[ad_1]

Within the dynamic world of market costs, timing is commonly the whole lot.

Understanding when to purchase or promote is essential to a profitable commerce. However how are you going to establish the opportune second to make a transfer? One technique many merchants embrace includes specializing in shares breaking their 52-week highs. That is the intriguing, but all-too-well-known, technique of buying and selling 52-week excessive breakouts.

This buying and selling strategy, whereas seemingly simple, encompasses a nuanced mix of momentum investing, psychology, market sentiment, and technical evaluation. Its attract lies within the premise that shares hovering to their highest peaks within the final yr typically carry the potential to climb even additional.

What is the Huge Deal A few 52-Week Breakout?

Except for 52 weeks representing a yr’s excessive (or low), listed here are a number of different the reason why this strategy could also be thought of favorable:

- Momentum Investing. This strategy goals to capitalize on the continuation of an current pattern. The essential thought is that shares which have not too long ago carried out nicely usually tend to proceed performing nicely. Thus, a inventory reaching new 52-week highs could possibly be a sign that its upward momentum will proceed.

- Hype Issue. When a comparatively standard inventory breaks above its 52-week excessive, it might probably typically create a way of pleasure, urgency, and even FOMO (Worry Of Lacking Out) amongst speculators, which may drive extra shopping for strain and doubtlessly push the inventory worth even larger.

- Market Sentiment. Breaking a 52-week excessive might be seen as a powerful bullish sign, indicating that maybe the constructive sentiment will seemingly be validated by basic expectations (i.e., earnings).

- Resistance Turns into Help. In technical evaluation, the 52-week excessive is commonly seen as a resistance degree. If a inventory breaks by way of this degree, it is thought that the resistance has been damaged and would possibly, ought to the inventory proceed shifting upward, flip into “help.”

Watch Out for the Dangers

It is essential to notice that simply because a inventory has damaged its 52-week excessive does not assure that it’ll proceed to go up. The inventory could also be overvalued above the 52-week degree.

The inventory could expertise a false breakout. Different elements, similar to firm’s fundamentals, market circumstances, and macroeconomic elements, can even affect a inventory’s future efficiency.

The “tradability” of a inventory is determined by the inventory itself. In different phrases, there are many variables that may make one inventory a greater prospect than one other regardless of each breaking above their 52-week highs. So search for setups with a positive risk-to-reward ratio. Additionally, make certain your stops are set at cheap ranges (not too tight, however not too far both).

Methods to Scan for 52-Week Breakouts Earlier than They Take Place

To get a bounce on the 52-week breakout earlier than it occurs, run a scan on Grayson Roze’s New 9-Month Excessive Beneath 52-Week Excessive scan.

From Charts & Instruments menu, scroll all the way down to Pattern Scan Library and click on Browse Scan Library.

For instance, operating a scan this morning yielded solely two outcomes.

Luckily, the primary suggestion, GXO Logistics Inc (GXO), occurred to interrupt out as we speak, which supplies a transparent instance of what this scan does.

Simply so , the next will not be a commerce advice. It is an instance of the way you would possibly use StockCharts’ scan capabilities to discover a tradable asset; on this case, an asset that aligns with the 52-week breakout setup.

A Break Above the 52-Week Excessive… So, Now What?

The primary suggestion from the hypothetical scan is GXO, which occurs to be breaking out as we communicate. So, now what?

First, know one thing in regards to the inventory earlier than you commerce it. Bear in mind, this illustrates an instance of the scan (and never as a tradable asset).

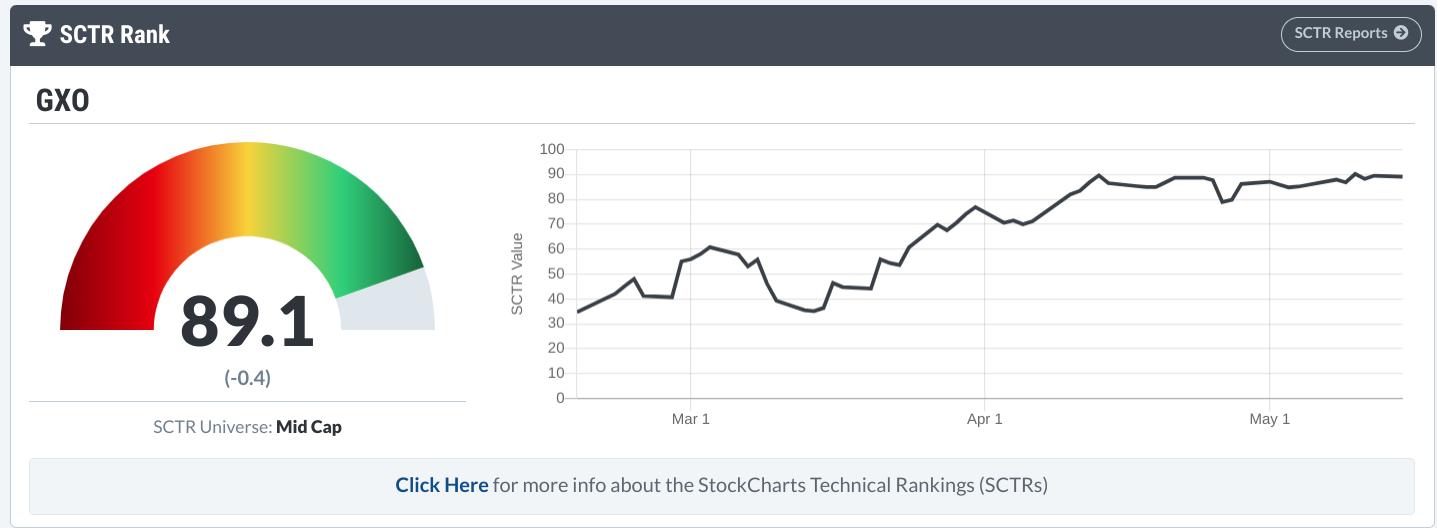

GXO’s SCTR studying has been on the up-and-up for a while (see picture beneath).

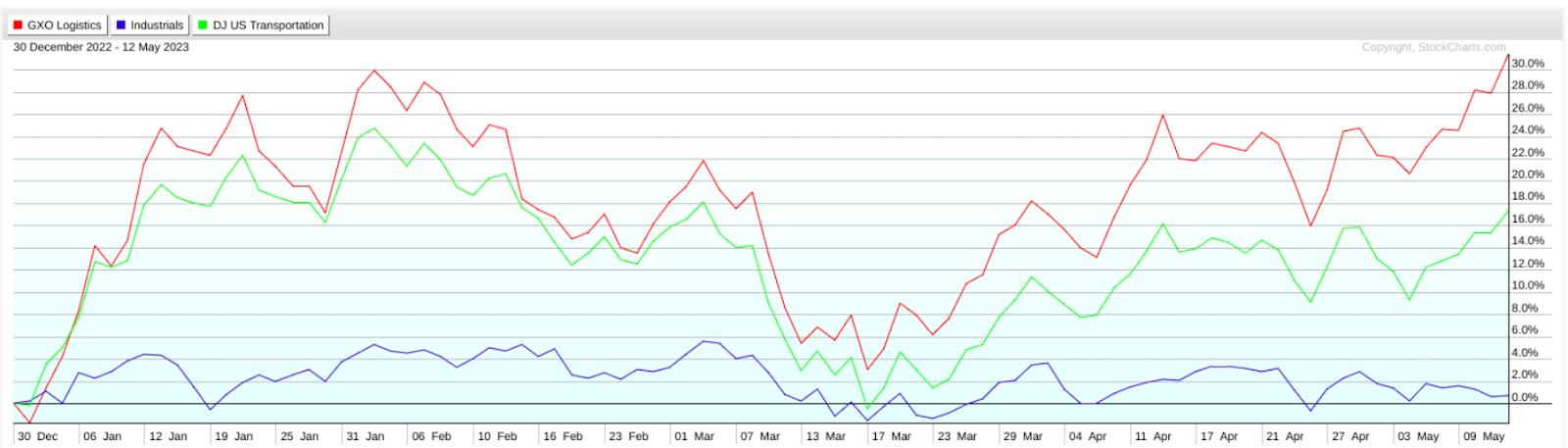

As a inventory throughout the Industrials sector and Transportation Providers business, GXO has been outperforming each year-to-date.

Let’s take a better have a look at the breakout itself.

Should you have a look at the Relative Power Index and the Stochastic Oscillator within the above chart, you would possibly get a sense that sits someplace between “we’re getting into oversold territory” and “this oversold studying can keep at these ranges for a chronic interval.”

Each intuitions can appear unsettling, particularly should you enter with an extended place proper because it breaks out (which is now, kind of). So, it is best to take a look at the draw back and see the place, if it pulls again, the inventory would possibly discover some help.

Should you have a look at the inexperienced horizontal strains, you will discover loads of “ranges” through which a number of areas of help or resistance-turned-support lay.

For a dealer trying to make an entry, any of these strains make for a doubtlessly favorable entry level. So far as a stop-loss is anxious, the road beneath the $50 vary makes for an inexpensive cease, because the vary beneath could start to render the upside bias invalid. A break beneath $44 would invalidate the bias and the commerce (relying on the place you entered your place).

The Backside Line

Utilizing a instrument just like the 9-Month Excessive Beneath 52-Week Excessive scan is usually a game-changer for recognizing doable 52-week breakout trades. It may well enable you to get forward of the curve.

However keep in mind, as a lot as we would love each breakout to be a surefire win, buying and selling is extra complicated. Simply because a inventory hits a brand new excessive doesn’t suggest it is set to skyrocket. Typically, the inventory is likely to be overvalued, otherwise you would possibly run right into a false breakout. All the time keep watch over the corporate’s fundamentals and total market vibes.

In brief, be savvy about it. Use the scan, but additionally use your head. Make certain the potential rewards outweigh the dangers, and set your stops at cheap ranges. Ultimately, buying and selling is about timing and being able to make your transfer when the chance strikes.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Karl Montevirgen is knowledgeable freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Sequence 3 and Sequence 34 licenses along with a twin MFA in essential research/writing and music composition from the California Institute of the Arts.

Study Extra

Subscribe to ChartWatchers to be notified at any time when a brand new put up is added to this weblog!

[ad_2]