[ad_1]

The STOCHASTIC indicator is among the many hottest buying and selling indicators and rightfully so. The STOCHASTIC indicator is a good momentum and trend-following indicator. It could possibly help merchants in understanding pattern dynamics and enhance their chart studying.

Nonetheless, I’m all the time astonished that many merchants don’t actually perceive the indications they’re utilizing. Or, even worse, many merchants use their indicators within the improper method after which make unhealthy buying and selling selections that would have been simply prevented.

On this article, I’ll enable you to perceive the STOCHASTIC indicator in the proper method and I’ll present you what it does and the way you should utilize it in your buying and selling.

What’s the Stochastic indicator?

The STOCHASTIC indicator exhibits us details about momentum and pattern power. As we are going to see shortly, the indicator analyses value actions and tells us how briskly and the way sturdy the worth strikes.

This can be a quote from George Lane, the inventor of the STOCHASTIC indicator:

“Stochastics measures the momentum of value. Should you visualize a rocket going up within the air – earlier than it may well flip down, it should decelerate. Momentum all the time adjustments path earlier than value.” – George Lane, the developer of the Stochastic indicator

What’s momentum?

Earlier than we get into utilizing the Stochastic, we must be clear about what momentum really is.

Investopedia defines momentum as “The fee of acceleration of the value of a safety.” by way of Investopedia

I’m all the time a fan of digging into how an indicator really analyzes value and what makes the indicator go up and down. That method, we will acquire necessary insights about one of the best software for the indicator shortly.

How is the STOCHASTIC calculated?

The stochastic indicator analyzes a value vary over a selected time interval or value candles; typical settings for the Stochastic 14 durations/value candles.

The Stochastic indicator takes the very best excessive and the bottom low over the past 14 candles and compares it to the present closing value. It is so simple as that.

We are going to see how this works with the next two examples.

Instance 1: A excessive Stochastic quantity

When your Stochastic is at a excessive worth, it signifies that the worth closed close to the top quality over a sure time interval or plenty of value candles.

The graphic under marks the bottom low and the very best excessive of the final 14 candlesticks.

The excessive is at 0.6283

The low is at 0.6258

And the shut is at 0.628

The vary between the excessive and the low is 0.0025 (0.6283 – 0.6258).

And the space between the shut and the very best excessive is 0.0003 (0.6283-0.628).

All we do now’s divide 0.003 by 0.0025 to verify how shut is the worth to absolutely the excessive of that vary. The calculation provides us 12%.

Which means that the present shut is 12% away from the highest and 88% (100%-12%) from the underside.

And, certainly, the Stochastic on this instance is at 88.

The Stochastic indicator, subsequently, tells you the way shut has the worth closed to the very best excessive or the bottom low of a given value vary.

The mathematics is definitely fairly easy.

You simply verify the whole distance of the vary between the very best excessive and the bottom low. After which all you do is see how shut the worth is closing to the very best excessive or the bottom low.

Instance 2: A low Stochastic quantity

Conversely, a low Stochastic worth signifies that the momentum to the draw back is robust.

Within the screenshot under we will already see that the worth has moved decrease considerably over the past 14 candles. And we will additionally see that the present shut is comparatively near absolutely the low. Solely a small candlestick wick is protruding decrease.

Simply by understanding that we will already assume that the Stochastic indicator must be very low because the Stochastic measures how shut the worth is closing to the bottom low and the way distant the worth is from the very best excessive.

And, certainly, the Stochastic indicator exhibits a price of 13. Which means that the worth is 13% away from the bottom low and 87% away from the very best excessive.

Overbought vs Oversold

The misinterpretation of overbought and oversold is likely one of the largest issues and faults in buying and selling. We’ll now check out these expressions and be taught why there’s nothing like overbought or oversold.

The Stochastic indicator does not present oversold or overbought costs. It exhibits momentum.

Usually, merchants would say {that a} Stochastic over 80 means that the worth is overbought and when the Stochastic is under 20, the worth is taken into account oversold. And what merchants then conclude is that an oversold market has the next probability of happening and vice versa. That is improper and really harmful!

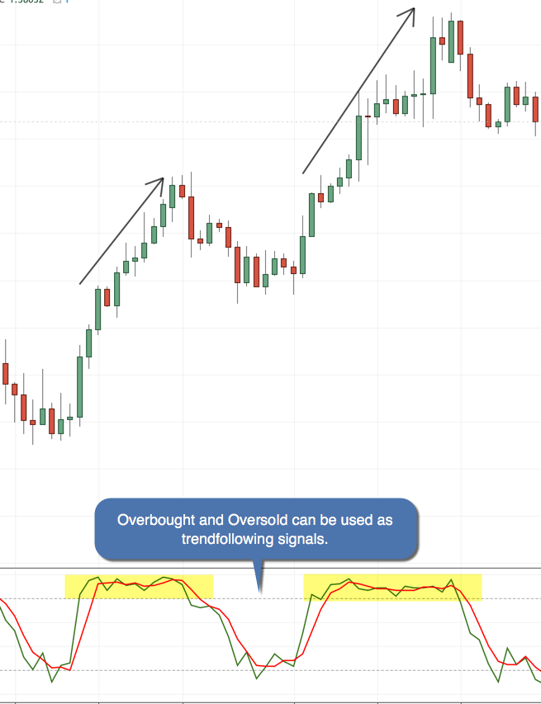

As now we have seen above, when the Stochastic is above 80 it signifies that the pattern is robust and not that it’s more likely to reverse. A excessive Stochastic signifies that the worth is ready to shut close to the highest and stored pushing larger. A pattern wherein the Stochastic stays above 80 for a very long time indicators that momentum is excessive and not that it is best to get able to quick the market.

The picture under exhibits the habits of the Stochastic inside an extended uptrend and a downtrend. In each instances, the Stochastic entered “overbought” (above 80), “oversold” (under 20) and stayed there for fairly a while, whereas the traits stored on going.

The idea that the Stochastic exhibits oversold/overbought is improper and you’ll shortly run into issues once you commerce this manner. A excessive Stochastic worth exhibits that the pattern has sturdy momentum and NOT that it is able to flip round.

The Stochastic indicators

Lastly, I wish to present the most typical indicators and methods how merchants are utilizing the Stochastic indicator:

-

Breakout buying and selling: Whenever you see that the Stochastic is instantly accelerating in a single path and the 2 Stochastic bands are widening, it may well sign the beginning of a brand new pattern. If it’s also possible to spot a breakout out of sideways vary in your value chart, even higher.

-

Development following: So long as the Stochastic is above 80 it confirms a robust bullish pattern. And a Stochastic under 20 factors to a robust bearish pattern.

-

Robust traits: When the Stochastic is within the “oversold/overbought space”, don’t battle the pattern however attempt to maintain on to your trades and keep on with the pattern.

-

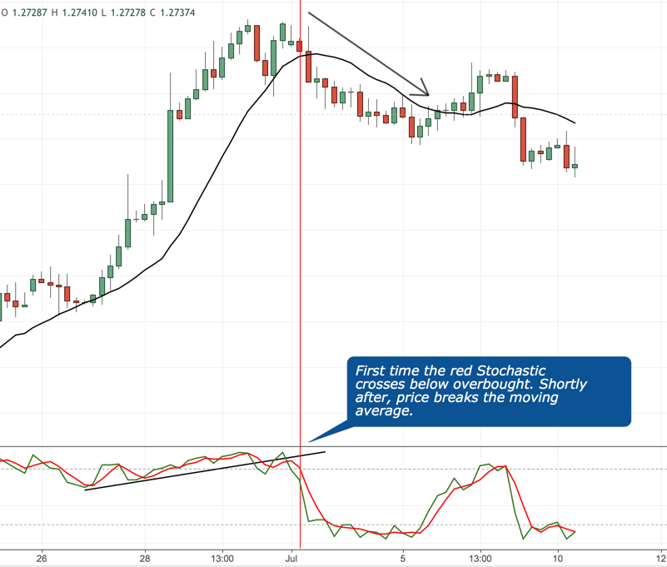

Development reversals: When the Stochastic is altering path and exits the overbought/oversold areas, it may well foreshadow a pattern reversal. Particularly when the indicator sign is adopted by reversal indicators in your value charts.

-

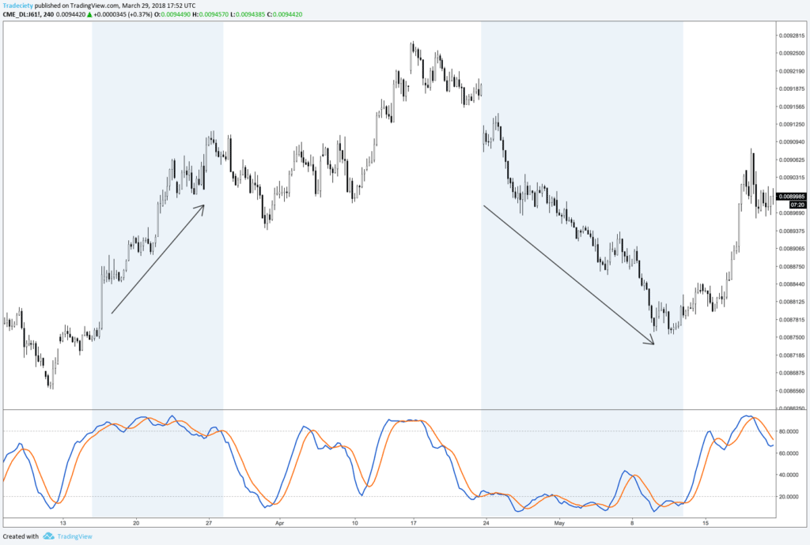

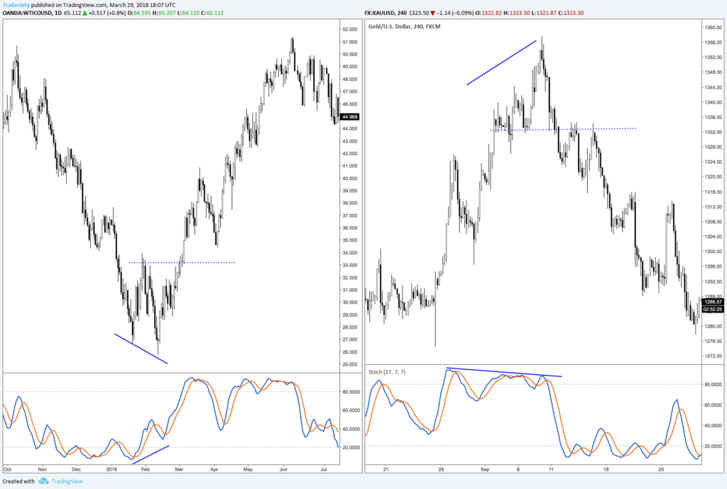

Divergences: As with each momentum indicator, divergences may also be an important sign right here to indicate potential pattern reversals, or no less than the tip of a pattern. A divergence is a state of affairs the place the indicator and the worth motion are displaying opposing indicators.

On the left within the screenshot under, the worth is making decrease lows in the course of the downtrend, whereas the indicator is already making larger lows. The Stochastic exhibits that the final bearish pattern wave is much less sturdy than the earlier ones.

Combining the Stochastic with different instruments

As with every different buying and selling idea or software, you shouldn’t use the Stochastic indicator by itself. To obtain significant indicators and enhance the standard of your trades, you possibly can mix the Stochastic indicator with these 3 instruments:

-

Transferring averages: Transferring averages generally is a welcome boost they usually act as filters to your indicators. All the time commerce within the path of your shifting averages. So long as the worth is above the shifting common, solely search for longs – and vice versa.

The worth stayed above the shifting common for an prolonged time period whereas the Stochastic was near the 80 stage, confirming a robust bullish pattern.

-

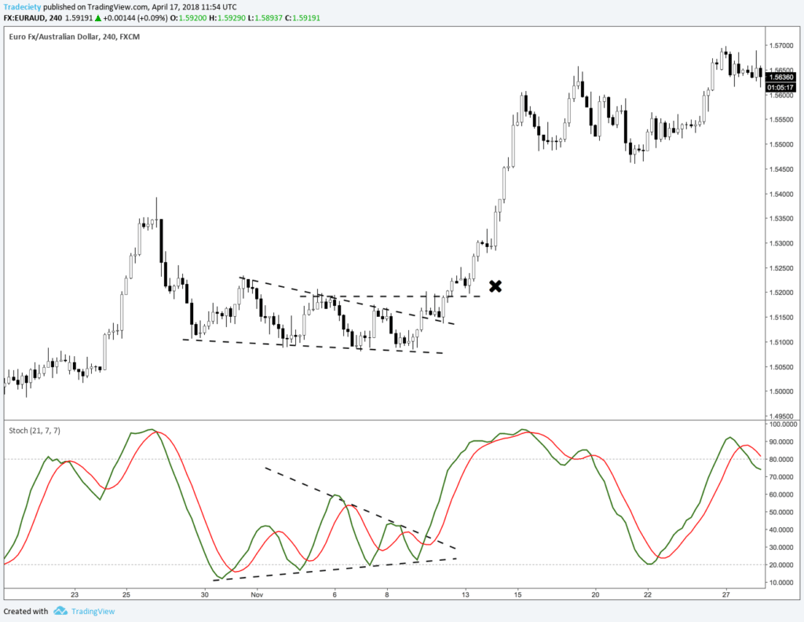

Value patterns: As a breakout or reversal dealer, it is best to search for wedges, triangles, head and shoulders, or rectangles. When value breaks such a formation with an accelerating Stochastic, it may well probably sign a profitable breakout.

-

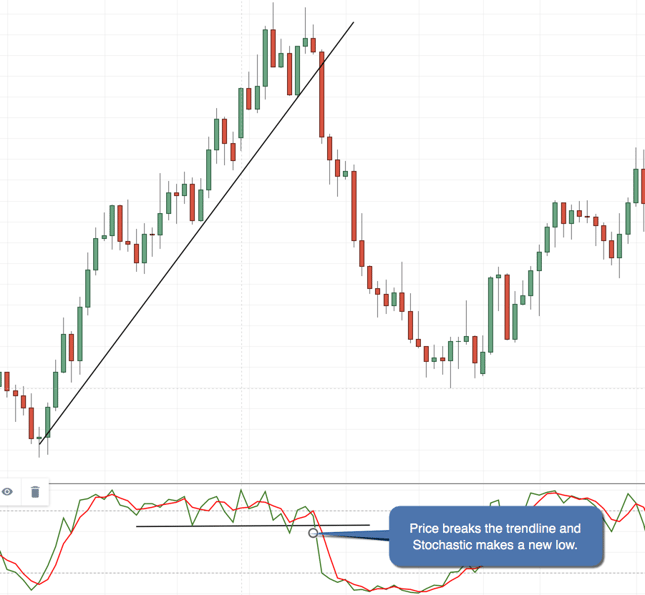

Trendline: Particularly Stochastic divergences or Stochastic reversals will be traded successfully with trendlines. You’ll want to discover a longtime pattern with a legitimate trendline after which anticipate the worth to interrupt it with the affirmation of your Stochastic.

Recap: Learn how to use the Stochastic indicator

Though the Stochastic indicator is a quite simple software and solely seems to be at just a few key information factors in your charts, it may well present significant pattern info.

The good thing about having an indicator in your chart is that it provides an goal confluence issue to your decision-making. Many merchants wrestle as a result of their buying and selling approaches are too discretionary and their selections are sometimes too subjective. Including goal instruments to your buying and selling can usually make an enormous distinction.

Moreover, I wish to spotlight the significance of attending to know your buying and selling instruments. As with the instance of the Stochastic indicator, many merchants could understand now that their understanding (particularly relating to oversold and overbought) have been fully improper. A improper software of your buying and selling instruments results in incorrect buying and selling selections as nicely. It’s subsequently important that you just take the time to totally perceive the instruments you might be utilizing. And as now we have seen with the Stochastic, that is usually no rocket science and lots of indicators comply with easy but efficient rules.

[ad_2]

-1.png?width=1257&height=975&name=Stoch%20YT%2016%2001%2023%20(Frame%200_01_30%3B15)-1.png)

-1.png?width=1077&height=988&name=Stoch%20YT%2016%2001%2023%20(Frame%200_03_56%3B18)-1.png)