[ad_1]

This was a foul week when it comes to financial knowledge for Germany: it began on Tuesday with a contraction in manufacturing PMI for the eleventh month in a row (42.9, nicely beneath the contraction threshold of fifty), in a rustic the place business is its robust level; it continued with relatively adverse measurements from the distinguished financial institute IFO on the present state of the financial system. Lastly on Friday, first the very unhealthy shopper confidence knowledge after which the understanding that Germany has entered recession, after 2 quarters in a row of contraction (-0.4% final, –0.3% this, Q/Q). Consumption was weak as ”households spent much less on meals and drinks, clothes and footwear, and on furnishings”, within the phrases of the Statistisches Bundesamt Deutschland, which compiles the info. Finance Minister Christian Lindner just lately acknowledged in Berlin that “we should flip financial coverage round and put an finish to the abandonment of our competitiveness”, in a transparent reference to power and industrial coverage. Lastly, a drop in buying energy, thinned-out industrial order books in addition to the impression of essentially the most aggressive financial coverage tightening in many years, and the anticipated slowdown of the US financial system all argue in favor of a continued weak financial exercise.

GER40, German GDP Progress Fee

Regardless of this the DAX is one step away from all-time highs, reminding us as soon as once more that the financial system shouldn’t be the markets – or a minimum of they don’t transfer collectively (within the chart, to be honest, one can see a sure lag between the index worth and GDP development, with the previous seeming to precede, a minimum of after 2020)

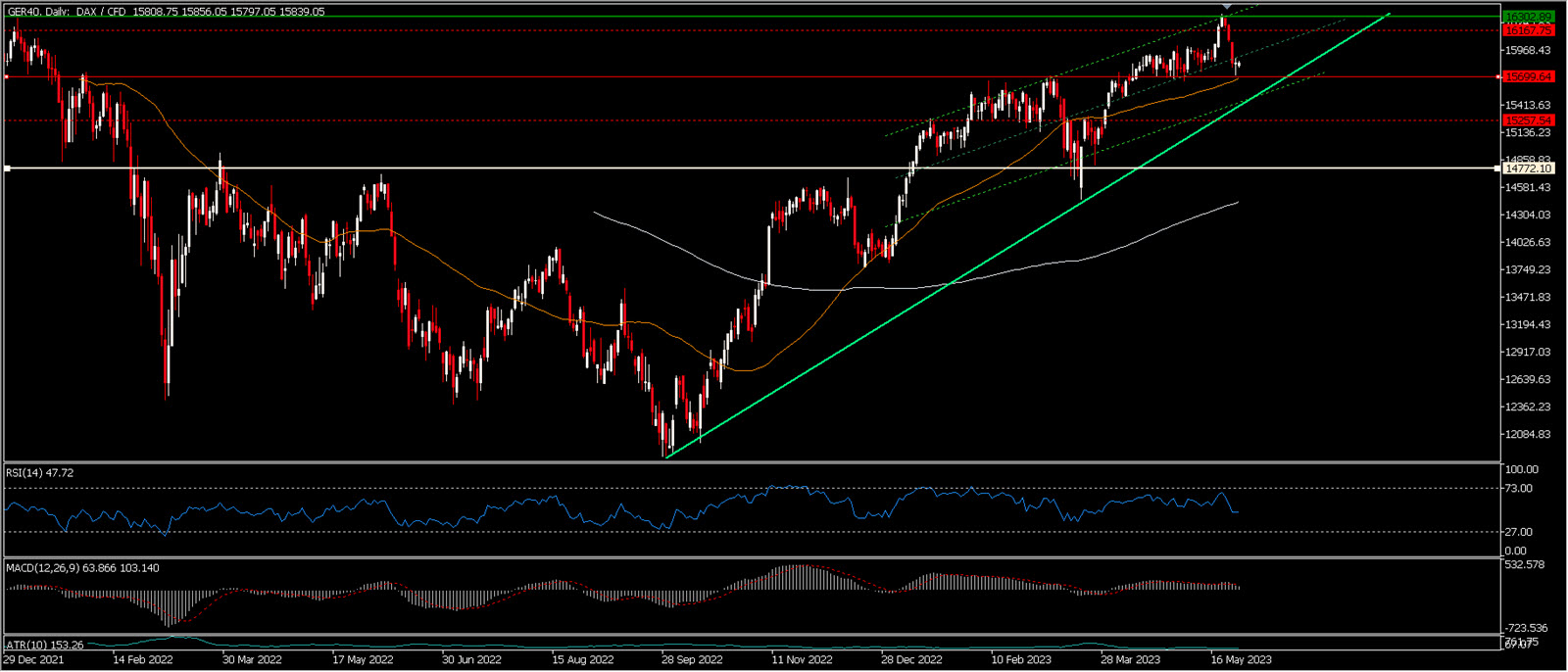

Technical evaluation

Final Friday, the DAX touched its all-time excessive of 16,331 in comparison with a earlier excessive on the fifth of January 2022 at 16,285. Since then, it has not had a great week and at present trades about 3% decrease at 15,848; a efficiency, nonetheless, consistent with different European indices such because the French FRA40(-3.5%) (that curiously sufficient has printed decrease highs in respect to its Apr 2023 ones).

GER40 vs FR40

The GER40 continues to be displaying a transparent bullish pattern that began on the finish of September 2022 (mild inexperienced) and slowed down at first of this 12 months (darkish inexperienced channel). After the descent of the previous couple of days, the index managed to bounce off the most necessary assist of 2023 until now, 15,700 (which can also be the place the MM50 is passing). It might break this degree with out compromising the longer-term pattern, which might nonetheless be secure a minimum of till round 15,475. The very fact is that after that degree is reached, there could possibly be additional house right down to 15,250 and that may clearly be beneath the 8 month lengthy trendline. The following most necessary assist, taking into consideration the costs of 2022, is within the 14,725 space, the place the GER40 would in all probability additionally commerce near its MM 200.

Presently the degrees to observe fastidiously for a sign of the path within the coming days are 15,700 – 16,000.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]