[ad_1]

I am a follower and believer of historical past with regards to the inventory market. After years of analysis, I perceive that some elements of U.S. fairness efficiency are slightly clear and ensuing technical alerts usually might be relied upon. There have been loads of warning alerts to open 2022 that prompt we had been in short- to mid-term hassle and I wrote and talked about them all through the primary six months of 2022. However lots of my alerts modified in mid-June, main me to name a backside in June 2022. The dangers of remaining quick had been too nice, whereas the reward to danger on the lengthy facet had improved significantly. Those that transitioned again into the inventory market final summer time have been handsomely rewarded with the S&P 500 up 13% now off that low.

I used to be criticized for calling for a bear market earlier than it began and later criticized after I prompt the bear market was over – effectively earlier than anybody else prompt it. It takes thick pores and skin to go in opposition to the plenty, however I merely name what I see. It helps that I am not brainwashed by all of the negativity within the media. The lesson right here is to maintain StockCharts.com turned on and all the skin noise TUNED OUT!

The Fed and Inflation

On Wednesday, the Fed acknowledged it is profitable the warfare on inflation. We’ll most likely see yet another 25 foundation level hike within the fed funds fee, however past that, I see a way more dovish Fed. I consider charges will come down later in 2023 and, if the January jobs report was any indication, a really gentle touchdown is totally doable. Progress with falling charges is NIRVANA for fairness costs. In 2022, we had two quarters of detrimental GDP with rising charges. That is what the S&P 500 priced in throughout its 27% cyclical bear market drop. The NASDAQ fell nearer to 40%. It was all baked in.

Bear Market: Cyclical vs. Secular

Many had been, and a few nonetheless are, calling for a secular bear market, which is a long-term bear market. The issue is that you may’t name a long-term bear market till it confirms. We have had 3 secular bear markets since 1950. 3!!!! For those who’re counting them in your hand, you continue to have two fingers left. Put one other method, they do not occur fairly often, but the Peter Schiffs of the world are granted method an excessive amount of air time on CNBC to spew their nonsense. Give it some thought. Why would CNBC proceed to cater to somebody who has repeatedly missed the most important bull markets in historical past and referred to as the market mistaken 12 months after 12 months after 12 months? It is the train-wreck strategy to driving viewership, a humiliation should you ask me.

The Large Image

Anybody who has been to any of my market outlook webinars is aware of that I begin off each considered one of them with a BIG PICTURE 100-year chart of the S&P 500. This is what it at present seems like:

Actually, how will you take a look at this chart and frequently be bearish U.S. equities? We’re in one other long-term interval (secular BULL market) the place U.S. equities are in favor. There’ll often be short-term intervals of weak point, particularly after large rallies like we had in 2020 and 2021. These are cyclical bear markets that require persistence. It is advisable acknowledge these intervals BEFORE they occur, as a result of swing buying and selling methods will not be rewarded and you may lose some huge cash rapidly. That is why I instructed EarningsBeats.com members originally of 2022 that we wanted to appreciate that situations would change and swing buying and selling would not work. You both want to maneuver to money or change into extra aggressive on the quick facet. In early February, I hosted a webinar, Anatomy of a Cyclical Bear Market, to assist our members perceive what we had been going to be going through. For those who merely caught with what had been working, you would be no higher off than Cathie Wooden, who managed her ARK funds into the bottom over the previous couple years. She by no means adjusted to the cyclical bear market at hand and her traders paid a ridiculously-hefty worth. It ought to have been prevented.

However let’s get again to that chart above. I exploit it for perspective. And “perspective” is my phrase for 2023, changing “persistence” in 2022. This large image view helps me climate markets like 2022, believing that we’ll come out of it stronger than ever, returning to all-time highs. However you need to train persistence through the turmoil. Throughout secular bear markets, the month-to-month PPO turns decidedly detrimental. That has but to occur because the month-to-month PPO stays optimistic and appears as if it is starting to show again up. Additionally, throughout secular bear markets, the month-to-month RSI dips effectively beneath 40. The month-to-month RSI has already bottomed above 40 and has moved again up into the 50s. You want technical affirmation of a secular bear market and we’re seeing none.

The Future Path

We have seen a really good rally. January was one of many strongest on document, the ninth finest January on the S&P 500 since 1950. Sturdy Januarys virtually all the time lead to very sturdy years. It isn’t an ideal science and definitely not a assure, however there’s lots of historical past that implies the possibilities of a robust 12 months improve considerably. Additionally, the most important subject that we confronted in 2022 was sentiment. It was method too bullish on the finish of 2021 on the heels of the most important 22-month improve within the S&P 500 because the Thirties. We badly wanted sentiment to show bearish and that solely occurs a method – a prolonged bear market the place everybody’s psyche turns from ecstasy to despair. We wanted all of the YouTube specialists (sarcasm) unanimously believing it was unimaginable to see a market backside and that our solely path was decrease. That is the kind of mentality that marks bottoms.

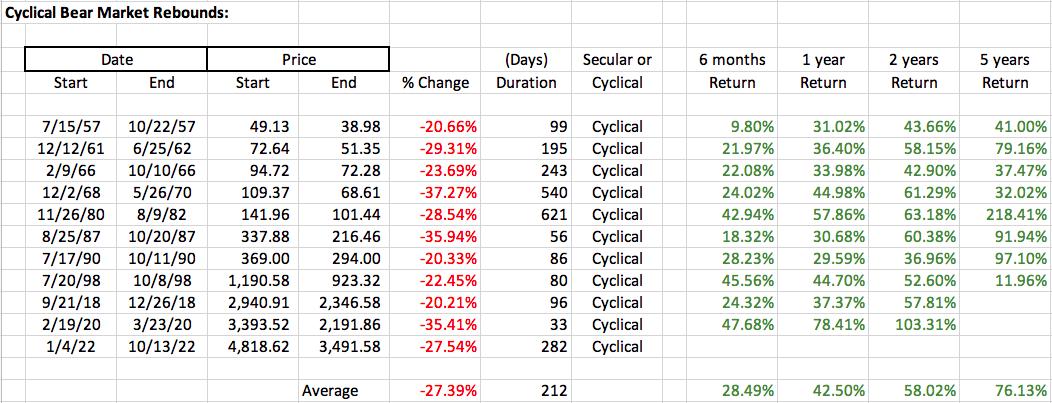

Luckily, after months of ache, we obtained to the place we wanted to get and the underside fashioned. The October 2022 low will mark the seventh time within the final 14 bear markets (6 of 11 if we solely take a look at cyclical bear markets) that the bear market backside occurred in October. As a result of many traders don’t acknowledge the top of bear markets, additionally they miss out on the large market good points that sometimes observe. Under is a desk of the 11 cyclical bear markets since 1950, displaying the good points made within the following 6-month, 1-year, 2-year, and 5-year intervals:

Have a look at these 1-year returns after cyclical bear markets ended. The worst 1-year return was 29.59%. If we apply that WORST return to the October 2022 low, then we should always count on the S&P 500 to be at 4525 by October 2023. If we apply the AVERAGE 1-year return of 42.50%, then we’ll see the S&P 500 at 4975. Unexpectedly, all-time highs are not that distant.

Sadly, that is the kind of analysis at EarningsBeats.com that CNBC and different media shops might produce if they really had been focused on offering helpful instructional content material for his or her viewers. Nevertheless it’s all in regards to the mighty greenback. Schooling takes a again seat to earnings. Their pursuits lie in promoting {dollars} and scaring viewers into watching with ridiculously-bearish headlines, and the faster that everybody acknowledges that, then the faster they will stroll away and give attention to what’s really necessary.

Please be part of my FREE EB Digest e-newsletter if you have not already. CLICK HERE to enter your title and e mail deal with. There is not any bank card required and you may unsubscribe at any time.

Comfortable buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Day by day Market Report (DMR), offering steering to EB.com members every single day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as effectively, mixing a novel ability set to strategy the U.S. inventory market.

Subscribe to Buying and selling Locations with Tom Bowley to be notified every time a brand new put up is added to this weblog!

[ad_2]