[ad_1]

I’ve all the time discovered the world of buying and selling and finance to be fascinating. I had aspirations of coming up with a profitable buying and selling methodology that would make me stand out from different merchants. However I was conscious that a robust background in arithmetic was essential for me to succeed in my targets. In order to mannequin the modifications in forex costs, I started to check Calculus diligently. After that I studied linear algebra, which I used to study and work with forex information matrices. I was in a position to estimate possibilities and make predictions primarily based on historic information with the assist of statistics. The greatest portfolio allocation and threat minimization have been then achieved utilizing optimization. In order to study forex developments and patterns, I additionally used time collection evaluation.

I regarded into machine studying as a result of I was dissatisfied with simply utilizing historic information. This helped me create buying and selling algorithms and predictive fashions. I used Monte Carlo Simulation to additional assess potential outcomes and threat in my buying and selling methods. I used Fractal Geometry in addition to all of these strategies to study market patterns and predict future developments. I researched stochastic processes to simulate erratic habits in the monetary markets and used quantity idea to encrypt monetary transactions and defend towards on-line threats. With the assist of all these mathematical calculations, I was in a position to develop a profitable buying and selling technique. I integrated all of my data and used it in a refined, all-encompassing approach, which offers me a huge edge over different merchants. My plan was a enormous success, and I gained a repute as a monetary genius.

A quick overview of gathering info for my advisor.

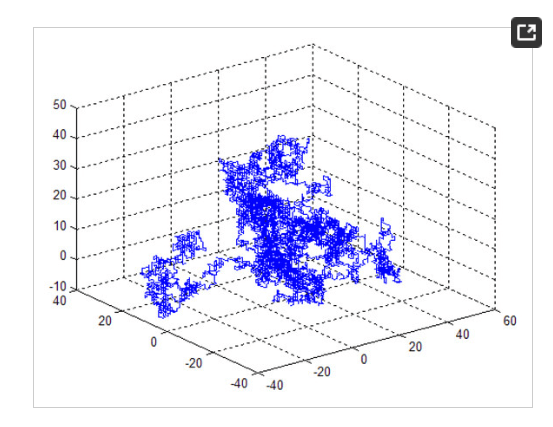

Multifractal evaluation has been utilized to the examine of assorted stylized monetary market details, together with market effectivity, monetary disaster, threat evaluation and collapse prediction. This idea might be referred to as the random stroll speculation (RWH). An instance of a three-dimensional random stroll is proven in Determine 1. Fashions of this kind are utilized in many purposes the place they assist to clarify the noticed traits of fields, that are recognized to be the results of random processes, i.e., the place the spatial and temporal traits of the bodily system are non-dec.

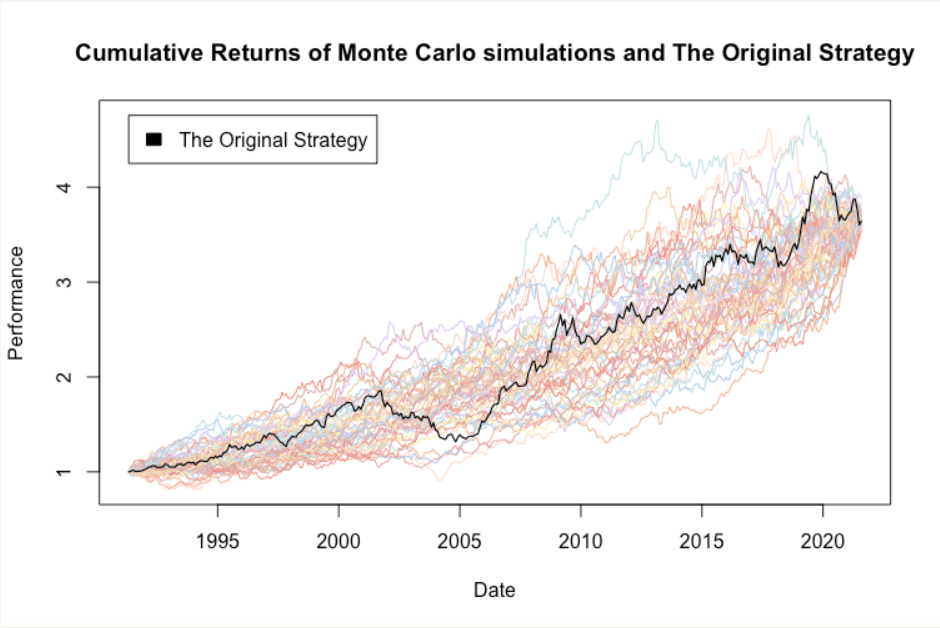

Monte Carlo simulation is used to foretell the likelihood of assorted outcomes when different approaches, corresponding to optimization, could be tough to make use of. The principle purpose is to create various situations that take into consideration doable threat and assist in determination making.

Varieties of Monte Carlo Technique Simulations

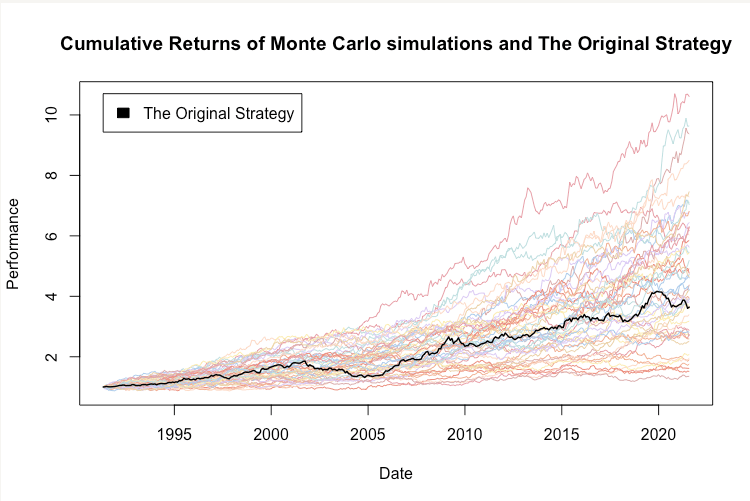

There are a number of sorts of Monte Carlo purposes in quantitative buying and selling methods. I’ve centered on other ways to randomize technique returns.

- Monte Carlo sampling with out alternative

- Monte Carlo sampling with alternative

- Monte Carlo returns with alternative.

- Comparability with random methods

Monte Carlo sampling with out alternative:

This Monte Carlo methodology solely modifications the order of the returns, i.e., its “shuffles” the returns. The essential assumption underlying this methodology is that the returns will stay the identical (or related), however the order through which they seem might change.

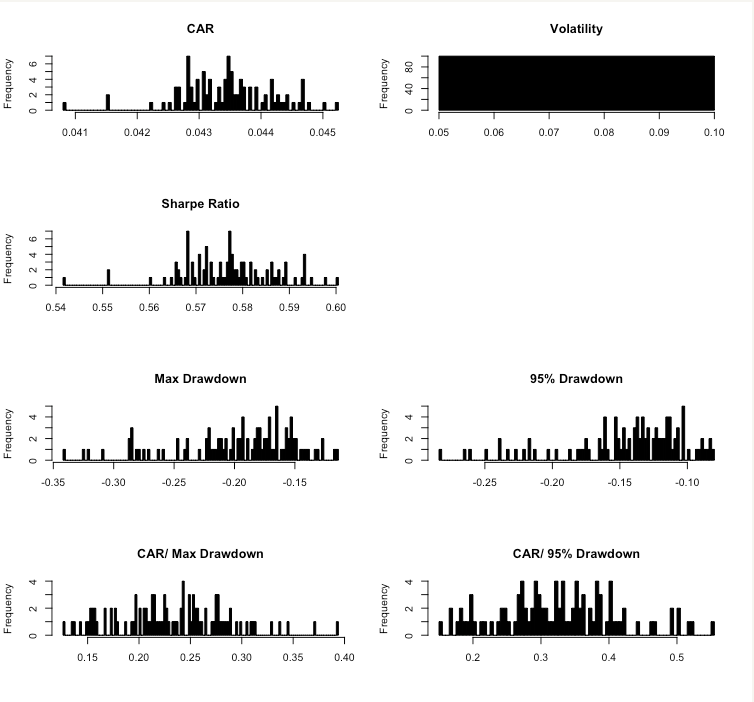

As well as, the next determine exhibits a set of histograms displaying the frequency of particular person threat and return traits in 100 simulations. There is just one worth for volatility, as a result of I utilized random sampling with out alternative.

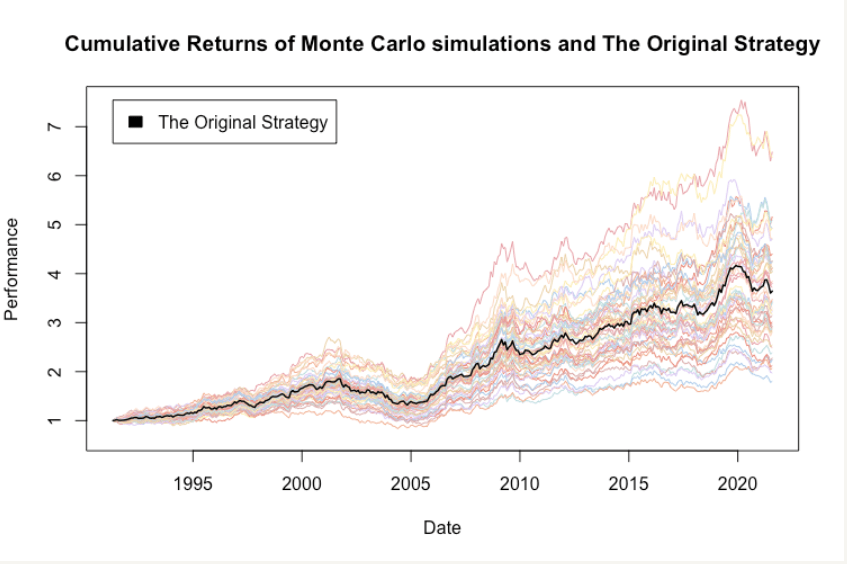

Monte Carlo sampling with substitution:

This Monte Carlo methodology not solely modifications order of the returns, it additionally randomly skips or repeats returns of the unique technique. The principle assumption behind this methodology is, {that a} return distribution will keep the identical (or related), however returns might change extra considerably. Monte Carlo sampling with alternative creates rather more selection in simulated technique returns.

Monte Carlo return alterations:

This Monte Carlo methodology modifications randomly picked returns in random path by a pre-specified quantity. The principle assumption behind this methodology is, that returns might merely change into smaller or bigger sooner or later. It’s helpful to look at technique’s sensitivity to such a situation.

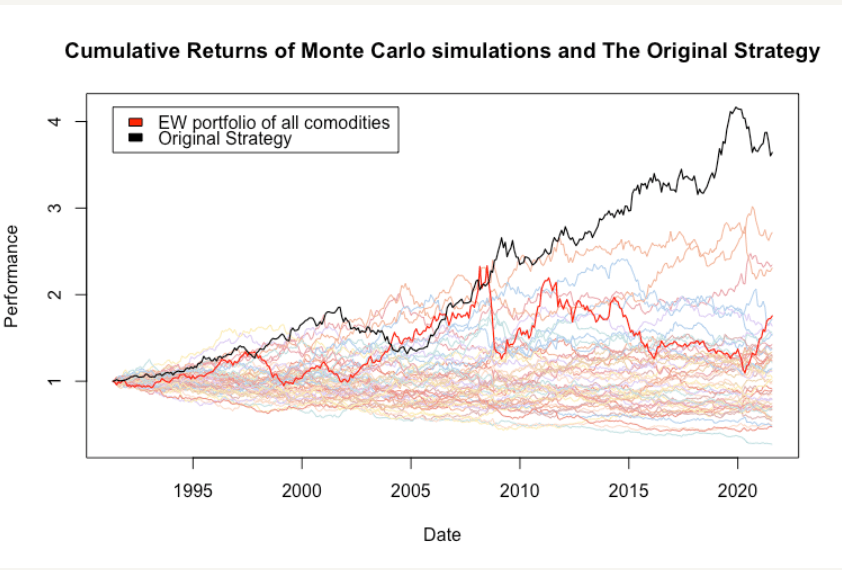

Comparability towards Random Methods:

This Monte Carlo methodology is used to create a set of random methods to check to the unique technique. It’s primarily based on the idea that our preliminary technique ought to outperform most random methods.

Random trades, by definition, fluctuate round zero more often than not. This ought to be one of many best hurdles to beat in our technique. This set of Monte Carlo exams serves as an impartial (from our technique) benchmark to be surpassed.

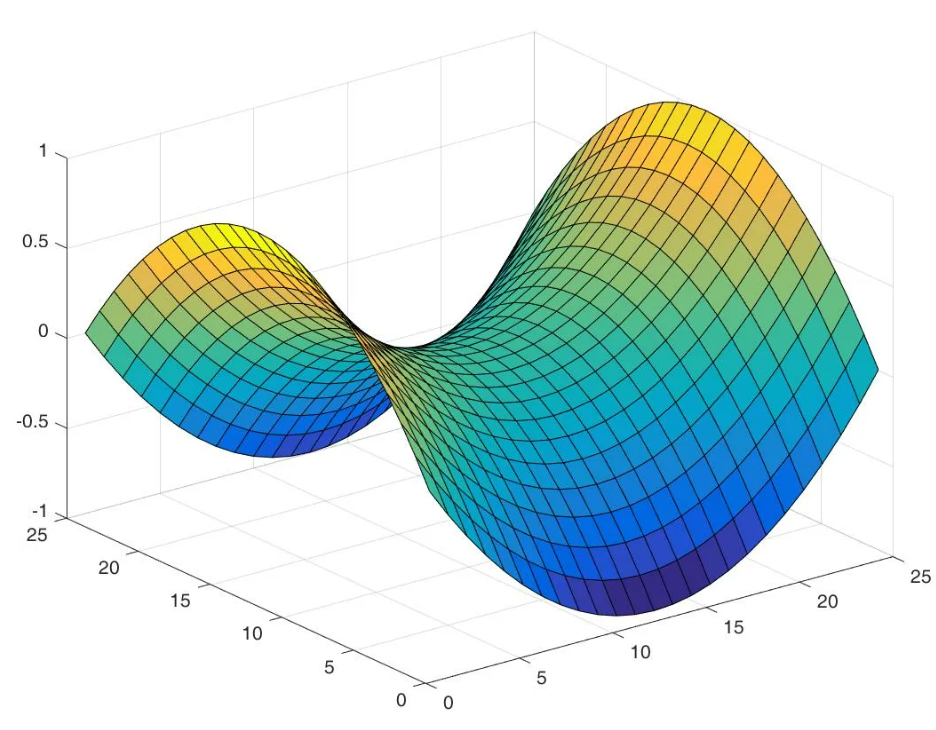

The key of Maserati Advisor’s superb outcomes lies within the mixture of the cycle matrix and superior machine studying algorithms. This distinctive mixture of mathematical strategies offers merchants unprecedented perception and predictive skill. The cycle matrix I developed primarily based on my intensive data of linear algebra is a robust software that analyzes market patterns and identifies recurring cycles in forex costs. Combining this with the most recent advances in machine studying, Maserati EA is ready to make predictions with outstanding accuracy and navigate even essentially the most unpredictable market situations. The cycle matrix mixed with machine studying varieties the core of Maserati EA and offers merchants with a robust and complex monetary buying and selling resolution. Maserati’s distinctive outcomes and dependable efficiency are testomony to the effectiveness of this revolutionary strategy.

You will need to perceive that purchasing Knowledgeable Advisors with out dwell indicators and historic information is just not a clever funding. Dwell indicators and historic information present necessary info that’s used to guage the efficiency and accuracy of an EA. With out this info, it’s unimaginable to find out if an EA is a viable choice on your buying and selling technique. Investing in a buying and selling advisor with out dwell indicators and historic information is like shopping for a automotive and not using a take a look at drive or finding out its previous efficiency. You merely cannot make an knowledgeable determination with out evaluating the dwell efficiency of the advisor and its previous observe file.

Purchase Dependable Advisor is sort of a Maserati automotive.

Coming Quickly on Sale

[ad_2]