[ad_1]

The hole between the need for annuities and precise holdings possible because of logistical impediments.

My colleagues, Karolos Arapakis and Gal Wettstein, have simply printed a very attention-grabbing paper on the “annuity puzzle.” That’s, whereas financial fashions predict that many individuals could be higher off with annuities, solely a small portion of retirees really maintain an annuity. Economists have spent the previous couple of many years figuring out the explanation why people won’t need to annuitize. In distinction, Karolos and Gal discover that a lot of folks appear to need annuities however are stymied by logistical impediments to truly buying them.

Their conclusions emerge from a survey, performed by Greenwald Analysis in June of 2023, of 1,216 people ages 55-95 who’ve no less than $100,000 in investable property. The evaluation included a randomized management trial (RCT) module that cut up the members into three teams. Within the management group, the trial elicited every client’s minimal annual lifetime annuity cost at which they might purchase an annuity for a $100,000 premium. Therapy Group 1 was supplied the identical annuity however with a function that any remaining premium could be paid to the decedent’s heirs. Therapy Group 2 was supplied the identical annuity because the management group, however with a liquidity function whereby purchasers may break the contract and withdraw the remaining premium.

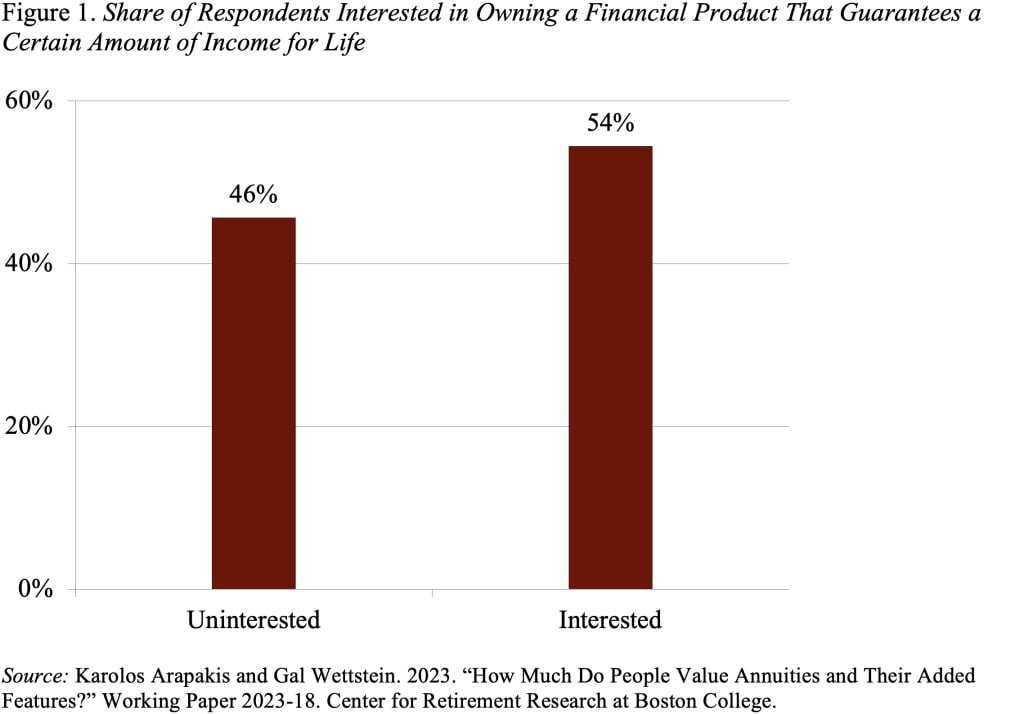

Earlier than the RCT started, all respondents had been probed relating to their views on annuities. Seventy-six p.c mentioned that theythought it was precious to personal a monetary product that ensures a certain quantity of revenue for all times, and 60-76 p.c of respondents agreed that merchandise with lifetime advantages present peace of thoughts, defend towards residing a very long time, and protect homeowners from inventory market threat. Crucially, 54 p.c of these with out an annuity mentioned that they had been no less than considerably enthusiastic about proudly owning a product with lifetime revenue (see Determine 1).

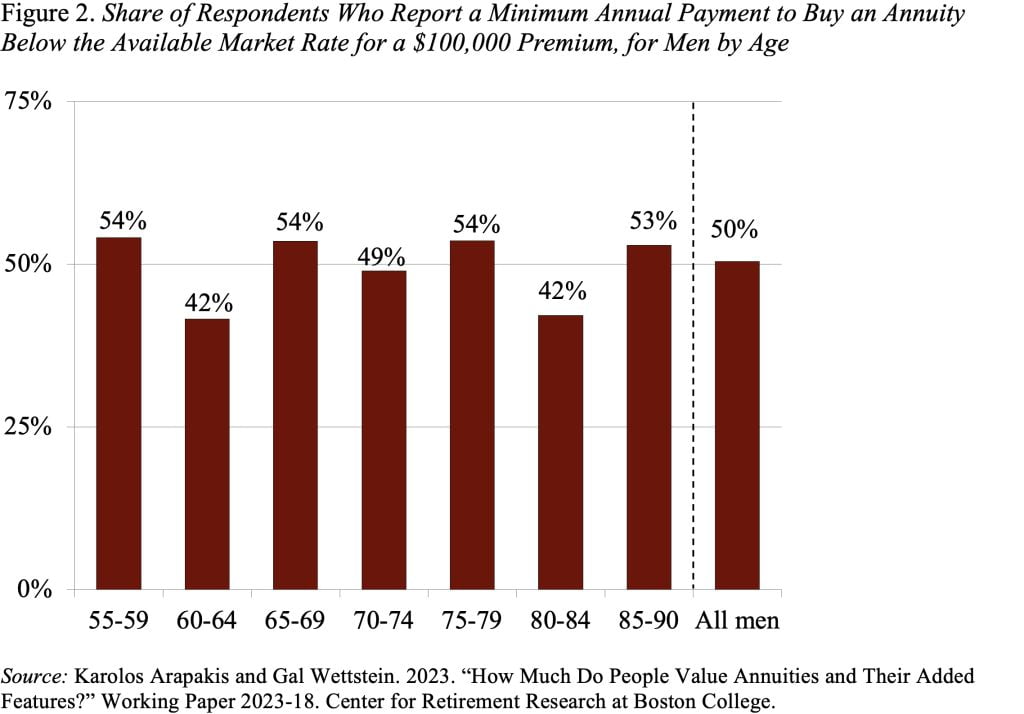

Direct questions on annuities, nevertheless, can’t inform us whether or not persons are possible to purchase the product. That’s, annuities could also be nice, however potential clients may merely view them as not value the fee. To handle this difficulty, the survey requested respondents within the management group how a lot assured annual revenue they might require to be prepared to pay a $100,000 premium. Roughly half of respondents’ required funds had been decrease than the funds they might have gotten from annuities offered available on the market to clients with their very own age and gender on the time the survey was fielded. Determine 2 exhibits this outcome by age group for males. The outcomes for girls look very comparable.

(Surprisingly, the outcomes additionally present that individuals weren’t prepared to pay extra for annuities with the added bequest function (supplied to Group 1) and entry to liquidity (supplied to Group 2).)

The discovering that fifty p.c of respondents are prepared to purchase annuities at prevailing market charges – far in extra of the share of respondents who even have an annuity – contrasts sharply with the present concentrate on explanations for why people don’t need to annuitize. As an alternative, the outcomes counsel that individuals need annuities however face logistical impediments round how precisely to go about shopping for them.

[ad_2]