[ad_1]

In style methods to comply with with the Superior CCI Buying and selling robotool

The Easy CCI and the Superior CCI buying and selling robots and instruments had been created with a view to aid you obtain your objectives and win within the markets, not by supplying you with an unknown magical formulation, or an “AI” that may predict the longer term for you. They had been designed with a view to offer you loads of choices to create your individual methods.

We imagine that the human needs to be above any robotic, and by doing so, the human will earn not solely the earnings of his technique (if he succeeds) but additionally the psychological satisfaction that he did succeed. If not, he earns from information and he turns into a greater and wiser dealer.

On this article we’re gonna see a few of the widespread methods which you can comply with simply that can assist you kickstart your individual journey by utilizing these “robo-tools’.

Product: https://www.mql5.com/en/market/product/97538

Technique 1 – “Swing CCI”

You may comply with this technique with each robots, so for those who don’t have cash to buy the Superior CCI, we acquired your again mate! You may obtain the free “Easy CCI” buying and selling robotic.

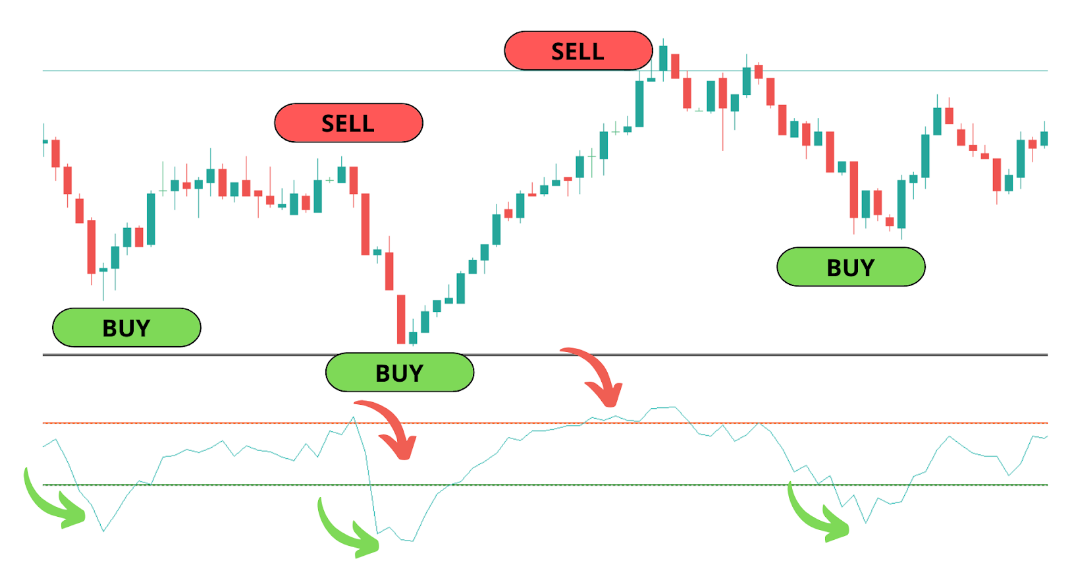

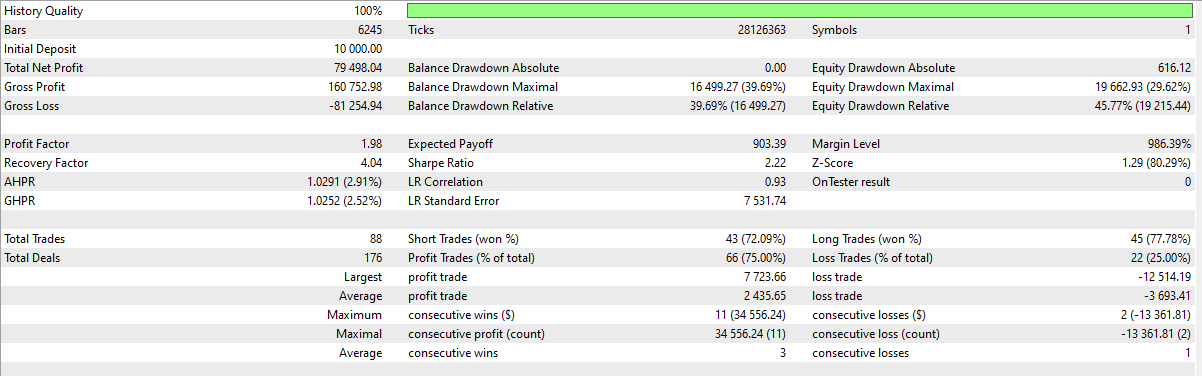

The concept could be very easy. Purchase whenever you cross above or under a CCI stage, shut and promote on one other stage.

Let’s see a easy instance by utilizing a picture:

In each robots there’s no choice to not add a stop-loss or a take-profit stage. It doesn’t matter what, we imagine {that a} stop-loss should be there, someplace. Something might occur, Murphy’s legislation could be very intently associated with buying and selling, so with a view to comply with this technique you’ll have to add the SL and TP ranges distant from the entry value. And it’s because we have to give the market some house to breathe. Let’s enter the market after we get an oversold sign (purchase) and exit and promote after we get an overbought sign.

Even when the market begins trending in the direction of one path, the loss can be in all probability the minimal as we’re gonna exit at a powerful pullback.

You may search via all of the obtainable timeframes and you may discover all of the property obtainable out of your dealer.

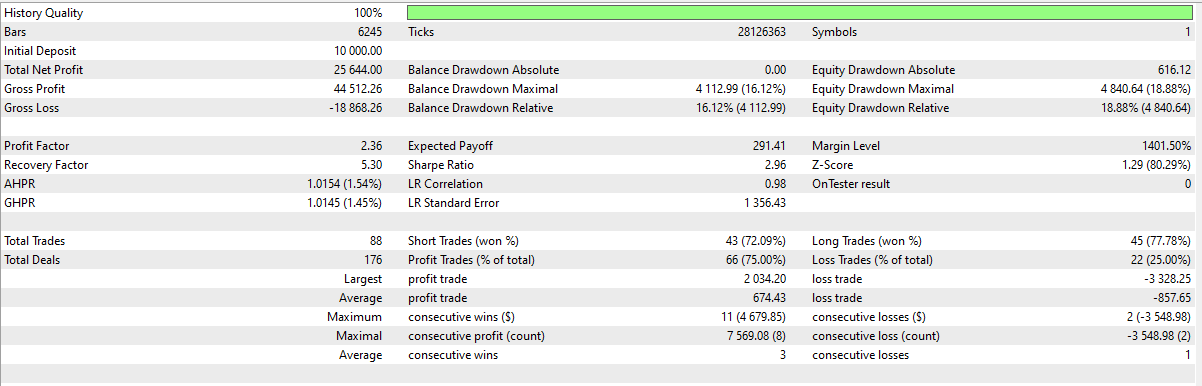

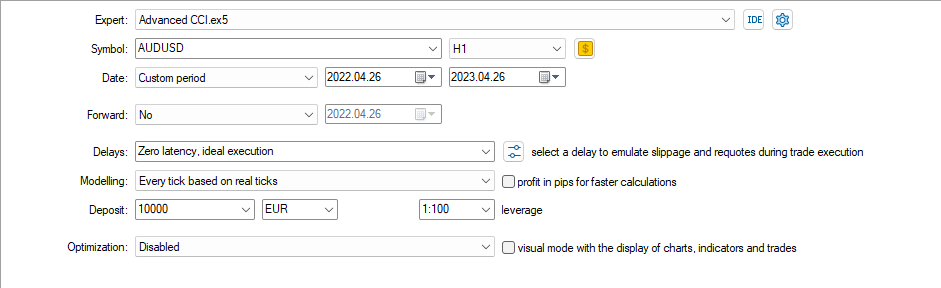

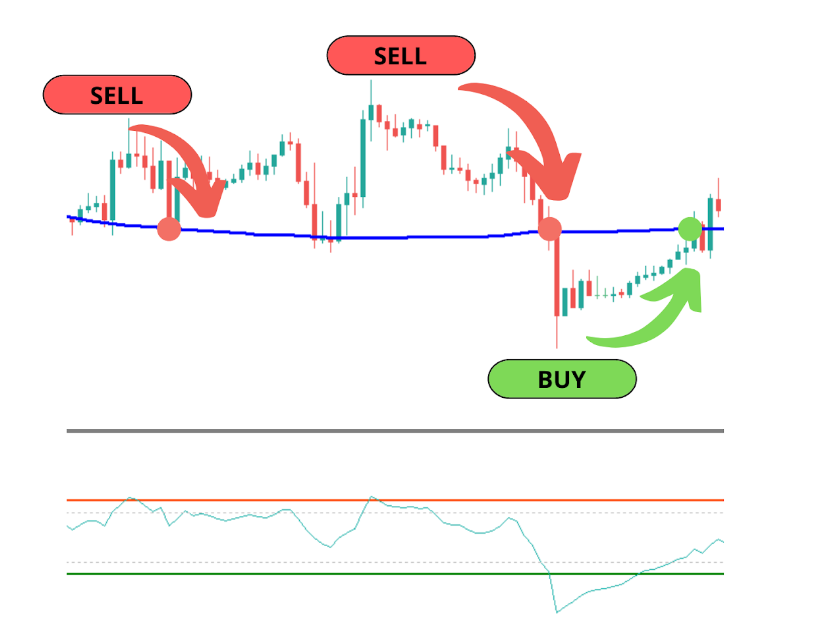

I’d like to provide you an instance right here. Utilizing the AUDUSD – H1 and by including these inputs:

-

Purchase when crossing ABOVE -160

-

Promote when crossing BELOW 160

-

Shut open positions at reverse sign: TRUE

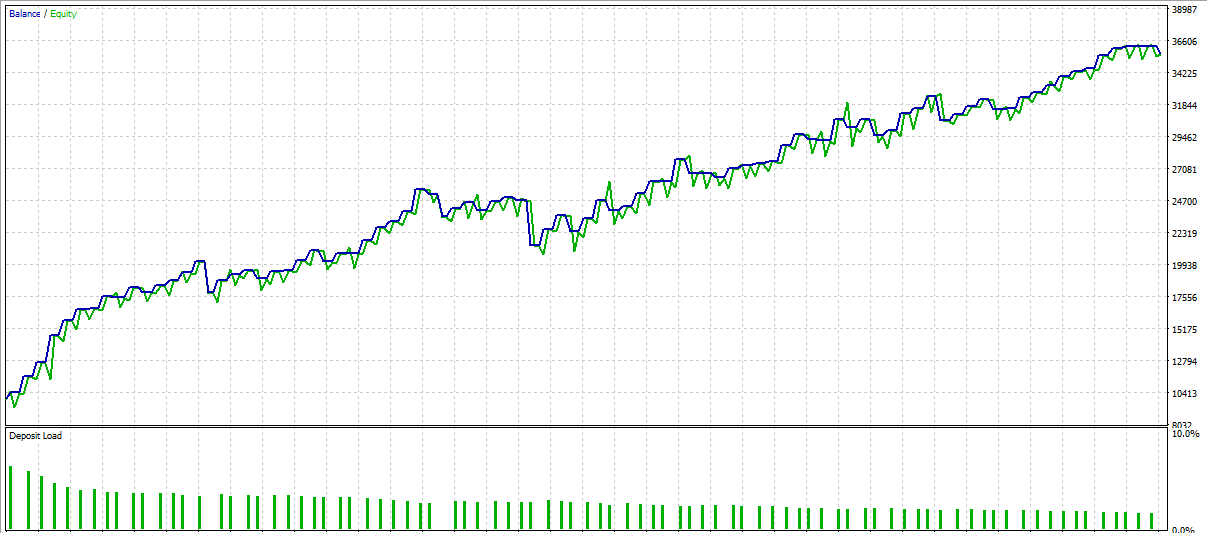

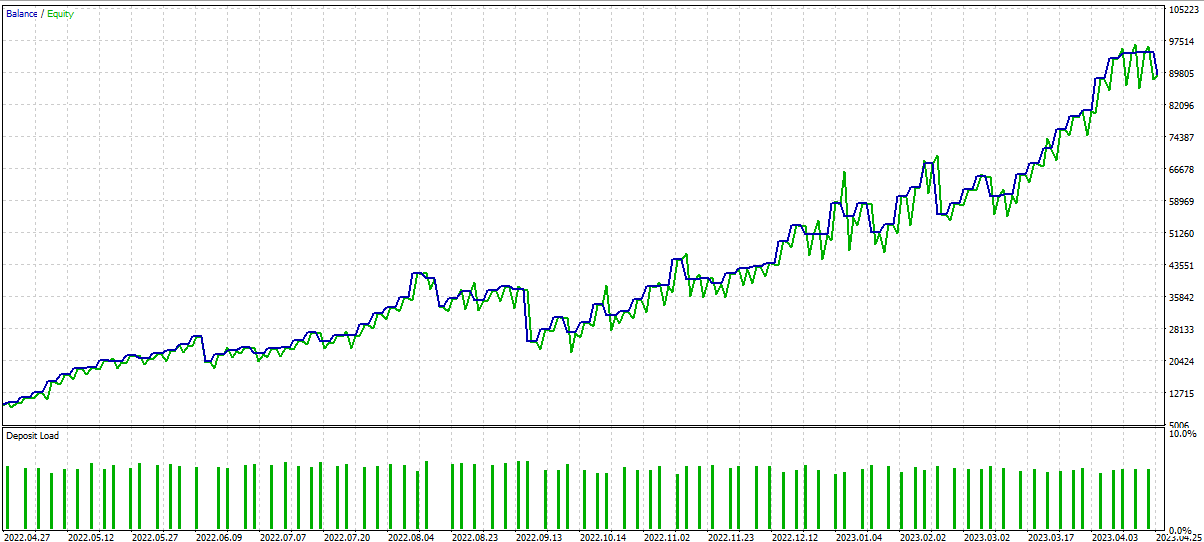

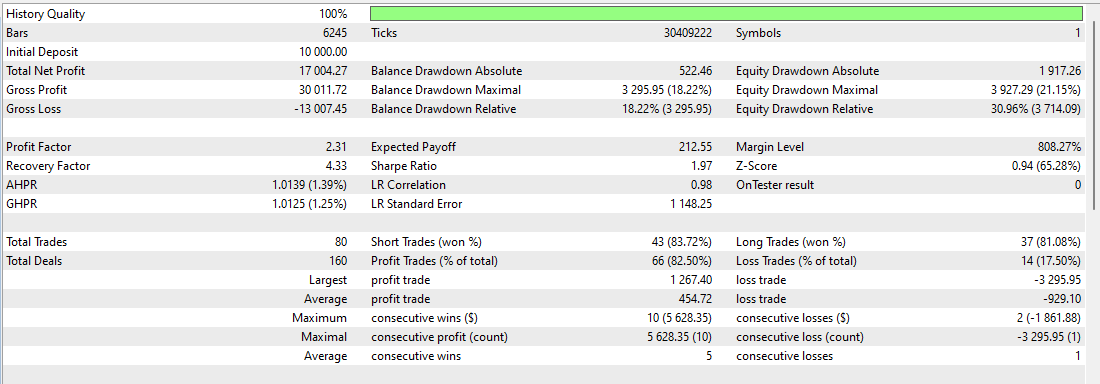

Let’s verify the outcomes (Each tick primarily based on actual ticks for 1 yr)

The consequence offers us a revenue of greater than 25,000$ and it turns our 10,000$ account into 35,644$

We are able to discover extra combos utilizing a few of the Superior CCI robotic functionalities, such because the trailing SL, dynamic exit utilizing the “Handle” tab, the place we will set a % or a certain quantity to cease buying and selling or the dynamic lot measurement, the results of it I am sharing under:

From 10,000$ to 89,498$.

Technique 2 – Imply reversion

Extremely popular technique, and certainly one of my favorites, after we anticipate the market eventually to return again to the imply value, aka MA.

With a view to comply with a technique like this, we’re gonna allow the MA filter, obtainable solely within the Superior model.

After now we have an oversold or overbought sign we’re gonna enter the market, and the goal is gonna be a Transferring Common of our selection.

After all now we have a weak level and that is when a market is trending. Once more we’re gonna exit on the MA, however what occurs if the pattern is sharp and lengthy. Because of this we want a stop-loss once more. Alternative ways so that you can select a great stop-loss stage, reminiscent of:

-

The closest excessive or low (excessive for promote and low for purchase) the place you may also add some factors, to provide an additional house for the current excessive/low to behave like a help/resistance stage.

-

One other approach is to make use of the ATR issue. This manner you may add your stop-loss to some bars above or under the entry level.

-

Final however not least, is the most typical approach, by utilizing a distance in factors.

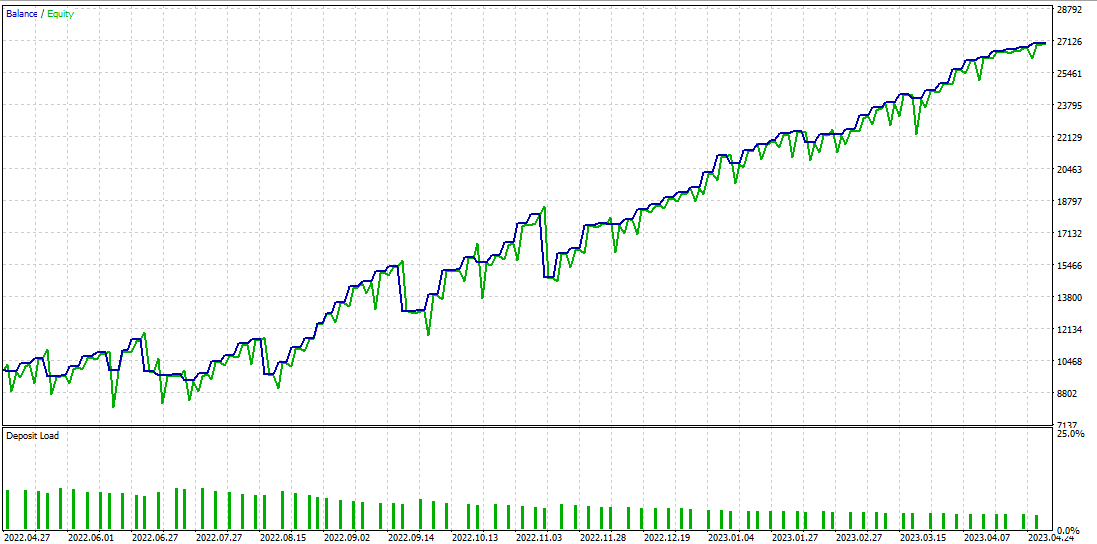

Let’s see an instance collectively.

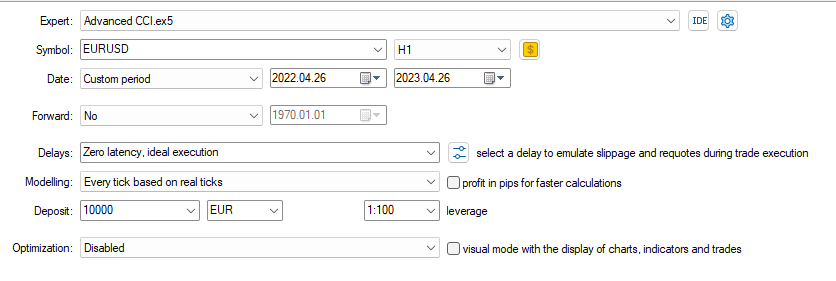

-

Image: EURUSD

-

Timeframe: H1

-

Backtest interval: 1 yr

Outcomes:

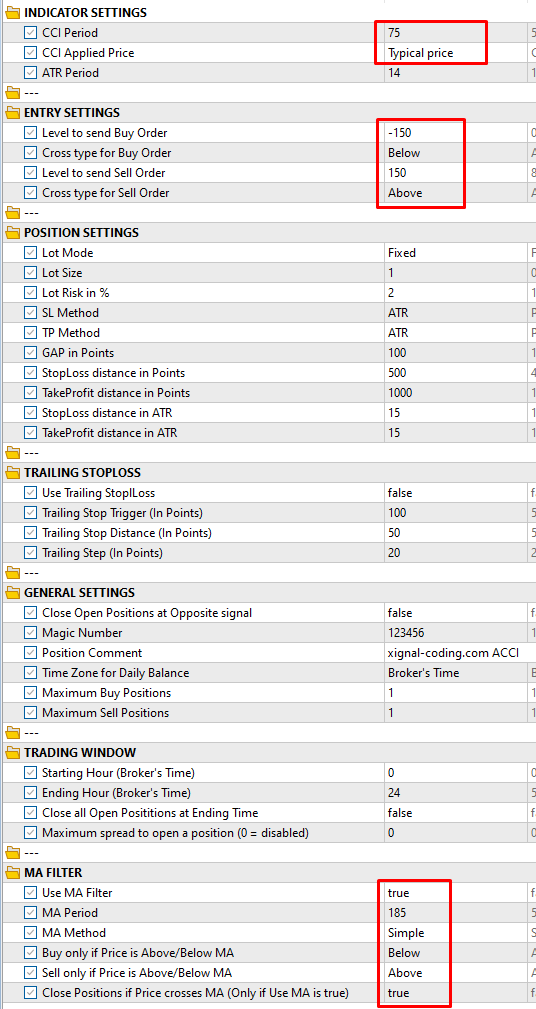

Inputs:

CCI Interval: 75

CCI Methodology: Typical Value

Purchase when Value is under the MA and likewise CCI crosses under -150.

Promote when value is above the MA and CCI crosses above 150 stage.

Extra methods are coming quickly…

[ad_2]