[ad_1]

EUR/USD: A lot Depends upon the CPI

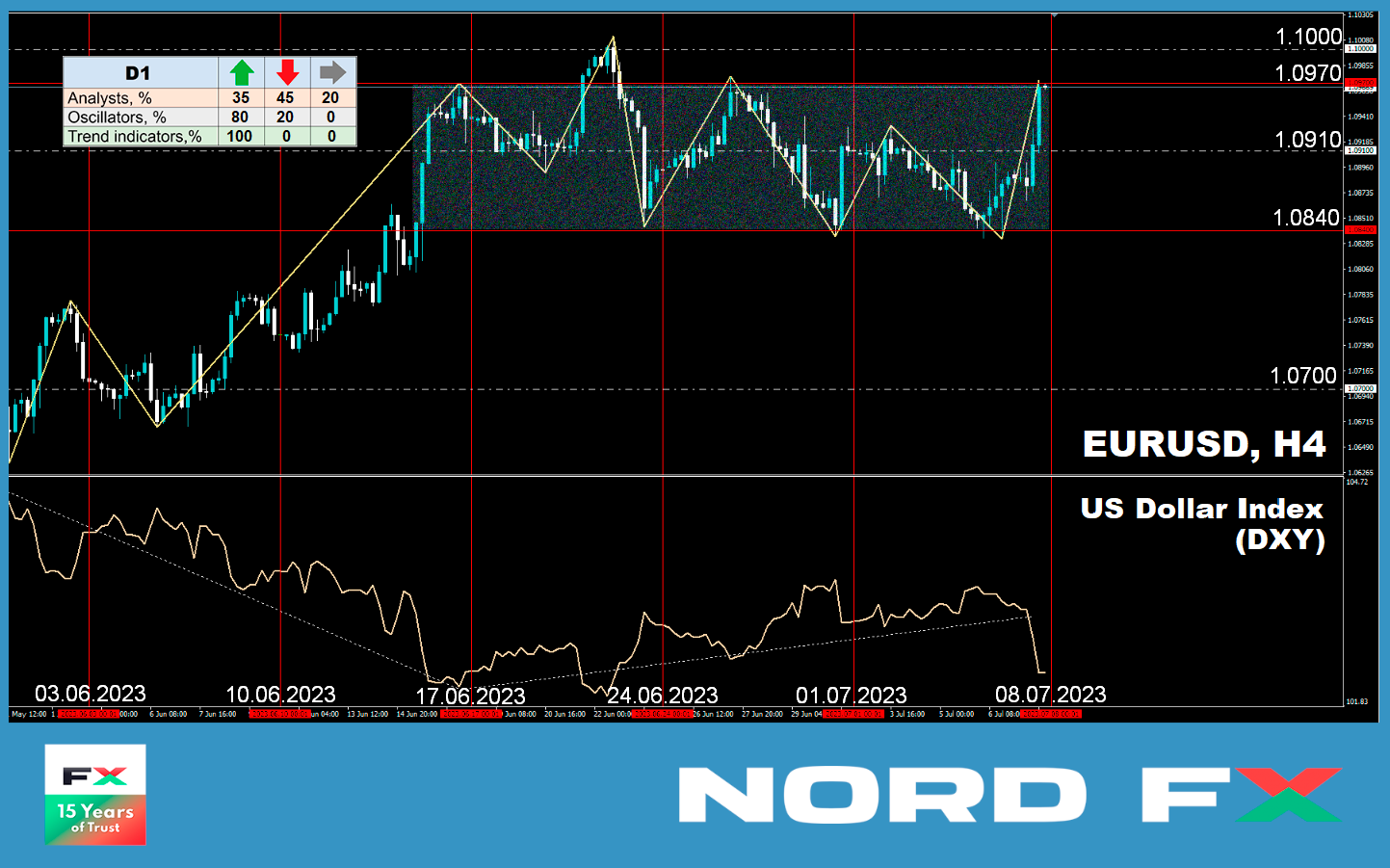

● The Greenback Index (DXY) steadily elevated throughout the previous week, main as much as Thursday, July 6. Because of this, EUR/USD was extra inclined in direction of the American foreign money, inflicting the pair to discover a native backside on the 1.0833 degree. The greenback’s power was pushed by the publication of the minutes from the Federal Open Market Committee’s (FOMC) final assembly on June 14. In it, the Committee members highlighted the dangers of inflationary strain and expressed a dedication to swiftly obtain their goal inflation ranges of two.0%. Additionally they famous the appropriateness of at the least another rate of interest hike, along with the one in July, which boosted confidence for DXY bulls. Recall that the pinnacle of the regulator, Jerome Powell, additionally said on the finish of June that the “overwhelming majority of Federal Reserve leaders count on two or extra price hikes by the top of the yr”.

● Every thing gave the impression to be going nicely for the greenback. Nonetheless, the statistics launched all through the week had been fairly combined, stirring doubts relating to the unwavering hawkish coverage of the regulator. On one hand, in response to the ADP report, employment within the US personal sector, with a forecast of 228K, truly grew by 497K in June, considerably greater than the 267K in Could. Then again, the JOLTS job openings index stood at 9.82 million in Could, down from 10.3 million the earlier month and falling wanting the anticipated 9.935 million. The US manufacturing PMI index, which has been falling for eight consecutive months, disillusioned as nicely, reaching 46.0 in June – the bottom degree since Could 2020. Commenting on these figures, Chris Williamson, Chief Enterprise Economist at S&P World Market Intelligence, said that “the well being of the US manufacturing sector deteriorated sharply in June, and that is fuelling fears that the economic system could slide into recession within the second half of the yr”.

These fears had been additional exacerbated by renewed commerce tensions between the US and China. In opposition to this backdrop, market contributors are questioning whether or not the Fed will dare to make one other rate of interest hike after the July one? (The market has lengthy taken under consideration the speed enhance on July 27 from 5.25% to five.50% in its quotations.) Or will the regulator announce the top of the present financial tightening cycle? The most recent batch of labour market knowledge launched on Friday, July 7, might assist reply this query.

The figures turned out to be disappointing for DXY bulls. Non-Farm Payrolls (NFP), a key barometer of potential financial cooling in the US, confirmed that the variety of new jobs created exterior the agricultural sector decreased to 209K in June. This determine is decrease than each the Could worth of 306K and the forecast of 225K. As for the expansion of common hourly wages, in response to the report from the US Bureau of Labor Statistics, this indicator remained on the earlier degree: 4.4% YoY and 0.4% MoM. The one market expectation that was met was the unemployment price, which decreased from 3.7% to three.6% over the month.

● Following the discharge of such knowledge, greenback sellers returned to the market, and EUR/USD ended the work week on the 1.0968 degree. As for the near-term prospects, on the time of scripting this evaluation on the night of July 7, 35% of analysts forecast additional development for the pair, 45% anticipate a decline, and the remaining 20% took a impartial stance. Among the many oscillators on D1, 80% favour the bulls, 20% the bears, and all pattern indicators are leaning in direction of bullish. The closest help for the pair is positioned round 1.0895-1.0925, adopted by 1.0835-1.0865, 1.0790-1.0800, 1.0740, 1.0670, and at last, the Could thirty first low of 1.0635. The bulls will meet resistance within the 1.0975-1.0985 space, adopted by 1.1010, 1.1045, 1.1090-1.1110.

● The upcoming week brings a complete bundle of US client inflation knowledge that would have probably the most important affect on the Federal Reserve’s future financial coverage. The Client Worth Index (CPI) values, together with the core, will likely be printed on Wednesday, July 12. The following day, on Thursday, July 13, we’ll get data on key indicators such because the variety of preliminary jobless claims and the US Producer Worth Index (PPI). On Friday, as a ‘cherry on high’, we’ll be introduced with the College of Michigan’s Client Confidence Index. As for vital European statistics, the German Client Worth Index (CPI) will likely be printed on Tuesday.

GBP/USD: Prospects for a Bullish Development

● Previously week, the pound clearly grew to become the beneficiary in GBP/USD. As of June 29, the British foreign money was buying and selling on the 1.2600 degree, and by July 7, it had already reached a excessive of 1.2848.

The pound was buoyed by weak manufacturing exercise and labor market knowledge within the US, and doubts in regards to the continuation of the Fed’s hawkish stance. It was additionally helped by the truth that the UK Manufacturing Buying Managers’ Index (PMI) got here in at 46.5 in June, which, though decrease than the earlier determine of 47.1, was above the market expectation of 46.2. In opposition to this backdrop, the probability of additional lively tightening of financial coverage by the Financial institution of England (BoE) is virtually past doubt. Following its conferences in Could and June, the BoE raised rates of interest by 25 foundation factors and 50 foundation factors to five.00%. Many analysts consider that the regulator might push it as much as 5.50% within the subsequent two conferences, after which even as much as 6.25%, regardless of the specter of an financial recession. In such a state of affairs, the British foreign money has a big benefit. For instance, at Credit score Suisse, they consider that GBP/USD nonetheless has potential to develop to 1.3000.

● The pair ended the previous week on the 1.2838 degree. “The pattern momentum stays confidently bullish throughout short-term, medium-term, and long-term oscillators, suggesting that the push to 1.2850 (and past) remains to be in play,” Scotiabank economists write. In concept, with the present volatility, GBP/USD might cowl the remaining distance to 1.3000 in only a few weeks and even days. Nonetheless, at this level, solely 25% of consultants help this state of affairs. The alternative place was taken by 45%, and neutrality was maintained by 30%.

As for technical evaluation, 90% of the oscillators on D1 level to the north (1 / 4 are within the overbought zone), and 10% want to the east. 100% of the pattern indicators advocate shopping for. In case of the pair’s motion to the south, it can discover help ranges and zones at 1.2755, 1.2680-1.2700, 1.2590-1.2625, 1.2480-1.2510, 1.2330-1.2350, 1.2275, 1.2200-1.2210. In case of the pair’s development, it can meet resistance on the ranges of 1.2850, 1.2940, 1.3000, 1.3050 and 1.3185-1.321.

● Notable occasions for the upcoming week embrace a speech by Financial institution of England Governor Andrew Bailey on Monday, July 10, and the discharge of the UK’s labour market knowledge on Tuesday, July 11.

USD/JPY: The Pair’s Interrupted Flight and Triumph of the Bears

● What consultants had lengthy been ready for has lastly occurred: USD/JPY interrupted its “moon flight” and switched to an emergency decline. Extra exactly, it was not only a decline, however an actual crash. The rationale for it, after all, was weak macroeconomic knowledge from the U.S. since nothing has modified on the aspect of Japan. The coverage of the Financial institution of Japan (BoJ) stays unchanged. The Deputy Governor of the Central Financial institution, Shinichi Uchida, has not too long ago as soon as once more dominated out the potential of an early finish to ultra-soft financial coverage and exit from destructive rates of interest.

The financial coverage carried out by the Authorities and the Central Financial institution of Japan over the previous few years clearly signifies that the yen price, and even inflation, aren’t their high precedence, regardless that the CPI has accelerated to three.1% YoY. The principle factor is the financial indicators, and evidently every little thing is okay right here. The Tankan Index of Giant Producers printed on Monday, July 3, confirmed a formidable enhance from 1 to five (with a forecast of three), indicating an enchancment within the enterprise local weather within the nation.

● USD/JPY traded at 145.06 on June 30, and the minimal on July 7 was recorded at 142.06. Thus, in only a week, the yen managed to win again a full 300 factors from the greenback. The rationale for such a triumph of the bears is the oversold Japanese foreign money. As strategists of the French monetary conglomerate Societe Generale level out, the yen hasn’t been this low cost for the reason that Seventies. “Giant pricing errors can last more than we’re used to considering,” they write, “however this one is extraordinary, and as quickly as charges begin to convert once more, the yen will undoubtedly begin a rally.” Analysing the pair’s prospects, Societe Generale expects that the yield on 5-year U.S. bonds will drop to 2.66% in a yr, permitting USD/JPY to interrupt under 130. If the yield on Japanese authorities bonds (JGB) stays on the present degree, the pair has an opportunity to even drop to 125.00.

We famous within the final evaluation that Danske Financial institution economists predict a USD/JPY price under 130.00 on the horizon of 6-12 months. Strategists at BNP Paribas make an identical forecast – they aim the extent of 130.00 by the top of this yr and 123.00 by the top of 2024. The Wells Fargo prediction seems modest – its consultants consider that by the top of 2024, the pair will solely drop to 133.00.

● The previous week noticed USD/JPY finish at 142.10. On the time of scripting this evaluation, 60% of analysts consider that the southward motion is only a short-term correction, and that the pair will return to development within the coming days. The remaining 40% voted for its additional fall. The indications of indicators on D1 are fairly numerous. Amongst oscillators, 25% are colored inexperienced, 15% are impartial gray, and 60% are pink (with 1 / 4 signalling the pair’s oversold). Amongst pattern indicators, the stability of energy between inexperienced and pink is 50% to 50%. The closest help degree is within the zone of 1.4140-141.60, adopted by 140.45-140.60, 1.3875-1.3905, 137.50, 135.90-137.05. The closest resistance is 145.00-145.30, then the bulls might want to overcome obstacles on the ranges, 146.85-147.15, 148.85, and from there it isn’t far to the October 2022 peak of 151.95.

● No important financial data associated to the Japanese economic system is predicted to be launched within the upcoming week.

CRYPTOCURRENCIES: Three Development Triggers – The Federal Reserve, Halving, and Ladies

● The start of the summer time turned out to be fairly sizzling for the crypto business. On the one hand, regulators continued to tighten their grip on the sector. On the opposite, we’re witnessing a surge in institutional curiosity. At first, it’s purposes for the launch of spot bitcoin ETFs from such giants as BlackRock, Invesco, Constancy, and others.

Relating to regulatory strain, debates have been happening for over a yr. Some warmly welcome this course of, whereas others protest. The previous argue that it will cleanse the business of unscrupulous contributors and entice billions, if not trillions, of institutional {dollars} to the crypto market. The latter declare that the intervention of the identical US Securities and Trade Fee (SEC) fully breaks the principle precept of cryptocurrencies – independence from states and governments. “Legislation enforcement regulation is killing our economic system,” wrote Tim Draper, co-founder of enterprise capital agency Draper Fisher Jurvetson, on June 20. “I feel we now have an actual drawback as a result of the SEC is sowing worry… This obligatory regulation would not make sense.”.

● Be aware that the SEC has beforehand rejected all purposes to create spot ETFs on bitcoin. This time round, the Fee said that the contemporary purposes aren’t clear and complete sufficient. Nonetheless, corporations aren’t retreating and have already submitted edited variations. “Approval of purposes for a spot ETF on bitcoin will let buyers know that the primary cryptocurrency is a reputable asset,” explains MicroStrategy co-founder Michael Saylor. “If the SEC approves purposes for this asset, a person can press a button and purchase bitcoin for $10 million in 30 seconds.” “This is a vital milestone on the trail to institutional acceptance. I feel it is vital, though I do not assume bitcoin will develop to $5 million in a single day,” the billionaire concluded. Nonetheless, within the medium time period, in response to Hugh Hendry, supervisor of hedge fund Eclectica Asset Administration, bitcoin might triple its capitalization.

By the way in which, the aforementioned Tim Draper beforehand predicted that the value of bitcoin would attain $250,000 by the top of 2022. When his forecast didn’t come true, he prolonged the timing of its realization by one other six months till mid-2023. Now Draper has adjusted his forecast once more – in response to him, the principle cryptocurrency will attain the said aim with a 100% chance by the top of June 2025. Furthermore, one of many drivers of development would be the acceptance of bitcoin by ladies.

● Housewives paying for purchases with bitcoin can undoubtedly turn into a critical issue. Nonetheless, extra “conservative” analysts desire to level to 2 others: 1) the easing of the Federal Reserve’s financial coverage and a pair of) the upcoming bitcoin halving in April 2024. In anticipation of those two occasions, crypto exchanges are noting a lower in provide, and long-term holders have amassed a report variety of cash of their wallets: 13.4 million bitcoins.

Relating to level 1. At its June assembly, the Federal Reserve determined to take a pause and left the important thing rate of interest unchanged. Nonetheless, the potential of one or two extra hikes of 25 b.p. every isn’t dominated out. After this, the cycle of financial tightening could also be accomplished, and on the finish of 2023 – the start of 2024 markets count on a reversal and the beginning of a lower within the price. This could positively have an effect on buyers’ danger urge for food and facilitate the influx of capital, together with into digital belongings.

Level 2. Halving. This occasion additionally normally has a optimistic impact on bitcoin quotes. A correlation between the halvings that happen each 4 years and the dynamics of the coin’s worth has lengthy been famous. Analyst Root introduced an fascinating radial diagram on this matter. Making a circle in 4 years, the value varieties the cycle’s peaks and troughs in the identical sectors. And, in response to this diagram, after discovering the underside in 2023, bitcoin ought to transfer in direction of a worth of $1 million per coin, which it can attain in 2026.

● As for the close to future, CoinDesk researchers consider that market contributors ought to now be doubly cautious when buying and selling cryptocurrency. The actual fact is that for the reason that IV quarter of 2022, fiat liquidity indicators worldwide are quickly declining, and the expansion of BTC quotes in such circumstances is an anomaly. The BTC price reached an area worth backside on the $15,500 mark final November and since then has doubled to $31,000. Furthermore, since June 15 alone, the value has jumped by greater than 20%.

In line with Decentral Park Capital’s portfolio supervisor Lewis Harland, the state of affairs stays sophisticated. He confirmed that not too long ago tracked fiat indicators, equivalent to the online liquidity of the Fed and the worldwide degree of web liquidity, have fallen sharply. “That is the principle motive why we’re cautious about BTC, regardless of the optimistic market consensus. We predict buyers are overlooking this,” added Harland. (The worldwide web liquidity indicator, which accounts for fiat provide in a number of main nations, has dropped to $26.5 trillion – the bottom degree since November 2022. These knowledge had been offered by TradingView and Decentral Park Capital).

Anomalous, within the opinion of a number of specialists, can also be the drop in correlation between bodily and digital gold. Whereas the value of bitcoin exhibits explosive development, the worth of gold is step by step lowering. Fred Thiel, CEO of Marathon Digital, a mining firm, steered that this not solely signifies a change in priorities in favour of digital belongings but in addition demonstrates that bitcoin is turning into extra accessible to a wider vary of buyers.

Euro Pacific Capital President Peter Schiff disagrees with these theses. In line with this ardent gold supporter, most buyers do not truly consider in bitcoin, however are solely hoping that somebody will purchase it from them at a better worth. “The fast fall within the worth of the primary cryptocurrency is only a matter of time. The height we noticed in 2021, round $70,000, is it. And in the end bitcoin will explode,” stated Schiff, including that tales about folks shedding cash on cryptocurrency will eclipse tales about folks getting wealthy on it.

● In line with famend analyst Benjamin Cowen, the decline in fiat liquidity will primarily negatively affect not bitcoin, however altcoins. “Liquidity is drying up, so folks see relative security in bitcoin in comparison with the altcoin market,” the specialist believes. “However that does not imply bitcoin cannot fall; it simply means it is somewhat safer.”

In line with Cowen’s forecast, bitcoin might rise about 14% in comparison with present ranges and attain a most of $35,000 in 2023. “Within the brief time period, it is actually laborious to say if bitcoin can rise somewhat once more. For myself, I set a goal of $35,000,” the analyst stated.

The crypto dealer often called Altcoin Sherpa is assured that the principle cryptocurrency can first rise to $32,000 after which to a brand new 2023 excessive of $40,000. Nonetheless, he isn’t so positive in regards to the $40,000 mark. After that, there must be a big correction downwards.

● In line with technical evaluation, the BTC/USD cryptocurrency pair could also be forming a brand new “bullish flag” sample on the chart. This opinion was expressed by consultants from Fairlead Methods. They said, “Bitcoin is digesting its positive factors throughout the consolidation section. A possible new bullish flag is forming, which might happen with a breakthrough above the weekly Ichimoku cloud round $31,900.”

The consultants defined that this sample consists of a pole and a flag. The pole represents the preliminary worth rally, whereas the flag represents subsequent consolidation attributable to “short-term exhaustion of bullish sentiment” and an absence of robust promoting strain. In line with the idea of technical evaluation, as soon as the asset breaks above the flag’s boundary worth, it tends to rise by a distance roughly equal to the size of the pole.

Within the case of bitcoin, the upward motion from the low on June 15, 2023, at $24,790 to the excessive on June 23 at $31,388 represents the pole, and the following consolidation fashioned the flag. In line with analysts, a possible breakthrough for BTC would enable the cryptocurrency’s worth to achieve the subsequent key resistance degree at $35,900.

● In line with crypto strategist and dealer Bluntz, who precisely recognized the underside of the bear marketplace for bitcoin in 2018, he has now offered a forecast relating to ethereum. He believes that the main altcoin is displaying all of the indicators of a robust rally that would happen within the coming months. In line with the crypto strategist, the remaining a part of 2023 might set ethereum up for parabolic development, surpassing bitcoin considerably.

Bluntz is taken into account an skilled practitioner of technical evaluation, notably Elliott Wave Concept, which permits for worth behaviour forecasting primarily based on crowd psychology, usually manifesting in waves. In line with this concept, a bullish asset reveals a five-wave rally, with the third wave signalling the steepest ascent. Bluntz means that ethereum is already within the early phases of the third wave surge, which might result in ETH approaching $4,000 earlier than the top of 2023.

In distinction, Altcoin Sherpa made an opposing forecast. Taking a look at ETH/BTC, he famous that ethereum is prone to decline in relation to the flagship cryptocurrency and goal for the decrease finish of the vary round 0.053 BTC, or $1,614.

● As of the time of writing the evaluation, Friday night, July 7, BTC/USD is buying and selling round $30,200, and ETH/USD is within the vary of $1,860. The general cryptocurrency market capitalization has decreased and stands at $1.176 trillion ($1.191 trillion per week in the past). The Crypto Worry & Greed Index stays on the border between the Greed and Impartial zones, at the moment at 55 factors (56 factors per week in the past).

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]