[ad_1]

Picture supply: Getty Pictures

Studying about investing is usually a enjoyable journey, and I’m right here to share some suggestions and tips with you but in addition to dispel some harmful myths.

Certain, some folks may strike it wealthy with meme shares or cryptocurrencies, however let’s not overlook the clever previous saying, “gradual and regular wins the race.” For each “to the moon” winner on the market, there’s a loser with a blown-up account watching a -90% or greater loss.

To keep away from this, I recommend the age-old observe of diversification. Unfold your danger out amongst many shares from all market cap sizes and sectors. As a substitute of attempting to select and select the winners, take into account shopping for your entire inventory market! Right here’s a historic instance utilizing index funds.

The facility of compounding

To be a savvy investor, take into account specializing in managing dangers, like avoiding excessive charges, not chasing scorching property, and maintaining a excessive financial savings and contribution charge. For instance this, let’s time journey again to the 12 months 1993 — 30 years in the past.

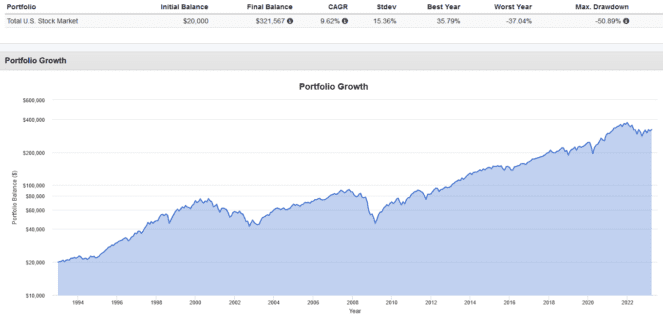

Think about that you just’re 25 years previous with $20,000 to speculate, and you set all of it in a low-cost index fund monitoring your entire U.S. inventory market. That’s over 3,000 large-, mid-, and small-cap shares from all 11 market sectors in your portfolio through only a single ticker.

By March 31, 2023, your preliminary $20,000 would have grown to $329,822, because of a 9.62% common annualized return, and also you didn’t do something greater than reinvesting dividends and staying the course (e.g., avoiding timing the market and panic promoting).

In fact, it wasn’t at all times a easy trip. You needed to endure huge losses in the course of the Dot-Com bubble and the 2008 Nice Monetary Disaster, which noticed your portfolio drop by 50%. Nevertheless, in case you have been in a position to tolerate the volatility and maintain a long-term focus, you have been handsomely rewarded later.

Needless to say that is with none extra contributions. Had you made extra periodic investments, your outcomes would have been even higher.

Which ETFs to make use of

To index the whole U.S. market, Canadians could make use of two Vanguard exchange-traded funds, or ETFs, with one being buying and selling in Canadian {dollars} and the opposite buying and selling in U.S. {dollars}.

In a Registered Retirement Financial savings Plan (RRSP), take into account Vanguard Complete Inventory Market ETF. As a U.S.-listed ETF, VTI is just not topic to the 15% overseas withholding tax on dividends when held in an RRSP. This, together with an ultra-low expense ratio of 0.03% makes it extremely value efficient.

In a Tax-Free Financial savings Account (TFSA), overseas withholding tax is utilized on U.S. funding dividends. On this case, traders can save on the overseas alternate prices of shopping for U.S. ETFs and go for the Canadian-listed Vanguard US Complete Market Index ETF as a substitute, which prices a 0.16% expense ratio.

[ad_2]