[ad_1]

Gold on Tuesday (23/05) closed greater by 0.15% and Silver continued its second day of decline by -0.76%. Larger world bond yields and a stronger USD on Tuesday weighed on treasured metals. US 10-year T-note yields rose to a 2-month excessive of three.7%, the best since mid-March, as merchants assessed the outlook for financial coverage and the debt ceiling deadlock within the US. The ten-year German Bund yield rose to 2.4%, primarily fuelled by market expectations that the ECB will persist in its efforts to tighten financial coverage in response to issues about inflation, regardless of issues in regards to the potential impression on the monetary system of a sequence of fast price hikes. The UK 10-year Gilt yield rose to 4.1%, its highest degree since October 2022, fuelled by expectations of additional coverage tightening by the BOE. Governor Andrew Bailey not too long ago admitted that if inflationary pressures persist, extra financial coverage tightening could also be vital.

Nevertheless, the decline in metallic costs is proscribed as the continuing US debt ceiling deadlock has fuelled safe-haven demand for treasured metals.

Skinny XAUUSD trades on Monday and Tuesday are prone to look impartial. A transfer above $1984 may goal the 38.2% FR retracement degree of the 2079.28-1951.87 drawdown within the $2000 spherical determine. In the meantime a transfer under the current low may lengthen the decline of the $2079.28 peak to check the 100-day EMA/ascending trendline round $1932. So long as the$1951 assist holds, it may carry consolidation for some time.

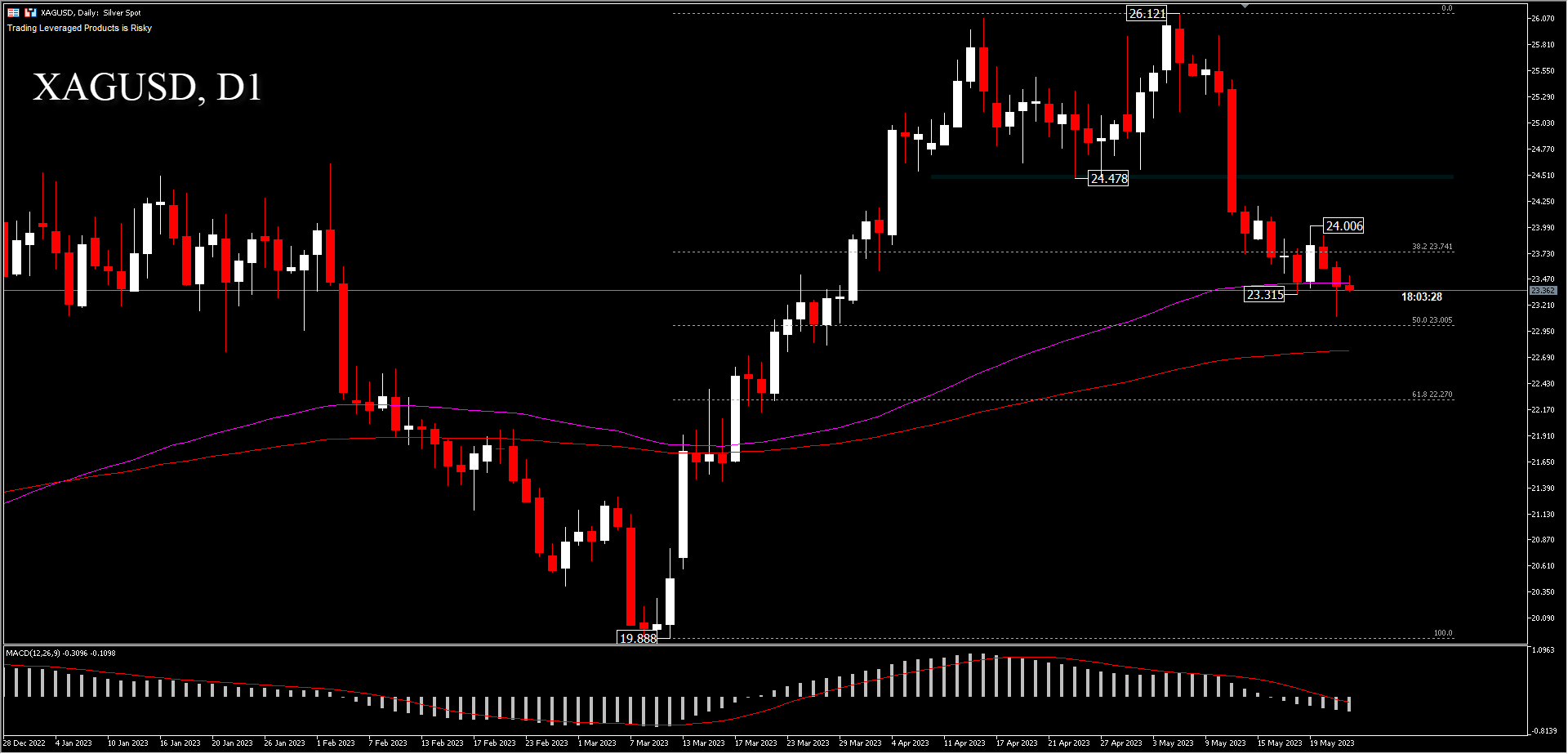

Silver costs had been additionally weighed down on Monday and Tuesday, by industrial metallic demand issues, after March Eurozone development manufacturing fell probably the most in additional than 2 years. Development output within the Euro Space fell by 1.5% in comparison with the identical interval final 12 months in March, following downwardly revised progress of two.1% within the earlier month. This marked the sharpest contraction in development output since August 2021, pushed by declines in constructing exercise (-1.3% vs. 2.1% in February) and civil engineering works (-2.2% vs. 2.3%).

On a month-to-month foundation, output shrank by 2.4% in March, reversing two consecutive months of enlargement. As well as, America’s Could S&P manufacturing PMI fell greater than anticipated and the Eurozone’s Could S&P manufacturing PMI unexpectedly contracted on the sharpest tempo in 3 years fueling Tuesday’s value declines.

The XAGUSD value has moved under the April opening value and is presently held above the 100-day EMA. A transfer under the $23.31 assist may resume the decline to check the 50% FR degree of the 19.88–26.12 retracement at $23.00 and 200-day EMA at $22.75. In the meantime, a transfer above the each day resistance of $24.00 may take a look at the neckline resistance at $24.47.

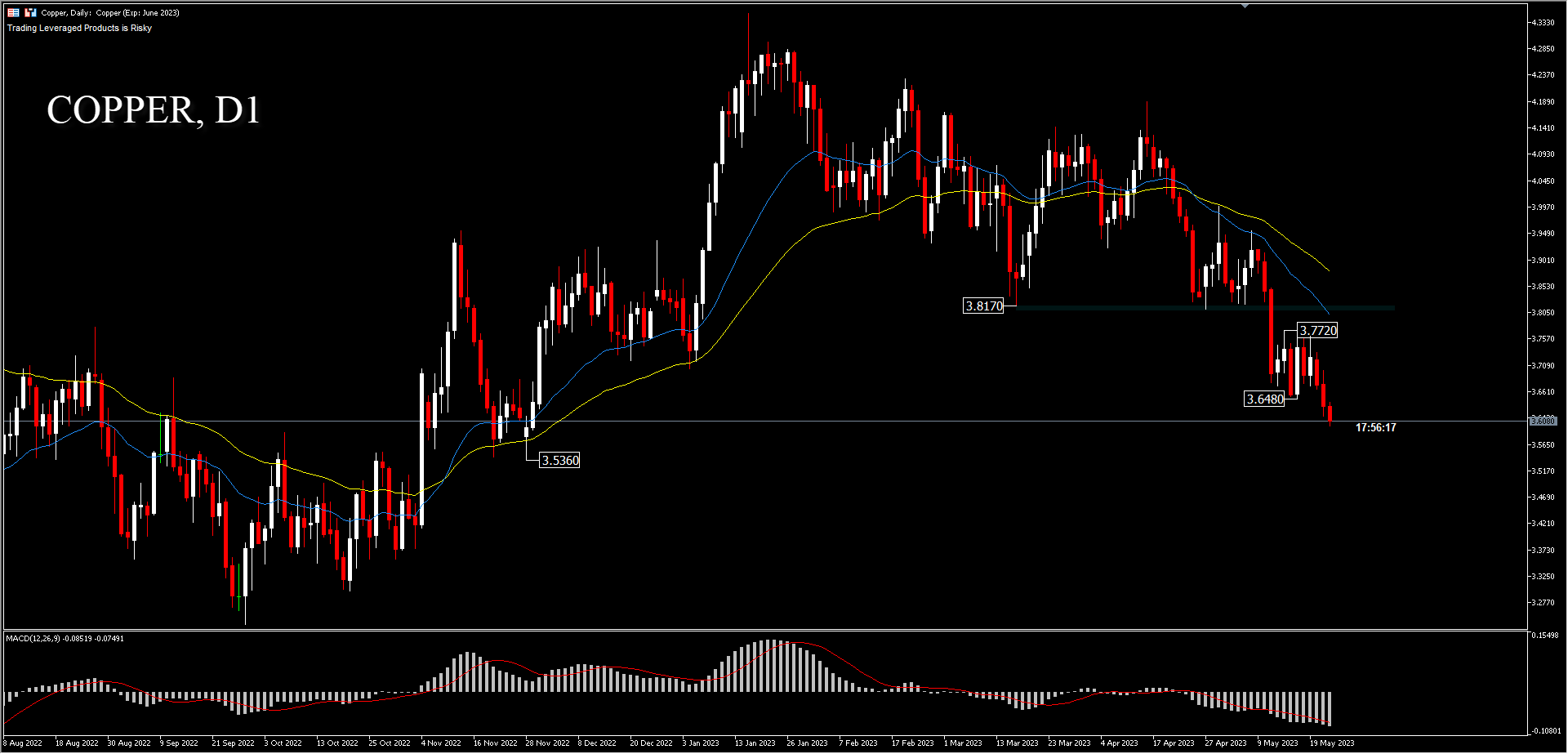

Copper – Disappointing Chinese language information has painted a combined image for the world’s second largest economic system after an upbeat begin to the 12 months, with a weaker-than-expected rebound pushing Copper to commerce close to its lowest degree to this point in 2023. Copper costs are nonetheless sustaining a decline under $3.64 in early week buying and selling. Costs are seen to have left the $3.64-$3.77 consolidation. A sputtering restoration in China has dragged copper costs to a five-month low, delaying one of the anticipated bull runs within the commodity market. Poor industrial demand prompted China to decrease copper import quotas. Technically, bear stress could be very sturdy as mirrored by the steepness of the 26-day EMA. Continued draw back motion after surpassing the $3.64 assist may take a look at the $3.53 assist, whereas upside motion would discover limitations at $3.77 and $3.81.

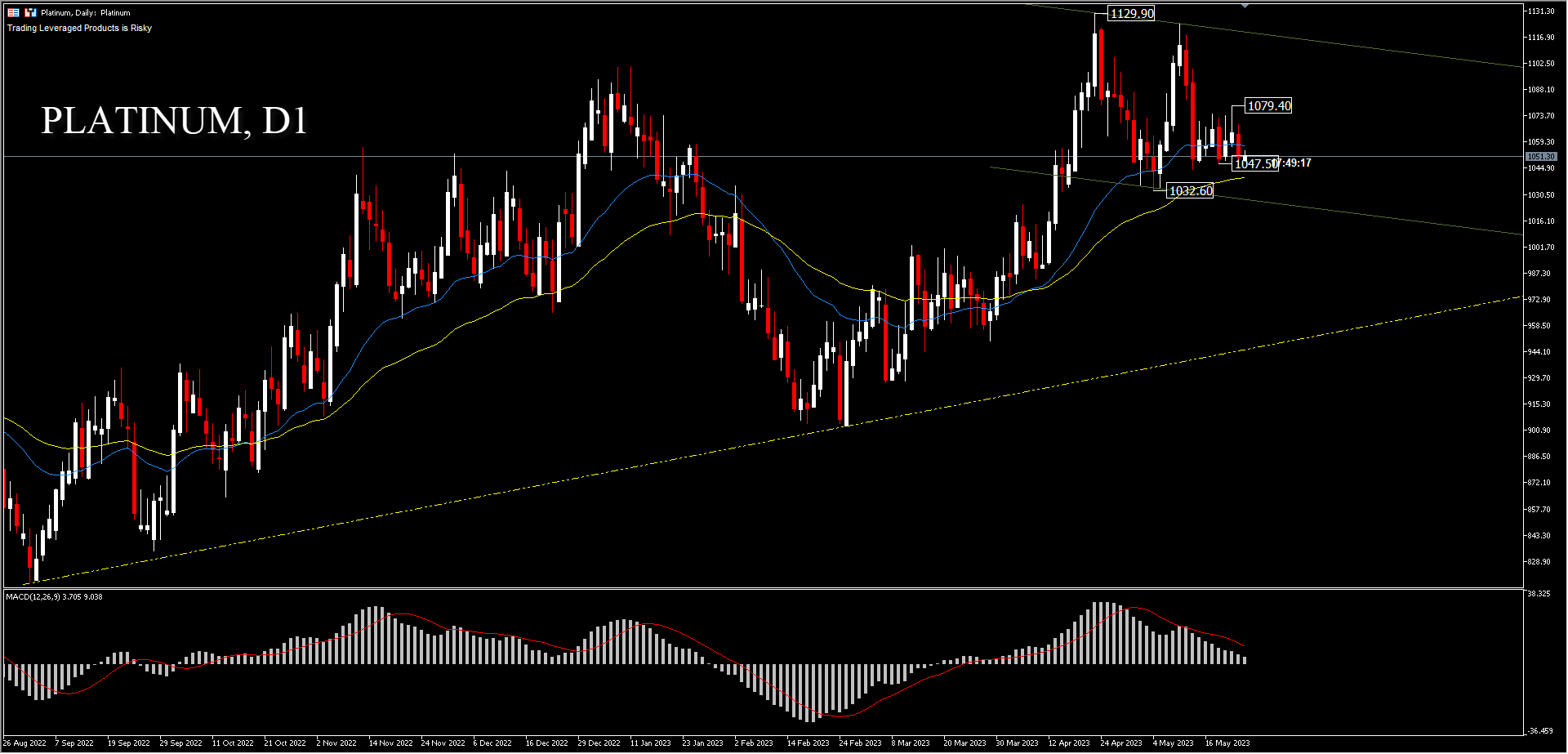

Gold has emerged because the best-performing treasured metallic in 2023 amid financial uncertainty and geopolitical tensions fuelling demand for the yellow metallic. In distinction, Platinum and Palladium have underperformed, with round +0.5% and -14% respectively. Nevertheless, each ought to achieve important traction, because of the rising stress round local weather change. Recognized for his or her distinctive catalytic properties, excessive melting level and purity, they’re utilized in a variety of medical, industrial and digital purposes, from the automotive sector and electrical gas cell expertise to luxurious items.

Platinum remains to be buying and selling between its 26-day EMA common. It consolidated within the final 7 days, buying and selling between $1047.50 and $1079.40. A double high has fashioned signalling hesitant bull curiosity to maintain the rally momentum. A transfer under $1047.50 may take a look at the $1032.60 assist and a transfer under this degree may verify the short-term downtrend. On the upside, a transfer past the $1079.40 resistance would open the door for a retest of the $1129.90 peak.

Palladium has continued to consolidate above the $1338.55 value ground within the final 2 months. The very best value it managed to report was seen at $1643.15 in April. The present outlook is comparatively secure, and there’s no clear path but, till the value strikes above the resistance of $1643.15 to verify the beginning of a bullish pattern or strikes under $1338.55 to sign that the energy of the bears shouldn’t be over.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]