, folks will cease paying their huge mortgage and auto loans. It will result in extra losses at banks, identical to 2008/2009.

Everybody will look to the Fed to save lots of the day. And they’re going to fake they’ve every thing below management, however they don’t. Again in 2008 their stability sheet was solely $900 billion. At the moment it’s 9 occasions as massive. The relentless QE whereas rates of interest had been suppressed has left them with huge unrealized losses on the mortgage and Treasury bonds they purchased. They let the inflation genie out of the bottle and now it’s ingrained within the economic system. Corporations who gave 2% annual raises to their workers for a decade at the moment are compelled to provide 4% or extra because of the Fed created inflation.

If the Fed slashes charges and goes again to cash printing by means of QE, the present 6% inflation price will skyrocket again to double digits. If Powell does nothing or continues elevating charges, the banking system will probably collapse. His decisions are deflationary collapse or hyper-inflationary collapse. He’s caught between the proverbial rock and a tough place. Since he’s managed by Wall Avenue, he’ll slash charges, restart QE, backstop the bankers, and screw the common American, as all the time. My conclusion reached in my 2008 article, simply earlier than the monetary system imploded appears, for essentially the most half, to use immediately.

“The U.S. banking system is actually bancrupt. The Treasury, Federal Reserve, FASB, and Congress are colluding to maintain the American public at midnight for so long as doable. They’re making an attempt to purchase time and prop up these banks to allow them to persuade sufficient fools to provide them extra capital. They may proceed to jot down off debt for a lot of quarters to return. We’re in peril of duplicating the errors of Japan within the Nineteen Nineties by permitting them to fake to be sound. We might have a zombie banking system for a decade.”

We by no means paid the piper and cleaned out the excesses of the earlier banking disaster. The monetary situation of the nation is way worse than it was in 2008. The monetary situation of the common American is way worse than it was in 2008. The monetary situation of the Federal Reserve is way worse than it was in 2008. The monetary situation of the banking system is way worse than it was in 2008. Our leaders kicked the can down the street so as to give the system the looks of stability, and we allow them to do it. We might have taken the ache in 2008 and let the system reset after purging all of the unhealthy debt and unhealthy banks, however we selected the flawed path and can now endure the implications described by Ludwig von Mises a century in the past.

“There is no such thing as a technique of avoiding the ultimate collapse of a growth caused by credit score growth. The choice is just whether or not the disaster ought to come sooner as the results of voluntary abandonment of additional credit score growth, or later as a ultimate and whole disaster of the foreign money system concerned.” – Ludwig von Mises

My recommendation 15 years in the past on the finish of the article was to cut back your deposit publicity in any respect monetary establishments, don’t put money into monetary shares, comply with the writings of trustworthy truthful analysts and this ultimate piece of recommendation, which is as stable now because it was then:

“Whenever you see a financial institution CEO or a prime authorities official inform you that every thing is alright, run for the hills. They’re mendacity. They didn’t see this coming they usually don’t know the way it will finish.”

We’re at the start of the subsequent world monetary disaster, not the tip. Fourth Turnings don’t fizzle out. They construct to a crescendo of chaos and struggle. This monetary disaster will usher within the army battle that has been beckoning for the final 12 months. Time to buckle up and put together for the approaching storm.

[ad_2]