[ad_1]

Multi-timeframe buying and selling describes a buying and selling strategy the place the dealer combines completely different buying and selling timeframes to enhance decision-making and optimize their chart analyses.

The aim of multi-timeframe buying and selling is to boost the revenue profile of particular person trades by buying and selling long-term alerts in a short-term timeframe. We´ll clarify what this implies with concrete examples within the following article.

Usually, merchants make use of 1 so-called increased timeframe and one decrease timeframe. The upper timeframe is used to investigate the longer-term chart and development context to get a basic sense of market route and sentiment. Merchants attempt to set up a directional bias (lengthy, brief, or impartial) on the upper timeframe after which search for particular buying and selling alternatives within the increased timeframe route on their decrease timeframes. The decrease timeframe is hereby used to time entries and handle buying and selling positions.

Prime-down vs. bottom-up

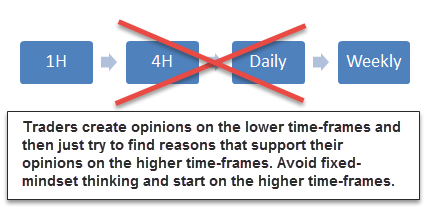

One of many greatest errors merchants make when performing a multi-timeframe evaluation is that they begin their evaluation on the bottom of their time frames after which work their method as much as the upper time frames. This is able to be known as a bottom-up strategy.

Beginning your evaluation in your decrease timeframe the place you place your trades creates a really slender and one-dimensional view and it misses the purpose of the a number of timeframe evaluation. Usually, merchants simply undertake a particular market route or opinion on their decrease timeframes and are then simply on the lookout for methods to substantiate their opinion on the upper timeframe.

We advocate the top-down technique. With a top-down strategy, a dealer begins their evaluation on the upper timeframe to get a basic sense of the market sentiment, the overall development context, and turns into conscious of necessary value hurdles and key ranges. On the decrease timeframe, the dealer then appears for buying and selling alternatives primarily based on the upper timeframe perspective. The commerce then suits completely into the general chart narrative.

Which timeframes to make use of?

The primary query that all the time comes up when stepping into multi-timeframe buying and selling is which timeframes to make use of. I like to recommend conserving it easy, particularly to start with. There isn’t a must reinvent the wheel.

Greater timeframe |

Decrease timeframe |

Buying and selling type |

| Weekly | Day by day or 4H | Swing buying and selling |

| Day by day | 4H or 1H | Shorter-term swing buying and selling |

| Day by day | 30min or 15min | Intra-day buying and selling |

| 4H | 30min or 15min | Quick-paced intra-day buying and selling |

| 1H | 15min or 5min | Basic day-trading |

| 1H | 5min or 1 min | Quick-paced day-trading / Scalping |

The desk above exhibits the most typical timeframe combos. To enhance the consistency in your buying and selling strategy, I like to recommend choosing one mixture and sticking to it for an prolonged time period. This manner, you’ll be able to acquire expertise with the required timeframe mixture and see if it’s the proper match to your buying and selling.

You need to keep away from leaping round between timeframe combos as a result of it creates inconsistencies in your buying and selling and introduces noise.

Stick with one timeframe mixture for a minimum of 30 to 50 trades earlier than altering timeframes.

5 Multi-timeframe methods

Now that you’ve settled on a timeframe mixture, we will begin using our timeframes. However what can we search for in the next timeframe particularly?

Right here, merchants can select from quite a lot of completely different increased timeframe “cues” (or so-called confluence components). Relying in your most popular chart evaluation strategy, you’ll find the correct match to your personal multi-timeframe technique.

Within the following, I record a number of confluence components which are typical for the next timeframe strategy:

#1 Ranges – Breakout

Probably the most generally used increased timeframe ideas is one in all help and resistance ranges. Merchants who make use of help and resistance ranges on the upper timeframe sometimes both search for a bounce or a break of a long-term horizontal degree.

The picture beneath exhibits the Day by day timeframe degree with a robust resistance degree marked. The dealer identifies the extent on their increased timeframe and upon the break switches to a decrease timeframe to search for buying and selling bullish alternatives.

The picture beneath exhibits the 1H timeframe after the break of the resistance degree. The value trended increased after the breakout and the dealer would have finished properly to undertake a bullish sentiment and search for bullish trend-continuations.

#2 Ranges – Bounce

As an alternative of on the lookout for the next timeframe breakout, merchants may also select to search for a bounce off a help or resistance degree. Within the picture beneath, the sturdy resistance degree has been holding a number of instances on the upper 4H timeframe. So long as the worth shouldn’t be in a position to shut above the extent, a dealer would possibly undertake a bearish commerce sentiment. Particularly after seeing the sign of deceleration (smaller candlesticks), the upper timeframe bearish bias can be utilized to search for brief buying and selling alternatives on the decrease timeframe.

The decrease 15 min timeframe exhibits an attention-grabbing Head and Shoulders chart sample on the time of the 4H deceleration candle. With the upper timeframe bearish bias in thoughts, a dealer may need a buying and selling plan to brief the market after the profitable breakout (or retest) of the neckline.

The value fell sharply after the breakout and retest of the Head and Shoulders sample. The sturdy increased timeframe resistance degree and the deceleration candle allowed the dealer to undertake a bearish bias early on, whereas the decrease timeframe helped the dealer to time the brief commerce successfully.

Buying and selling alerts on a decrease timeframe enable the dealer to optimize the holding time and likewise the reward:threat ratio as a result of the commerce often has a better cease, and a extra aggressive entry whereas using a wider goal primarily based on the upper timeframe context.

#3 Highs and lows

As an alternative of utilizing long-term help and resistance ranges, some merchants use native highs and lows for his or her multi-timeframe buying and selling technique.

The general strategy is hereby much like the beforehand mentioned support-and-resistance degree technique.

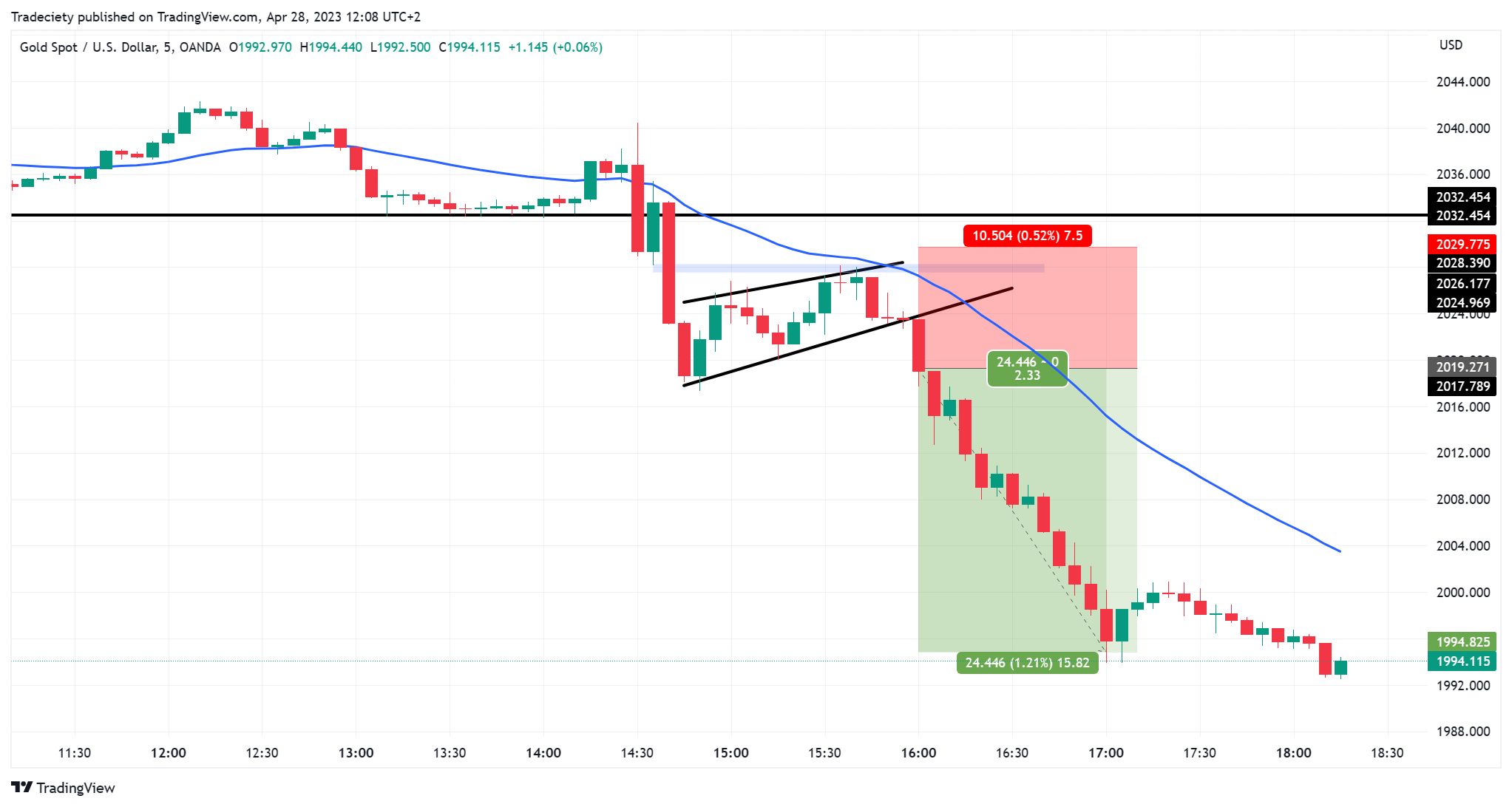

First, the dealer is on the lookout for a robust earlier excessive (or low). Within the picture beneath, the worth first overshot the earlier excessive earlier than sturdy bearish momentum entered the market and the worth fell again beneath the excessive. In technical evaluation, we consult with such a sample as a fakeout (or entice) as a result of the preliminary breakout is failing and trapping long-positioned breakout merchants.

This increased timeframe sign is offering us with a bearish bias that we are going to carry over to our decrease timeframe.

On the decrease timeframe, the worth is constructing a flag breakout sample shortly after the fakeout sign. Flags are among the many hottest trend-continuation patterns. The break of the trendline sometimes alerts the entry for a development continuation.

The downtrend unfolded after the flag breakout.

The sign length of the upper timeframe is hereby used optimally. The longer the prediction interval, the decrease the accuracy often is. Buying and selling the fakeout immediately on the upper timeframe often ends in considerably longer holding intervals. By utilizing the decrease timeframe to time the entry and the exit, the holding time can usually be lowered to an absolute minimal. The shorter the holding time, the less further threat components – akin to information occasions or in a single day publicity – the dealer has.

#4 Candlesticks

Candlestick buying and selling is a very talked-about buying and selling strategy, however it usually lacks robustness when merchants solely depend on a single candlestick. To enhance the sign high quality, merchants can apply a multi-timeframe strategy to candlestick alerts.

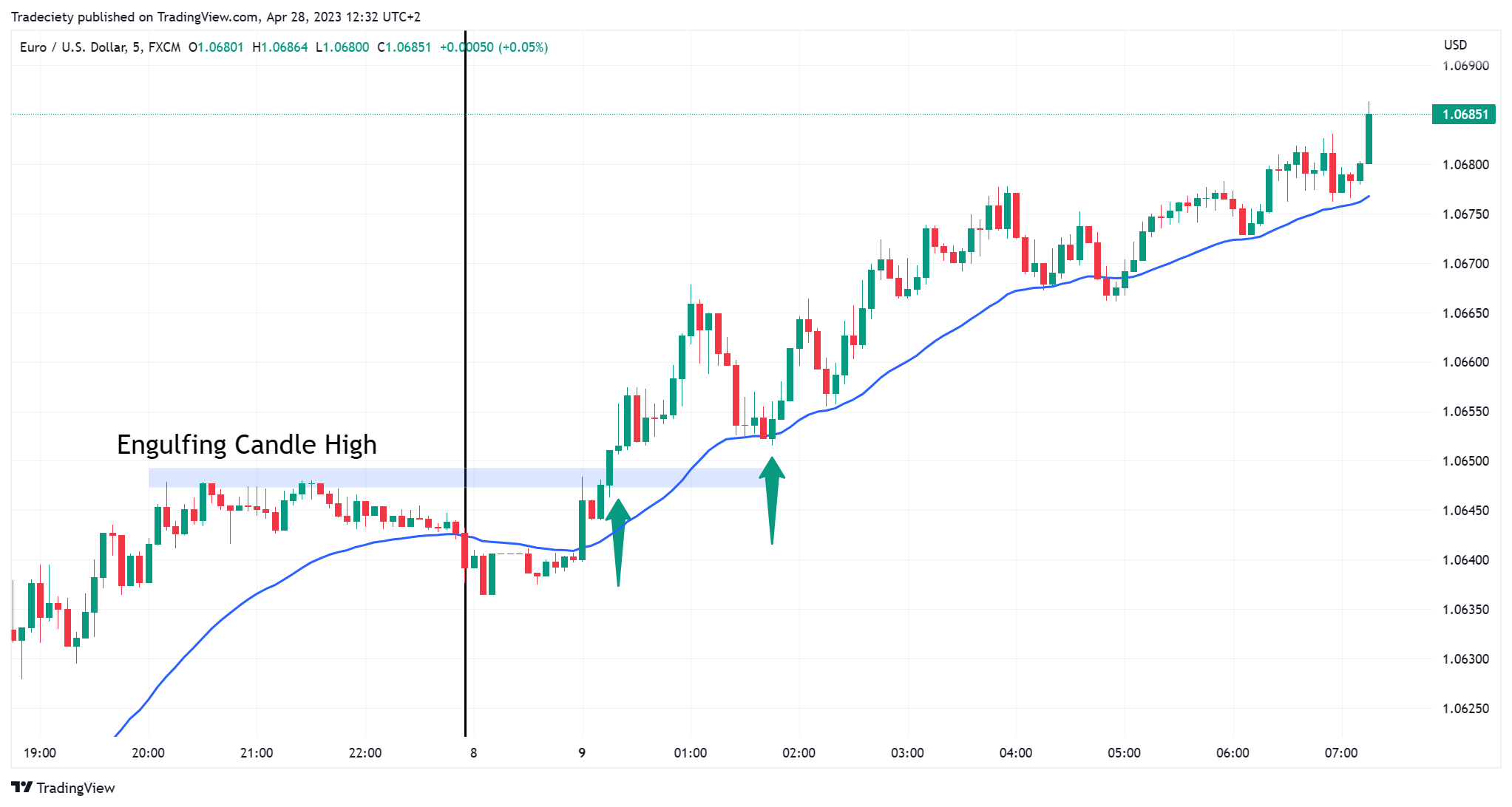

The picture beneath exhibits a bullish engulfing candlestick on the upper Day by day timeframe. On the identical time, the worth is in an general bullish uptrend. Moreover, the bullish candlestick additionally happens proper on the 30 EMA (shifting common). Many merchants use shifting averages for his or her trend-following pullback buying and selling.

The candlestick sign suits properly into the development narrative. After figuring out the engulfing candlestick, a dealer can now transfer to a decrease timeframe to search for bullish buying and selling alerts into the upper timeframe bias.

The picture beneath exhibits the decrease 5min timeframe. The blue space marks the excessive of the Day by day engulfing candlestick. After the breakout, the worth trended increased. A trend-following dealer may need been in a position to execute a breakout lengthy commerce to seize the bullish momentum.

Whereas some merchants would possibly simply commerce the Day by day sign blindly, a multi-timeframe strategy permits the dealer to search out the proper entry value and profit from the short-term momentum that the engulfing candlestick alerts.

#5 Patterns

As an alternative of on the lookout for single candlesticks on the upper timeframe, merchants may also use advanced chart patterns as their sign for the next timeframe bias.

Within the picture beneath, the upper 4H timeframe exhibits an general bearish development with a sideways flag sample. The trendline describes the decrease boundaries of the flag sample.

After the breakout, the worth is returning again to the trendline to carry out a retest. When the worth reaches the trendline, the candlestick alerts deceleration – the candlestick turns and exhibits bearish momentum. This sign might be used to maneuver to a decrease timeframe with a bearish bias in thoughts.

On the time of the upper timeframe retest sign, the decrease 5min timeframe types a triple prime vary sample. Decrease timeframe patterns are splendid in terms of buying and selling plan creation as a result of they provide a transparent and goal entry level. For a brief buying and selling plan, the dealer waits for a bearish breakout beneath the low of the sample.

A breakout then alerts a commerce entry. On this case, the dealer goes with the upper timeframe development and likewise with the decrease timeframe breakout momentum. Each timeframes are completely aligned.

After the breakout, the worth fell sharply. The long-term development continued and with the decrease timeframe sign, a dealer may need been in a position to execute a excessive reward:threat ratio commerce.

Infinite potentialities

Under no circumstances are the launched buying and selling approaches the one ones for multi-timeframe buying and selling; they only function a supply of inspiration to create your individual multi-timeframe buying and selling technique.

There are not any limitations in terms of constructing a multi-timeframe technique and merchants could make use of all forms of buying and selling instruments and ideas. Be it value motion, basic chart patterns, or indicator alerts, all combos are conceivable.

Remaining phrases and suggestions

An important side of a multi-timeframe buying and selling technique (and of all different buying and selling approaches for that matter) is consistency. Resist the urge of leaping round timeframes and all the time wanting to mix new timeframes.

The extra noise and inconsistencies you have got in your buying and selling, the more severe the outcomes sometimes are. Due to this fact, choose one timeframe mixture and keep it up for a minimum of 30 trades to get a tough thought of how properly it suits into your general buying and selling philosophy. After 30 trades with the identical strategy, you’ll have a significantly better thought of how properly it fits you.

And listed here are my last suggestions in terms of multi-timeframe buying and selling:

- Begin your chart evaluation on the upper timeframe. The highest-down strategy retains you open-minded and you’ll usually make significantly better buying and selling selections.

- Be clear about your increased timeframe sign(s). Though I’ve launched 5 completely different multi-timeframe methods, it doesn’t imply that you have to be buying and selling all 5 on the identical time. Choose one buying and selling technique that fits you after which observe it for an prolonged time period. System hopping is a good hazard and needs to be averted.

- Do your chart evaluation on the identical time every day. Whenever you select the 4H as your increased timeframe, for instance, set an alert for every 4H candle shut and undergo your markets one after the other to replace your charting instruments and search for your increased timeframe alerts.

- You don´t must have a bias. Not all the time will you have the ability to arrive at a transparent bullish or bearish chart bias and it is very important keep open to the concept of getting a “impartial” bias. You wouldn’t have to commerce on a regular basis. Watch for the correct chart state of affairs and keep away from taking suboptimal trades the place you wouldn’t have an edge.

Have I missed one thing? Check out the video beneath and go away a touch upon YouTube. I look ahead to listening to from you.

[ad_2]