[ad_1]

Bounce to:

Calculating, gathering, and reporting gross sales tax and use tax can get sophisticated as a enterprise grows, and it may be straightforward to confuse these two varieties of oblique taxes. Altering tax laws may also make it difficult to maintain tempo. Nonetheless, you will need to perceive each the variations and similarities to assist guarantee compliance and visibility into an organization’s prices.

Gross sales tax and use tax are each a type of oblique tax, that means they’re a tax that may be shifted to others. Whereas they’re each a tax paid to the federal government on the purchases of products or companies, there are variations in how they’re collected and paid to the federal government.

They’re an necessary income for the federal government and each state with a gross sales tax additionally imposes use tax. That is meant to stop state residents from avoiding the gross sales tax by buying their items on-line. To realize a greater understanding of gross sales tax versus use tax, let’s take a more in-depth look.

What’s gross sales tax?

Gross sales tax is a tax imposed on the sale of products and companies. It’s usually a proportion of the acquisition worth and is added to the ultimate price of the services or products. The speed of gross sales tax varies by location, with completely different states and localities having their very own charges. In the USA, gross sales tax shouldn’t be a federal tax, however moderately a state and native tax. Gross sales tax income is used to fund numerous authorities packages and companies similar to training, transportation, and healthcare.

Gross sales tax is a tax collected by an organization on the retail gross sales of products and companies when the ultimate sale within the provide chain is reached.

Retail gross sales taxes are necessary sources of income inside the USA. Forty-five states and the District of Columbia acquire statewide gross sales tax. There are additionally native gross sales taxes, that are collected in 38 states. Native gross sales taxes can, in some cases, even exceed state charges.

On the state stage, it’s not unusual to have multiple gross sales tax price. Gadgets deemed requirements like groceries could have a decrease tax price (and even be exempt) in an effort to supply some low-income tax reduction. In the meantime, some states could apply a better tax to items and companies normally consumed by vacationers, like inns and rental automobiles.

As famous above, many states even have native gross sales taxes. Native gross sales taxes typically apply to the identical objects because the state gross sales tax. Subsequently, calculating the whole state and native gross sales tax usually includes including the state price to the native price and multiplying it by the price of taxable objects.

On condition that gross sales tax charges typically differ on the state and native ranges, this may sway a client to buy throughout borders for a decrease price or purchase their merchandise on-line.

As an illustration, when this text was printed, Louisiana ranked among the many states with the highest common mixed state and native gross sales tax charges at 9.6 %; whereas, Maine ranked among the many lowest at 5.5 %.

What do governments do with the gross sales tax income generated? Oftentimes, a lot of what’s collected in gross sales tax income goes right into a Normal Fund. That is then used to pay for numerous companies and initiatives (like colleges and infrastructure) throughout the state.

For instance, in California, retail gross sales of tangible objects are typically topic to gross sales tax. The state gross sales and use taxes present income to the state’s Normal Fund, to cities and counties by means of particular state fund allocations, and to different native jurisdictions.

California does exempt some objects from gross sales and use tax, together with:

- Gross sales of sure meals merchandise for human consumption (many groceries)

- Gross sales to the U.S. Authorities

- Gross sales of prescription drugs and sure medical units

- Gross sales of things paid for with meals stamps

Clearly, there are a number of elements to contemplate because it pertains to gross sales tax. Subsequently, you will need to have the suitable instruments and sources in place to navigate the complexities and guarantee compliance.

Who remits gross sales tax?

The duty of remitting gross sales tax usually falls on the vendor or service provider who makes the sale. It’s their duty to gather the gross sales tax from the client on the time of the sale after which remit that tax to the suitable authorities company. The vendor should hold correct information of their gross sales and the taxes collected, and file common reviews with the federal government company that collects the tax. Failure to remit gross sales tax may end up in penalties and authorized penalties for the vendor.

Gross sales tax is added to the gross sales worth of an excellent or service and is then charged by the retailer to the tip client. The retailer then remits that collected tax to the federal government. Tax jurisdictions solely obtain tax income when a sale is made to the tip client.

It must be famous that, when shopping for provides or supplies that shall be resold, companies can problem resale certificates to sellers and will not be accountable for gross sales tax.

Customers, in addition to firms, are possible most acquainted with gross sales tax versus use tax. Gross sales tax is simpler to know since customers can clearly see their tax burden on the receipt of buy.

Examples of gross sales tax

To additional illustrate the applying of gross sales tax, let’s take into account just a few examples. First, remember that the tax have to be collected on the quantity of the sale that’s taxable.

Usually, the whole quantity of taxable gross sales occasions the gross sales tax price equals the gross sales tax quantity.

Instance A

Let’s assume the gross sales tax price is 0.0825. The system would then be: Whole Quantity × 0.0825 = Gross sales Tax Quantity.

To additional illustrate: A client buys a brand new jacket from a retailer for $150.00. The gross sales tax price that the retailer should cost the buyer is 0.0825 %. On this state of affairs, the gross sales tax is $12.38 ($150.00 × 0.0825 = $12.38).

Instance B

The retailer may additionally set the gross sales worth to incorporate the gross sales tax quantity. This, nonetheless, have to be clearly said on any paperwork used to advertise the sale. On this state of affairs, let’s assume the gross sales tax price is 8.9 % and the retailer has included the gross sales tax quantity within the complete promoting worth.

To “again out” the gross sales tax quantity from the marketed worth, the retailer would divide the whole worth (which incorporates the gross sales tax) by one, plus the gross sales tax price.

To additional illustrate: A shoe store has sneakers which might be being marketed as $100.00 with tax included. The gross sales tax price is 8.9 %. To calculate the promoting worth of the sneakers, divide $100.00/1.089 = $91.83.

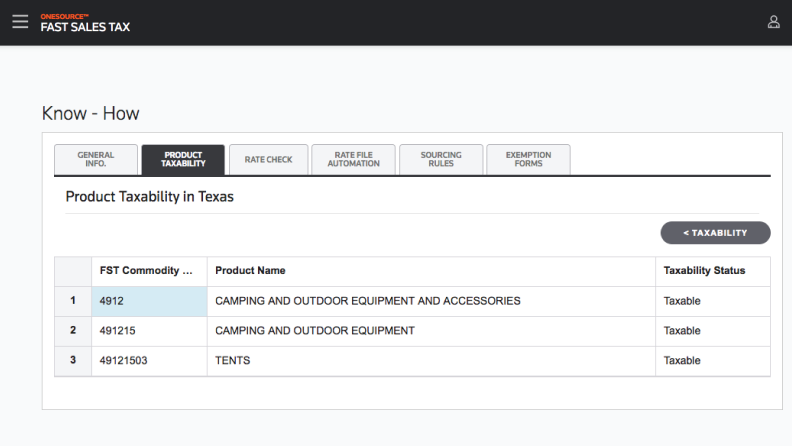

ONESOURCEQuick Gross sales Tax options:

|

|

What’s use tax?

Use tax is a tax that’s imposed on the use, storage, or consumption of products and companies that had been bought with out paying gross sales tax. It’s usually imposed by the state or native authorities the place the products or companies are used, and the speed is usually the identical because the gross sales tax price. Use tax is designed to make sure that individuals who buy items and companies from out-of-state distributors or on-line retailers pay the identical quantity of tax as they’d in the event that they bought the products or companies regionally. Like gross sales tax, use tax income is used to fund numerous authorities packages and companies.

Use tax refers back to the tax imposed on the taxable items and companies that weren’t taxed on the level of sale. Every state that imposes gross sales tax levies a use tax for purchases made outdoors of the state. So, typically, use tax charges are the identical as gross sales tax charges.

Use tax most frequently happens when a client orders items from outdoors of the state (similar to on-line) and the retailer (not having nexus, or presence, within the client’s state) doesn’t must cost gross sales tax on the acquisition.

The underside line: Taxing authorities need customers to pay a gross sales tax on all purchases they make, whether or not it’s a tax an organization expenses to the buyer after which remits to the federal government (often known as gross sales tax), or a tax the buyer pays to the federal government (often known as use tax).

Who remits use tax?

The duty of remitting use tax usually falls on the purchaser of the products or companies. If the purchaser didn’t pay gross sales tax on the time of buy, they’re answerable for reporting and paying the use tax on to the suitable authorities company. Nonetheless, in some instances, the vendor or service provider might also be answerable for gathering and remitting use tax on behalf of the purchaser. This could range relying on the particular legal guidelines and laws of the state or locality the place the acquisition was made.

Use tax solely applies to out-of-state purchases the place no gross sales tax was collected and, as famous earlier, the buyer is usually answerable for remitting use tax per calendar yr. Individuals can use tax return due dates to pay use taxes. Nonetheless, many customers don’t pay the tax. Due to this, the Supreme Court docket made some updates to gross sales and use tax laws within the South Dakota v. Wayfair case and established a brand new definition of nexus. You possibly can test together with your state’s Division of Income or Taxation to view particular legal guidelines in your area.

On account of the rulings, if a enterprise sells items in any state — even when they don’t have a bodily presence in that state (often known as financial nexus) and the transaction is on-line solely — it could now be obligated to register in that state and acquire gross sales tax. Earlier than Wayfair, nexus trusted an organization’s “bodily presence” within the state.

For firms that do enterprise digitally, oblique tax software program instruments are particularly necessary to guarantee compliance with advanced financial nexus legal guidelines and with states’ numerous gross sales tax necessities.

Examples of use tax

To additional illustrate the applying of use tax, let’s take into account just a few examples.

Instance A

In Georgia, as an example, a use tax is imposed upon the primary occasion of use, consumption, distribution, or storage within the state of non-exempt tangible private property bought at retail outdoors of Georgia.

To additional illustrate, let’s take a more in-depth take a look at the tax imposed on non-exempt objects introduced into Georgia.

On this state of affairs, a contractor buys a bulldozer in one other state and pays state gross sales tax however no native gross sales tax. The next week the contractor transports the bulldozer into Georgia and performs a job in Corridor County. The contractor now owes Georgia state use tax on the acquisition worth of the bulldozer at a price of 4 %. The contractor’s Georgia state use tax legal responsibility shall be lowered by the gross sales tax beforehand paid within the different state. As well as, the contractor owes Corridor County use tax on the acquisition worth of the bulldozer on the Corridor County gross sales tax price.

Instance B

Now take into account the tax imposed on non-exempt objects and taxable companies that weren’t taxed on the level of sale. If a taxpayer purchases taxable items or companies in Georgia with out the cost of tax, the taxpayer should accrue and remit the tax.

So, for instance, a retailer buys mild bulbs tax-free underneath phrases of resale to promote in its retailer. The retailer takes the sunshine bulbs out of stock to mild up the shop. That enterprise proprietor now owes gross sales tax on the value for which they bought the bulbs. The gross sales tax on this case is often known as “use tax” as a result of it’s not paid on the level of sale, however accrued on the time of use.

One other instance is that if an individual purchases a bicycle on-line. The vendor doesn’t cost gross sales tax. The bicycle is delivered to the customer in Georgia. That purchaser now owes “use tax” on the bicycle’s gross sales worth.

Instance C

Let’s now take into account some use tax eventualities in Arizona.

Think about, for instance, an Arizona resident who orders a range and fridge from an organization primarily based in New Hampshire. Nonetheless, the customer had them shipped on to their cabin in Colorado. The client plans to put in these things within the cabin after they go to. Does the customer owe Arizona use tax on this buy?

No. The Arizona use tax solely applies to property used, consumed, or saved within the state. Because the range and fridge had been by no means saved or used inside Arizona, the taxpayer shouldn’t be required to report or pay Arizona use tax on this buy.

One other instance: Let’s say an individual orders assorted specialty luncheon meats, cheeses, and crackers from an organization primarily based in Wisconsin for consumption at residence in Arizona. Will Arizona use tax apply to this buy?

No. On this case, the taxpayer wouldn’t report the acquisition of this merchandise. Luncheon meats, cheeses and crackers bought for residence consumption are meals merchandise, that are exempt from tax.

Clearly, calculating, gathering, and reporting gross sales tax and use tax can shortly turn out to be sophisticated. In at this time’s enterprise setting, it may be difficult for retailers and distant sellers to maintain tempo. That’s why leveraging the suitable instruments and options to make sure compliance is crucial.

Gross sales tax vs. use tax

The variations

Gross sales tax and use tax are each varieties of taxes which might be imposed on the sale of products and companies. The primary distinction between the 2 is that gross sales tax is a tax on the sale of tangible private property, whereas use tax is a tax on using that property inside a state.

Gross sales tax is usually charged by the vendor on the time of the sale, whereas use tax is usually self-assessed by the purchaser when the vendor has not charged gross sales tax. Use tax is usually utilized to items which might be bought outdoors of the purchaser’s state after which introduced into the state to be used, in addition to to items which might be bought on-line or by means of catalogs.

The similarities

The similarities between the 2 taxes are that they each generate income for state and native governments, they’re each collected by the state, and so they each intention to tax the consumption of products and companies.

Moreover, each taxes are topic to exemptions and exclusions for sure varieties of purchases, similar to meals, drugs, and sure varieties of tools.

Abstract

In conclusion, each gross sales tax and use tax are varieties of taxes which might be levied on completely different transactions. Gross sales tax is usually charged on the level of sale on items and companies, whereas use tax is normally charged on objects that had been bought outdoors of the state however are used inside the state.

The primary distinction between the 2 taxes is the place they’re utilized. Gross sales tax is utilized to the acquisition worth of products and companies, whereas use tax is utilized to the worth of the merchandise when it’s first introduced into the state.

It’s necessary to notice that not all states have a use tax, however all states with a gross sales tax even have a use tax. Moreover, the charges for gross sales tax and use tax can range relying on the state and the kind of merchandise being taxed.

In the end, understanding the variations between gross sales tax and use tax is necessary for people and companies alike, as failure to adjust to these laws may end up in penalties and fines.

[ad_2]