[ad_1]

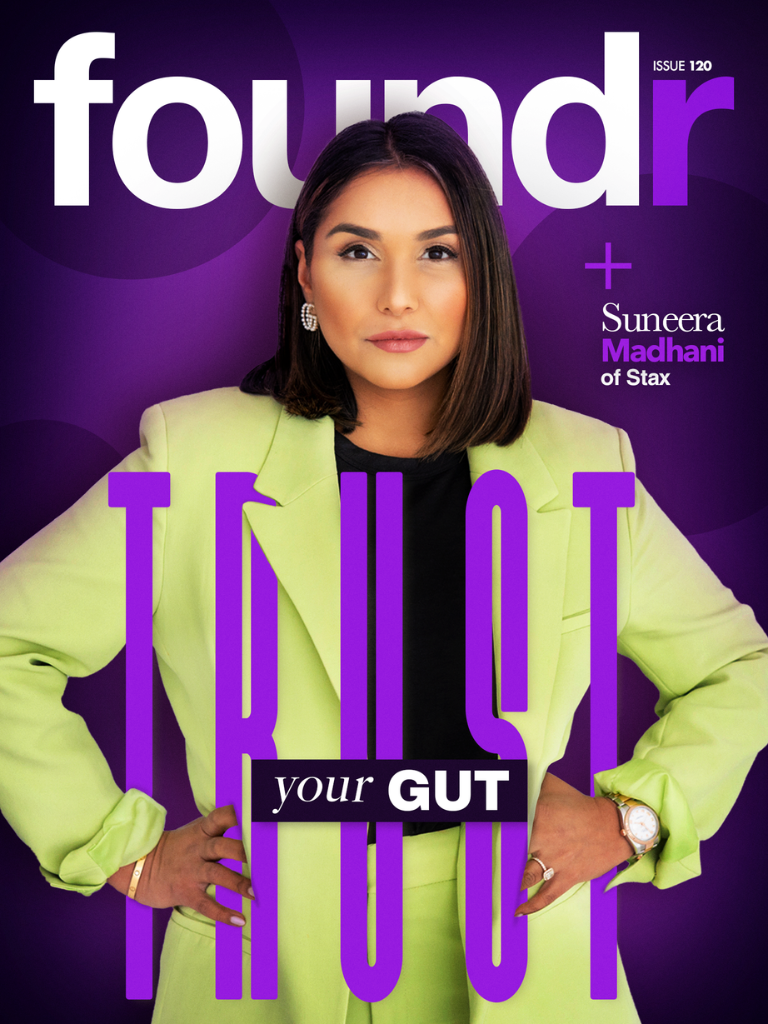

Foundr Journal publishes in-depth interviews with the world’s biggest entrepreneurs. Our articles spotlight key takeaways from every month’s cowl characteristic. We talked with Suneera Madhani, founder and CEO of Stax funds, about how she turned a rejected pitch right into a unicorn startup. To learn extra, subscribe to the journal.

—————

On a transparent and comfortably heat afternoon in Orlando, Florida, Suneera Madhani and her crew floated to a restaurant throughout from their downtown workplace. It was St. Patrick’s Day, and gleeful patrons stuffed the green-hued bar, however Madhani had one thing to rejoice in addition to the vacation.

Her enterprise, Stax (previously Fattmerchant), had simply acquired a time period sheet for $17 million. Simply 4 years prior, in 2014, Madhani began the all-in-one fee platform utilizing $50,000 in startup capital from family and friends. Madhani by no means thought that she, a lady with immigrant dad and mom and minimal startup connections, may construct a million-dollar enterprise.

“It’s a really thrilling time for a founder any time you obtain something tangible on paper,” Madhani says.

The subsequent day, she introduced the supply to her board and began pursuing the diligence course of with the investor.

“Lengthy story brief, my intestine was not clicking,” Madhani says.

However the board stored pushing to proceed till the buyers adjusted their bid. When Madhani noticed the supply, she was shocked.

“I mentioned, ‘There’s no method I’m going to f***ing settle for this.’”

Madhani’s instinct proved appropriate. At present, Stax has greater than 300 workers and $100 million-plus in recurring software program income, oversees $23 billion in funds, and was acknowledged by Forbes as one of the revolutionary fintech firms.

Madhani knew Stax was price extra. Rather more. We’re speaking billions, not tens of millions.

Household Dinner

Earlier than boardrooms and valuations, Madhani labored for a bank card firm promoting transaction machines out of the trunk of her Volkswagen Beetle.

Her dad and mom immigrated to the US from Pakistan, met in Chicago, married, then moved their younger household to Dallas, Texas. It was by means of her household that Madhani discovered the highs and lows of entrepreneurship.

“I come from this line of entrepreneurship out of necessity,” Madhani says. “To ensure that them to have their American dream, they needed to begin a enterprise.”

Her household’s companies ranged from quick meals chains to a advertising company, and Madhani spent her childhood serving to after faculty and on weekends. Satirically, her dad and mom’ imaginative and prescient of the American dream was to present Madhani and her brother an training—to not turn out to be entrepreneurs.

“I noticed firsthand what it took to construct a enterprise, what it took for companies to fail, the hardship, the great, the unhealthy, the ugly, and every little thing in between.

“However all of that credit score goes to my dad and mom, ” Madhani says.

However credit score isn’t only for her dad and mom’ actions however for what they mentioned at a fateful dinner that modified Madhani’s life.

‘Why Not You?’

In 2012, a uncommon snowstorm hit Texas whereas Madhani was visiting her dad and mom in Dallas. As a result of she was caught 1000’s of miles from her residence in Orlando, she had her subscription packing containers rerouted. She was obsessive about the early-adopter subscriptions like Birchbox and BarkBox in a time she describes because the “pre-subscription financial system.”

“[Then] that mild bulb went off, and I used to be like, ‘Holy s***, why isn’t there a flat subscription in funds?’”

As a substitute of going residence on that journey, she ended up routing her ticket to Houston, the headquarters of the bank card firm she labored for. She secured a gathering with the C-suite and labored on the presentation for per week whereas binging the primary two seasons of Shark Tank to good her pitch.

“All I needed was to see this success in my very own firm,” Madhani says. “[But] they laughed me out of the boardroom.”

Distraught and annoyed, Madhani returned to Dallas simply in time for Friday’s household dinner. She defined the frustration of the assembly and why the concept of a subscription fee platform may work.

“My household checked out me and mentioned, ‘Why not you?’”

It was the primary time Madhani realized she may do it herself, however she instantly blurted out excuses—no growth expertise, no buyers, no trade connections.

“My dad and mom mentioned, ‘What’s the worst that would occur? Give your self six months and provides it a go,’” Madhani says.

She stop her job and moved into her dad and mom’ home. With $50,000 of startup capital raised from private financial savings, buddies, household, and her now-husband, she shortly spent half of the funding on compliance with bank card firms like Visa and Mastercard. She didn’t have leftover capital to rent workers or contract out work, so she leaned into what made her distinctive.

Maintain Studying: How Erin Deering Constructed Triangl Right into a Swimwear Motion

“By not having capital, it truly compelled me to suppose, ‘How am I going to do that in another way compared to the trade?’”

In 2014, most bank card firms went to market by means of bodily banking channels. Utilizing her background in digital advertising, Madhani constructed an internet site, began writing blogs for website positioning, and invested $500 in Google Advert Phrases.

“I encourage founders to leverage any white-label options which might be already there to get an MVP off the bottom,” Madhani says. For instance, she partnered with a banking establishment to white label a transaction software program to check the speculation of a subscription-style mannequin versus a percentage-style mannequin.

“We took a guess on that thesis and constructed our know-how to be a funds hub,” Madhani says. “We had been capable of construct our platform with our prospects.”

She found that as an alternative of attracting prospects like small enterprise eating places, they had been reaching healthcare {and professional} companies that wanted an omnichannel platform for in-person and on-line funds.

“That was the thesis that introduced us the place we’re as we speak,” Madhani says.

Stax grew to become the primary subscription-based bank card processor to come back to market with flat charges and limitless bank card utilization. Rapidly, they had been thought of the Netflix of bank card processing. Inside six months of her dad and mom’ instructed timeline, she processed greater than $5 million in funds.

The three Minds

The most important lesson Madhani discovered in her profession occurred when she met along with her board following the primary time period sheet supply.

“It was a s***present of a board assembly,” Madhani says. The buyers had lowered their preliminary $17 million supply to $12 million. “In case you’re negotiating with one get together, you’re negotiating with your self.”

However the board nonetheless needed to take the deal.

“I mentioned, ‘You guys simply invested on this enterprise. What has modified within the final six weeks that you simply’re able to take this minimal supply simply incrementally greater than you invested in?’”

Madhani didn’t again down. She relied on what she describes as her “three minds”—analytical, coronary heart, and intestine.

“I want all three to make the selections, and when one isn’t feeling proper, I’ve to belief that.”

Shortly following the rejection of the bid, she acquired one other time period sheet for $50 million. It was a non-public fairness deal that purchased out their preliminary buyers—the boardroom naysayers—and exited them 18 occasions their funding.

“Your instinct is essentially the most highly effective instrument you’ve gotten, [so] use it and don’t low cost it and take heed to it,” Madhani says.

To this point, Stax has raised $500 million in capital and is rising triple digits year-over-year. In March of 2022, Stax formally grew to become a unicorn startup with a valuation of greater than $1 billion.

Learn how to Make Enterprise Selections

Under is how Madhani makes use of her “three minds” methodology for making choices.

- Analytical: What do the numbers and developments present?

- Coronary heart: What are your trusted advisors, crew, and prospects telling you?

- Intestine: What do you are feeling down in your core that’s the appropriate resolution?

If one of many 3 minds is off, which means there’s a drawback. When all 3 are unified, you possibly can belief your resolution.

[ad_2]