[ad_1]

If you’re having a tough time determining the market’s subsequent strikes, begin by interested by buying and selling vary. The 2023 Outlook spells out causes for a 1000-point buying and selling vary potential within the SPY from 3200-4200. We’re including that the NASDAQ 100, via QQQ, can head to 330 earlier than topping out, then simply as simply skid to assist at 230.

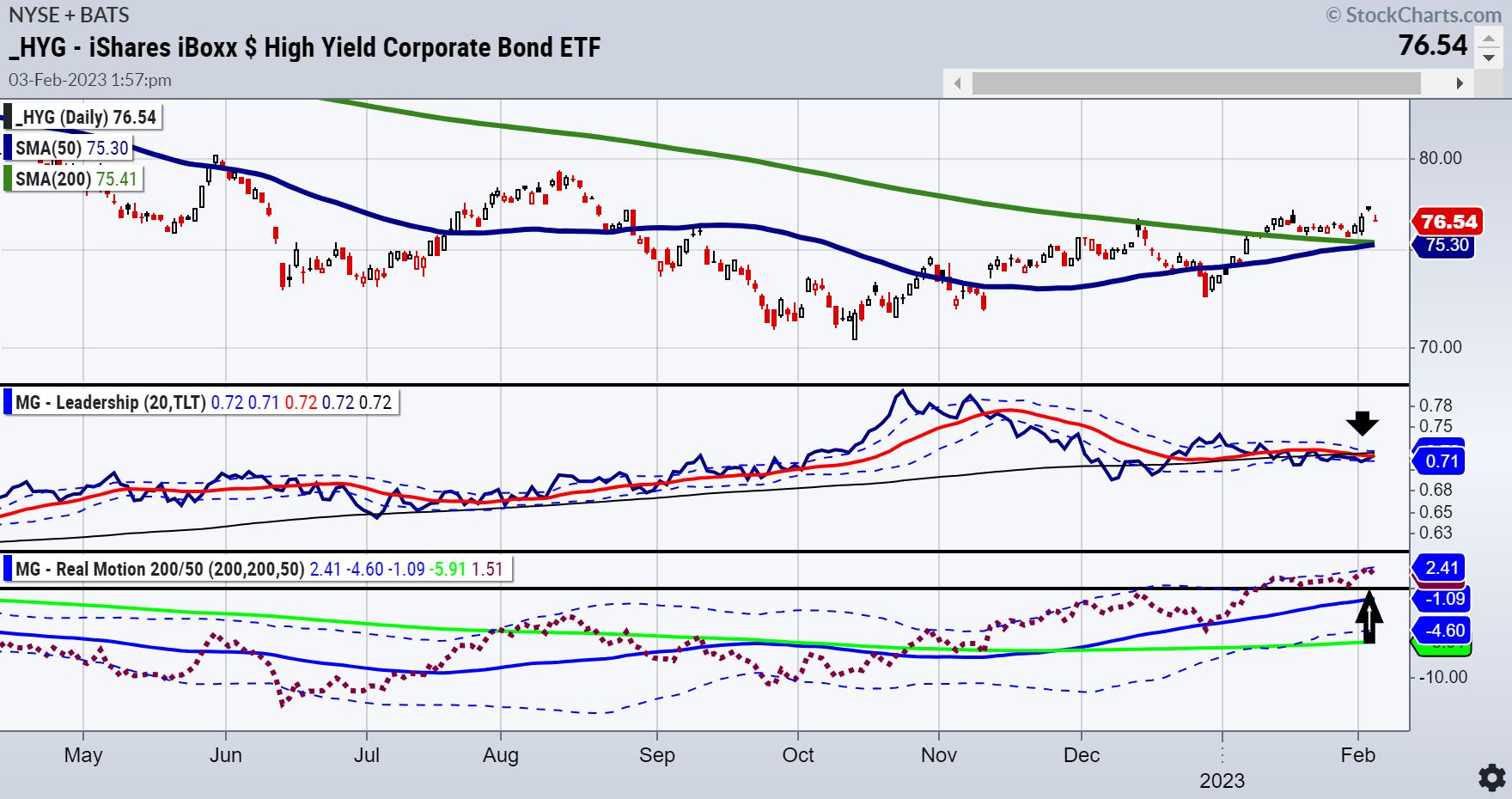

Additionally, take into consideration this–the relationship between the excessive yield/excessive debt bonds and the 20+ yr lengthy bonds is as blended up as you. On the one hand, lastly, the excessive yield bonds are simply beginning to outperform the lengthy bonds-risk on. (See down arrow.) However, the actual movement momentum indicator flashed a imply reversion on junk bonds. (See up arrow.)

(Take a look at our Huge View this weekend for the newest on key market internals)

So the indices are caught. The bond relationships are caught. The financial knowledge is caught. Recession coming or gentle touchdown achieved? Caught. What about inflation, geopolitical stress, local weather points and meals shortages, together with wage improve demand and social unrest?

Caught.

Maybe the Financial Fashionable Household may also help.

The Russell 2000 (IWM) or Granddad of the Financial Fashionable Household, had a golden cross, and cleared the December highs (although not the August ones). 202 is the place main resistance from the 23-month MA sits. Actual Movement reveals new highs in momentum. A optimistic.

Triple Play reveals management towards the benchmark. A optimistic.

Granny Retail (XRT) reveals comparable technical patterns.

Neglect the remaining and simply take a look at Granny and Gramps, one ought to suppose blue skies. Have a look at the 23-month transferring common although at 78.00, and we see XRT trades nicely under that stage.

Till confirmed in any other case, commerce with a mindset that the market is approaching the high quality. Additionally, don’t get overly complacent about inflation peaking–we nonetheless see a possible trainwreck. Nonetheless, the trendy household has an incredible observe document. Which means, above these vary resistance ranges, comply with their lead.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Guide, to study extra.

Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

See Mish, a panel of specialists and Yahoo Finance hosts cowl jobs, buying and selling ranges and the way forward for inflation.

https://www.youtube.com/watch?v=KpANMvNES3s

Mish shares her views on how one can strategy the earnings bulletins of Apple, Amazon, and Alphabet, and offers her technical outlook on how the earnings outcomes may influence the S&P 500 and Nasdaq 100 on this look on CMC Markets.

Hearken to Mish on Chuck Jaffe’s Cash Life, starting across the 27-minute mark.

Kristin and Mish talk about whether or not or not the market has run out of fine information on this look on Cheddar TV.

Harry Melandri and Mish talk about inflation, the Federal Reserve, and all of the sparkplugs that might ignite on Actual Imaginative and prescient.

Jon and Mish talk about how the market (nonetheless rangebound) is relying on a dovish Fed on this look on BNN Bloomberg.

Mish discusses value and what indices should do now on this look on Making Cash with Charles Payne.

On this look on TheStreet.com, Mish and JD Durkin talk about the newest market earnings, knowledge, inflation, the Fed and the place to place your cash.

On this look on CMC Markets, Mish digs into her favorite commodity trades for the week and offers her technical tackle the place the buying and selling alternatives for Gold, oil, copper, silver and sugar are.

- S&P 500 (SPY): Goal 420 with 390-400 assist.

- Russell 2000 (IWM): 190 now assist and 202 main resistance.

- Dow (DIA): 343.50 resistance and the 6-month calendar vary excessive.

- Nasdaq (QQQ): 300 is now the pivotal space.

- Regional Banks (KRE): 65.00 resistance.

- Semiconductors (SMH): 246 is the 23-month transferring average–can she maintain? Sister Semis is the hare this previous week.

- Transportation (IYT): It is like chips are on a bullet train–this 23-month MA is 244–we are again under that stage.

- Biotechnology (IBB): Sideways motion.

- Retail (XRT): 78.00 the 23-month MA resistance; nearest assist 68.00.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary info and training to 1000’s of people, in addition to to massive monetary establishments and publications corresponding to Barron’s, Constancy, ILX Techniques, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the High Inventory Choose of the yr for RealVision.

Subscribe to Mish’s Market Minute to be notified every time a brand new put up is added to this weblog!

[ad_2]