[ad_1]

Totally different monetary devices don’t transfer in isolation. As an alternative, the markets are intertwined, and the costs of various property are associated. This idea is called “correlation.” When asset costs are correlated, merchants can examine the costs of 1 asset to a different to make buying and selling selections.

Correlation buying and selling is a singular and worthwhile buying and selling methodology. Two of essentially the most positively correlated property are Gold and Silver. This text solutions the query, “What’s the Gold/Silver Ratio?” and the best way to use it in buying and selling.

What Is the Gold/Silver Ratio?

The Gold/Silver Ratio measures Gold’s relative energy to Silver. It does this by evaluating the value of Gold to Silver by calculating what number of ounces of Silver purchase one ounce of Gold.

When the Gold/Silver Ratio will increase, Gold turns into extra expensive relative to Silver. When the Ratio decreases, Gold turns into less expensive relative to Silver.

Each Gold and Silver are freely traded commodities towards the US Greenback. Which means their Ratios are free to maneuver round as market forces change the costs of Gold and Silver.

This was not at all times the case. Within the late nineteenth and early twentieth century, the US was on a “Gold commonplace,” which in the end set the worth of Gold towards the US Greenback. For instance, in 1944, the US authorities set the worth of Gold to $35 an oz.. Setting the value of Gold would have restricted how a lot the Gold/Silver Ratio moved. The US authorities formally left the Gold commonplace in 1971.

How the Gold/Silver Ratio Works

The Gold/Silver Ratio is a quantity that may change because the respective costs of Gold and Silver change.

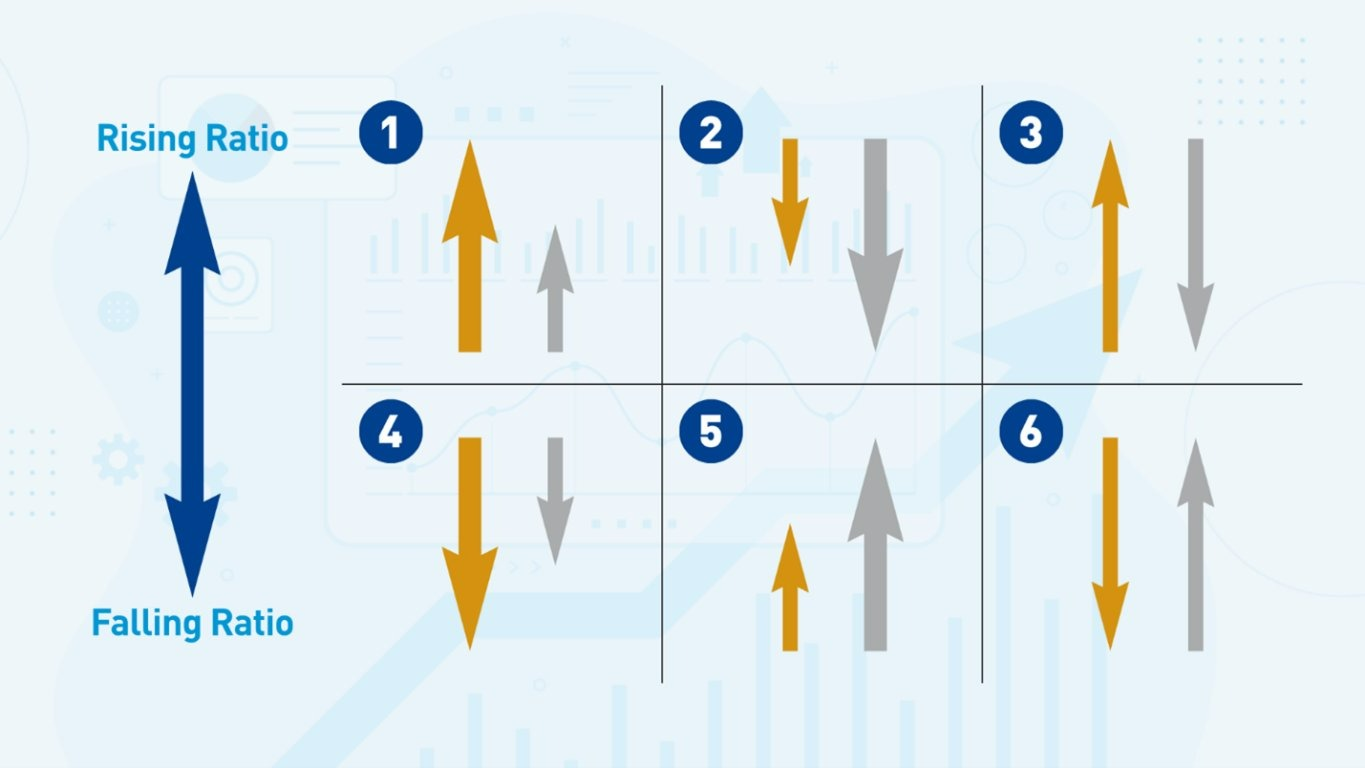

- If Gold’s worth will increase by a higher share than the value of Silver, the Ratio will increase.

- If Gold’s worth decreases by a smaller share than the value of Silver, the Ratio will increase.

- If Gold’s worth will increase and the value of Silver declines, the Ratio will increase.

- If Gold’s worth decreases by a higher share than the value of Silver, the Ratio decreases.

- If Gold’s worth will increase by a smaller share than the value of Silver, the Ratio decreases.

- If Gold’s worth decreases and the value of Silver will increase, the Ratio will lower.

Be aware that the costs of Gold and Silver can transfer collectively in a single path, however the Ratio can go within the different path. So, Gold and Silver costs can each rise, however the Ratio can fall relying on how the metals rise. Or Gold and Silver can each fall, however the Ratio can rise relying on how the metals fall. This is a vital characteristic of the Gold/Silver Ratio as a result of it measures the Gold vs Silver worth as a relative worth, not an absolute worth.

Which Elements Affect the Gold-to-Silver Ratio?

On the floor, the Gold/Silver Ratio is affected by the adjustments within the costs of Gold and Silver.

The Impact of Silver on the Ratio

Producers and different industries use Silver in manufacturing. For instance, Silver is significant in producing photo voltaic cells and electronics. So, its bodily demand is an element of the worldwide economic system. Silver can be purchased and offered as a speculative asset.

Silver vs Gold Worth

The Silver market is a small market at a few tenth in measurement of the Gold market, so it’s extra unstable—it takes much less buying and selling quantity to push the value in both path in a smaller market. Traditionally, Silver is about twice as unstable as Gold.

So, the Gold/Silver Ratio is affected by the volatility of Silver costs and its demand to be used in manufacturing and business. Nonetheless, that doesn’t inform the entire story.

The Impact of Gold on the Ratio

Gold costs additionally transfer and due to this fact have an effect on the Gold/Silver Ratio. Gold is used a lot much less in industrial manufacturing than Silver and is traded mainly as a speculative asset. A giant cause traders commerce Gold is that they take into account it a protected haven asset, i.e., traders flip to Gold to retailer worth when there’s financial turmoil, e.g., in periods of excessive inflation or inventory market downturns.

S&P 500 vs. Gold/Silver Ratio

The S&P 500 Index and the Gold/Silver Ratio are inversely correlated. When the S&P 500 Index rises, the Gold/Silver Ratio sometimes goes down, and when the S&P 500 Index falls, the Ratio sometimes rises.

An excellent instance of the inverse correlation was through the inventory market downturn in early 2020. The S&P 500 fell into bear market territory with report pace, and the Gold/Silver Ratio concurrently reached to an all-time excessive.

Financial Sentiment

Financial sentiment is a big driver of the Gold/Silver Ratio’s worth. Some merchants see the Ratio as a number one indicator of financial sentiment. When the Ratio is excessive, financial sentiment is poor and vice versa.

Find out how to Calculate the Gold-Silver Ratio

To calculate the Gold/Silver Ratio, take the value of an oz. of Gold and divide it by the value of an oz. of Silver. The value of Gold and Silver are mostly quoted in ounces, however the calculation additionally works in case you use a special unit of measurement, akin to grams.

If Gold is $1800 per ounce and Silver is $24 per ounce, the Gold/Silver Ratio might be 1800/24 = 75.

If the Gold/Silver Ratio is 75, it takes 75 ounces of Silver to purchase 1 ounce of Gold.

What’s the ‘Proper’ Gold/Silver Ratio?

The Quantity of Bodily Gold vs. Silver

Geologists estimate there’s about 17 to 19 occasions extra Silver than Gold within the earth’s crust. Silver mine output worldwide is about 8 occasions higher than Gold’s by weight every year.

Historic Gold/Silver Ratios

With Silver’s availability round 17-19 greater than Gold’s and mining output round 8 occasions extra, many individuals would anticipate the Gold/Silver Ratio to be a minimum of decrease than 20. Nonetheless, the Ratio all through the twenty first century has by no means dropped beneath 30. More often than not, the Gold/Silver Ratio has been in a variety between 45 and 85.

The Ratio is at an attention-grabbing level on the time of publication, as a result of it might doubtlessly stage above the resistance stage at 85.

Pre-1900, the Gold/Silver Ratio was round 16, a lot nearer to the bodily portions of every steel on the earth.

A Return to a Traditionally Low Gold/Silver Ratio?

Some analysts consider the Gold/Silver Ratio will finally return to pre-1900 ranges. For that to occur, the value of Silver should rise relative to the value of Gold, and a few analysts cite that as a cause to speculate closely in Silver. Nonetheless, a falling Gold/Silver Ratio doesn’t essentially imply Silver costs will rise. The Ratio might nonetheless fall even when Silver costs fall so long as Gold costs fall a lot additional.

Instance of the Gold/Silver Ratio

The Gold/Silver Ratio has diverse significantly over the centuries that civilizations have used Gold and Silver as shops of worth.

To recap, the Gold/Silver Ratio is the value of Gold divided by the value of Silver. For instance, if the Ratio is 75, it takes 75 ounces of Silver to purchase 1 ounce of Gold.

A Current Low Level within the Gold/Silver Ratio

Within the twenty first century, the Gold/Silver Ratio dropped to 32 in April 2011. The S&P 500 Index was starting to get better from the 2008 credit score disaster and start the longest US inventory market bull run in historical past. The low Ratio worth of 32 in 2011 signaled confidence within the US economic system and the inventory market.

A Current Excessive Level within the Gold/Silver Ratio

Within the twenty first century, the Gold/Silver Ratio rose to a report excessive of 126 in March 2020. This was when the S&P 500 Index started its sudden drop because of the market situations created by covid. The excessive Ratio worth of 126 within the Gold/Silver Ratio signaled a substantial amount of concern within the US economic system and the inventory market.

How You Can Use the Gold/Silver Ratio to Commerce Treasured Metals

Technical Evaluation of Gold/Silver Ratio

The Gold/Silver Ratio could be became a chart, akin to a candlestick chart. I’ve discovered that the Gold/Silver Ratio chart has outlined assist and resistance ranges and even chart patterns, akin to triangles. Which means I can use technical evaluation to point how the Gold/Silver Ratio may transfer.

Utilizing the Gold/Silver Ratio to time trades

Let’s say I’m bullish on Gold, and I wish to place a protracted commerce. To assist me time my commerce, I would study the Gold/Silver chart to make sure it additionally appears to be like bullish, for instance, if it has not too long ago bounced off a assist stage. Bear in mind, even when the Ratio rises, the worth of Gold might nonetheless fall. The Ratio alone doesn’t imply Gold or Silver will rise or fall—it is best to solely use it as further affirmation.

Utilizing a CFD to commerce the Gold/Silver Ratio

Earlier than CFDs had been fashionable, if folks wished to commerce the Gold/Silver Ratio, they must purchase or promote each Gold and Silver within the right proportions to duplicate the Ratio. However as we speak, merchants can entry CFDs that observe the worth of the Ratio—a dealer can go lengthy or brief the Gold/Silver Ratio utilizing a CFD.

Conclusion

The Gold/Silver Ratio tracks the relative worth of Gold to Silver by dividing the Gold worth by the Silver worth. A rising Ratio means Gold is changing into costlier in comparison with Silver. A falling Ratio means Gold is changing into cheaper in comparison with Silver.

The Gold/Silver Ratio sometimes strikes in the wrong way to the S&P 500 Index. Thus, the Ratio is seen as a type of sentiment indicator, particularly as a result of traders take into account Gold to be a protected haven asset throughout troubling financial occasions.

Merchants can use the Ratio to assist inform Gold and Silver trades and even commerce the Ratio’s worth utilizing a CFD. Many buying and selling platforms can produce a chart of the Ratio, and Merchants can use technical evaluation on the Ratio chart like every other instrument.

FAQs

What is an efficient Ratio between gold and silver?

The Ratio has largely traded between 45 and 85 for the final 25 years.

What occurs when the gold-silver Ratio is excessive?

When the Gold-Silver ratio is excessive, Gold is costlier in comparison with Silver.

What occurs when the gold-silver Ratio is low?

When the Gold-Silver ratio is low, Gold is inexpensive relative to Silver.

Do gold and silver go up when inflation goes up?

Gold will increase extra throughout inflation as a result of traders see it as a protected haven asset.

Will gold and silver go up if the inventory market crashes?

Sometimes, each Gold and Silver decline in worth when the inventory market crashes.

number of materials from the Day by day Foreks info supply

Automate your buying and selling with our Robots and Utilities

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865

EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Utility ⚒

EasyTradePad MT4 – https://www.mql5.com/en/market/product/72256

EasyTradePad MT5 – https://www.mql5.com/en/market/product/72454

Threat supervisor MT4 – https://www.mql5.com/en/market/product/72214

Threat supervisor MT5 – https://www.mql5.com/en/market/product/72414

Indicators 📈

3 in 1 Indicator iPump MT4 – https://www.mql5.com/en/market/product/72257

3 in 1 Indicator iPump MT5 – https://www.mql5.com/en/market/product/72442

Energy Reserve MT4- https://www.mql5.com/en/market/product/72392

Energy Reserve MT5 – https://www.mql5.com/en/market/product/72410

[ad_2]