[ad_1]

EUR/USD: Why the Greenback Continues to Rise

● We titled our final week’s evaluation “Why the Greenback Rose” and detailed the explanations for the strengthening of the American forex. It is becoming to call at this time’s contemporary evaluation “Why the Greenback Continues to Rise,” and naturally, we’ll reply this query.

● The DXY greenback index has been on the rise for the previous two weeks, reaching a mark of 103.485 on Could 18. That is the best it has been since March 2023. This coincides with growing possibilities of a brand new rate of interest hike on the upcoming Federal Open Market Committee (FOMC) assembly of the U.S. Federal Reserve on June 14.

A possible U.S. authorities debt default may have dampened the hawkish sentiment of the American Central Financial institution. Nevertheless, firstly, the Federal Reserve has developed a system of measures since 2011 to mitigate the results of a U.S. default on its obligations. Secondly, and most significantly, it is unlikely they must resort to such quantitative easing (QE). President Joe Biden has expressed confidence in reaching a take care of the Republicans. Moreover, the Republican Home Speaker, Kevin McCarthy, has confirmed {that a} vote on the debt ceiling will happen subsequent week.

● Markets have responded to this with optimism and confidence that an financial and monetary market disaster will be averted. This has boosted not solely the greenback but in addition the S&P500, Dow Jones, and Nasdaq inventory indices (noting that such a mix is extraordinarily uncommon). Because of this, the chance of elevating the important thing rate of interest to five.5% has reached 33% (the probabilities have been near 0% at first of Could).

Lorie Logan, the president of the Federal Reserve Financial institution (FRB) of Dallas, and her colleague from St. Louis, James Bullard, are ready to vote for financial tightening. Raphael Bostic, the top of the FRB of Atlanta, doesn’t rule out that after a pause in June, the speed could possibly be raised on the July assembly. Neil Kashkari, the president of the FRB of Minneapolis, has additionally made hawkish statements. He agreed {that a} banking disaster could possibly be the supply of the financial slowdown. Nevertheless, in his view, the labor market stays fairly sturdy, inflation, though considerably weakened, nonetheless considerably exceeds the goal stage of two.0%, so it is too early to speak about easing financial coverage.

● EUR/USD fell to a stage of 1.0760 on Friday, Could 19, after which the decline ceased. This slowdown was aided by a press release from European Central Financial institution President Christine Lagarde, who stated that just like the Fed, the ECB “will boldly make the mandatory selections to return inflation to 2%”. Clearly, this may require additional tightening of credit score and financial coverage (QT) and a fee hike, as inflation (CPI) within the Eurozone is reluctant to lower. Statistics printed on Wednesday, March 17, confirmed that in annual phrases it had elevated over the month from 6.9% to 7.0%.

Economists from the Canadian funding financial institution TD Securities (TDS) consider that the deposit fee for the euro will rise from the present 3.25% to 4.00% by September and shall be maintained at this stage till mid-2024. Accordingly, after an increase of 75 foundation factors (bps), the important thing rate of interest will attain 4.5%.

● The image of the previous week can be incomplete with out the ultimate half, aptly titled “Why the Greenback Fell.” This occurred on the night of Friday, Could 19, because of the identical Fed. Extra exactly, its chairman Jerome Powell. Earlier within the day, he acknowledged that inflation was a lot larger than the goal, this created vital difficulties, and due to this fact it wanted to be introduced again to 2%. This speech had no impression on market members because it utterly aligned with their expectations. Nevertheless, in his second speech on the finish of the buying and selling week, Powell managed to shock the market. In accordance with him, the latest banking disaster, which led to a tightening of credit score requirements, has decreased the necessity for rate of interest hikes. “Our fee might not have to rise as a lot as we want,” Powell stated, including that “the markets have priced in a unique fee hike state of affairs than what the Fed is forecasting.”

● Following these phrases, EUR/USD rallied north, closing the previous week at a stage of 1.0805. As for the close to future, as of the night of Could 19, when this evaluation was written, most analysts (55%) anticipate the greenback to proceed strengthening. Northward corrections are anticipated by 30%, and the remaining 15% have taken a impartial place. Among the many oscillators on D1, 100% are colored crimson (though 1 / 4 of them are signalling that the pair is oversold). Among the many development indicators, 75% level south, and 25% look north. The closest help for the pair is situated round 1.0740-1.0760, adopted by zones and ranges of 1.0680-1.0710, 1.0620, and 1.0490-1.0525. Bulls will meet resistance round 1.0820-1.0835, then 1.0865, 1.0895-1.0925, 1.0985, 1.1045, 1.1090-1.1110, 1.1230, 1.1280, and 1.1355-1.1390.

● Noteworthy occasions for the upcoming week embody the publication of Germany’s enterprise exercise (PMI) and enterprise local weather (IFO) indices on Could 23 and 24, respectively. Additionally, the minutes of the final FOMC assembly shall be launched, on Wednesday, Could 24. We’ll know the GDP values of Germany and the US (preliminary) for Q1 2023, in addition to information from the US labour market, on Thursday, Could 25. To spherical off the working week, we predict information on US core sturdy items orders and private consumption expenditures on Friday, Could 26.

GBP/USD: BoE Hints at a Dovish Flip

● The plunge on Could 11 and 12 resulted in GBP/USD being unable to take care of its place above the sturdy 1.2500 help stage. On the previous week of Could 18, the pair reached the following, no much less vital, help stage, however could not break by means of it. After a number of makes an attempt to drop under 1.2391, the pair reversed and headed north, ending the week at 1.2445.

● The financial system of the UK at the moment, to place it mildly, does not look good. Inflation continues to be measured in double digits. And whereas common inflation slowed down a bit over the month, dropping from 10.4% to 10.1%, meals inflation, alternatively, is hovering: it has already reached 19.1% and will quickly cross into the third decade.

When it comes to bankruptcies, the UK ranked third on the earth in March, after Switzerland and Hong Kong. Furthermore, the wave of obligatory liquidations may flip right into a full-blown tsunami because the Electrical energy Invoice Help Program involves an finish. And if the federal government does not prolong it, many extra companies shall be buried beneath new payments. The one barely reassuring factor is that the business’s share of the nation’s GDP is lower than 20%. The service sector, which consumes considerably much less vitality, contributes about 75% of GDP.

● The pound may have been supported by additional tightening of the Financial institution of England’s (BoE) financial coverage. Nevertheless, judging by the latest statements of its leaders, the cycle of fee hikes is coming to an finish, with the final improve most certainly in June. Deputy Governor of the BoE, Dave Ramsden, talking earlier than the UK Parliament’s Treasury Choose Committee, acknowledged that whereas quantitative tightening (QT) does have some impact on the financial system, it’s fairly insignificant. One other Deputy Governor, Ben Broadbent, introduced a discount in QT volumes to disrupt market liquidity. Nevertheless, he was solely speaking concerning the volumes of bond gross sales, however general, the route of motion is clear.

● Commerzbank strategists rightly consider that the BoE’s indecision in combating inflation is placing heavy stress on the pound. Their colleagues from the Internationale Nederlanden Groep (ING) speak concerning the risk that if the Financial institution of England maintained its hawkish stance, GBP/USD may advance to the 1.3300 mark by the tip of the 12 months. However will it keep this stance?

At current, speaking concerning the near-term prospects for the pair, 35% of consultants keep a bullish outlook, 55% choose bears, and the remaining 10% choose to abstain from forecasts. Amongst oscillators on D1, 75% advocate promoting (20% are within the oversold zone), 10% are set to purchase and 15% are painted in impartial grey. Pattern indicators, as per week in the past, have a 50% to 50% ratio of forces between crimson and inexperienced. Assist ranges and zones for the pair are 1.2390-1.2420, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1,2025, 1.1960, 1.1900-1.1920, 1.1800-1.1840. When the pair strikes north, it’s going to meet resistance on the ranges of 1.2480, 1.2510, 1.2540, 1.2570, 1.2610-1.2635, 1.2675-1.2700, 1.2820 and 1.2940.

● Key occasions for the approaching week within the calendar embody Tuesday, Could 23, when preliminary enterprise exercise (PMI) information will arrive from varied sectors of the UK financial system. The following day will reveal the worth of one of many foremost indicators of inflation ranges, the Client Value Index (CPI) within the nation, adopted by two speeches by the Financial institution of England’s head, Andrew Bailey. Lastly, the amount of retail gross sales within the UK shall be disclosed on Friday, Could 26.

USD/JPY: The Yen Will get Knocked Down

● In April, the yen was the worst forex within the DXY basket. On ultra-dovish statements from the brand new Financial institution of Japan (BoJ) Governor Kazuo Ueda, USD/JPY soared to a peak of 137.77 by Could 2. After that, the banking disaster in the USA got here to assistance from the yen, taking part in the position of a secure haven, and the pair turned downwards. However not for lengthy…

Ueda as soon as once more struck on the nationwide forex, commenting on Japanese inflation information. He acknowledged that “the present inflation improve is because of exterior components and rising prices, not a strengthening of demand”, that “inflation in Japan is prone to gradual to under 2% in the course of the present fiscal 12 months” and that “tightening financial coverage would hurt the financial system”. The yen was additionally undermined by the GDP information for Japan printed on Could 17. If the nation’s financial system fell within the third and fourth quarters of 2022, then within the first quarter of 2023, it confirmed a rise of 1.6% YoY.

So, if inflation falls even under 2.0% by the center of the 12 months, and GDP grows, why ought to the central financial institution change something in its financial coverage and lift the rate of interest? Let it keep on the earlier detrimental stage of -0.1%. That is precisely what the market members thought, sending the yen into the abyss, and USD/JPY into flight. Because of this, it up to date a six-month excessive, reaching the peak of 138.74 on Could 18. The speech by the Fed Chair on the night of Friday, Could 19, barely weakened the greenback, and the tip of the week the pair met on the stage of 137.93.

● In fact, this flight wouldn’t have been potential with no strengthening greenback and U.S. Treasury bonds. It’s recognized that there’s historically a direct correlation between ten-year treasuries and USD/JPY. If the yield on securities goes up, so does the pair. And final week, in opposition to the backdrop of the hawkish temper of the Fed, the yield rose by 8%. One other piece of not very nice information for the Japanese forex is that SWIFT information confirmed that in April, the usage of the greenback in cross-border funds elevated from 41.74% to 42.71%, whereas the share of the yen, quite the opposite, fell from 4.78% to three.51%.

● Concerning the near-term prospects for USD/JPY, the votes of analysts are distributed as follows. For the time being, 35% of analysts vote for the strengthening of the Japanese forex. 45% of consultants anticipate a continuation of the flight to the Moon, 20% stay impartial. Among the many indicators on D1, absolutely the benefit is on the aspect of the greenback: 100% of development indicators and oscillators level north (though among the many latter 20% sign the pair is overbought). The closest help stage is within the 137.30-137.50 zone, adopted by ranges and zones at 136.70, 135.95-136.30, 134.85-135.15, 134.40, 133.60, 132.80-133.00, 132.00, 131.25, 130.50-130.60, 129.65, 128.00-128.15 and 127.20. The closest resistance is 138.30-138.75, then the bulls might want to overcome obstacles at ranges 139.05, 139.60, 140.60, 142.25, 143.50 and 144.90-145.10.

● There isn’t any vital financial info associated to the Japanese financial system anticipated to be launched within the upcoming week.

CRYPTOCURRENCIES: Bitcoin Has No Intention of Retreating

● Bitcoin has been beneath stress from sellers for the ninth consecutive week. Nevertheless, regardless of the problem, it manages to carry on, counting on sturdy help within the $26,500 zone, stopping it from falling to $25,000 and decrease. The bearish assault try on Friday, Could 12, was unsuccessful: after dropping to $25,800, BTC/USD reversed course and reached an area excessive of $27,656 on Could 15. In accordance with some consultants, traders appear prepared to purchase. Nevertheless, there are not any triggers for a bullish impulse. Market members are targeted on the prospects of a US debt default on June 1, which is inflicting them to chorus from any vital exercise. On the similar time, there’s an atypical scenario the place each the Greenback Index (DXY) and inventory indices are rising concurrently. This preservation of investor danger urge for food undoubtedly supplied help to the cryptocurrency market.

Gold stays within the first place on the record of safe-haven belongings. Although the value of the dear steel is at the moment close to its historic excessive ($2,000 per ounce), it was chosen by about half of the surveyed traders from each classes. The Bloomberg report highlights the present deficit of different belongings to hedge in opposition to gold.

US Treasury payments grew to become the second hottest asset (bought by 14-15% of respondents). Bloomberg journalists see some irony on this, as these debt devices might doubtlessly default. Bitcoin is available in third place, barely behind the greenback, adopted by the Japanese yen and the Swiss franc.

● The debates within the US Congress concerning the debt ceiling have been comparatively lacklustre final week. Influencers’ statements on the ceiling (and the “backside”) for bitcoin have been equally sluggish and unsure. For instance, enterprise billionaire Chamath Palihapitiya acknowledged that, on one hand, the devaluation of the greenback actually stimulates the US financial system, and the dominant place of the greenback within the international financial system stays undisputed. Nevertheless, alternatively, he believes that in the long run, the US authorities is prone to face forex devaluation, and due to this fact, it’s advisable to spend money on dangerous belongings reminiscent of shares and cryptocurrencies.

● Paul Tudor Jones, the top of hedge fund Tudor Funding Company, who has at all times been a proponent of investing in bitcoin, has now acknowledged that the main cryptocurrency has turn out to be much less enticing within the present regulatory and financial scenario. He famous that bitcoin is at the moment going through actual issues as a result of your entire regulatory equipment in the USA is in opposition to cryptocurrencies. Moreover, the billionaire expects a lower in inflation within the US, which makes hedging belongings much less interesting. Bitcoin is commonly perceived as an asset for defense in opposition to inflation.

Paul Tudor Jones himself continues to carry a small quantity of bitcoin and has no intention of promoting the cryptocurrency even within the distant future. Nevertheless, it seems that he has deserted his earlier plans to take a position as much as 5% of his wealth in BTC. Maybe he has determined to attend out these unsure instances.

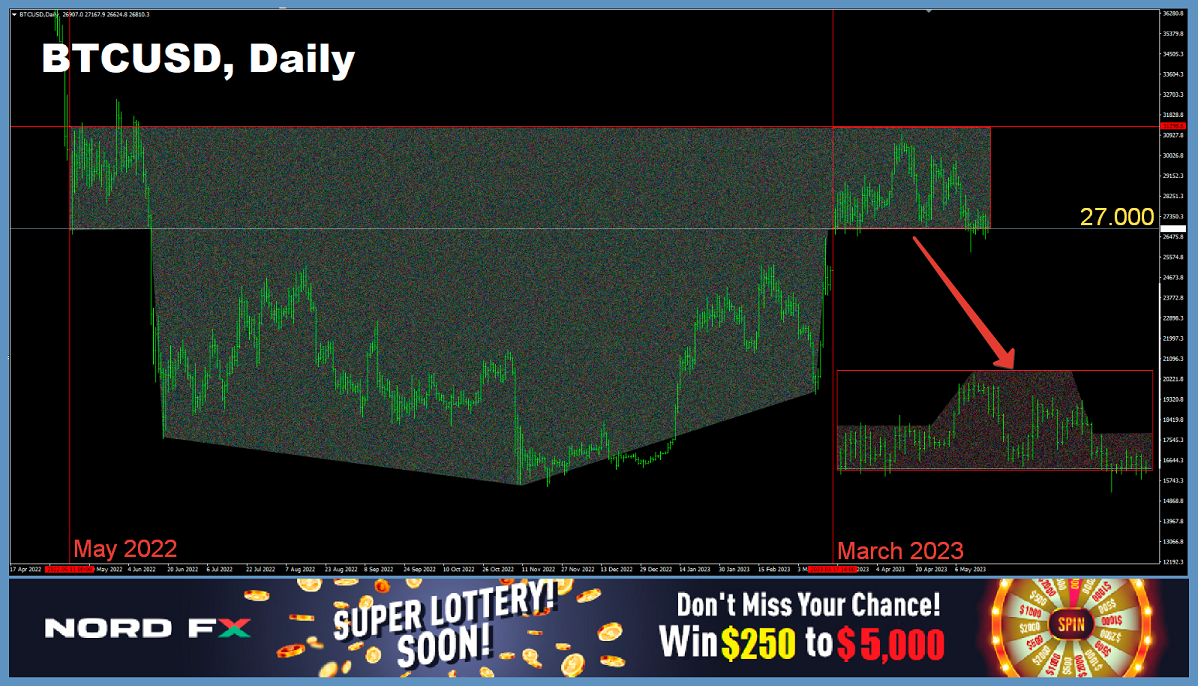

● Mark Yusko, the founder and CEO of cryptocurrency hedge fund Morgan Creek Digital, has reiterated his prediction of an inevitable bull rally within the digital asset market. He believes that the “crypto summer time” is prone to start in mid-June. In accordance with him, bitcoin may already make a major breakthrough as a technical reversal sample is forming on the chart. “If you happen to take a look at the chart [starting from May 2022], you may see that it is an exquisite inverted head and shoulders sample on the $27,000 stage,” Yusko writes. “It is a actually attention-grabbing technical sample. And you recognize, I believe we want some excellent news to provide it a lift.” (Concerning the necessity for excellent news, one can solely agree with Mark Yusko. Nevertheless, in the event you take a look at the chart ranging from March 17-18, 2023, the top and shoulders sample would level in the wrong way).

● Glassnode, too, anticipates the arrival of the primary summer time month. “We’re assured in our medium-term goal of $35,000 as exterior pressures ease. The Federal Reserve will pause its rate of interest hike in June […] – optimum for upward motion [of bitcoin] all through the summer time. The greenback index has crossed under a major transferring common – explosive actions are forward,” analysts from the company clarify.

● Although summer time is approaching, it has not but arrived. As of the night of Friday, Could 19, BTC/USD is at the moment buying and selling at $26,850. The whole market capitalization of the crypto market stands at $1.126 trillion ($1.108 trillion per week in the past). The Crypto Worry & Greed Index has remained comparatively unchanged over the previous seven days and is within the Impartial zone at 48 factors (49 factors per week in the past).

● And to conclude the evaluation, with the intention to brighten up the tranquil state of the crypto market, let’s focus on a sensation. Debates have ignited on-line concerning the primary buy made with BTC. It seems that the legendary pizza might not have been the precise first buy. It has been found that in 2010, a consumer named Sabunir tried to promote a JPEG picture for 500 bitcoins, which was price about $1 on the time. As proof, a screenshot indicating the date of January 24, 2010, has been introduced, which is 4 months previous to Laszlo Hanyecz’s well-known pizza buy of 10,000 BTC. Additionally it is claimed {that a} consumer named Satoshi Nakamoto even tried to take part within the shopping for/promoting course of.

Nevertheless, doubts remained as as to whether it was merely an tried sale or if the transaction really passed off. To dispel the doubt, Matt Lohstroh, co-founder of Gige Vitality, carried out his personal investigation. In accordance with the obtained on-chain information, on January 24, 2010, 500 BTC (equal to roughly $13.3 million on the present trade fee) have been certainly acquired in Sabunir’s pockets. Because of this the transaction did happen, and due to this fact, this picture is certainly the world’s first merchandise bought with BTC.

So now, as a substitute of celebrating the annual Pizza Day on Could 22, will crypto fans should mark January 24 because the Day of the JPEG Picture? However what concerning the “Bitcoin Pizza” pizzeria owned by Morgan Creek co-founder Anthony Pompliano? Evidently “JPEG Pizza” does not sound fairly as appetizing.

NordFX Analytical Group

Discover: These supplies usually are not funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]