[ad_1]

- Mine lifetime of 35 years and after-tax payback of 4.0 years

- After-tax web current worth (“NPV”) (8%) of US$1.72 billion and inner fee of return (“IRR”) of 18.3%

- Common nickel manufacturing of 99 million lbs. per 12 months

- Common C1 working prices of US$2.74/lb nickel and all-in sustaining prices (“AISC”) of US$3.12/lb nickel

- Common US$481 million of annual earnings earlier than royalties, taxes and depreciation

Cautionary Assertion: The PEA is preliminary in nature and consists of inferred mineral assets which can be thought of too speculative geologically to have the financial issues utilized to them that may allow them to be categorized as mineral reserves. Mineral assets will not be mineral reserves and shouldn’t have demonstrated financial viability. There is no such thing as a certainty that the conclusions or outcomes as reported within the PEA will probably be realized.

“This PEA establishes Baptiste as a premier large-scale nickel undertaking,” commented FPX Nickel’s President and CEO, Martin Turenne. “The Venture has the potential to be a big international nickel operation, with a multi-generational working life and common annual manufacturing of 99 million kilos of contained nickel. Baptiste’s huge scale, mixed with low C1 working prices of US$2.74/lb, has the potential to ship sturdy working margins all through the nickel worth cycle, producing common earnings (earlier than royalties, taxes and depreciation) of US$481 million per 12 months and an after-tax NPV of US$1.7 billion. With its proximity to zero-carbon hydroelectric energy, the truth that its nickel product can bypass smelters for direct sale to finish customers, and the carbon-absorbing properties of Baptiste host rock, the Venture is properly positioned to handle the rising market demand for environmentally sustainable nickel manufacturing.”

The Firm has additionally recognized quite a lot of optimization alternatives to be investigated within the subsequent part of undertaking growth, together with however not restricted to:

- Potential suitability of Baptiste nickel merchandise for the electrical car battery market

- Sale of by-product iron ore focus or pellets

- Extra drilling to increase the Baptiste Deposit, which stays open with robust grades at depth over your complete mineralized footprint

- Potential discovery of extra large-scale nickel deposits inside the 245 sq. kilometre Decar Nickel District on three identified targets, most notably on the Van goal

- Ongoing analysis in collaboration with the College of British Columbia on the flexibility of Baptiste waste rock and tailings to naturally sequester atmospheric carbon dioxide (“CO2”)

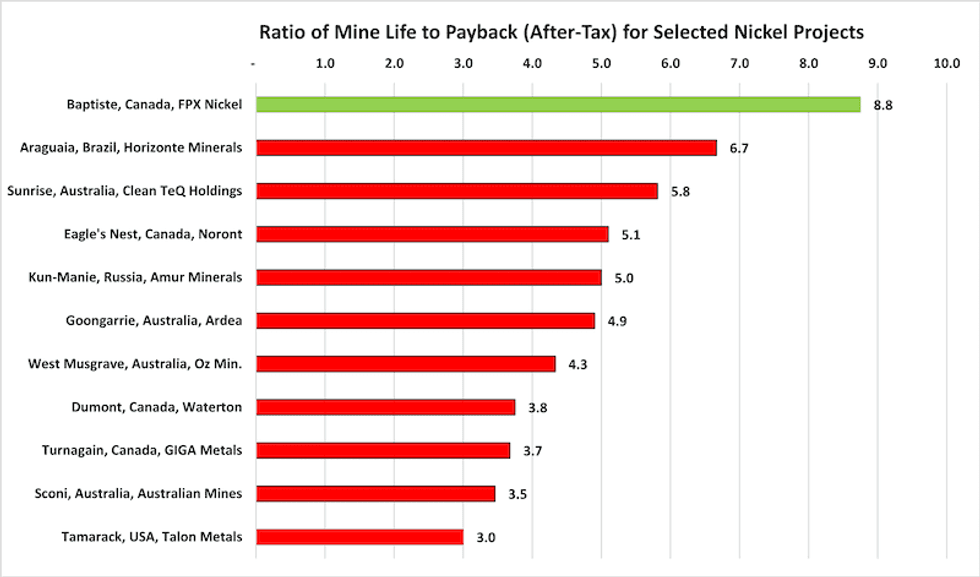

With its prolonged mine life and fast payback, Baptiste ranks favourably amongst international development-stage nickel initiatives, offering potential publicity to a number of cycles within the nickel market whereas effectively repaying upfront capital. Determine 1 demonstrates the strategic worth of Baptiste compared to different pre-production nickel initiatives, as expressed by its excessive ratio of projected mine life (35 years) to after-tax payback interval (4 years).

Determine 1 – Comparability of International Nickel Tasks

Supply: Firm financial research; see Desk 11 beneath.

Overview of PEA Outcomes and Assumptions

The Baptiste PEA demonstrates the potential for establishing a greenfield open-pit mine and an on-site magnetic separation and flotation processing plant, utilizing standard expertise and tools. At a throughput fee of 120,000 tonnes per day (or 43.8 million tonnes per 12 months), annual manufacturing is projected to common 99 million kilos nickel contained in ferronickel (“FeNi”) briquettes at C1 working prices of US$2.74 per pound of nickel. It’s anticipated that the Baptiste FeNi briquette will probably be bought on to stainless-steel producers and garner 98% of the London Steel Change (“LME”) nickel worth, in step with payabilities earned by normal FeNi merchandise within the international market.

All quantities are in United States {dollars} until in any other case specified; desk totals might not sum because of rounding.

Desk 1 – Baptiste Venture PEA Outcomes and Assumptions (all in US$)

| Outcomes | |

| Pre-tax NPV (8% low cost fee) | $2.93 billion |

| Pre-tax IRR | 22.5% |

| Payback interval (pre-tax) | 3.5 years |

| After-tax NPV (8% low cost fee) | $1.72 billion |

| After-tax IRR | 18.3% |

| Payback interval (after-tax) | 4.0 years |

| Internet money flows (after-tax, undiscounted) | $8.73 billion |

| C1 working prices 1 | $2.74/lb nickel |

| AISC prices 2 | $3.12/lb nickel |

| Assumptions | |

| Processing throughput | 120,000 tonnes per day |

| Mine life | 35 years |

| Life-of-mine stripping ratio (tonnes:tonnes) | 0.40:1 |

| Life-of-mine common annual nickel manufacturing | 99 million lbs. |

| Nickel worth 3 | $7.75/lb |

| Baptiste product payability (% of nickel worth) | 98% |

| Pre-production capital expenditures | $1.67 billion |

| Sustaining capital expenditures | $1.11 billion |

| Change fee | 0.76 US$/C$ |

- C1 working prices are the prices of mining, milling and concentrating, on-site administration and normal bills, metallic product therapy costs, and freight and advertising and marketing prices much less the web worth of by-product credit, if any. These are expressed on the idea of per unit nickel content material of the bought product.

- AISC of all-in sustaining prices comprise the sum of C1 prices, sustaining capital, royalties and closure bills. These are expressed on the idea of per unit nickel content material of the bought product.

- Nickel worth based mostly on the typical of six long-term analyst forecast costs.

Capital Prices

The whole pre-production capital prices, together with direct prices, oblique prices and contingency was estimated at $1.67 billion. This represents the pre-production capital expenditure required to help start-up of operations in 12 months 1. The capital value associated to the implementation of in-pit tailings deposition in 12 months 22 was estimated at $103 million. That is the capital expenditure particularly required to permit for finer main grinding (leading to improved nickel restoration) and for pumping tailings to the mined-out pits for in-pit deposition, and different related prices (see additional dialogue underneath Metallurgy and Mineral Processing and Tailings Administration beneath). Sustaining capital prices (which excludes the capital value associated to the implementation of finer main grinding and in-pit deposition) had been estimated at $1.01 billion. These prices embody gadgets comparable to mine tools fleet additions and replacements, amenities additions and enhancements and prices referring to tailings storage facility and floor water administration that are incurred over the life-of-mine (“LOM”).

Desk 2 – Capital Prices

| Class | Pre-Manufacturing US$ million | In-Pit Tailings Deposition (12 months 21) US$ million |

Sustaining US$ million | Whole LOM US$ million | ||

| Direct Prices | ||||||

| Cellular Tools | $155 | – | $354 | $509 | ||

| Tailings | $138 | $15 | $534 | $687 | ||

| Mine and tailings web site preparation | $96 | – | $90 | $186 | ||

| Mineral processing | $610 | $88 | $18 | $717 | ||

| Off-site infrastructure | $64 | – | – | $64 | ||

| On-site infrastructure | $66 | – | $7 | $73 | ||

| Whole direct prices | $1,129 | $103 | $1,003 | $2,235 | ||

| Oblique prices | $292 | – | $8 | $300 | ||

| Contingency | $254 | – | – | $254 | ||

| Whole undertaking capital prices | $1,675 | $103 | $1,012 | $2,789 | ||

Working Prices

Desk 3 presents a abstract of the estimated common working prices for the preliminary Part 1 (Years 1 to 21), Part 2 (Years 22 to 35, throughout which interval the Venture will undertake finer main grinding and in-pit tailings deposition) and for the life-of-mine, expressed in US$/tonne of dry materials processed (milled).

Desk 3 – Whole Estimated Part and Common LOM Working Prices (US$/t milled)

| Estimated common LOM working prices | Part 1 (Years 1-21) |

Part 2 (Years 22-35) |

Common (LOM) |

|||

| Mining | $2.28 | $2.66 | $2.43 | |||

| Mineral processing | $2.71 | $2.91 | $2.79 | |||

| Product transport | $0.19 | $0.18 | $0.19 | |||

| Rail terminal and entry street | $0.05 | $0.05 | $0.05 | |||

| Common web site providers | $0.62 | $0.62 | $0.62 | |||

| Common and administration | $0.25 | $0.25 | $0.25 | |||

| Whole working prices | $6.09 | $6.66 | $6.32 | |||

Desk 4 presents estimated part and common LOM working prices said on a per unit of nickel manufacturing foundation.

Desk 4 – C1 prices and AISC prices (US$/lb nickel)

| Part 1 (Years 1-21) |

Part 2 (Years 22-35) |

Common (LOM) |

||||

| C1 prices | $2.61 | $2.94 | $2.74 | |||

| AISC prices | $3.13 | $3.11 | $3.12 | |||

Mineral Useful resource Estimate

The PEA incorporates an up to date 2020 useful resource estimate for the Baptiste Deposit together with all knowledge from the 83 floor drillholes accomplished since 2010 and a pair of,053 samples from a re-sampling program of 2010/2011 drill core that was carried out in 2012. The estimate is geologically constrained inside 4 mineralized domains and in all fairness comparable amongst totally different estimation strategies (i.e., bizarre kriging, inverse distance squared weighting, nearest neighbour).

The 2020 useful resource mannequin includes a big, delta formed quantity that measures roughly 3.0 km in size and 150 to 1,080 m in width and extends to a depth of 540 m beneath the floor. The Baptiste Deposit stays open at depth over your complete system and is roofed by a median of 12 metres of overburden.

Desk 5: 2020 Baptiste Deposit Pit-Constrained Mineral Useful resource Estimate *

| Class | Tonnes (000’s) | Davis Tube Recoverable (“DTR”) Nickel Content material | ||

| % Ni | Tonnes Ni | Kilos Ni (000’s) | ||

| Indicated | 1,995,873 | 0.122 | 2,434,965 | 5,368,173 |

| Inferred | 592,890 | 0.114 | 675,895 | 1,490,092 |

* See Notes for Tables 5 and 6 beneath.

Desk 6: 2020 Baptiste Deposit Block Mannequin Tonnage and Grades Reported at a Vary of Lower-off Grades (Base Case 0.06% DTR Ni) *

| Lower-off Grade (DTR Ni %) | Indicated | Inferred | ||

| Tonnes (000’s) | DTR Ni Grade (%) | Tonnes (000’s) | DTR Ni Grade (%) | |

| 0.02 | 2,076,969 | 0.119 | 750,633 | 0.098 |

| 0.04 | 2,055,578 | 0.120 | 659,900 | 0.107 |

| 0.06 | 1,995,873 | 0.122 | 592,890 | 0.114 |

| 0.08 | 1,871,412 | 0.126 | 499,993 | 0.122 |

| 0.10 | 1,617,364 | 0.131 | 399,801 | 0.130 |

* Notes for Tables 5 and 6:

- Up to date mineral useful resource estimate ready by GeoSim Companies Inc. utilizing bizarre kriging with an efficient date of September 9, 2020.

- Davis Tube magnetically-recovered (“DTR”) nickel is the nickel content material recovered by magnetic separation utilizing a Davis Tube, adopted by fusion XRF to find out the nickel content material of the magnetic fraction; in impact a mini-scale metallurgical check. The Davis tube technique is the worldwide, trade normal metallurgical testing equipment for restoration of magnetic minerals.

- Indicated mineral assets are drilled on approximate 200 x 200 metre drill spacing and confined to mineralized lithologic domains. Inferred mineral assets are drilled on approximate 300 x 300 metre drill spacing.

- An optimized pit shell was generated utilizing the next assumptions: US$6.35 per pound nickel worth; a forty five° pit slope; assumed mining restoration of 97% DTR Ni and course of restoration of 85% DTR Ni, an alternate fee of $1.00 CAN = $0.76 US; and mining prices of US$2.75 per tonne, processing prices of US$4.00 per tonne. A US$1.00 per tonne minimal revenue was additionally imposed to exclude materials near the break-even cut-off.

- A base case cut-off grade of 0.06% DTR Ni represents an in-situ metallic worth of roughly US$7.00 per tonne which is believed to supply an affordable margin over working and sustaining prices for open-pit mining and processing.

- Totals might not sum because of rounding.

- Mineral assets will not be mineral reserves and shouldn’t have demonstrated financial viability.

Mining

The PEA mine plan relies on the mineral useful resource estimate and its underlying geological block mannequin. The mine plan envisions a three-phased open pit mine growth, with the Part 1 pit masking the primary 21 years of mine life. Throughout this part, tailings will probably be deposited in an exterior tailings storage facility (“TSF”). The Part 2 and three pits increase laterally in direction of the northwest and northeast from the Part 1 pit, offering mill feed for years 22 to 35, permitting tailings to be positioned within the mined-out Part 1 pit. A pit rim dam will probably be constructed in 12 months 25 to permit entry from the part 3 pit to the plant and to accommodate the extra tailings that will probably be saved within the Part 1 and Part 2 pits after they’re mined out.

Mining will probably be carried out utilizing standard truck and shovel strategies. Massive-scale open pit mining will present the mineral processing plant feed at a fee of 120,000 tonnes per day, or 43.8 million tonnes each year. Annual mine manufacturing of mill feed and waste will peak at 80.1 Mt/a with a life-of-mine stripping ratio of 0.40:1 together with preproduction (0.32 through the first 10 years of operation, and 0.22 over the primary 16 years of operation). Final pit portions with corresponding DTR nickel grades are proven in Desk 7.

Desk 7 – Final Design Pit Portions

| Materials Classification | Tonnage (Mt) | Grade (% DTR Ni) |

| Indicated | 1,326 | 0.124% |

| Inferred | 177 | 0.102% |

| Whole for processing | 1,503 | 0.121% |

| Waste rock | 540 | |

| Overburden | 55 | |

| Whole waste | 596 | |

| Whole materials mined | 2,098 | |

| Stripping ratio (LOM) | 0.40 :1 |

Observe: Mineral assets will not be mineral reserves and shouldn’t have demonstrated financial viability

Pit phasing (Phases 1 via 3) was developed to maximise grade early within the mine life, with a starter pit being developed initially of Part 1 to focus on a shallow higher-grade zone of nickel mineralization. A manufacturing schedule exhibiting tonnage and grade by mining part is offered in Desk 8.

Desk 8 – Mining Schedule by Part

| Materials Classification | Tonnage (Mt) | Grade (% DTR Ni) |

| Part 1 (Years 1-21) | ||

| Indicated | 803 | 0.128% |

| Inferred | 42 | 0.114% |

| Whole for processing – Part 1 | 845 | 0.127% |

| Phases 2 and three (Years 22-35) | ||

| Indicated | 523 | 0.117% |

| Inferred | 135 | 0.099% |

| Whole for processing – Phases 2 and three | 658 | 0.113% |

| Whole for processing – LOM | 1,503 | 0.121% |

Observe: Mineral assets will not be mineral reserves and shouldn’t have demonstrated financial viability

Metallurgy and Mineral Processing

The metallurgical testwork for the PEA was carried out at ALS in Kamloops, British Columbia and was centered on the next:

- Magnetic separation exams at a variety of main grind sizes (P80 from 57 µm to 360 µm);

- Magnetic cleansing exams to 25 µm ultimate regrind dimension;

- Flotation testwork on the magnetic cleaner focus underneath numerous situations and reagent additions;

- Mineralogical evaluation of the pinnacle pattern and a few merchandise generated within the testwork.

A conceptual mineral processing flowsheet was developed as the idea for the PEA. The method flowsheet relies on conventional grinding, magnetic separation and flotation processes. Unit operations on this flowsheet embody crushing and grinding, magnetic separation, magnetic focus re-grinding to 25 microns (P80), additional magnetic cleansing phases, adopted by rougher and cleaner flotation phases to provide a ultimate nickel focus grading 63% nickel.

The metallurgical testwork outcomes indicated that at a main grind of 300 µm, it’s doable to provide a 63% nickel focus with a nickel restoration of 85% of the DTR nickel feed grade. In 12 months 22, when in-pit tailings deposition is applied, a finer main grind of 170 µm might be achieved via the addition of a 3rd ball mill leading to a DTR nickel restoration of 90%.

Subsequent to the flotation course of, the 63% nickel focus is dewatered, filtered to a filter cake and briquetted right into a ultimate saleable ferronickel product. The flotation course of additionally produces a magnetite-rich tailings stream which has the potential to be bought or additional valorized as a saleable iron ore product. For the PEA, no by-product revenues have been acknowledged for the potential sale of this magnetite-rich product.

Product Advertising

Metallurgical testwork carried out for the PEA Research has proven that the Baptiste Venture can produce a clear, high-grade, ferronickel focus via a traditional mineral processing flowsheet. The FeNi focus, agglomerated in briquette kind, constitutes the ultimate saleable product generated by the Venture for consumption by stainless-steel producers. The projected product specification for the Baptiste briquettes is offered in Desk 9.

Desk 9: Projected Product Specification for Baptiste FeNi Briquettes

| Components and Minerals | Content material |

| Ni | 60-65% |

| Fe (complete) | 30-32% |

| Awaruite (Ni3Fe alloy) | 77-83% |

| Metallic Fe in awaruite | 19-21% |

| Magnetite (Fe3O4) | 13-18% |

| Co | 1% typical |

| Cu | 0.7% typical |

| P | 0.02% typical |

| S | 0.6% typical |

| MgO | 1% typical |

| SiO2 | 1.5% typical |

| Cr2O3 | 0.4% typical |

The promoting worth to be obtained from the sale of the Baptiste FeNi briquettes to stainless-steel producers will usually be a operate of two variables: (1) the LME nickel worth and (2) a reduction or premium to the LME nickel worth, based mostly available on the market positioning of the Baptiste FeNi briquettes in relation to competing sources of nickel feedstock to stainless producers, together with stainless-steel scrap, nickel pig iron, normal FeNi and Class 1 nickel briquettes or cathode. The promoting worth decided by the evaluation of those two elements is the value used for the financial evaluation carried out for the PEA.

An extended-term LME base nickel worth assumption of $7.75 per pound is assumed within the PEA which is in step with the typical long-term nickel worth of forecasts supplied by six base metals analysts. In an effort to assess the potential payability for the Baptiste product, said as a share of the LME base worth, the next sources of knowledge had been thought of:

- The outcomes of the Firm’s preliminary product market testing undertaken with stainless-steel and ferronickel producers;

- Preliminary market suggestions based mostly on casual discussions with nickel customers and merchants, together with an impartial guide to the Firm and representatives of enormous worldwide buying and selling homes specializing in nickel merchandise;

- Benchmarking with typical specs for normal FeNi and nickel pig iron (“NPI”) merchandise from numerous producers;

- Historic premium / low cost knowledge for normal FeNi.

The evaluation, in consideration of the aforementioned info sources, concluded {that a} low cost of two% utilized to the LME nickel worth gives an affordable assumption for figuring out the promoting worth for use for the PEA.

Off-Website Infrastructure

The Decar District web site entry street, having a complete size of 121 km, consists of an current paved street section and an current forestry service street (“FSR”). A brand new 110-m span bridge and a brand new 4.5 km FSR section will probably be required to entry the property. Additionally, upgrades will probably be required to an current 20-m span bridge and to 12 km of current FSR segments.

A road-to-rail switch facility is proposed to be constructed off-site within the neighborhood of the present CN Rail department line. The switch facility is for use primarily for transloading containerized FeNi briquettes onto railcars for transport to the Prince Rupert port terminal for eventual supply to ports in Asia. The FeNi briquettes will probably be loaded into containers on the mine web site and trucked by the Firm to the switch facility. The Venture will, on common, produce about 72,000 tonnes of FeNi briquettes yearly, or a median of roughly 200 tonnes per day.

Electrical energy to the Venture will probably be supplied via a brand new hydro-electric energy transmission line with a capability of 120 MW and a transmission voltage of a single, 230 kV circuit. The proposed energy transmission line relies on a tie-in level positioned roughly 98 km from the Venture.

Tailings Administration

The proposed tailings disposal technique for the Baptiste Venture relies on two phases. For Part 1, spanning from years 1 to 21, tailings are disposed of inside a traditional exterior tailings storage facility. The proposed exterior TSF is proposed to be constructed utilizing the centerline building technique with a downstream slope of 3H:1V. It is going to be constructed primarily with cycloned sand tailings generated within the mineral processing plant and designed to retain tailings produced through the first 21 years of manufacturing based mostly on the mine schedule. Geotechnical design standards are based mostly on regional expertise as no web site investigations associated to the TSF constructions have been accomplished up to now.

Thereafter, tailings are proposed to be disposed inside the exhausted open pit based mostly on an in-pit disposal technique. Upon completion of mining of the Part 1 pit in 12 months 21, the pit would then begin being backfilled with tailings produced whereas processing materials mined within the Phases 2 and three pits, beginning in 12 months 22. A pit rim dam will probably be required with a purpose to accommodate the tailings produced whereas mining the Part 3 pit to the tip of the 35-year mine life.

Sensitivity Evaluation

A sensitivity evaluation was carried out on a pre-tax and after-tax foundation, whereby pre-production capital value, annual working prices and product promoting worth had been individually diversified between +/-20% to find out the impression on the Venture’s IRR and NPV at an 8% low cost fee. Outcomes are offered in Desk 10.

Desk 10 – Sensitivity Evaluation

| Sensitivity | -20% | -10% | Base Case | +10% | +20% |

| Working Prices | |||||

| Pre-Tax | |||||

| NPV | $3,449 M | $3,188 M | $2,927 M | $2,666 M | $2,406 M |

| IRR | 24.6% | 23.6% | 22.5% | 21.5% | 20.4% |

| After-Tax | |||||

| NPV | $2,057 M | $1,889 M | $1,721 M | $1,552 M | $1,384 M |

| IRR | 19.9% | 19.1% | 18.3% | 17.4% | 16.5% |

| Capital Prices | |||||

| Pre-Tax | |||||

| NPV | $3,233 M | $3,080 M | $2,927 M | $2,774 M | $2,621 M |

| IRR | 27.2% | 24.6% | 22.5% | 20.8% | 19.2% |

| After-Tax | |||||

| NPV | $2,002 M | $1,862 M | $1,721 M | $1,579 M | $1,437 M |

| IRR | 22.4% | 20.1% | 18.3% | 16.7% | 15.3% |

| Ni Promoting Value | |||||

| Pre-Tax | |||||

| NPV | $1,426 M | $2,177 M | $2,927 M | $3,678 M | $4,428 M |

| IRR | 15.7% | 19.2% | 22.5% | 25.7% | 28.6% |

| After-Tax | |||||

| NPV | $750 M | $1,237 M | $1,721 M | $2,202 M | $2,680 M |

| IRR | 12.8% | 15.6% | 18.3% | 20.7% | 23.0% |

On the LME spot nickel worth of $6.86/lb. (closing worth on September 7, 2020), the Venture’s after-tax IRR and NPV (8% low cost fee) could be 15.2% and US$1.16 billion, respectively.

Venture Alternatives

A number of undertaking optimization alternatives requiring additional examine have been recognized which can additional improve undertaking economics, together with the next:

- Electrical Car Battery Utility: Based mostly on batch stress leach exams carried out on a pattern of Baptiste flotation focus, it’s anticipated that the nickel-cobalt leach answer produced will probably be a super feedstock for the manufacturing of nickel sulphate and cobalt sulphate for the electrical car (“EV”) battery market. These optimistic check outcomes present the Firm with a chance to pursue another advertising and marketing route for a part of its nickel manufacturing, which might permit the Firm to develop into a participant within the EV battery worth chain. Because the Venture advances, this chance will should be supported with extra testwork and a validation of course of economics.

- Sale of Iron Ore Focus: The method flowsheet developed within the PEA generates a flotation tailing with a excessive iron content material (within the type of magnetite), which might probably be marketable as a magnetite iron ore focus and generate extra monetary profit to the Venture. An in depth logistics and marketability evaluation to additional develop this chance is required to include the potential good thing about this product stream into the Venture’s economics.

- Mineral Exploration: Assay outcomes of outcropping bedrock samples have outlined a promising drill-ready goal on the Van goal, which is positioned 6 km north of the Baptiste Deposit at related elevations, and accessible by way of logging roads. These outcomes show that the floor expression of the Van goal is bigger in space and related in DTR nickel values to the Baptiste Deposit. A drill program is really useful for the Van goal to check its potential to comprise a standalone deposit to enrich the Baptiste Deposit.

- CO2 Sequestration: Laboratory testing by researchers from the College of British Columbia has demonstrated that the Baptiste Deposit’s mineralization can soak up vital portions of carbon dioxide when uncovered to air via a pure strategy of mineral carbonation. FPX is enterprise additional analysis in collaboration with UBC to evaluate and advance the potential growth of a low-carbon or carbon-neutral operation at Baptiste (see FPX Nickel information launch dated September 1, 2020). The potential advantages of carbon sequestration haven’t been included into the current PEA.

Webinar

The Firm’s administration will host a reside webinar on Thursday, September 10 at 1:00 p.m. Japanese (10:00 a.m. Pacific) to supply an summary of the PEA outcomes and to reply questions from individuals. Members can entry the reside webinar on the following hyperlink: https://zoom.us/j/99574244901

Notes Relating to the PEA

The PEA was produced by a crew of impartial consultants who possess intensive experience of their respective fields. Additional particulars on the contributors might be discovered within the Certified Individuals part of this information launch.

The efficient date of the 2020 PEA is September 9, 2020 and a technical report referring to the PEA will probably be filed on SEDAR inside 45 days of this information launch.

Notes Relating to Determine 1

Data in Determine 1 concerning the mine life and payback interval of worldwide nickel initiatives is taken from firm experiences and financial research, as proven in Desk 11 beneath.

Desk 11 – Mine Life and Payback for Chosen Nickel Venture Financial Research

| Venture (Nation) | Mine Life (Years) |

After-Tax Payback (Years) | Ratio of Mine Life to Payback (After-Tax) | Firm Report |

| Baptiste (Canada) | 35 | 4.0 | 8.8 | FPX Nickel Corp. information launch, September 9, 2020 |

| Araguaia (Brazil) | 28 | 4.2 | 6.7 | Horizonte Minerals Plc information launch, October 29, 2018 |

| Dawn (Australia) | 25 | 4.3 | 5.8 | Clear TeQ Holdings Restricted information launch, June 25, 2018 |

| Eagle’s Nest (Canada) | 10 | 2 | 5.1 | Noront Assets Ltd. information launch, September 5, 2012 |

| Kun-Manie (Russia) | 15 | 3 | 5 | Amur Minerals Company information launch, February 26, 2019 |

| Goongarrie (Australia) | 25 | 5.1 | 4.9 | Ardea Assets Restricted information launch, July 24, 2018 |

| West Musgrave (Australia) | 26 | 6 | 4.3 | Oz Minerals Restricted information launch, February 12, 2020 |

| Dumont (Canada) | 30 | 8 | 3.8 | RNC Minerals information launch, Could 30, 2019 |

| Turnagain (Canada) | 27 | 7 | 3.7 | Onerous Creek Nickel Company information launch, October 20, 2011 |

| Sconi (Australia) | 18 | 5.2 | 3.5 | Australian Mines Restricted information launch, November 20, 2018 |

| Tamarack (USA) | 7.5 | 2.5 | 3.0 | Talon Metals Corp. information launch dated March 5, 2020 |

Certified Individuals

The scientific and technical info contained on this information launch pertaining to the Venture has been reviewed, verified and permitted by the next Certified Individuals as outlined by NI 43-101: Angelo Grandillo, P. Eng. of BBA Inc., Gordon Chen, P. Eng. of Stantec Inc., Sean Ennis, P. Eng. of Stantec Inc., Jeff Austin, P. Eng. of IME Inc., Ronald G. Simpson, P. Geo. of GeoSim Companies Inc., and Ronald Voordouw, P. Geo. of Fairness Exploration Consultants Ltd. (who has additionally verified the sampling, analytical, and check knowledge underlying the disclosed Mineral Useful resource estimate). The entire above-noted Certified Individuals are impartial of FPX Nickel. Dr. Peter Bradshaw, P. Eng., FPX Nickel’s Certified Individual underneath NI 43-101, is chargeable for the opposite technical info (info indirectly associated to the PEA) on this information launch.

Concerning the Decar Nickel District

The Firm’s Decar Nickel District claims cowl 245 sq. kilometres of the Mount Sidney Williams ultramafic/ophiolite complicated, 90 km northwest of Fort St. James in central British Columbia. The District is a two-hour drive from Fort St. James on a high-speed logging street.

Decar hosts a greenfield discovery of nickel mineralization within the type of a naturally occurring nickel-iron alloy referred to as awaruite, which is amenable to bulk-tonnage, open-pit mining. Awaruite mineralization has been recognized in 4 goal areas inside this ophiolite complicated, being the Baptiste Deposit, the B goal, the Sid goal and Van goal, as confirmed by drilling within the first three plus petrographic examination, electron probe analyses and outcrop sampling on all 4. Since 2010, roughly $25 million has been spent on the exploration and growth of Decar.

Of the 4 targets within the Decar Nickel District, the Baptiste Deposit has been the primary focus of diamond drilling since 2010, with a complete of 82 holes and over 31,000 metres of drilling accomplished. The Sid goal was examined with two holes in 2010 and the B goal had a single gap drilled into it in 2011; all three holes intersected nickel-iron alloy mineralization over extensive intervals with DTR nickel grades corresponding to the Baptiste Deposit. The Van goal was not drill-tested at the moment as rock publicity was very poor previous to logging exercise by forestry corporations.

As reported within the present NI 43-101 useful resource estimate, having an efficient date of September 9, 2020, the Baptiste Deposit accommodates 1.996 billion tonnes of indicated assets at a median grade of 0.122% DTR nickel, thus equating to 2.4 million tonnes of nickel, and 593 million tonnes of inferred assets with a median grade of 0.114% DTR nickel, containing 0.7 million tonnes of nickel, reported at a cut-off grade of 0.06% DTR nickel. Mineral assets will not be mineral reserves and shouldn’t have demonstrated financial viability.

About FPX Nickel Corp.

FPX Nickel Corp. is concentrated on the exploration and growth of the Decar Nickel District, positioned in central British Columbia, and different occurrences of the identical distinctive fashion of naturally occurring nickel-iron alloy mineralization referred to as awaruite. For extra info, please view the Firm’s web site at www.fpxnickel.com or contact Martin Turenne, President and CEO, at (604) 681-8600 or at ceo@fpxnickel.com.

On behalf of FPX Nickel Corp.

“Martin Turenne”

Martin Turenne, President, CEO and Director

Ahead-Wanting Statements

Sure of the statements made and knowledge contained herein is taken into account “forward-looking info” inside the which means of relevant Canadian securities legal guidelines. These statements deal with future occasions and situations and so contain inherent dangers and uncertainties, as disclosed within the Firm’s periodic filings with Canadian securities regulators. Precise outcomes might differ from these at the moment projected. The Firm doesn’t assume the duty to replace any forward-looking assertion.

Neither the TSX Enterprise Change nor its Regulation Companies Supplier accepts accountability for the adequacy or accuracy of this launch.

Click on right here to attach with FPX NIckel Corp (TSXV:FPX) for an Investor Presentation

[ad_2]