[ad_1]

Though many non-traders and even merchants imagine that buying and selling could be very tough, fact of the matter is, the idea of buying and selling the foreign exchange markets could be very easy. Foreign exchange merchants merely should purchase a foreign money pair once they imagine that worth goes up and promote it again to the market as soon as worth is increased than their entry worth. On the flip facet, merchants may quick a foreign money pair once they imagine worth will go down, then purchase it again once more when worth is decrease than their entry level.

Nonetheless, most merchants expertise plenty of problem buying and selling the foreign exchange market not as a result of it’s tough however as a result of they overcomplicate issues. One among my buying and selling mentors even mentioned that the principle purpose foreign currency trading is tough is just not as a result of it’s inherently tough however as a result of merchants really feel the should be doing one thing to earn although they need to simply let their trades play out. If a dealer has a worthwhile buying and selling technique, she or he ought to be capable to draw constant income over the long term. The legislation of enormous numbers would show to them that their methods are worthwhile.

With that mentioned, easy buying and selling methods might work very nicely within the foreign exchange market. So long as a dealer is both profitable extra typically than they’re shedding, as in a excessive win price technique, or profitable greater than they’re shedding, which is a excessive risk-reward technique, that dealer ought to be worthwhile over the long term.

Easy buying and selling methods corresponding to sample breakouts work nicely within the foreign exchange market or some other buying and selling market. It’s because these breakout factors are sometimes excessive likelihood entry factors to enter the market. On high of this, most sample buying and selling methods permit for a constructive risk-reward ratio.

Heiken Ashi Candlesticks

Merchants have been historically viewing their charts as a bar chart. Then got here the Japanese candlesticks, which revolutionized the way in which merchants take a look at their charts. Now, they will simply establish the route of every candle primarily based on its coloration. Merchants might additionally simply interpret worth motion primarily based on the excessive and low of worth in relation to its opening and shutting worth. Most merchants these days use Japanese candlesticks to view a tradeable safety or foreign exchange pair.

Nonetheless, new improvements coming from the Japanese have additionally been just lately developed. The Heiken Ashi Candlesticks is a brand new technique of viewing worth which is a modification of the unique Japanese candlesticks.

Heiken Ashi Candlesticks plot the usual excessive and low of every interval simply as the unique Japanese candlestick. Nonetheless, as an alternative of plotting the open and shut of every candle, the Heiken Ashi Candlesticks modify it primarily based on the typical motion of worth. This creates candles which change coloration solely when the short-term development or momentum has shifted.

The Heiken Ashi Candlesticks are glorious indicators to assist merchants establish short-term momentum reversals in addition to the present short-term development route.

Shifting Common Convergence and Divergence

Shifting Common Convergence and Divergence or extra popularly often known as the MACD, is a basic momentum technical indicator which might be one of the vital broadly used oscillating technical indicator.

The MACD, because the identify suggests, relies on the crossing over of a pair of shifting averages.

It’s computed by subtracting the worth of an Exponential Shifting Common (EMA) from a quicker shifting EMA line. That is normally plotted as a histogram bar representing the MACD.

Then, a sign line is derived from the prior MACD bars or line. The sign line is principally a Easy Shifting Common (SMA) of the prior MACD bars or strains.

Pattern route and bias relies on the placement of the MACD bars or line and the sign line in relation to its midline, which is zero. Optimistic values point out a bullish development bias, whereas detrimental values point out a bearish development bias. The development can be thought of bullish if the MACD bars or line is above the sign line, and bearish whether it is under the sign line.

Buying and selling Technique

Heiken Ashi 20-50 Foreign exchange Buying and selling Technique is a straightforward development following technique which relies on momentum breakouts of helps and resistances shaped throughout retracement or contraction durations. It additionally makes use of the 2 indicators above to substantiate the commerce setup.

The MACD is used to establish the development route bias. That is primarily based on whether or not the histogram bars and the sign line are constructive or detrimental. This must also agree with the development route indicated by the crossing over of the 20-period and 50-period EMA strains.

Throughout a trending market, worth ought to retrace in the direction of the realm of the 20-period EMA line. This could create a minor assist or resistance line. Commerce setups are developed as worth breaks out of the assist or resistance line in the direction of the route of the development.

The Heiken Ashi Candlesticks are used to substantiate the short-term momentum reversal occurring aftern the retracement, within the route of the development.

Indicators:

- 20 EMA

- 50 EMA

- Heiken Ashi

- MACD

- Quick EMA: 17

- Gradual EMA: 31

- MACD SMA: 14

Most well-liked Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

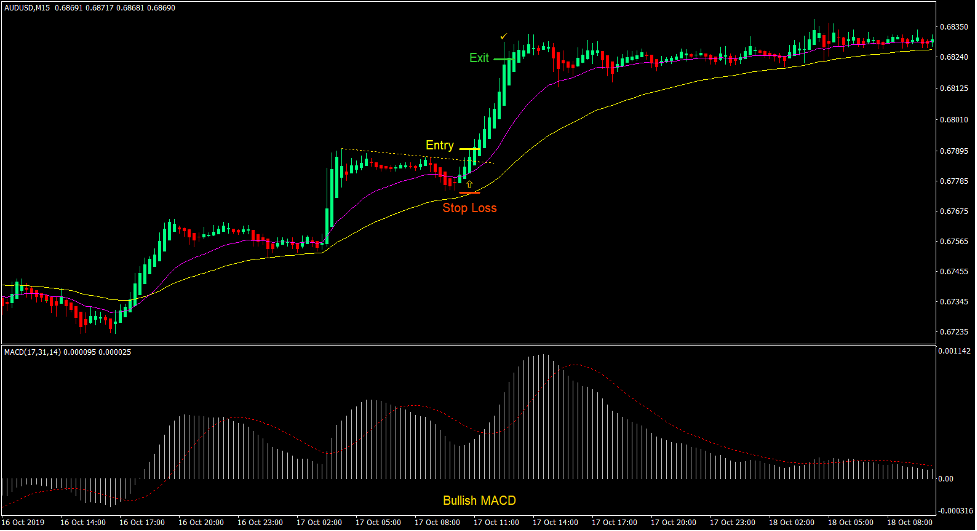

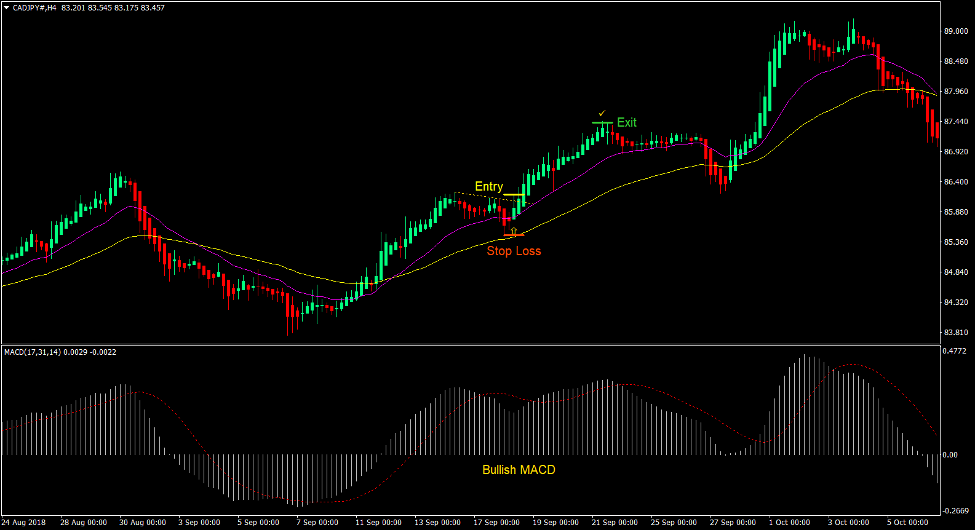

Purchase Commerce Setup

Entry

- The 20 EMA line ought to be above the 50 EMA line.

- The MACD bars and sign line ought to be constructive.

- Value ought to retrace in the direction of the realm of the 20 EMA line.

- A resistance line ought to be shaped.

- Value ought to break above the resistance line.

- The Heiken Ashi Candlesticks ought to change to inexperienced.

- Place a purchase cease order above the excessive of the Heiken Ashi Candlestick.

Cease Loss

- Set the cease loss on the assist under the entry candle.

Exit

- Set the take revenue goal at 2x the chance on the cease loss.

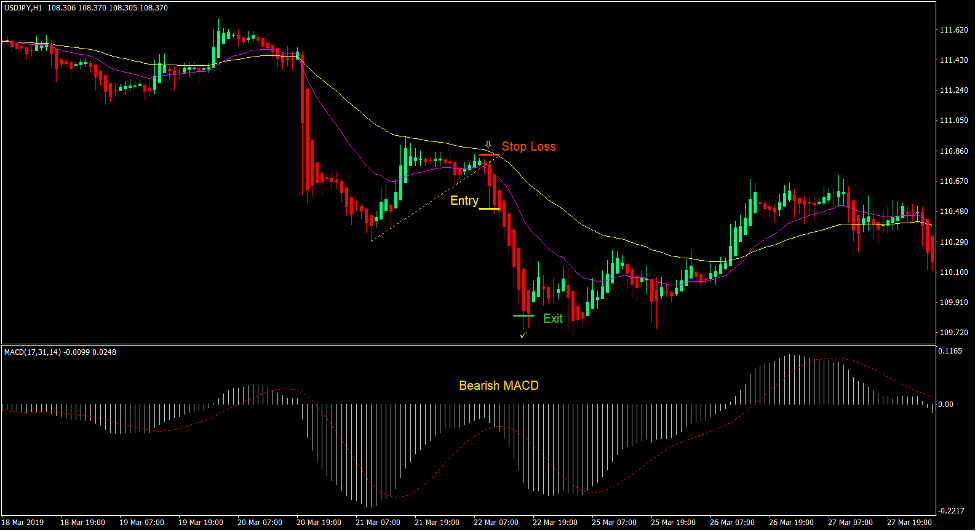

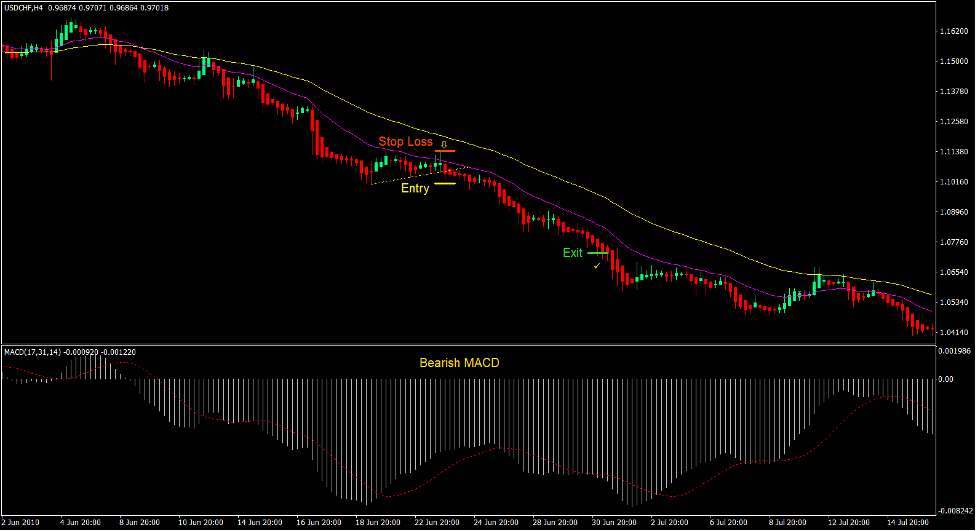

Promote Commerce Setup

Entry

- The 20 EMA line ought to be under the 50 EMA line.

- The MACD bars and sign line ought to be detrimental.

- Value ought to retrace in the direction of the realm of the 20 EMA line.

- A assist line ought to be shaped.

- Value ought to break under the assist line.

- The Heiken Ashi Candlesticks ought to change to purple.

- Place a promote cease order under the low of the Heiken Ashi Candlestick.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Set the take revenue goal at 2x the chance on the cease loss.

Conclusion

This buying and selling technique is a working buying and selling technique. In the event you would look carefully, the assist or resistance strains shaped throughout a retracement would normally be part of a flag sample. Flag patterns are excessive likelihood development continuation patterns. Nonetheless, figuring out these patterns might show to be very tough. By combining these technical indicators to kind this template, merchants can now extra simply establish these circumstances as breakouts proper after a retracement that happen throughout robust trending markets.

Foreign exchange Buying and selling Methods Set up Directions

Heiken Ashi 20-50 Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past knowledge and buying and selling alerts.

Heiken Ashi 20-50 Foreign exchange Buying and selling Technique supplies a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and alter this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

How one can set up Heiken Ashi 20-50 Foreign exchange Buying and selling Technique?

- Obtain Heiken Ashi 20-50 Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Heiken Ashi 20-50 Foreign exchange Buying and selling Technique

- You will notice Heiken Ashi 20-50 Foreign exchange Buying and selling Technique is out there in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]