[ad_1]

The transient’s key findings are:

- Whereas annuities provide retirees a dependable stream of lifetime earnings, few individuals buy them.

- To probe individuals’s perceptions of annuities, a brand new survey queried these close to or in retirement with over $100,000 in monetary belongings.

- About half of respondents say they’d be keen to purchase an annuity at prevailing market charges, whereas simply 12 % truly achieve this.

- The examine examined whether or not low annuity take-up could possibly be defined by a scarcity of liquidity or the shortcoming to make bequests, however discovered no such proof.

- In brief, individuals could also be deterred not by a scarcity of curiosity in annuities however by a lack of expertise of the product and easy methods to purchase it.

Introduction

Though many financial fashions predict excessive annuitization charges, solely a small portion of retirees maintain an annuity. This discrepancy is called the “annuity puzzle.” Many explanations have been superior for this puzzle, all of them selling explanation why people won’t need to annuitize.

This transient, which relies on a current paper, analyzes a brand new survey of people close to or in retirement with over $100,000 of investable belongings. The findings counsel that roughly half of this inhabitants need to purchase an annuity at prevailing market costs – considerably greater than the 12 % that really achieve this. Additional, they counsel that probably aversive qualities of annuities, corresponding to the truth that they can’t be bequeathed or that they tie up wealth in an illiquid type, have a negligible impression on the respondents’ willingness to annuitize.

The remainder of the transient is structured as follows. The primary part briefly discusses the background of the annuity puzzle. The second part describes the survey. The third part presents the outcomes. The ultimate part concludes that many extra people are keen to purchase annuities than truly purchase them, suggesting that logistical impediments stymie extra widespread annuitization.

Background

The annuity puzzle is a longstanding query. Since 1965, economists have argued that many people ought to annuitize at the least a few of their wealth in retirement. Nevertheless, within the biennial Well being and Retirement Research (HRS), a nationally consultant survey of Individuals over age 50 performed by the College of Michigan, solely 12 % of households with monetary belongings over $100,000 obtain any annuity earnings.

Present Explanations for Annuity Puzzle

Researchers have supplied many potential rationales for the annuity puzzle. A number one clarification is that annuities are too costly. One motive for top prices is hostile choice – that longer-lived people usually tend to purchase annuities within the first place, main suppliers to lift costs. Insurance coverage firms even have administrative prices and search to make earnings. A second clarification for the annuity puzzle is that folks might need to bequeath their belongings – making annuities with out survivor advantages unattractive. A 3rd clarification is that folks might fear about annuities being illiquid, thus making people unable to pay for giant sudden bills, corresponding to pricey nursing house stays.

A current evaluation of the literature additionally documented a couple of different distinguished explanations for the annuity puzzle. What all the reasons have in frequent is that they counsel explanation why people won’t need to annuitize, for “good” causes (e.g., as a result of Social Safety gives adequate lifetime earnings) or for “dangerous” causes (corresponding to people mistakenly believing they’re unlikely to dwell very lengthy).

Monetary Literacy and Channel Components

Wanting past why people won’t need to annuitize, different elements might result in low annuitization charges even when people could be inclined to purchase an annuity if supplied one. For instance, some people won’t know that annuities exist, or they won’t perceive them. Additional, even when people are involved in annuities, they won’t know easy methods to purchase them.

Particularly, social psychology has lengthy acknowledged “channel elements:” seemingly small traits of a scenario that may have far-reaching penalties for the flexibility of people to comply with by way of on their intentions. For instance, a traditional experiment discovered that giving college students info on the significance of tetanus vaccines produced the intention to be inoculated. Nevertheless, solely a bunch of scholars who got concrete plans for receiving the shot ended up getting vaccinated. This consequence, replicated many instances since, led to the conclusion that intentions are inadequate to provide motion on their very own, however reasonably require particular step-by-step plans.

Within the context of annuities, this discovering implies that wanting to purchase an annuity is meaningfully faraway from truly shopping for one. The outcomes of the brand new survey and its randomized management trial described subsequent are per this social psychology instinct.

Survey and Randomized Management Trial

The survey, performed by Greenwald Analysis in June of 2023, questioned 1,216 people. Members had been ages 55-95 and had over $100,000 in financial savings, excluding actual property, outlined profit pension plans, and the worth of any enterprise. Amongst different issues, the survey probed respondents’ demographic and financial traits, their sentiments relating to annuities, and their longevity expectations.

The core of the evaluation depends on a randomized management trial (RCT) with a management group and two remedy teams. Within the management group, the trial elicited every shopper’s minimal annual lifetime annuity cost at which they’d purchase an annuity for a $100,000 premium. In Remedy Group 1, shoppers had been supplied the identical annuity as within the management group however, on this case, the annuity had an added early dying bequest function: if the payouts by the point of dying had not exhausted the premium, the stability could be paid out to the decedent’s heirs. In Remedy Group 2, shoppers had been supplied the identical annuity as within the management group however, on this case, the annuity had an added liquidity function: the place annuity holders might break the contract and withdraw the remaining premium.

Outcomes

The survey contains each direct questions on how respondents really feel in the direction of assured lifetime earnings typically, in addition to an RCT designed to elicit valuations of ordinary fast annuities, on the one hand, and the 2 variations of annuities, on the opposite. This part presents the three units of outcomes.

Direct Questions on Assured Lifetime Earnings Sentiments

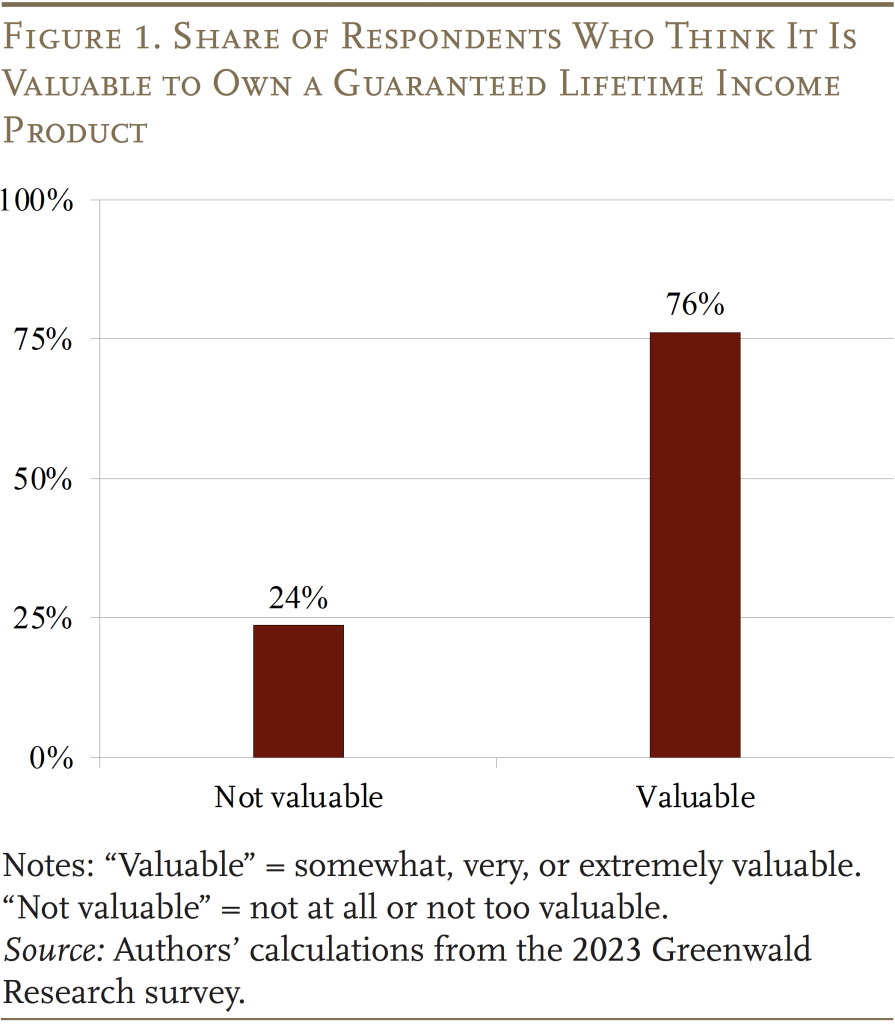

The survey asks respondents immediately how they really feel about annuities. Determine 1 exhibits that 76 % say it’s at the least considerably worthwhile.

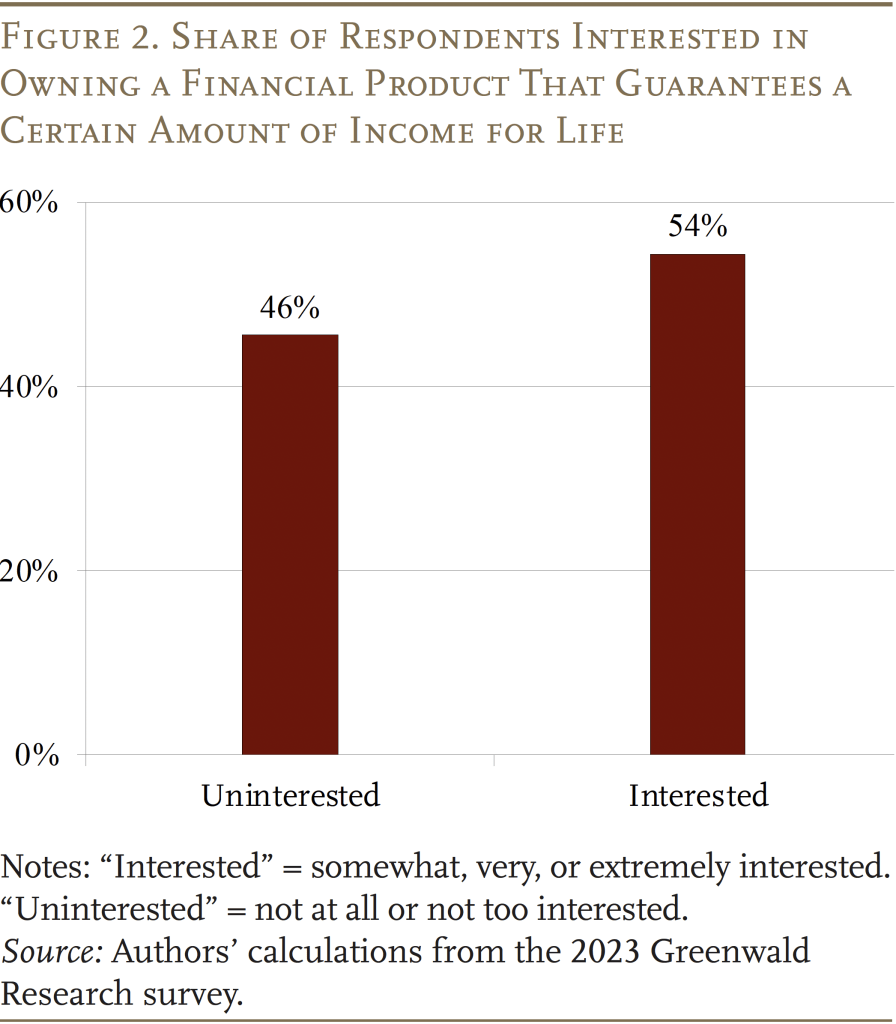

Additional, of those that don’t presently personal an annuity, most say they’re at the least considerably involved in proudly owning one (see Determine 2).

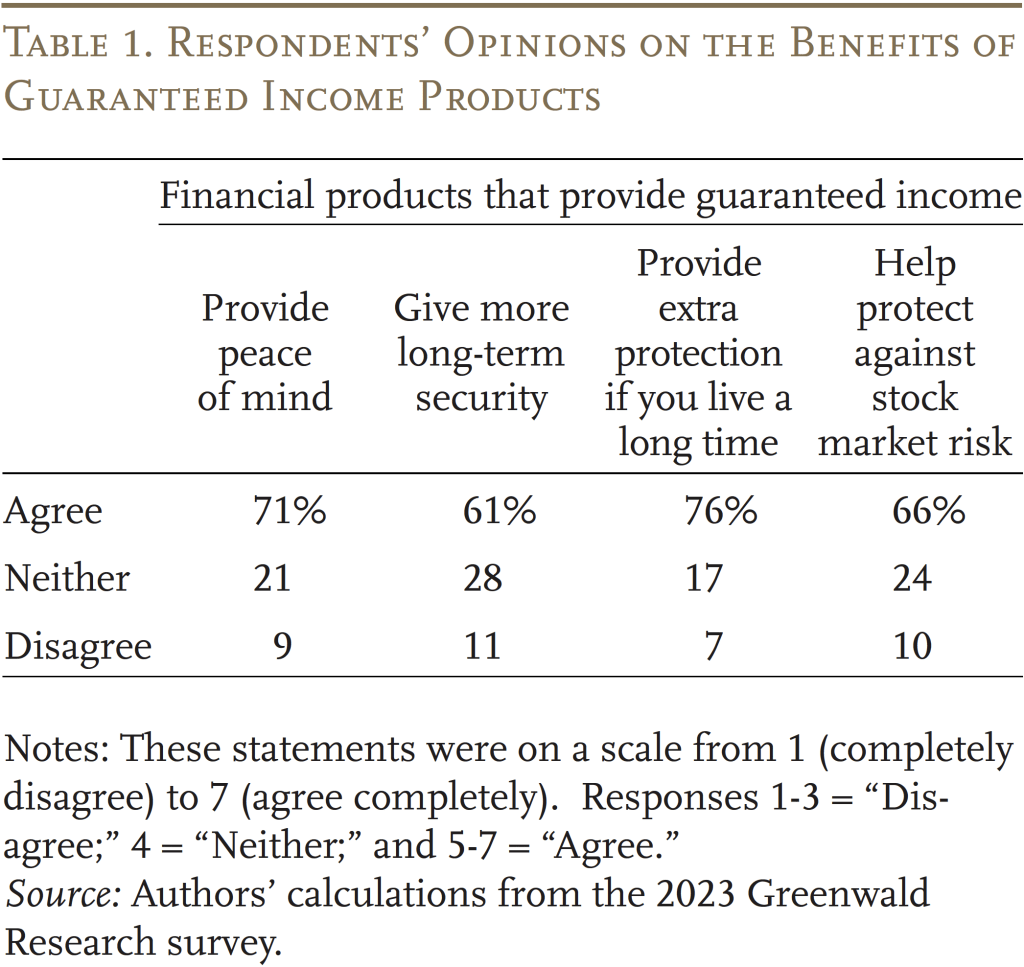

Respondents additionally usually agree that assured lifetime earnings would offer emotional and insurance coverage advantages (see Desk 1).

Direct questions on annuities within the summary, nonetheless, can not decide why those that don’t worth annuities really feel that approach. Particularly, respondents might imagine annuities are good however not price their value, one of many principal explanations of the annuity puzzle. Or, they could like the concept of an annuity however really feel its advantages are outweighed by its prices by way of foregone bequests or liquidity. The RCT part of the survey explores these points additional.

Instant Annuity Valuations

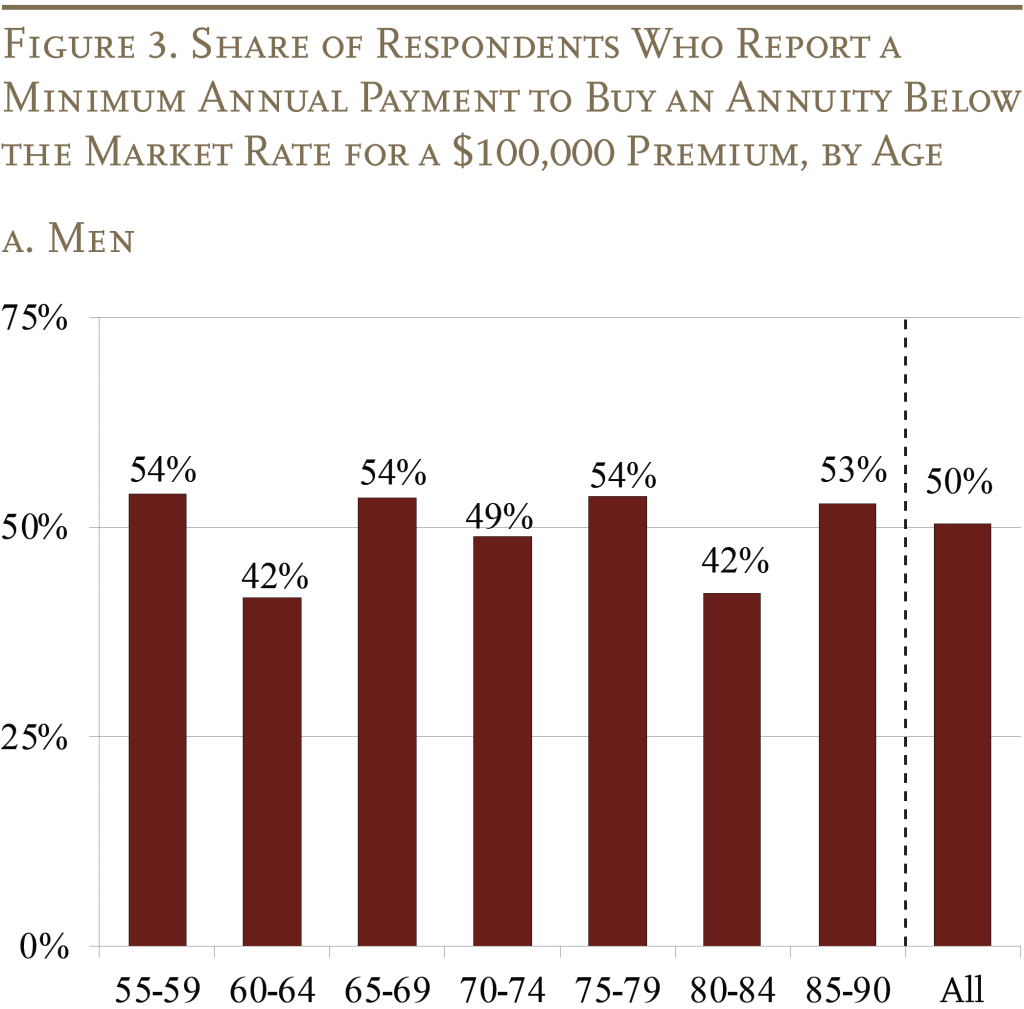

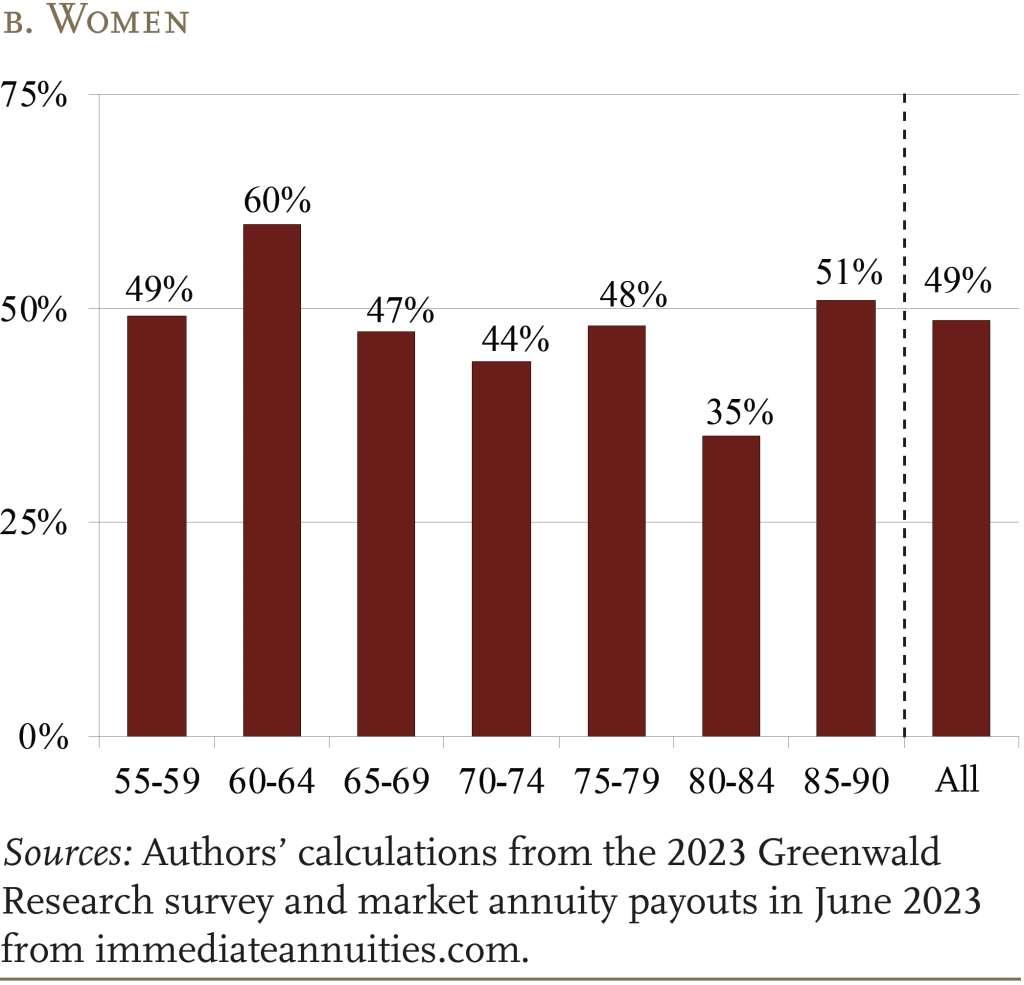

The RCT elicited from every respondent how a lot assured month-to-month earnings they’d require with a purpose to be keen to pay a $100,000 premium. Roughly half of respondents’ required funds had been decrease than the funds they may have gotten from annuities bought available on the market to prospects with their very own age and gender on the time the survey was fielded. Figures 3a and 3b present this consequence by age group, for women and men respectively.

The 50-percent share of respondents keen to purchase annuities at prevailing market charges far exceeds the share of respondents who even have an annuity (13.5 %) or the share of comparable people in bigger surveys with over $100,000 in monetary belongings (12 %). Thus, the outcomes counsel that a big swath of the inhabitants with belongings adequate to purchase an annuity additionally need to purchase an annuity, but don’t comply with by way of on that need. This discovering contrasts with all the reasons of the annuity puzzle that depend on rationales for why people don’t need to annuitize. As an alternative, the outcomes counsel that some logistical obstacle corresponding to channel elements is stopping extra widespread annuitization, reasonably than the aversive high quality of annuities themselves.

Distinction in Valuations for Totally different Annuity Sorts

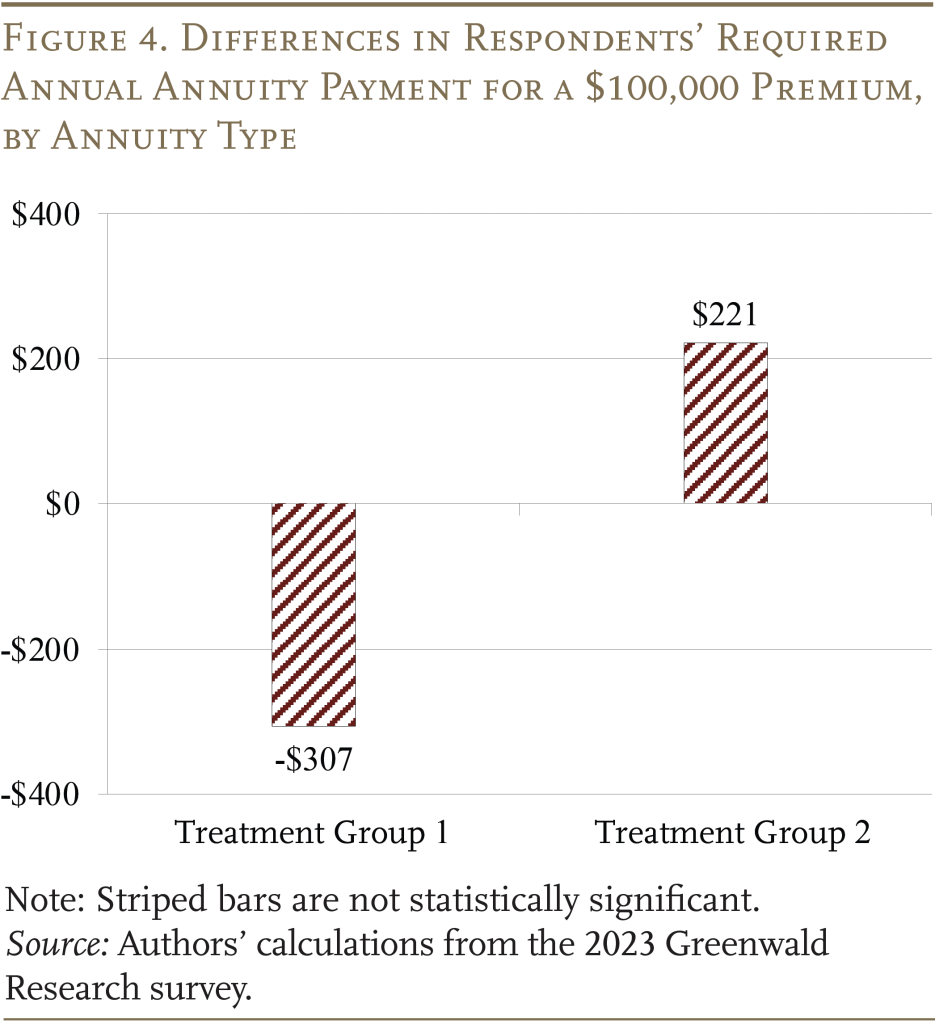

The outcomes of the RCT relating to various kinds of fast annuities additionally assist the notion that it’s not aversion to annuities per se suppressing demand for the product. Moderately, the evaluation finds no proof that respondents are keen to pay extra for dying advantages or liquidity choices past what they’re keen to pay for the standard fast annuity.

Determine 4 exhibits regression coefficients for a way way more annual earnings people require to pay a $100,000 premium for an annuity with dying advantages or a liquidity possibility, in comparison with the usual fast annuity.

Neither of those coefficients is statistically totally different from zero. In different phrases, regardless of the notion that the shortage of means to bequeath an annuity and its illiquidity are main explanation why people don’t need to annuitize, the RCT finds that merchandise enjoyable these constraints could be no extra enticing to shoppers than the usual annuity (which many truly like as is).

Conclusion

Annuity demand has persistently fallen far wanting what financial concept predicts, a discrepancy referred to as the “annuity puzzle.” This transient experiences on findings from a current examine of demand for annuities based mostly on a survey of older people with over $100,000 in investable belongings. The examine elicited respondents’ willingness to purchase an annuity, and used an RCT to check whether or not shoppers would discover annuities with dying advantages or larger liquidity extra enticing.

The examine discovered that roughly half of respondents could be keen to purchase an annuity at prevailing market charges, a far larger share than those that truly do purchase annuities. The truth that so many respondents needed annuities at these costs means that explanations counting on explanation why shoppers won’t need to annuitize at market costs can not seize the entire story. Respondents additionally didn’t seem extra keen to purchase annuities that tackle their most distinguished aversive qualities – that they can’t be bequeathed and that they’re illiquid.

General, the findings counsel {that a} lack of need to purchase annuities just isn’t the explanation why roughly 40 % of people with over $100,000 in monetary belongings don’t annuitize (the 50 % who need to annuitize minus the 12 % who achieve this). Moderately, the findings are per channel elements, like lack of familiarity with annuities or how precisely to go about shopping for them, being main impediments to annuitization.

References

Arapakis, Karolos and Gal Wettstein. 2023a. “Longevity Threat: An Essay.” Particular Report. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Arapakis, Karolos and Gal Wettstein. 2023b. “What Issues for Annuity Demand: Goal Life Expectancy or Subjective Survival Pessimism?” Working Paper 2023-2. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Bernheim, B. Douglas. 1991. “The Vanishing Nest Egg: Reflections on Saving in America.” Berkeley, CA: Precedence Press Publications.

Gollwitzer, Peter M. 1999. “Implementation Intentions: Robust Results of Easy Plans.” The American Psychologist 54(7): 493-503.

Hosseini, Roozbeh. 2015. “Adversarial Choice within the Annuity Market and the Function for Social Safety.” Journal of Political Financial system 123(4): 941-984.

Hubbard, Robert and Kenneth Judd. 1987. “Social Safety and Particular person Welfare: Precautionary Saving, Borrowing Constraints, and the Payroll Tax.” American Financial Evaluation 77(3): 630-646.

Laitner, John, Dan Silverman and Dmitriy Stolyarov. 2018. “The Function of Annuitized Wealth in Publish-retirement Conduct.” American Financial Journal: Macroeconomics 10(3): 71-117.

Leventhal, Howard, Robert Singer and Susan Jones. 1965. “Results of Worry and Specificity of Advice Upon Attitudes and Conduct.” Journal of Character and Social Psychology.

Lusardi, Annamaria and Olivia S. Mitchell. 2014. “The Financial Significance of Monetary Literacy: Principle and Proof.” Journal of Financial Literature 52(1): 5-44.

Mitchell, Olivia S., James M. Poterba, Mark J. Warshawsky, and Jeffrey R. Brown. 1999. “New Proof on the Cash’s Value of Particular person Annuities.” The American Financial Evaluation 89(5): 1299-1318.

O’Dea, Cormac and David Sturrock. 2023. “Survival Pessimism and the Demand for Annuities.” The Evaluation of Economics and Statistics 105(2): 442-457.

Pashchenko, Svetlana. 2013. “Accounting for Non-Annuitization.” Journal of Public Economics 98(C): 53-67.

Wettstein, Gal, Alicia H. Munnell, Wenliang Hou, and Nilufer Gok. 2021. “The Worth of Annuities.” Working Paper 2021-5. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Yaari, Menahem E. 1965. “Unsure Lifetime, Life Insurance coverage, and the Principle of the Client.” The Evaluation of Financial Research 32(2): 137-150.

[ad_2]