[ad_1]

Hey there, fellow monetary fans!

Right this moment, we’re diving into a subject that always finds itself on the heart of heated debates and political discussions: the debt ceiling. You’ll have heard this time period tossed round, however do you really perceive what it means and why it issues to your private funds? Don’t fret! We’re right here to unravel the thriller and make clear how the debt ceiling can influence your monetary future.

![]()

What’s Debt Ceiling and Why it Issues

At its core, the debt ceiling is a authorized restrict on the quantity of debt the federal government can accumulate to fund its operations and meet its monetary obligations. Consider it as a monetary cap that restricts the federal government’s borrowing capability. Now, you may be questioning, “Why ought to I care in regards to the authorities’s debt ceiling?” Properly, my buddy, the reply lies within the ripple impact it could actually have on varied elements of our economic system and, finally, our private funds.

When the debt ceiling is reached, it triggers a fragile dance of political negotiations and potential penalties. Failure to boost the debt ceiling may end in a authorities shutdown or default on its monetary obligations. This state of affairs can have severe implications for the economic system, inflicting instability in monetary markets, growing rates of interest, and weakening the worth of the forex. And guess what? All these elements can instantly influence your pockets.

What Occurs when Debt Ceiling is Raised (or Not)

When the federal government raises the debt ceiling, it permits itself to proceed borrowing and assembly its monetary obligations. This motion supplies stability and ensures the functioning of important authorities companies. Nonetheless, it additionally signifies that the federal government’s debt burden continues to develop, and also you may be questioning in regards to the long-term penalties.

Alternatively, if the debt ceiling isn’t raised, it could actually result in a authorities shutdown or, even worse, a default on its debt funds. This will create a domino impact, inflicting panic in monetary markets, growing borrowing prices, and probably resulting in a recession. These circumstances have an effect on companies, job safety, and general shopper confidence, instantly impacting your monetary well-being.

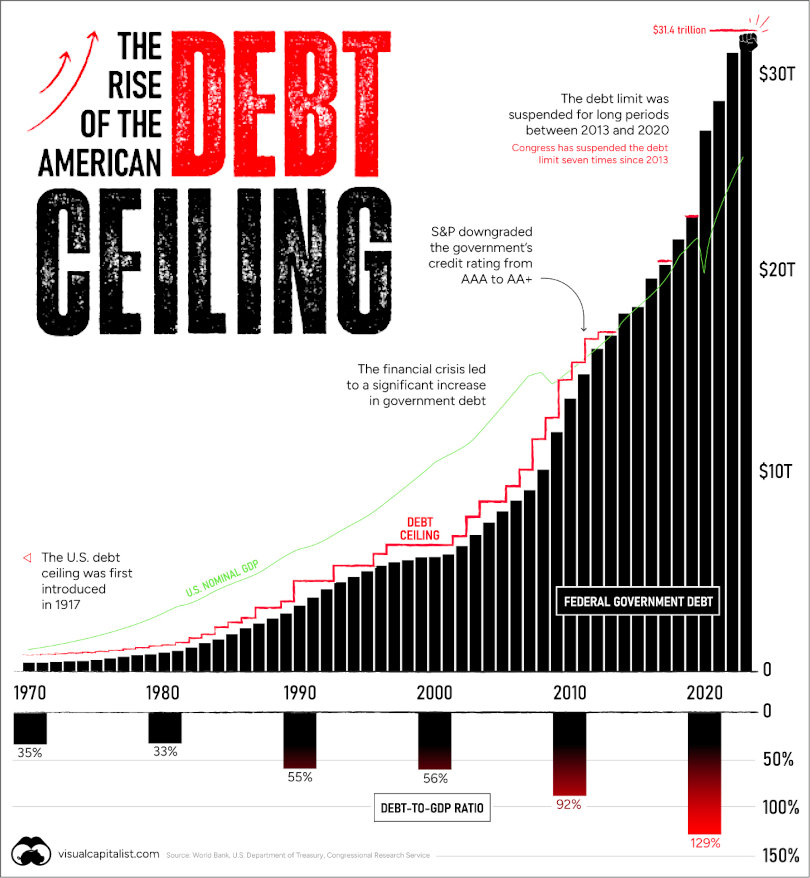

So, how excessive is the ceiling we’re speaking about? To offer you some concepts, right here is an inventory of the final 5 debt ceiling elevating within the U.S., together with the quantity by which it was raised:

- September 28, 2017: Raised by $1.5 trillion to $20.3 trillion.

- August 1, 2019: Raised by $2 trillion to $22.3 trillion.

- December 21, 2020: Raised by $480 billion to $22.78 trillion.

- August 11, 2021: Raised by $3.5 trillion to $26.28 trillion.

- March 15, 2022: Raised by $480 billion to $30.78 trillion.

The approaching June 1, 2023 deadline for elevating the federal debt restrict has raised considerations as U.S. Treasury Secretary Janet Yellen warns of the federal government’s lack of ability to pay all its payments. President Joe Biden, whereas deeming the Republicans’ provides unacceptable, stays open to spending cuts and tax changes for a possible settlement.

Failing to boost the debt ceiling may set off monetary market chaos and elevated rates of interest, underscoring the pressing want for motion to keep away from potential default and its far-reaching penalties.

The right way to Reply to the Authorities’s Determination about Debt Ceiling

As a person, it’s important to be ready and proactive in response to potential authorities selections concerning the debt ceiling. Listed here are just a few steps you may take to guard your private funds:

- Keep Knowledgeable: Regulate information and updates associated to the debt ceiling. Perceive the potential implications and the way they’ll have an effect on your monetary state of affairs.

- Finances and Save: Set up a stable funds and construct an emergency fund. Having a monetary security internet may also help you climate unsure occasions and sudden financial fluctuations.

- Diversify Your Investments: Contemplate diversifying your funding portfolio to unfold danger. Discover totally different asset courses, corresponding to shares, bonds, actual property, and commodities, to guard your self from potential market volatility.

- Reduce Debt: Preserve your private debt in verify. Excessive-interest debt can turn out to be burdensome throughout financial instability. Prioritize paying off money owed and keep away from taking up pointless monetary obligations.

- Search Skilled Recommendation: Seek the advice of with a monetary advisor to evaluate your private state of affairs and create a tailor-made plan. They will present steering on the best way to navigate unsure monetary occasions and make knowledgeable selections.

![]()

Conclusion

Understanding the debt ceiling and its influence on private finance is essential for all of us. As residents, it’s important to remain knowledgeable, be ready, and take needed steps to safeguard our monetary well-being. By staying proactive, budgeting properly, and diversifying our investments, we are able to navigate the unsure waters and defend our private funds from the potential repercussions of the debt ceiling selections.

Keep in mind, your monetary future is in your arms, and being educated in regards to the elements that may affect it empowers you to make knowledgeable selections.

Whereas the debt ceiling could appear to be a distant and complicated problem, its ramifications can have an actual influence in your every day life. By understanding its significance, you may higher anticipate potential challenges and adapt your monetary technique accordingly.

So, the following time you hear discussions in regards to the debt ceiling within the information or amongst mates, you received’t be left scratching your head. You’ll have a grasp of its implications and the way it pertains to your private funds.

In a world the place financial landscapes can shift quickly, staying knowledgeable and ready is vital. Take management of your monetary future by educating your self in regards to the debt ceiling and its far-reaching results. By doing so, you’ll be geared up to navigate any potential storms that come your manner and make sure the stability of your private funds.

Keep in mind, monetary literacy is a lifelong journey, and every step you are taking towards understanding complicated matters just like the debt ceiling brings you nearer to monetary empowerment.

Keep curious, keep knowledgeable, and keep proactive in managing your private funds. The debt ceiling could also be a puzzle, however with the precise data and mindset, you may unlock the trail to a safe monetary future.

Right here’s to your monetary well-being and the pursuit of information!

[ad_2]