[ad_1]

Australia’s federal parliament has authorized a A$15 billion Nationwide Reconstruction Fund, meant to reverse the nation’s dwindling manufacturing sector. It’s the “first step” in Prime Minister Anthony Albanese’s election promise “to revive our capacity to make world-class merchandise.”

The fund will concentrate on investing in high-tech manufacturing. There are seven precedence areas:

- clear vitality

- medical science

- transport

- value-added manufacturing in agriculture, forestry, and fisheries

- value-added manufacturing in mining

- army tools, and

- “enabling capabilities.”

The fund is predicted to function commercially and ship a return on its investments. Its method will probably be just like the Clear Power Finance Company, which over the previous decade has offered greater than $10 billion in grants and loans to low-emission vitality initiatives.

Investments will probably be within the type of loans, fairness and ensures. It is going to be a co-investment mannequin, which means non-public buyers should match funds offered.

It’s going to begin with $5 billion. The opposite $10 billion will offered in instalments over the remainder of the last decade. After 2030, investments are anticipated generate sufficient income to assist new initiatives. These selections will probably be made by a board that will probably be unbiased of the federal authorities.

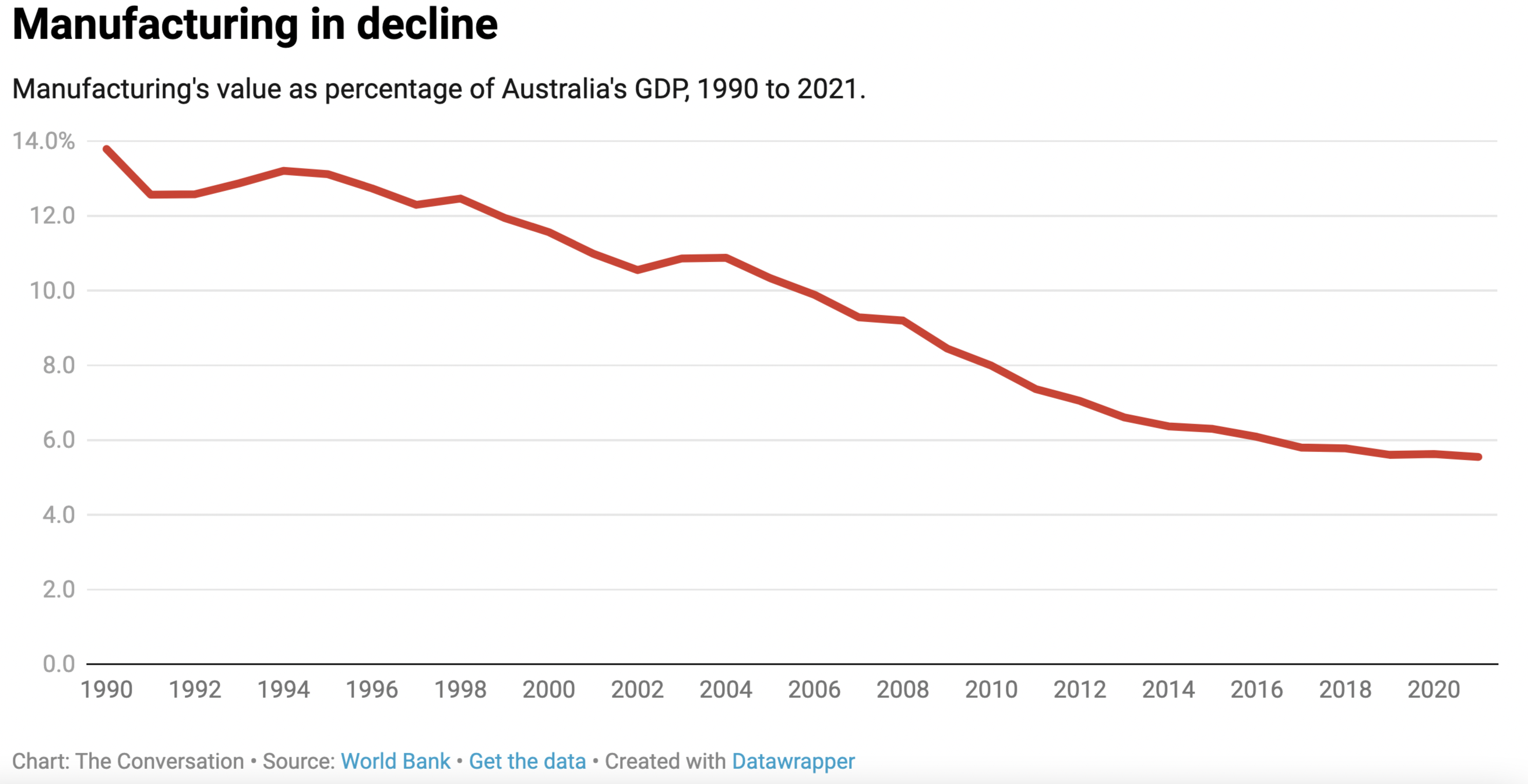

Manufacturing information

Criticisms of the fund

There’s assist for the fund from employer teams and commerce unions. However there are additionally criticisms.

Extra broadly, some economists argue government-supported funding schemes misallocate sources, give sure companies an unfair benefit, and decelerate innovation over time by investing an excessive amount of in a single space and ravenous different progressive concepts of sources. As The Economist has put it, attempting to “choose winners” may also imply investing in losers.

However government-backed investments do play an important function in offering monetary assist to commercialise new expertise, for which attracting non-public funding is often robust.

The federal opposition has complained the Albanese authorities ought to concentrate on extra instant challenges going through producers, reminiscent of excessive vitality costs and labour shortages.

Opposition frontbencher Paul Fletcher has expressed concern the fund will finance initiatives that “wouldn’t achieve getting non-public sector finance – however which for political causes the federal government needs to fund”. A manufacturing unit in a marginal seat, for instance.

There are precedents for such considerations. The Morrison authorities, of which Fletcher was a senior member, did such issues with funding for automotive parks and sporting services.

However additionally it is the case that such pork barrelling didn’t occur with the Morrison authorities’s $1.3 billion Fashionable Manufacturing Initiative, which offered grants in roughly the identical precedence areas as the brand new fund.

Regardless of political and monetary incentives to seek out fault with it, the Albanese authorities has endorsed the Fashionable Manufacturing Initiative’s expenditure. It has criticised solely the best way the Morrison authorities manipulated the timing of funding bulletins.

Nor has the Clear Power Finance Company, established by the Gillard authorities in 2012, confronted such criticisms. It’s thought to be a hit story throughout the political spectrum, from teams such because the Australian Conservation Basis to mining magnate Clive Palmer.

The institution of the Nationwide Anti-Corruption Fee ought to additional give confidence that Albanese, a longtime champion of constructing issues in Australia, is honest about “full transparency” for the Nationwide Reconstruction Fund.

3 methods to enhance the fund

To however to enhance the fund’s probability of success, there are three issues that may be executed.

First, to attain the transparency Albanese has promised, the fund ought to publicly share the reasoning behind its funding selections, just like how the Reserve Financial institution of Australia’s board publishes minutes of its month-to-month coverage conferences. Being open about decision-making will construct public belief within the fund’s transparency and equity.

Second, the Nationwide Reconstruction Fund’s funding board might want to clearly define funding priorities whereas staying versatile, so initiatives that span a number of sectors or purposes don’t fall between the cracks. Breakthrough concepts might not match neatly right into a single class. For example, artificial biology expertise can be utilized in meals manufacturing and plastic recycling. It doesn’t belong to only one precedence space.

Third, supporting particular person initiatives isn’t sufficient. Right here’s the place these “enabling capabilities” are essential. Altering the trajectory of producing in Australia requires a supportive ecosystem that aligns issues like funding and coverage priorities in training and coaching, analysis being executed in universities, immigration settings, and pure benefits.

Tasks gained’t succeed with out expert staff, sturdy analysis backing, and quick access to suppliers and clients.

Australia’s renewable vitality sector is an instance of a supportive atmosphere that may result in success. Australia has loads of solar and wind, a rising variety of expert staff within the renewable vitality discipline, high analysis establishments, a educated investor base because of the Clear Power Finance Company, and a rising quantity of people that care about eco-friendly vitality options.

By setting clear targets, encouraging innovation, and making selections clear, the fund stands one of the best probability to attain what it has been created to do.

[ad_2]