[ad_1]

Resulting from harsh storm circumstances that occurred on March 31 and April 1, elements of Indiana have been left in a state of catastrophe, and the IRS has provided tax aid to victims of those storms. If these storms impacted you, we would like you to know TurboTax is right here for you, and we wish to preserve you updated with essential tax aid data that will assist you on this time of want.

The Federal Emergency Administration Company (FEMA) declared the latest occasions as a catastrophe. The IRS introduced that victims of the cruel storms that occurred in elements of Indiana now have till July 31, 2023, to file varied particular person and enterprise tax returns and make sure tax funds.

What are the prolonged tax and cost deadlines in Indiana?

The tax aid postpones varied tax submitting and cost deadlines that occurred beginning on March 31, 2023. In consequence, affected people, and households that reside or have enterprise in Allen, Benton, Clinton, Grant, Howard, Johnson, Lake, Monroe, Morgan, Owen, Sullivan and White counties have till July 31, 2023, to file returns and pay any taxes that have been initially due throughout this era. These embody:

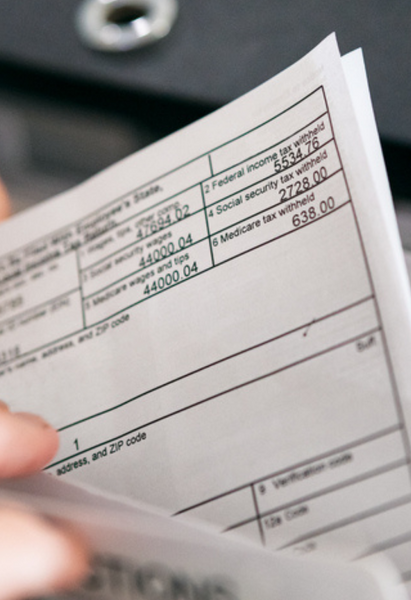

- 2022 Particular person and Enterprise Returns: 2022 particular person tax returns and funds that have been due on April 18, 2023, in addition to varied 2022 enterprise returns, together with funds usually due on March 15 and April 18 have an prolonged deadline till July 31, 2023.

- 2022 IRA Contributions: Affected taxpayers may have till July 31, 2023, to make 2022 IRA contributions to make an affect on their 2022 taxes.

- Quarterly Estimated Tax Cost: Quarterly estimated tax funds usually due April 18, 2023, and June 15, 2023, have been prolonged till July 31, 2023.

- Quarterly Payroll and Excise Tax Returns: Quarterly payroll and excise tax returns which might be usually due on April 30, 2023, are additionally prolonged till July 31, 2023. As well as, penalties on payroll and excise tax deposits due on or after March 31 and earlier than April 18, 2023, will probably be abated so long as the deposits have been made by April 18, 2023.

What do I have to do to say the tax extension?

The IRS robotically gives submitting and penalty aid to any taxpayer with an IRS tackle of document positioned within the catastrophe space. Taxpayers don’t have to contact the IRS to get this aid. Nonetheless, if an affected taxpayer receives a late submitting or late cost penalty discover from the IRS that has an authentic or prolonged submitting, cost or deposit due date falling throughout the postponement interval, the taxpayer ought to name the quantity on the discover to have the penalty abated.

The present listing of eligible localities is all the time out there on the catastrophe aid web page on IRS.gov.

Some affected taxpayers might discover that they want extra time to file past the July 31 deadline. In that case, the IRS urges them to request the extra time, electronically, earlier than the unique April 18 deadline. After April 18 and earlier than July 31, catastrophe space taxpayers can file their extension requests solely on paper.

Do surrounding areas exterior of Indiana qualify for an extension?

The IRS will work with any taxpayer who lives exterior the catastrophe space however whose data needed to fulfill a deadline occurring through the postponement interval are positioned within the affected space. Taxpayers qualifying for aid who stay exterior the catastrophe space have to contact the IRS at 866-562-5227. This additionally contains employees helping the aid actions who’re affiliated with a acknowledged authorities or philanthropic group.

How can I declare a casualty and property loss on my taxes if impacted?

People or companies who suffered uninsured or unreimbursed disaster-related casualty losses can select to say them on both the tax return for the yr the loss occurred (2023 return usually filed subsequent yr on this occasion) or the loss may be deducted on the tax return for the prior yr (2022, usually filed this tax season). People may additionally deduct private property losses that aren’t coated by insurance coverage or different reimbursements.

Remember to write the next FEMA declaration quantity on any return claiming a loss:

The tax aid is a part of a coordinated federal response to the harm brought on by the cruel storms and relies on native harm assessments by FEMA. For data on catastrophe restoration, go to disasterassistance.gov.

If you’re not a sufferer, however you might be seeking to assist these in want, it is a nice alternative to donate or volunteer your time to reliable 501(c)(3) not-for-profit charities who’re offering aid efforts for storm victims.

[ad_2]