[ad_1]

On January 12, new Shopper Worth Index (CPI) information was launched for December, exhibiting falling inflation charges throughout the board. The headline CPI, the broadest measure of inflation within the U.S., dropped to six.5% year-over-year (YoY), down from 7.1% a month earlier. The “core” CPI, which excludes unstable meals and vitality costs, additionally fell to five.7%, down from 6% in November.

Whereas it’s encouraging to see the inflation fee drop on a YoY foundation, the extra related numbers from the CPI report come from the month-to-month information. Yr-over-year information is inherently backward-looking, and I’m assuming everybody studying that is most enthusiastic about realizing what’s prone to occur over the course of 2023. The information there’s a bit blended.

Breaking Down The Numbers

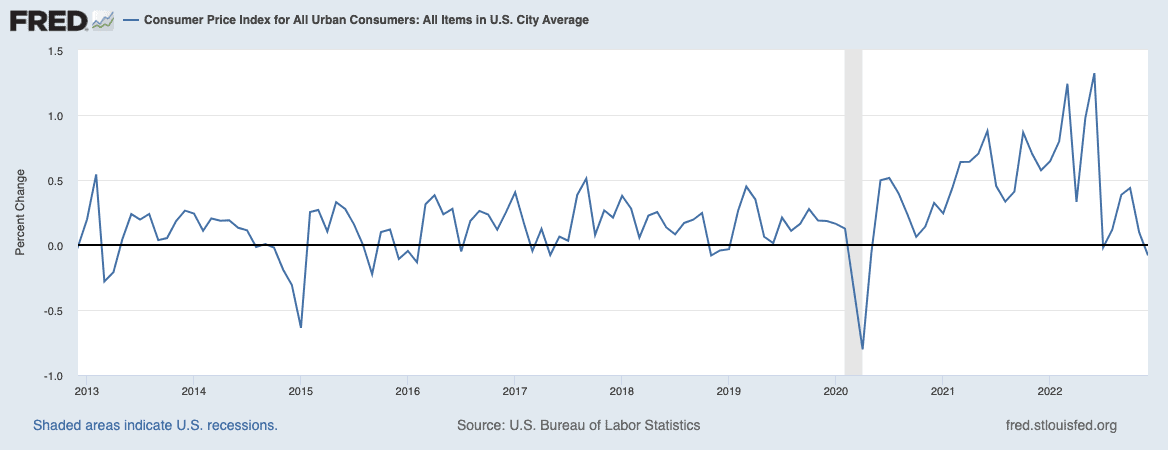

After we take a look at the headline CPI, this month’s report could be very encouraging, exhibiting that costs really fell 0.1% from November to December. Which means for the broadest measure of inflation within the U.S., costs really went down. It is a nice signal for the CPI going into 2023. For inflation to get beneath management, the tempo of value good points solely must sluggish, however costs going backward like final month is even higher.

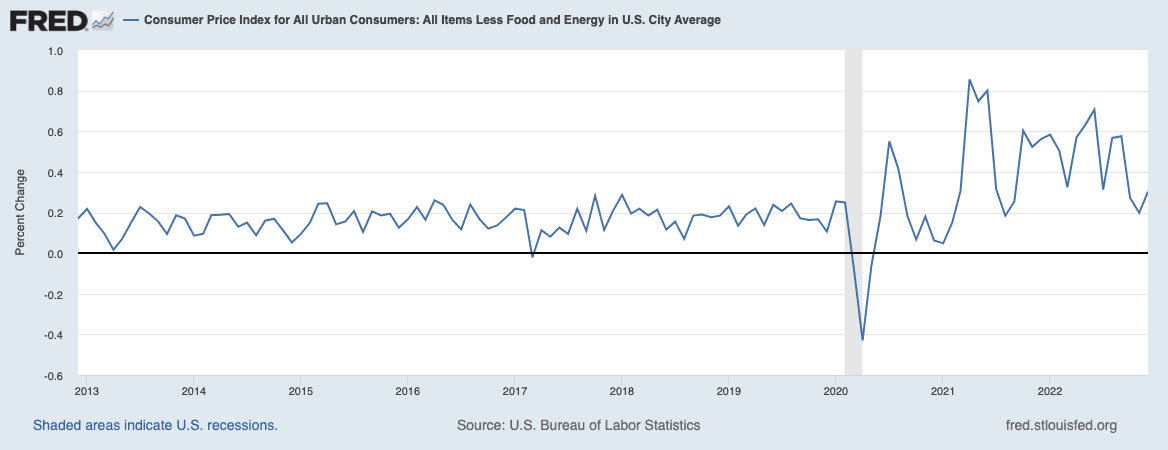

The Core CPI tells a unique story, with costs rising 0.3% in December, up from 0.2% in November. That is clearly not nice, because the tempo of inflation went up month-to-month, and the Federal Reserve could be very targeted on the Core CPI. 0.3% month-to-month inflation continues to be method too excessive.

Nonetheless, when taking a look at the previous couple of years, there’s a clear signal that issues are on the right track. All through 2021 and 2022, Core CPI progress was recurrently above 0.4%, so seeing it come right down to about 0.25% during the last three months is encouraging. However there’s nonetheless work to do. Personally, I’m optimistic issues will hold trending in the fitting course—principally attributable to one a part of the CPI that I’m intimately conversant in—housing costs.

One of many main issues retaining the Core CPI excessive is “shelter” inflation, which measures the price of housing (each for renters and owners) within the U.S. As measured by the CPI, shelter prices rose round 0.7% final month alone!

What’s the cope with that? Anybody who seems to be at information is aware of that the price of housing within the U.S. is falling, not rising! Rents and dwelling costs are declining modestly proper now, but the CPI nonetheless reveals them going up!

The reason being as a result of the CPI measures of shelter lag by 6-12 months (it’s horrible, I do know). So, the December 2022 report reveals housing and rental information for the Summer season of 2022! That’s annoying, however because the housing and rental markets began to shift in June/July, it implies that the CPI will begin reflecting the truth of housing costs within the coming months. To me, this can be a sturdy indication that the Core CPI will fall over the course of the subsequent six months. I can’t see how a lot and when, however I believe it is going to development downward within the first half of this yr.

What Occurs Subsequent?

I wrote an article in November stating that I believed inflation had formally peaked and shared an evaluation of month-to-month CPI charges and the rationale for my perception. Right here’s an replace to that evaluation.

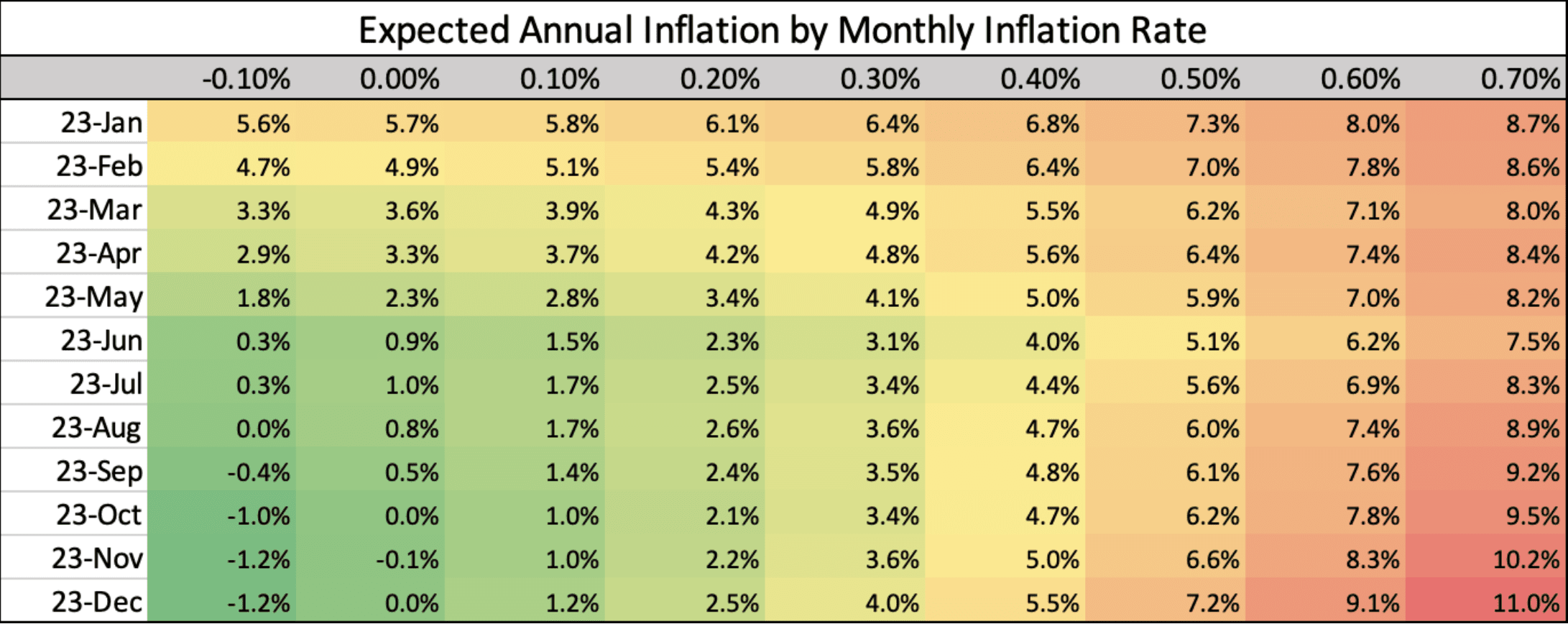

The chart above tasks year-over-year inflation numbers primarily based on what occurs to month-to-month will increase going ahead. For instance, if inflation continues to say no by 0.1% every month (prefer it did this month), then we’ll be under the Fed’s 2% annualized goal for inflation by Might 2023.

I don’t suppose that is practical, and we’re going to see modest month-to-month good points going ahead. If we see a mean month-to-month enhance of 0.1%, we’ll be beneath the Fed’s goal fee by June. If month-to-month inflation rises 0.16% (which is the typical for the final six months), we are able to anticipate to be under the Fed’s goal someday over the summer season. To me, this can be a very practical state of affairs.

In fact, the inflation fee may decide up steam once more, however that appears most unlikely. In nearly each dataset, we see that inflation has peaked and is beginning to return to earth. There may be nonetheless a methods to go, however it looks as if we should always have inflation beneath management someday this yr. That’s incredible information. Decrease inflation is nice for the financial system and for each American who has been harm by greater costs over the previous couple of years.

What Will The Fed Do?

Regardless of this encouraging information, I anticipate the Fed will increase the federal funds fee at the least another time. However, I believe we’re approaching the terminal fee (the speed at which the Fed stops elevating charges), and we may see the tip of this tightening cycle quickly.

Pausing fee hikes doesn’t imply falling charges, although. The Fed just lately issued steerage saying they don’t intend to decrease charges in 2023. Many buyers suppose that’s a bluff, however personally, I take the Fed at its phrase after which hope I’m incorrect. The Fed is lifeless critical about controlling inflation, and though I imagine they’ll cease elevating charges quickly, they received’t decrease charges at the least within the subsequent six months to be additional positive the danger of resurgent inflation is low.

Paused charges are nonetheless factor, although! A lot of the financial turmoil we’re experiencing proper now is because of uncertainty about Fed coverage. In the event that they cease elevating charges within the subsequent few months, it ought to give your complete financial system some sense of stability and hopefully result in a clearer and extra optimistic financial outlook.

What do you suppose will occur in 2023 primarily based on this inflation information? How will it impression your investing choices? Let me know within the feedback under.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you put money into actual property.

With direct-access to high-quality actual property investments, Fundrise permits you to construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has shortly grow to be America’s largest direct-to-investor actual property investing platform.

Notice By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.

[ad_2]