[ad_1]

There are two psychological elements that play with a dealer’s thoughts each time they’re buying and selling the foreign exchange market. One is greed and the opposite is concern. Whereas most merchants blame greed for inflicting them to lose cash when buying and selling, concern can be simply as damaging to a dealer’s account.

Seasoned merchants know that wins and losses are a given when buying and selling the market. Usually, merchants lose cash out of greed, which regularly causes them to get out of their recreation plan. Nevertheless, disciplined merchants lose cash not due to greed however purely as a result of the market is the market and it does no matter it desires to do. It’s all a part of the statistics of his or her technique. Nevertheless, at occasions merchants can not recuperate from their losses, which is part of the statistics, as a result of they’re afraid to take trades that would have doubtlessly earned them earnings. That is all due to concern.

One of many clear alternatives that merchants usually miss out on is when the market begins to pattern. Many merchants drool after they see the market trending, wishing that they have been in a position to take the commerce at the beginning of the pattern. Nevertheless, out of concern that the pattern might quickly finish, they’d somewhat not take any threat.

Trending markets have a lot potential. Merchants simply must know methods to enter a trending market with out making an attempt to chase value.

Ichimoku Kinko Hyo

Ichimoku Kinko Hyo is likely one of the few technical indicators which may declare to be an entire buying and selling system all by itself. That is doable as a result of this indicator supplies merchants a chook’s eye view of what the market is doing, from the long-term pattern all the way down to the short-term pattern and rapid value motion.

The Ichimoku Kinko Hyo consists of a number of modified shifting common traces, that are largely based mostly on the median of value inside a sure interval.

The Tenkan-sen or conversion line is computed because the median of value throughout the final 9 durations. This line represents the short-term pattern. This line is often used to substantiate short-term pattern reversals together with the Kijun-sen line.

The Kijun-sen or bottom line relies on the median of value during the last 26 durations. This line represents the short- to mid-term pattern. This line can be utilized as a trailing cease loss level since this may very well be an early warning of a doable pattern reversal.

Senkou Span A or main span A is derived from the median of the Tenkan-sen and Kijun-sen plotted 26 durations forward.

Senkou Span B or main span B is the median of value over the previous 52 durations plotted 26 durations forward.

The Senkou Span A and B kind the Kumo or cloud. The Kumo represents the route of the long-term pattern. The long-term pattern is bullish if the Senkou Span A is above Senkou Span B. However, the long-term pattern is bearish if the Senkou Span A is under Senkou Span B.

Chikou Span or lagging span is the present durations closing value plotted 26 durations again. This line can be utilized to find out the traits of value motion. It can be used to establish potential help or resistance ranges based mostly on its swing factors.

FBS Fisher

FBS Fisher is an oscillator kind of technical indicator which relies on the idea of a Gaussian regular distribution. This indicator derives its computation from the historic actions of value motion and converts the figures right into a Gaussian regular distribution. This normalizes value actions inside an oscillator vary, which in flip helps merchants establish potential oversold or overbought markets that would reverse.

The ensuing figures are plotted as histogram bars that would both be constructive or destructive. This indicator additionally modifies the colour of the bars to point a doubtlessly strengthening or weakening momentum.

Constructive gold bars point out a strengthening bullish pattern, whereas destructive gold bars point out a strengthening bearish pattern. Constructive crimson bars point out a weakening bullish pattern, whereas destructive lime bars point out a weakening bearish pattern.

Buying and selling Technique

Ichimoku Fisher Foreign exchange Buying and selling Technique can be utilized as a long-term pattern following technique or a pattern re-entry technique.

The Kumo is used to establish the route of the long-term pattern based mostly on how the Senkou Span A and B overlap, in addition to the colour shaded on the world contained in the Kumo.

Pullbacks would trigger the Tenkan-sen and Kijun-sen to briefly reverse. It also needs to trigger the FBS Fisher bars to briefly reverse.

The market is taken into account to be persevering with its pattern route if the Tenkan-sen crosses over the Kijun-sen in the direction of the route of the pattern and the FBS Fisher crosses over the midline and plots gold bars indicating the route of the pattern. This could represent a legitimate commerce setup.

Indicators:

- Ichimoku Kinko Hyo

- FBS Fisher

Most well-liked Time Frames: 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

Purchase Commerce Setup

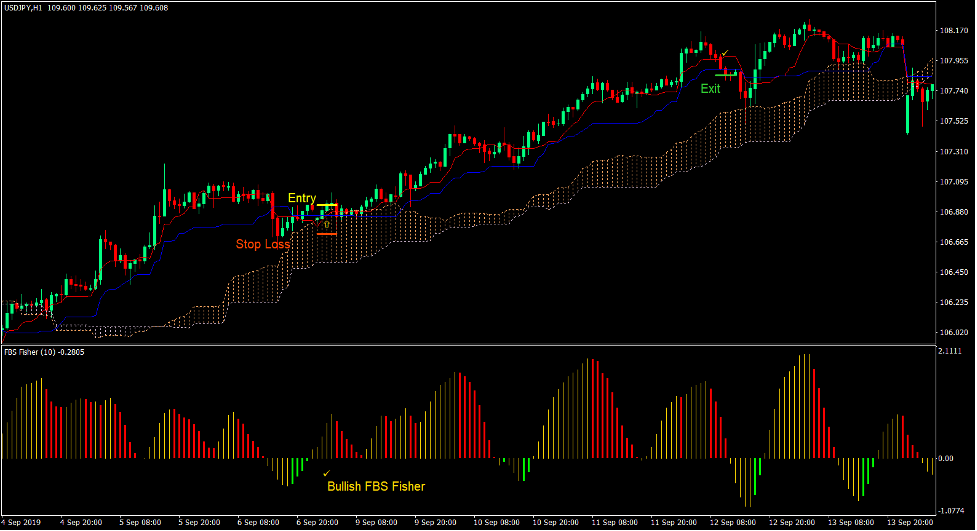

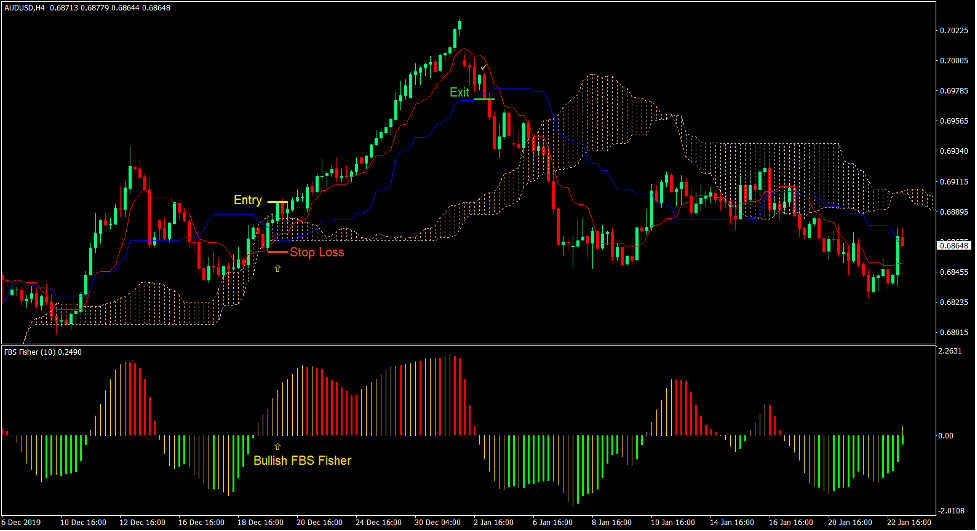

Entry

- The Senkou Span A ought to be above the Senkou Span B and the Kumo ought to be sandy brown.

- Worth motion ought to be trending up.

- Worth ought to pull again in the direction of the Kumo inflicting the Tenkan-sen to briefly cross under the Kijun-sen and the FBS Fisher bars to be destructive.

- Enter a purchase order as quickly because the FBS Fisher plots a constructive gold bar and the Tenkan-sen crosses above the Kijun-sen.

Cease Loss

- Set the cease loss on the help under the entry candle.

Exit

- Shut the commerce as quickly as value closes under the Kijun-sen.

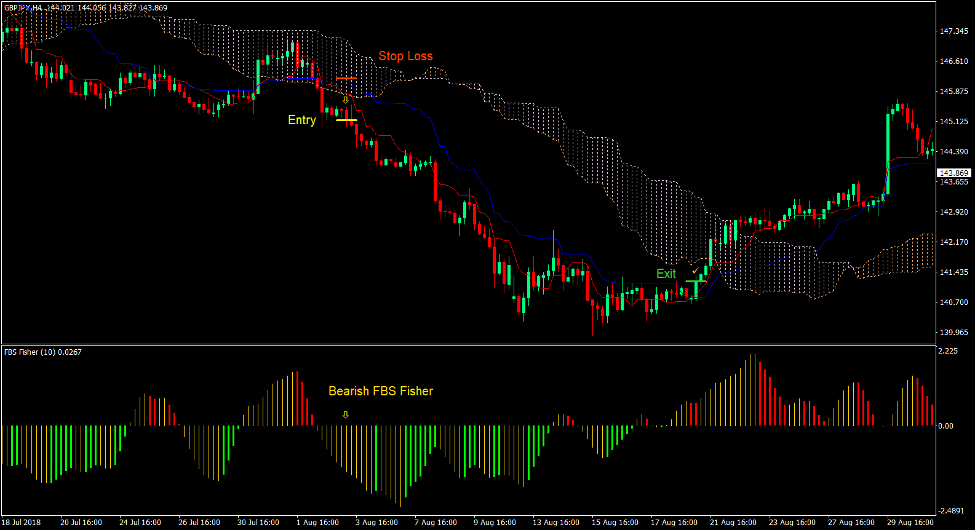

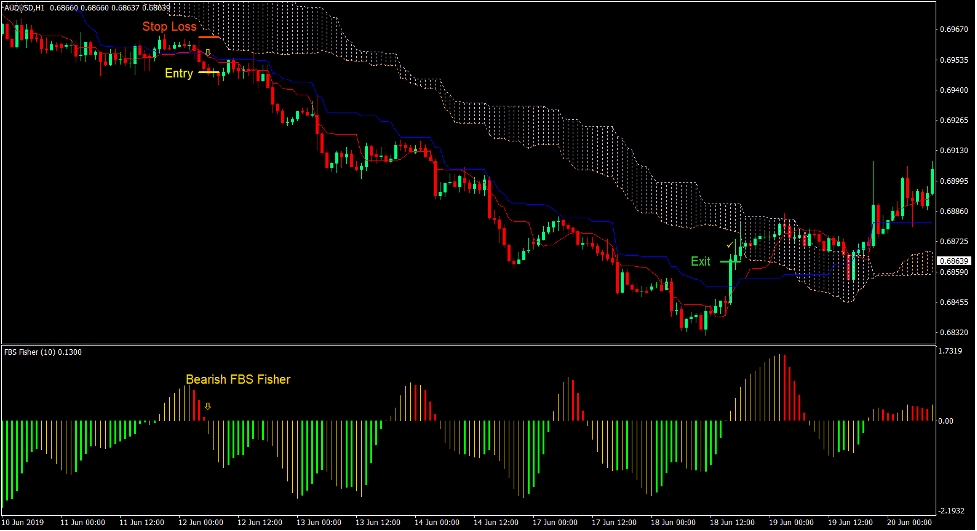

Promote Commerce Setup

Entry

- The Senkou Span A ought to be under the Senkou Span B and the Kumo ought to be thistle.

- Worth motion ought to be trending down.

- Worth ought to pull again in the direction of the Kumo inflicting the Tenkan-sen to briefly cross above the Kijun-sen and the FBS Fisher bars to be constructive.

- Enter a promote order as quickly because the FBS Fisher plots a destructive gold bar and the Tenkan-sen crosses under the Kijun-sen.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly as value closes above the Kijun-sen.

Conclusion

The Ichimoku Kinko Hyo indicator is an indicator which could be a full buying and selling system all by itself. In reality, crossovers between the Tenkan-sen and Kijun-sen whereas being aligned with Kumo is taken into account a typical Ichimoku Kinko Hyo technique.

The FBS Fisher serves as an extra layer of affirmation which merchants can use to enhance on their win chance. Nevertheless, merchants can even choose to make use of the shifting of the FBS Fisher bars to function an entry set off. This could be a extra aggressive methodology however it could additionally imply an earlier entry which ought to permit merchants to squeeze out a bit extra earnings.

Foreign exchange Buying and selling Methods Set up Directions

Ichimoku Fisher Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the collected historical past knowledge and buying and selling indicators.

Ichimoku Fisher Foreign exchange Buying and selling Technique supplies a possibility to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional value motion and modify this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Methods to set up Ichimoku Fisher Foreign exchange Buying and selling Technique?

- Obtain Ichimoku Fisher Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Ichimoku Fisher Foreign exchange Buying and selling Technique

- You will notice Ichimoku Fisher Foreign exchange Buying and selling Technique is out there in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]