[ad_1]

This text is offered by Hire To Retirement. Learn our editorial pointers for extra data.

Selecting the best actual property funding so as to add to your portfolio requires ample analysis and in depth data in regards to the market that you just’re investing in. A poor resolution may end up in your portfolio dropping considerably in worth. When markets begin to dip, and the economic system enters a recession, choosing the right funding turns into much more vital.

Probably the most rewarding investments are ones that happen in recession-proof markets, that are areas the place houses are in excessive demand no matter how the economic system is performing. Not each market performs the identical. By investing your cash in houses which are located in recession-proof markets, you’ll be able to profit from constant rental revenue, reasonable appreciation even in poor financial environments, and continued rental will increase YoY.

Why Now Is a Nice Time to Make investments

The latest market traits point out that 2023 is an effective time to spend money on actual property so long as you deal with the correct markets. In latest months, rates of interest have continued to extend. Nevertheless, these will increase have slowed and will come to a cease by the tip of this 12 months. Purchaser demand can also be slowing down, which makes it simpler so that you can spend money on actual property with no need to make quite a few bids earlier than having one accepted.

Whereas the present state of the economic system is adversely affecting the true property market as an entire, there are some particular person markets that seem like recession-proof, which implies that they are going to proceed to carry out properly in comparison with the nationwide housing market.

When figuring out markets which are thought-about to be recession-proof, there are a lot of components that ought to be thought-about, which embrace all the things from the common sale worth to the inhabitants numbers. The next provides a complete overview of 5 of the highest recession-proof markets you’ll be able to spend money on all through 2023.

Kansas Metropolis, Missouri

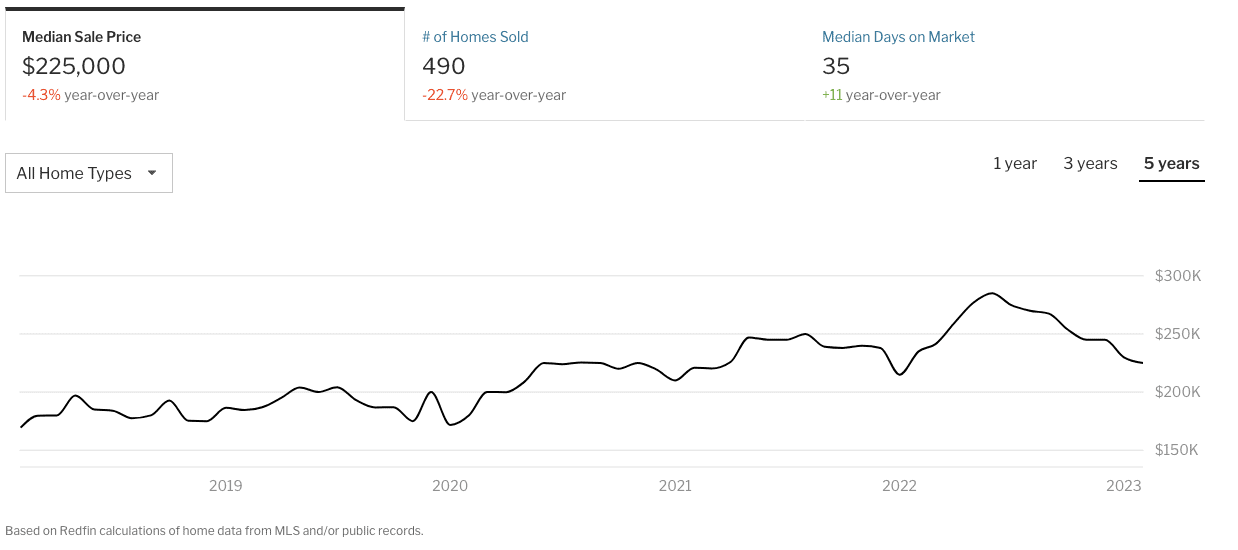

As the most important metropolis in Missouri, Kansas Metropolis has lengthy been a well-liked vacation spot amongst California residents in addition to people who find themselves transferring from different giant Midwest cities. There are quite a few items of knowledge and statistics that time in the direction of Kansas Metropolis being recession-proof. As an illustration, the median sale worth within the metropolis has continued to extend, which implies that purchaser demand isn’t dropping like it’s in cities and cities that aren’t recession-proof.

In each actual property market, dwelling costs normally attain their highest within the late spring and summer time months earlier than dipping barely within the winter months when not many consumers are in the marketplace. Whereas that is additionally the case in Kansas Metropolis, the median sale worth has been trending larger for a prolonged time period. The median sale worth as of 2023 is $230,000, which is a YoY enhance of round 7%. In June 2022, the median sale worth was $285,000.

All through the approaching months, dwelling values in Kansas Metropolis ought to enhance since there aren’t any indicators that the present financial local weather is impacting the native actual property market. Although houses have turn into dearer in Kansas Metropolis, the median worth of $230,000 is extremely inexpensive in comparison with many well-liked markets all through the U.S. Understand that rents don’t fall a lot throughout recessions, which supplies you the chance to cost comparatively excessive rents even while you’re in a position to buy a property at an inexpensive worth.

In January 2023, greater than 400 houses have been bought on this market. House gross sales normally get near 1,000 monthly throughout the heat summer time months. Over the previous few years, dwelling gross sales within the metropolis have been comparatively constant, which implies that the perfect time of 12 months so that you can make investments largely depends upon what sort of property you’re shopping for and the way a lot competitors you’re able to cope with.

Understand that 28% of houses in the marketplace in January 2023 noticed worth drops, which was an 11% YoY enhance. On this situation, you’ve some negotiating energy when making an attempt to acquire a decrease sale worth. Over the previous decade, Kansas Metropolis’s inhabitants numbers have steadily elevated. The present inhabitants is properly over 500,000 and has elevated by greater than 50,000 since 2010. If you happen to’re going to be renting out your funding property, you might be assured that there might be a lot of folks seeking to lease.

Akron, Ohio

Akron is one other well-liked midwest metropolis with inexpensive dwelling costs that buyers can benefit from. The present median sale worth is slightly below $107,000, which is near the value that it was on the identical time final 12 months. Whereas dwelling values in most cities normally attain their peak in June and July, the house costs in Akron matched the June excessive in September 2022.

One other signal that Akron is a recession-proof actual property market is that the variety of days that houses have remained in the marketplace earlier than being bought has been constant. In January 2022, houses have been in the marketplace for a mean of 33 days earlier than being bought. One 12 months later, houses are in the marketplace for a mean of 34 days earlier than being bought.

When a recession happens in markets that aren’t recession-proof, it’s frequent for purchaser demand to drop significantly, which ends up in dwelling stock staying in the marketplace for for much longer than standard. Even with a recession nearing, Akron’s actual property market is almost sustaining its efficiency when rates of interest have been at their lowest.

Lehigh Acres, Florida

Lehigh Acres is among the many strongest actual property markets within the U.S. and is right for anybody who’s seeking to spend money on actual property throughout 2023. Probably the obvious signal that the Lehigh Acres actual property market is performing properly is the median sale worth of greater than $327,000, which is almost 25% larger than the median sale worth in January 2022.

Although dwelling values are usually at their lowest in January, the median worth for a house in Lehigh Acres has solely been barely larger in July, August, and October of final 12 months. House values have risen considerably over the previous decade. In January 2018, the median sale worth for a house on this metropolis was $165,000, which implies that the present sale worth is almost double.

If you happen to’re seeking to spend money on actual property that may offer you constant revenue, the house you find yourself investing in ought to admire in worth over time due to the general well being of the Lehigh Acres market.

Understand that the inhabitants on this metropolis has risen significantly over the previous decade and can doubtless proceed to take action within the coming years. In 2011, Lehigh Acres was dwelling to a inhabitants of round 92,000. The whole inhabitants has elevated yearly and is now located at slightly below 125,000. As an investor, extra folks transferring into town ought to make it simpler so that you can discover tenants and maintain rents excessive.

Indianapolis, Indiana

Indianapolis is one other well-liked actual property market with inexpensive dwelling values. As of January 2023, the median sale worth for a single-family dwelling in Indianapolis is $215,000, which represents a YoY enhance of round 1.5%. The truth is, there has but to be a single month with out YoY progress in dwelling values in 4 years.

5 years in the past, the median sale worth for a house was a bit of over $136,000. By investing within the Indianapolis actual property market, it is best to have peace of thoughts that your property will admire in worth over time. Houses solely stay in the marketplace for a mean of 33 days earlier than being bought, which signifies that there are a lot of consumers and renters in the marketplace. Patrons who can’t afford to buy a house due to the recession usually tend to lease, which implies that it is best to be capable to usher in new tenants with out concern.

Whereas all houses are being bought comparatively rapidly, houses in well-liked areas of town go from being listed to pending in simply seven days. Like the opposite cities on this record, the inhabitants in Indianapolis has been on a gentle incline for the previous decade. In 2013, round 844,000 folks have been residing in Indianapolis.

Right this moment, the inhabitants is over 900,000 when taking present estimations into consideration.

One other indication that the market is recession-proof is the anticipated job progress within the metropolis. The common price of employment progress within the entirety of Indiana is round 2% in 2023 and 2024. As compared, Indianapolis is predicted to see employment progress of two.9% for a similar two years. Job progress implies that extra folks might be transferring into town and seeking to lease.

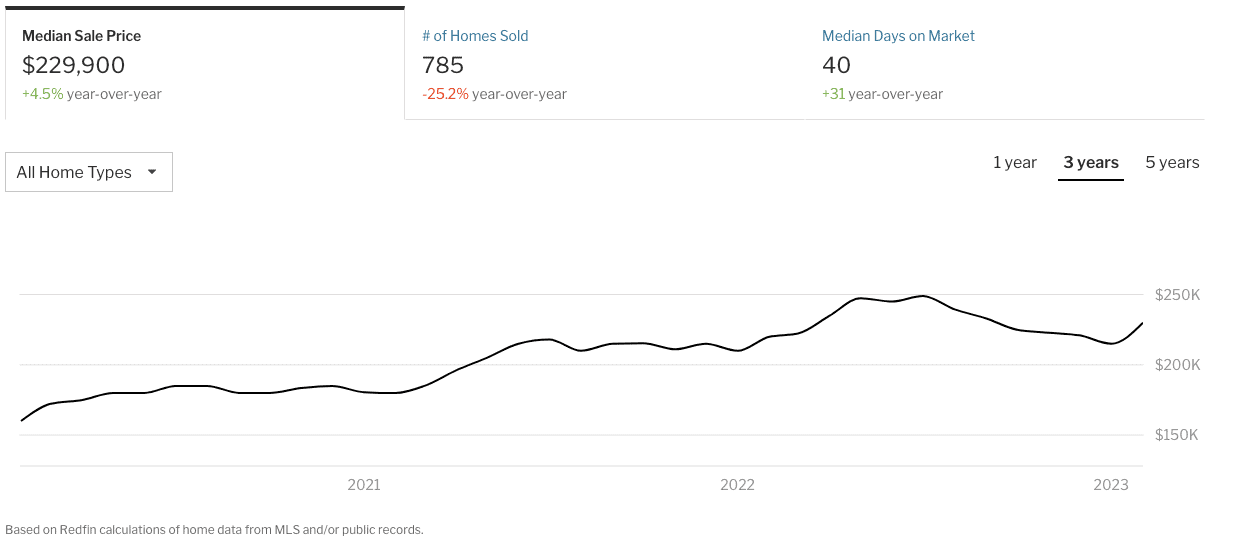

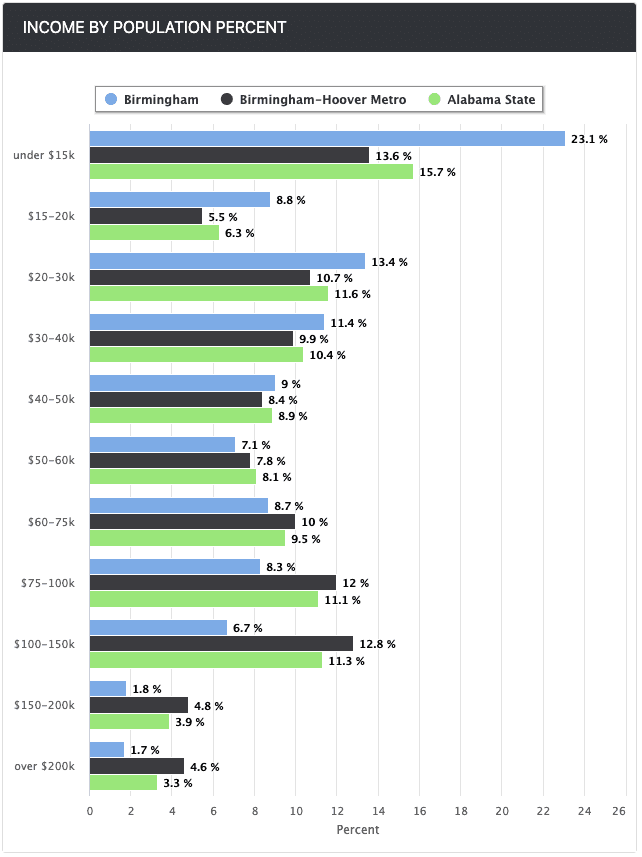

Birmingham, Alabama

If you happen to’re seeking to spend money on a well-liked actual property market that additionally has inexpensive houses, Birmingham would be the good place to look. The median sale worth for a single-family dwelling was slightly below $210,000 in December 2022, which marked a 20.7% enhance from the identical month in 2021. Once you buy a house in Birmingham, it is best to obtain a property that may enhance in worth as you maintain it.

Understand that actual property is commonly thought-about a hedge towards inflation. At a time when different investments are inclined to drop in worth, actual property values usually enhance. You can too keep a excessive revenue in a recession-proof market due to the power to cost constant rents.

The median lease for a one-bedroom residence in Birmingham is $1,298 as of February 2023, which is a pointy YoY enhance of 27%. With this data in thoughts, you’ve the chance to purchase at a low worth and lease out the property at a worth that’s a lot larger than the month-to-month mortgage could be.

One motive why Birmingham is a recession-proof market is due to the fixed job progress that town experiences. Over the previous 12 months, town has had job progress of round 2%. Current estimates state that job progress within the metropolis throughout the subsequent decade ought to be round 29%. Investing in a metropolis with excessive job progress implies that it is best to be capable to keep away from tenancy points. A scorching job market usually signifies that the true property market will even be well-liked.

Conclusion

Actual property is one sort of funding that you just don’t have to cease including to your portfolio when a recession hits. Throughout poor financial occasions, you might be able to maintain your revenue excessive and scale back portfolio losses by investing in markets which are thought-about to be recession-proof.

The 5 aforementioned markets have all confirmed to be well-liked locations amongst consumers. Once you spend money on certainly one of these markets, it’s doubtless that the worth of your property will proceed to extend the longer you maintain it.

This text is offered by Hire To Retirement

Hire To Retirement is the Nation’s main Turnkey Funding Firm providing passive revenue rental properties in the perfect markets all through the US to maximise Money Movement & Appreciation! Hire To Retirement is your associate in attaining monetary independence & early retirement by means of actual property investing. Put money into the perfect markets as we speak with a complete staff that handles all the things for you!

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]