[ad_1]

The Common True Vary indicator (ATR) is a extremely popular buying and selling indicator that can be utilized in many alternative buying and selling conditions. The ATR could also be helpful for trend-following buying and selling, enhance your understanding of market conduct, and should even assist to optimize goal placement to enhance a dealer´s winrate.

This information will first clarify the concept behind the ATR indicator after which discover the completely different use circumstances.

the Thought behind the ATR

The ATR is a volatility indicator which implies that it measures value fluctuations. That is in stark distinction to different development and momentum indicators such because the RSI or the STOCHASTIC indicator. That is additionally why the ATR could also be an awesome further confluence device to offer a unique method of value actions and complement your value evaluation.

I gained’t hassle you with math formulation however I strongly consider {that a} dealer should perceive how their indicators are being created and what makes them go up or down so as to make the appropriate buying and selling choices. It’s fairly straightforward, although, as we are going to see.

ATR stands for Common True Vary which implies that the ATR measures how a lot the value strikes on common. In essence, the ATR measures the candle measurement and the vary of value actions.

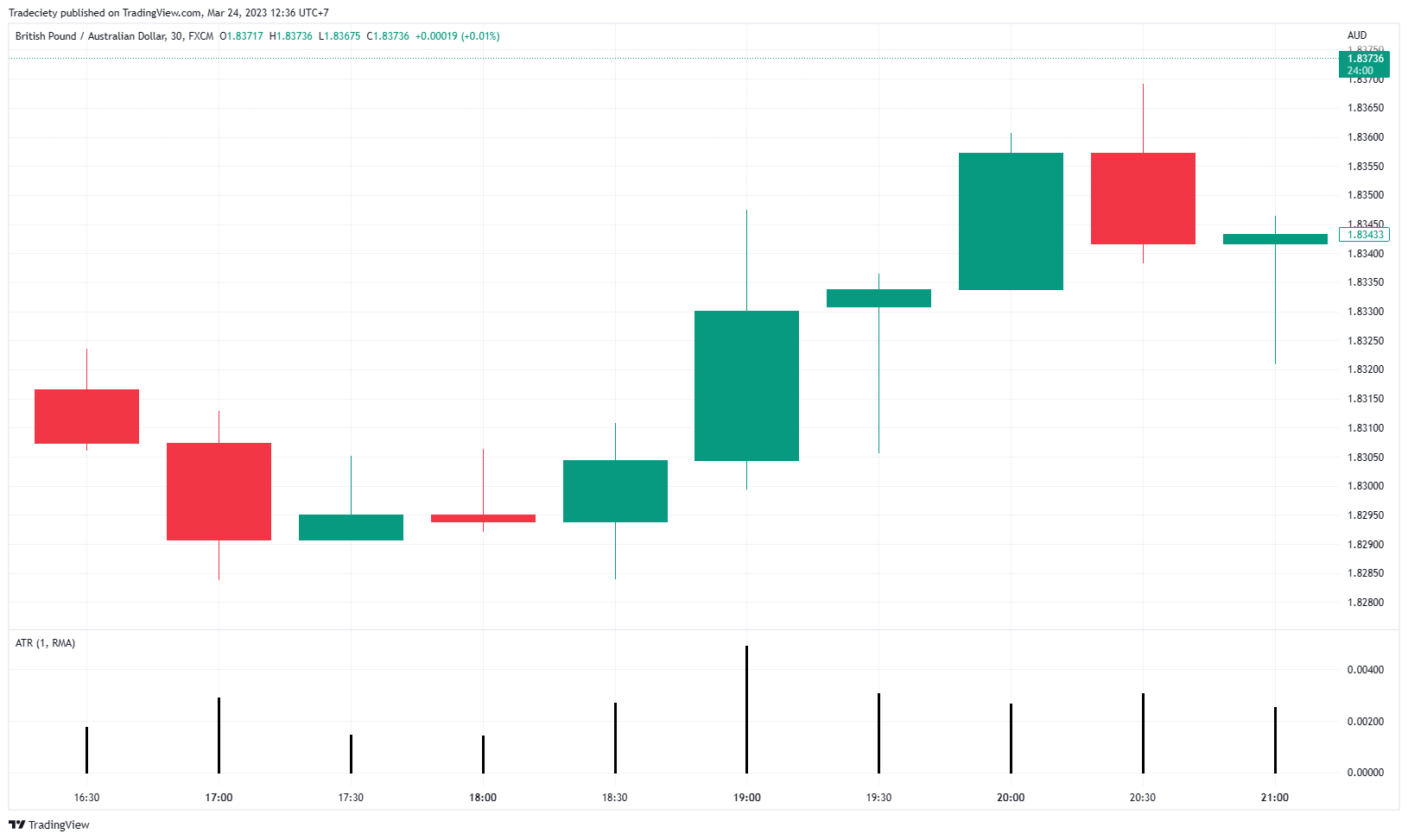

Under I set the ATR to 1 interval which implies that the ATR simply measures the vary/measurement of 1 candlestick.

The connection between the candle measurement and the ATR turns into very clear this manner. The bigger the candle, the upper the ATR is. The smaller the candle, the decrease the ATR is.

The ATR appears on the whole vary of a candlestick, together with the wick.

The ATR is usually set to 14 durations which implies that the ATR appears on the vary of candlestick measurement over the past 14 candlesticks. The screenshot beneath reveals the usual 14-period ATR. The highlighted durations present comparatively small candlesticks which result in a low and/or declining ATR. When the candlesticks improve in measurement, the ATR additionally will increase.

After all, this can be a very simplistic method of trying on the ATR, and math-wise, there is a bit more that goes into the calculation of the ATR. However for the common dealer, realizing the connection between candle measurement (vary) and the ATR worth is enough.

Momentum vs Volatility

Merchants usually mistakenly consider that volatility equals development momentum. Nevertheless, volatility doesn’t say something in regards to the development energy or the development route. Volatility reveals how a lot the value fluctuates forwards and backwards.

Volatility = How a lot the value fluctuates across the common value. In a high-volatility surroundings, value candles are normally bigger and exhibit longer wicks.

Momentum = Momentum describes the development energy in a single route. In a high-momentum surroundings, you usually see just one coloration of candles (only a few candles transferring in opposition to the development), and smaller candle wicks in opposition to the development route.

Within the screenshot beneath, the ATR and the STOCHASTIC indicator are used to indicate the distinction between momentum and volatility. Whereas the ATR is used to measure volatility, the STOCHASTIC is a pure development energy indicator.

The worth was in a bullish development in the course of the first highlighted part. The STOCHASTIC (decrease indicator window) was above the 80 stage, confirming a robust bullish development. Due to the absence of enormous wicks and the orderly development conduct, the ATR was at a low worth. This reveals a low volatility and excessive momentum trending market.

Through the second highlighted part, the value was in a downtrend. The STOCHASTIC confirmed the sturdy bearish development energy and it dropped beneath the 20 line. This time, nevertheless, the candlestick wicks have been a lot bigger in the course of the bearish development and the development was not as orderly as within the earlier bullish development. This led to a a lot increased ATR.

Apparently, completely different markets could present completely different traits with regards to the manifestation of volatility throughout trending markets. The screenshot beneath reveals the S&P500 and whereas uptrends usually occur with a low(er) ATR, downtrends usually – not all the time – occur in a extra excessive trend and, due to this fact, present a a lot increased stage of volatility.

That´s the place the previous saying “Shares take the steps on the way in which up and the elevator on the way in which down” comes from.

Such insights will be very invaluable to merchants with regards to optimizing their decision-making. Pattern-following buying and selling throughout excessive volatility traits could require a unique strategy with regards to cease trailing and commerce administration, for instance. Additionally, adjustments in volatility ranges could foreshadow a change in market and development construction as properly.

ATR and Tendencies

Modifications in volatility can even foreshadow adjustments in market sentiment.

A slim vary is a low-volatility market part. The 2 horizontal traces within the screenshot beneath outline the sideways vary within the situation beneath. The small candles and the absence of enormous wicks lead to a low ATR.

The breakout beneath the decrease vary help happens because the ATR begins rising as a result of the candles obtained bigger. Throughout the next bearish market part, the ATR retains rising all through the entire development.

Because the bearish development involves an finish, the ATR additionally reached its peak. Because the ATR declined, the development additionally stopped going decrease.

The ATR is usually a nice confluence for trend-following merchants in such a case. Though the ATR isn’t a trend-following device, adjustments in volatility can level to adjustments in market conduct.

Including an exponential transferring common (EMA) to the ATR can present attention-grabbing insights and supply an goal use case. The EMA is the blue line within the ATR window beneath.

The highlighted areas on the value chart beneath present durations throughout which the ATR is above the EMA. Each phases confirmed sturdy trending markets.

When the ATR is beneath the EMA, the development was reversing. And when the ATR and the EMA have been on high of one another, clustering collectively, the value was in a slim sideways interval.

Subsequently, understanding adjustments in ATR construction could also be helpful for merchants to accurately determine adjustments in value and development construction.

Exhausted ATR

One other widespread use case for the ATR is to search for exhausted value actions. Because the ATR tells us the common vary the value has moved over a given interval, we are able to use this data to estimate the chance for traits to proceed or stall.

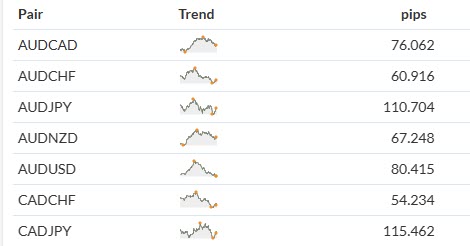

You might have observed that markets transfer otherwise and a few markets are likely to development considerably extra and longer than others. A have a look at the every day pip variation within the desk beneath reveals that there will be important variations between completely different Foreign exchange pairs.

The AUD/JPY, for instance, strikes roughly twice as a lot because the CAD/CHF.

supply: Mataf Foreign exchange volatility

Merchants can use the data on every day value fluctuations in numerous methods:

1. Market choice

Devices with a better common vary could present buying and selling alternatives that will result in capturing bigger successful trades. Thus, staying away from devices with extraordinarily low common pip ranges is usually a filter criterion in market choice.

2. Goal placement

By realizing that the AUD/JPY strikes on common 110 pips per day, merchants can use this data for his or her goal placement. Using a goal that’s 150 and even 200 pips away from the every day open could present a decrease likelihood of efficiently closing a successful commerce as a result of the market doesn’t transfer as a lot usually. A goal that’s solely 80 factors away could result in a better likelihood of realizing a successful commerce in such a case.

The Keltner channel is a well-liked buying and selling indicator that can be utilized on this context successfully. The Keltner channel plots the ATR bands across the value motion.

Within the screenshot beneath, the Keltner channel reveals the common pip vary over the past 7 days.

Through the downtrend, the impulsive bearish development waves usually finish proper on the decrease ATR band the place the value has exhausted its common value vary.

Concentrating on value ranges at, or near, the ATR bands could enhance goal placement for trend-following merchants.

3. Pattern continuation buying and selling

One other use case for the ATR-based Keltner channel is to estimate the chance of a development continuation. For instance, a breakout that happens near the Keltner channel could have a a lot decrease likelihood of leading to a long-lasting development continuation.

Within the screenshot beneath, the value broke above the resistance zone first. Nevertheless, the value was already near the upper Keltner channel on the time of the breakout as a result of the bullish development had already been happening for some time. Anticipating additional bullish development continuation strikes might not be a high-probability play in such a state of affairs.

Last Phrases

The ATR is a common buying and selling indicator that can be utilized in many alternative conditions and use circumstances.

For trend-following merchants, the ATR can present helpful details about the market construction. Modifications in volatility usually additionally could foreshadow adjustments in trending conduct. Moreover, trend-following merchants can also have the ability to optimize their goal placement through the use of the ATR-based Keltner channel.

However the ATR can even present common details about the underlying stage of volatility of a market or the common value vary for a particular interval.

General, the ATR could also be an awesome addition to all kinds of buying and selling methods and show efficient in enhancing value evaluation.

[ad_2]