[ad_1]

Hyve’s cash app is focusing on Gen Z and younger millennials with a technique to pay down debt, save and make investments with the assistance of family and friends. The social finance app is now open to the general public after a 12 months testing the product with tons of of beta customers.

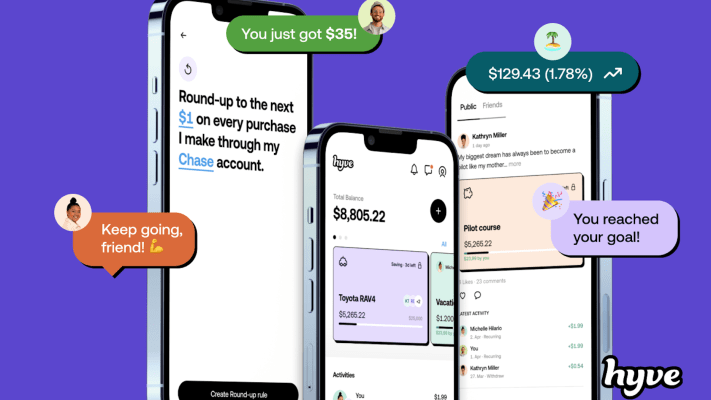

Hyve is constructing a multiplayer fintech infrastructure for saving and investing the place customers can create their community of supporters, and people folks can routinely spherical up their purchases to match the consumer’s private money contributions. The extra folks added to the “hyve,” the extra money the consumer saves to succeed in their targets.

Royi Markowitz, co-founder and CEO, Hyve. Picture Credit: Hyve

Social finance is on no account a brand new idea, suppose Public.com, Frich Cash, Braid, Observe and Shares. Nevertheless, Royi Markowitz, co-founder and CEO, advised TechCrunch that Hyve is a hybrid between Venmo and Acorns and differentiates itself from rivals by means of its infrastructure.

“At our core is our ledger, which is the cash actions inside the platform,” Markowitz mentioned. “To transform a single-player ledger right into a hybrid 3D multiplayer ledger may be very, very troublesome, particularly for a corporation that already has tons of of line objects of their ledger. Hyve is de facto the one place the place I may use my bank card to ship you $1 or $20 or $1,000 into your funding portfolio and be a part of your financial savings so you may get there quicker.”

Right here’s the way it works: After downloading the app and making a profile, customers hyperlink their financial institution accounts and arrange automated deposits. Then they create their first objective and share that with family and friends. Customers may uncover different folks’s targets through Hyve’s social feeds and help them.

The free app’s options embrace that auto spherical up of purchases, one-click investing from a financial savings account and a couple of.10% APY on all financial savings account balances. There are additionally monetary instruments to assist eradicate debt.

Hyve is pre-revenue and nonetheless within the very early phases, however by means of its beta program customers have created a “hyve” with a median of about three folks and created financial savings targets that they wish to obtain that complete over $850,000. Markowitz expects to succeed in 100,000 lively customers over the following 12 months.

Future planning for income consists of charging for the creation of “sensible” targets, saving as much as pay scholar loans, a price to attach customers to lenders, entry to insights and mortgage refinancing alternatives.

And although it’s targeted on shoppers, Markowitz mentioned the corporate lately secured its first employer — which he declined to call — that provides 300 new prospects to the roughly 1,000 folks at present on the waitlist. Below this mannequin, employers pays Hyve a SaaS price for every worker.

The corporate raised $2.25 million in a pre-seed spherical in January 2022 from an investor group that included The Flying Whale VC, MoreVC and the founders of Guardio. It’s at present elevating one other spherical of funding that’s anticipated to shut later this 12 months.

[ad_2]