[ad_1]

Shares of Nvidia (NVDA) soared at this time after the corporate reported earnings that had been nicely above estimates. Most spectacular nonetheless, was the corporate’s estimates for subsequent quarter’s revenues which was greater than 50% above Wall Road estimates. NVDA cited surging demand for its chips that assist with synthetic intelligence functions and the inventory is poised to commerce larger. Subscribers to my MEM Edge Report will likely be conversant in NVDA as we added the inventory to our Instructed Holdings Listing final January the place we have since supplied purchase sign alerts.

Along with Nvidia, these desirous to take part within the AI pushed progress development can look to corporations that present merchandise to the corporate which is a pacesetter in AI. Taiwan Semiconductor (TSM) is one such firm. As probably the most superior chipmaker on the earth, they manufacture the chips utilized by NVDA and TSM will get a reduce of no matter Nvidia makes.

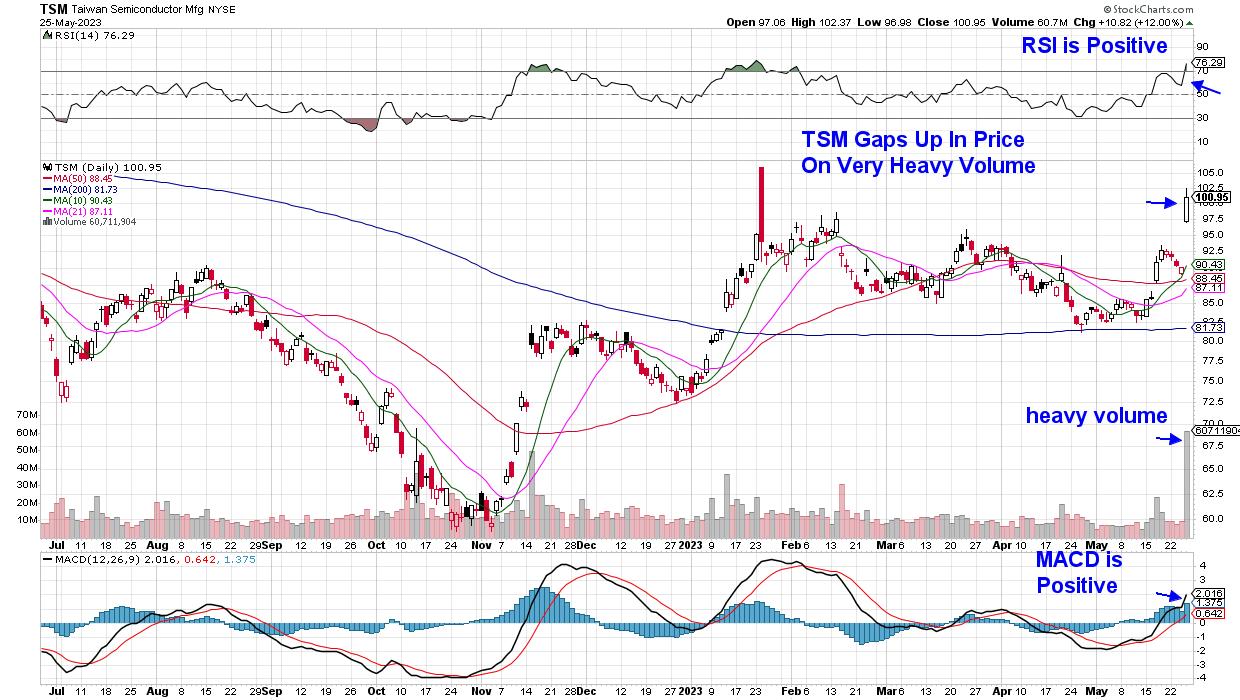

DAILY CHART OF TAIWAN SEMICONDUCTOR (TSM)

Taiwan Semiconductor (TSM) Gapped up 12% on very heavy quantity at this time. The excessive quantity signifies that the inventory is being accrued and it typically factors to additional upside.

Netherlands primarily based Semiconductor Tools producer ASML (ASML) is the one firm on the earth that may make its excessive ultraviolet (EUV) lithography machine. This software is required by corporations equivalent to TSM and different chipmakers within the AI area. ASML broke out of a 4-month base on heavy quantity at this time. Base breakouts typically precede lengthier uptrends and the longer the bottom, the longer the advance out of that base.

DAILY CHART OF ASML HOLDING (ASML)

With every of those corporations being within the Semiconductor business, you may need to keep watch over a Semiconductor ETF equivalent to SOXX. Within the chart beneath, you may see constructive momentum within the group with a constructive RSI and MACD as nicely. Semi shares are extremely cyclical and might pull again amid any hints of an financial slowdown. A break beneath the 50-day transferring common coupled with a damaging RSI or MACD would point out a reversal of the present uptrend.

DAILY CHART OF iSHARES SEMICONDUCTOR ETF

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

*This text was revealed earlier at this time at SimplerTrading.com

Mary Ellen McGonagle is knowledgeable investing advisor and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to change into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra

Subscribe to The MEM Edge to be notified at any time when a brand new put up is added to this weblog!

[ad_2]