[ad_1]

Many Foreign exchange merchants, particularly new Foreign exchange merchants, can really feel misplaced and confused available in the market. They really feel they’ll generate income however they discover it laborious to attain this with any form of consistency. Some find yourself saying that the market is random or that they’re struggling by the hands of dishonest Foreign exchange brokers, however these are normally simply excuses. The market definitely isn’t random and even when your Foreign exchange dealer is lower than good, you possibly can nonetheless generate income in the event you cease and take into consideration the market and apply a top-down method to your buying and selling. I’ll present right here a technique that can be utilized that chooses forex pairs in a approach that statistically produces optimistic returns.

What are Foreign exchange Momentum Buying and selling Methods?

“Momentum” merely means purchase one thing whether it is going up, and promote it whether it is taking place. There have been a number of tutorial surveys displaying that making use of this precept to all types of speculative markets is worthwhile over time and provides a profitable buying and selling “edge”.

One other sort of Foreign exchange momentum technique is a “better of” momentum buying and selling technique which buys these belongings which can be going up essentially the most strongly and sells these taking place most strongly. This additionally tends to work nicely and in reality tends to supply a larger reward to threat ratio than easy momentum methods.

I’m going to stipulate a Foreign exchange ‘Better of” Momentum Technique that I’ve developed beneath, with again check outcomes.

A Foreign exchange “Better of” Momentum Buying and selling Technique: Choosing Pairs

The primary a part of the technique is to create an excel spreadsheet that reveals the adjustments in value over the past 3 months of a universe of 28 Foreign exchange pairs and crosses. It’s easiest to make this calculation every weekend utilizing weekly open and shut costs, as a interval of 13 weeks approximates properly to three months.

I exploit the 28 pairs and crosses that you just get from the 7 main international currencies. There is no such thing as a motive why you can’t add currencies, though the extra unique you get, the costlier they get to commerce.

Select the 6 forex pairs/crosses which have moved essentially the most strongly over the previous 13 weeks. These are the pairs/crosses you’ll look to commerce over the approaching week. You’ll commerce within the path of the motion. For instance if EUR/USD has modified in worth by -5%, and that’s the largest change of any pair, you may be trying to commerce that pair quick.

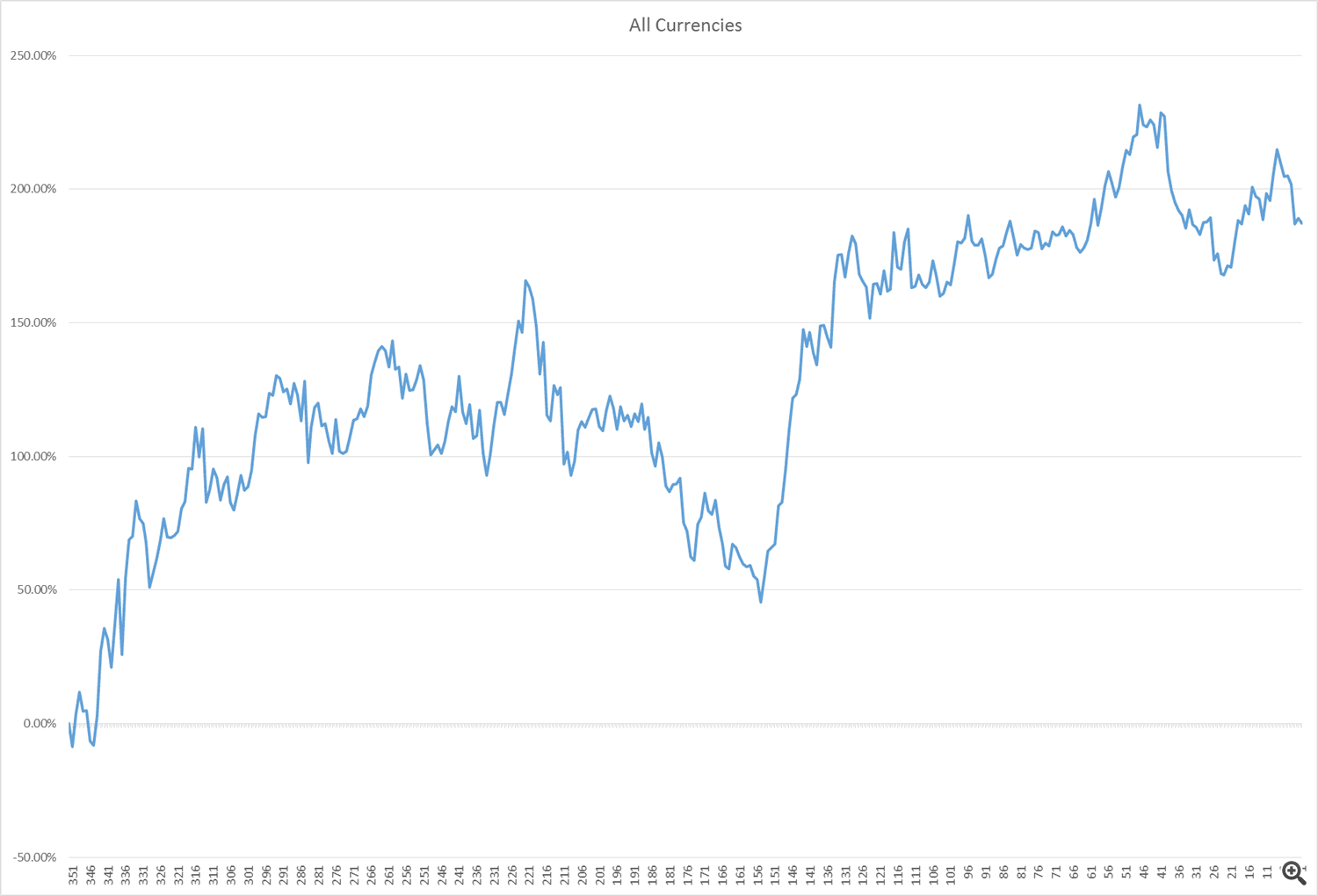

Over the previous 6.75 years, this methodology has proven a statistical chance of manufacturing a buying and selling edge. With out refining the tactic or utilizing leverage, this methodology has produced a complete return of 187.10%, which involves a really spectacular annualized return of 17.01%! The common week has produced a optimistic return of 0.53% and a median week a return of 0.43%. The common annual return was 23.63% and the median annual return was 19.08%. Efficiency is proven within the graph beneath.

You would possibly ask, why use a look-back interval of three months? It’s merely the interval that has labored greatest over the past 7 years or so. Earlier than the monetary disaster of 2008, utilizing a 6 month interval labored higher. Utilizing a 6 month interval has additionally been worthwhile over the past 7 years, however a lot much less so than 3 months. It appears that evidently shorter durations than 3 months are too quick, and durations longer than 6 months are too sluggish.

Buying and selling Chosen Foreign exchange Pairs

It ought to be potential to make the general outcomes even higher by making use of a place buying and selling technique to the pairs/crosses and instructions you may have decided for every week.

My favourite methodology is to make use of shifting common guidelines. I like to make use of an hourly chart with a 3 interval EMA and a ten interval SMA. When an hourly candle closes, and the three EMA crosses the ten SMA within the path of the pattern, I enter a place – however provided that the worth can be on the correct aspect of the 40 and 240 SMAs. This filter might help maintain you out of trades when the momentum isn’t actually there.

In fact, everybody has their favourite momentum buying and selling technique, and utilizing an indicator such because the RSI (Relative Energy Index) crossing 50 on all time frames with say a ten interval setting also can work very nicely. Any momentum indicator can be utilized, actually. You can even take note of assist and resistance after all: however near assist if the pattern is lengthy, promote near resistance if the pattern is down, after a pull-back. You’ll normally get the very best outcomes by ready for pull-backs to occur.

For cease losses, I like to make use of the 20 day Common True Vary. It takes expertise to handle cease losses manually however after you get a variety of expertise you possibly can study which of them to chop quick: these are principally the trades that go strongly towards you proper from the very starting. If the commerce goes in your favor by about 1 ATR, you possibly can look so as to add to the place upon additional shifting common crosses, breakouts, or no matter you want: utilizing breakouts so as to add to positions can work very nicely. When you may have about 3 positions on it’s time to think about taking partial income and/or shifting up cease loss ranges to lock in income.

Automate your buying and selling with our Robots and Utilities

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865

EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Utility ⚒

EasyTradePad MT4 – https://www.mql5.com/en/market/product/72256

EasyTradePad MT5 – https://www.mql5.com/en/market/product/72454

Danger supervisor MT4 – https://www.mql5.com/en/market/product/72214

Danger supervisor MT5 – https://www.mql5.com/en/market/product/72414

Indicators 📈

3 in 1 Indicator iPump MT4 – https://www.mql5.com/en/market/product/72257

3 in 1 Indicator iPump MT5 – https://www.mql5.com/en/market/product/72442

Energy Reserve MT4- https://www.mql5.com/en/market/product/72392

Energy Reserve MT5 – https://www.mql5.com/en/market/product/72410

[ad_2]