[ad_1]

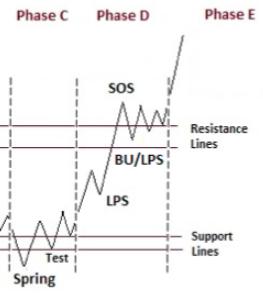

Are the key inventory indexes beneath Accumulation? If that’s the case, we Wyckoffians would anticipate an essential Markup (uptrend) to observe. Accumulation is the method of enormous pursuits (often called Composite Operators) stealthily Absorbing shares of shares they anticipate to understand in the course of the subsequent Markup Part. Accumulation can take an indeterminant time period to type. The C.O. will systematically Accumulate their ‘Line of Inventory’ throughout this trendless worth construction. Finally a larger variety of Institutional sort traders will start competing for the remaining provide of inventory, which signifies that Absorption (and subsequently Accumulation) is sort of full. The Regulation of Provide and Demand is at work right here. Demand is rising and Provide has been largely Absorbed. This unbalanced situation will ultimately throw shares and the market into a brand new uptrend.

Are the key inventory indexes beneath Accumulation? If that’s the case, we Wyckoffians would anticipate an essential Markup (uptrend) to observe. Accumulation is the method of enormous pursuits (often called Composite Operators) stealthily Absorbing shares of shares they anticipate to understand in the course of the subsequent Markup Part. Accumulation can take an indeterminant time period to type. The C.O. will systematically Accumulate their ‘Line of Inventory’ throughout this trendless worth construction. Finally a larger variety of Institutional sort traders will start competing for the remaining provide of inventory, which signifies that Absorption (and subsequently Accumulation) is sort of full. The Regulation of Provide and Demand is at work right here. Demand is rising and Provide has been largely Absorbed. This unbalanced situation will ultimately throw shares and the market into a brand new uptrend.

The S&P 500 Index has been range-bound since Might 2022. Now the Index is approaching the late-Might peak, which we outline as Resistance. The Might Help and Resistance have largely contained buying and selling as worth has been unable to meaningfully escape this zone to provoke a brand new development. Now the $SPX has rallied to the Might ’22 Resistance degree. Is Absorption practically full, which might enable the markup to proceed from right here? Beneath is a chart research of $SPX:

S&P 500 Index ($SPX) Accumulation Examine

Chart Notes:

- Preliminary Help (PS) and Promoting Climax (SC) cease the decline in Might and June.

- Spring & Check in October arrives on the finish of the third quarter.

- Two stage rally carries to the Resistance Zone & fulfilled the swing buying and selling PnF Goal.

- The Provide TrendLine has outlined the 2022 Bear development stride and has lastly been exceeded in January.

- Constructive breadth divergence or Inexperienced Shoots seem as Spring & Check develop.

S&P 500 Index Level & Determine Case Examine

S&P 500 Index Level & Determine Case Examine

PnF Chart Notes:

- Vary Certain since Might. Is Accumulation forming?

- Swing PnF Rely generated at third Quarter Spring & Check.

- Minimal Swing Rely goal has been met because the $SPX enters Resistance Zone.

- A Minor Signal of Energy (mSOS) developed as $SPX exceeded the December peak.

- The index accelerated into the mSoS, Resistance Zone and minimal PnF depend concurrently.

- Look ahead to a possible response with increasing quantity to sign exhaustion of the rally.

- Worth momentum might speed up into the 4,350 PnF higher goal zone. This could be a constructive.

- Look ahead to a Main Signal of Energy (MSoS) above the August excessive (4,300).

- After a MSoS, a Final Level of Help (LPS) or Again Up (BU) can be anticipated subsequent.

- As soon as a LPS or BU is recognized, Accumulation can flip right into a Markup.

Warning is warranted on the Resistance space of a buying and selling vary. Merchants should respect the potential of continuation of the downtrend in an ongoing bear market. The FED is on a marketing campaign to boost rates of interest which is a standard bear market backdrop. Now we have loved a robust rally with increasing breadth from the third quarter lows. PnF horizontal depend approach has properly focused the value goal just lately fulfilled.

Wyckoffians are ‘tape readers’. Due to this fact, we’ll look ahead to the diminished unfold and quantity traits that accompany a response right into a LPS or BU. These occasions would affirm late stage Accumulation and can be a juncture for positioning shares for a extra essential Markup section.

All of the Finest,

Bruce

@rdwyckoff

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Energy Charting Video

The latest Energy Charting video focuses on discovering Business Group management. On this case research the Semiconductor Group is profiled. A easy scan is used to determine shares which can be main.

Discovering Management in Semiconductors

For Extra on Wyckoff Accumulation

(click on right here) and (click on right here)

Announcement

Within the weekly Wyckoff Market Dialogue (WMD) Roman Bogomazov and I profile essential markets from a Wyckoff perspective. To be taught extra and to affix our Wyckoff Group go to (click on right here).

Bruce Fraser, an industry-leading “Wyckoffian,” started educating graduate-level programs at Golden Gate College (GGU) in 1987. Working intently with the late Dr. Henry (“Hank”) Pruden, he developed curriculum for and taught many programs in GGU’s Technical Market Evaluation Graduate Certificates Program, together with Technical Evaluation of Securities, Technique and Implementation, Enterprise Cycle Evaluation and the Wyckoff Technique. For practically three many years, he co-taught Wyckoff Technique programs with Dr.

Study Extra

Subscribe to Wyckoff Energy Charting to be notified every time a brand new put up is added to this weblog!

[ad_2]