[ad_1]

What’s a CFO KPI?

A CFO Key Efficiency Indicator (KPI) or metric is a quantifiable excessive stage measure of economic efficiency. These KPIs could be thought-about a particular subset of economic KPIs, used to assist a CFO make knowledgeable choices that steer their firm in the best path. These efficiency metrics will also be used to measure an organization’s monetary efficiency relative to rivals in the identical business. Publicly traded corporations publish this data in quarterly studies for buyers.

What KPIs Needs to be in a CFO’s Dashboard?

To find out what CFO KPIs are essential, we must always first have a look at what CFOs must cope with regularly. Most CFOs must cope with two main duties at work aside from attending 1000’s of conferences – making essential monetary choices for the corporate, and monetary reporting. To assist a CFO with these duties, a really particular set of economic KPIs have turn into commonplace and are thought-about customary apply. Fortunately, a number of the KPI gurus at insightsoftware have made a tidy little checklist for us.

Prime 5 Excel Ideas & Methods Each Finance Supervisor Ought to Know

Listed below are the CFO KPI examples that we’ll be going over on this publish:

- Fast Ratio

- Present Ratio

- Working Capital

- Working Money Circulation

- EBITDA & EBITDA Progress

- Return on Fairness

- Whole-Debt-to-Fairness Ratio

- Accounts Payable Turnover

- Money Conversion Cycle

- Gross Revenue Margin

- Earnings per Share

- Compound Common Progress Fee

- Worker Rely

- Curiosity Protection Ratio

Whereas this checklist will not be extraordinarily lengthy, it does require lots of knowledge and knowledge processing to generate these KPIs. Most corporations will make use of CFO dashboard software program to automate all the knowledge gathering, processing, and visualization course of. Listed below are a number of of the totally different dashboards that insightsoftware has to supply:

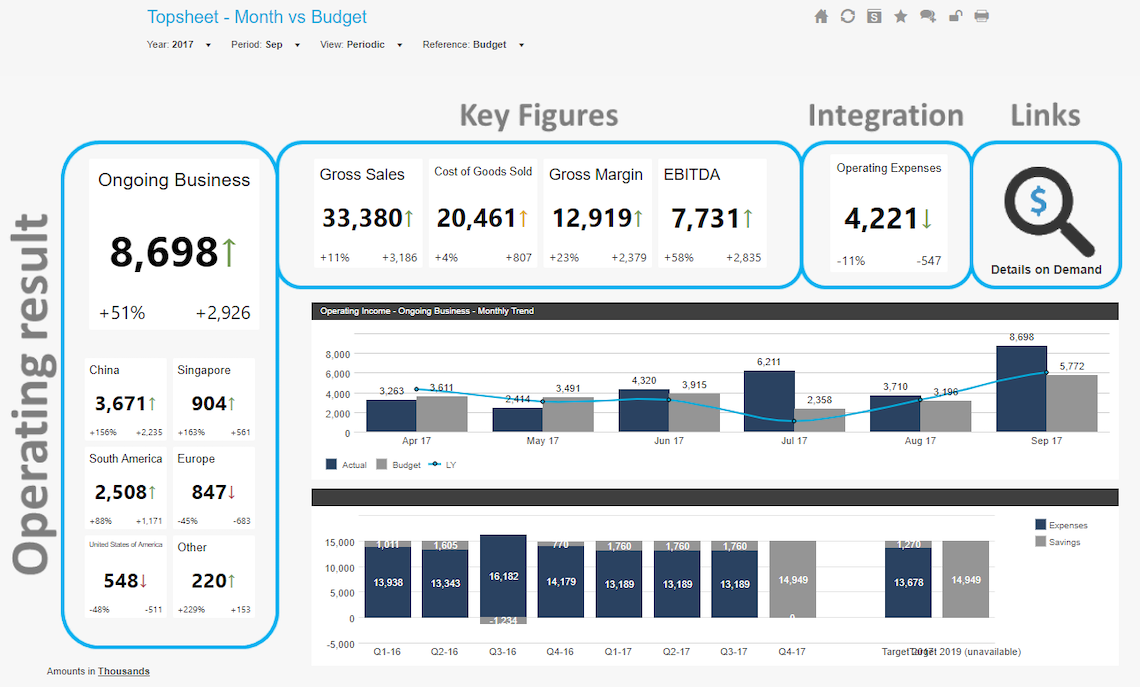

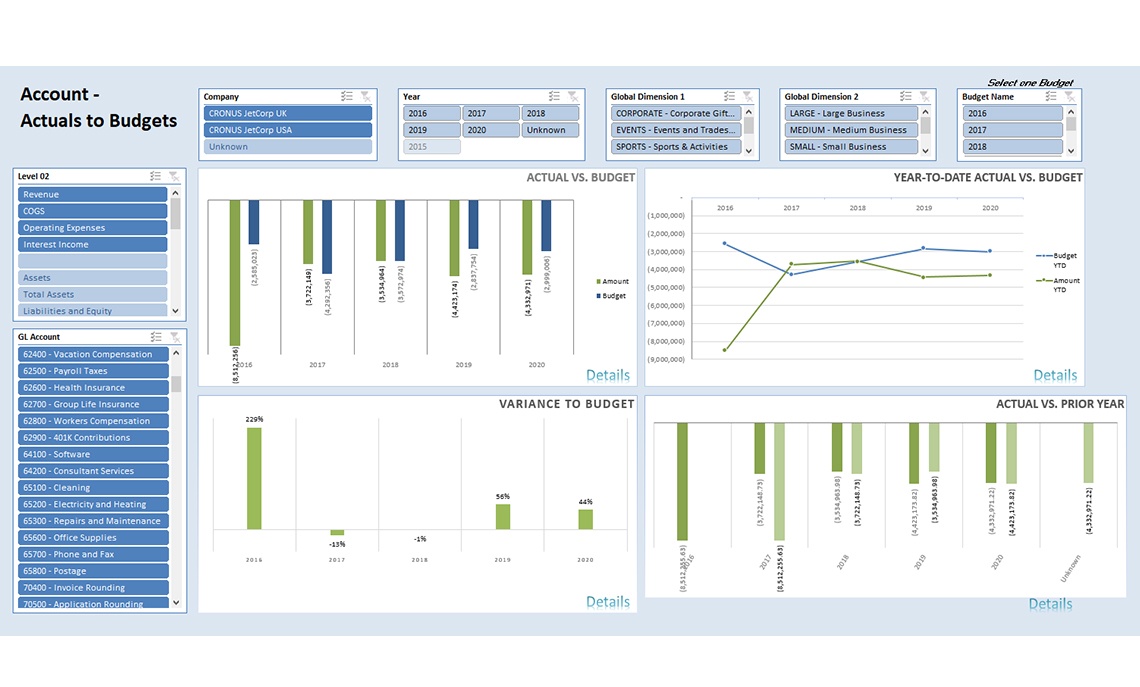

Topsheet Month vs Funds Instance CFO Dashboard

Get your personal customizable copy of this dashboard template free of charge right here.

This dashboard has been particularly tailor-made to satisfy the standards of a CFO KPI dashboard. All the important thing monetary data for day-to-day operation is entrance and middle, with month-to-month and quarterly traits out there at a look. This high-level monetary overview makes use of predefined narrative template performance to offer data in an simply consumable format, in addition to enabling the CFO to inform the story behind the numbers.

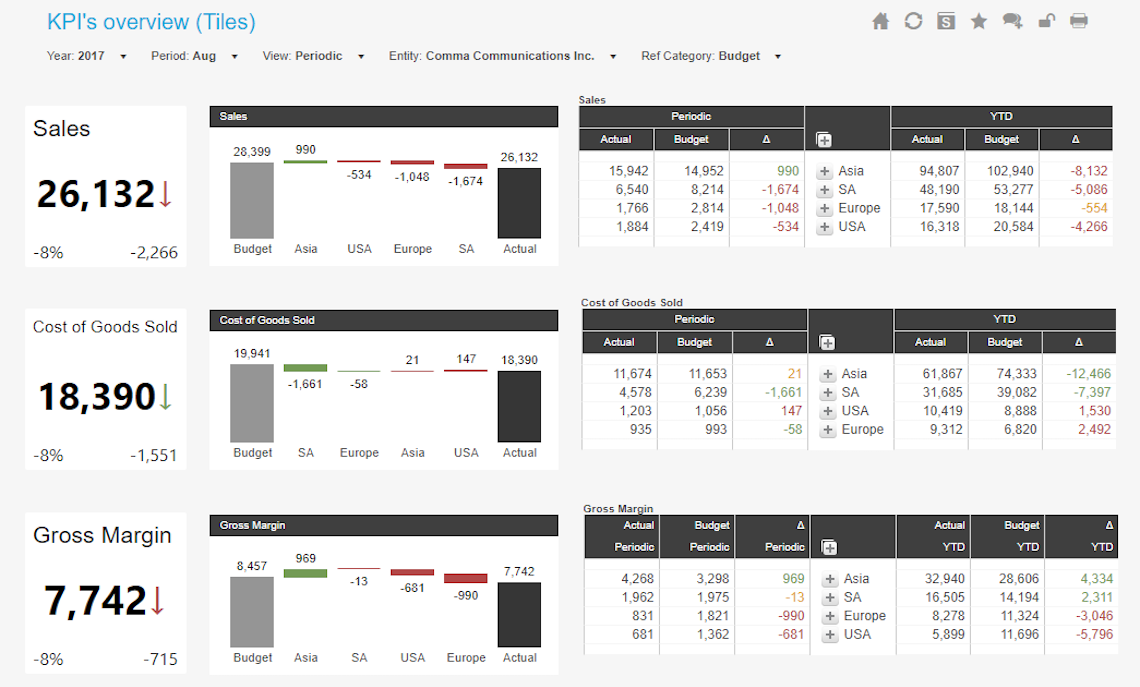

CFO KPI Overview Dashboard Instance

Get your personal customizable copy of this CFO dashboard template free of charge right here.

For these C-Ranges who love knowledge on a regular basis, we’ve additionally developed an government stage KPI dashboard. This can enable you to rapidly determine areas of the enterprise that want quick consideration, enabling you to treatment the state of affairs earlier than it will get out of hand. This KPI dashboard makes use of CXO Software program’s signature ‘efficiency tiles’ function, dynamic waterfall charts, and drillable tables to provide the most related data in a user-friendly package deal. Get extra data on this dashboard right here.

KPIs and Metrics for the CFO’s Dashboard

The mantra of the company world is “time is cash”. With this in thoughts, you may perceive why a busy CFO would need monetary data out there immediately. This has been the driving power behind the event of CFO KPI dashboards and their implementation as customary apply. Listed below are 13 CFO KPI examples you may anticipate to see on a CFO dashboard.

- Fast Ratio – The fast ratio is likely one of the mostly used CFO KPIs. It means that you can rapidly assess the monetary well being of your organization. This well being verify is completed by measuring an organization’s capability to right away fulfill its brief time period monetary obligations. This monetary metric ought to be entrance and middle on a CFO KPI dashboard. Fast Ratio = (Money + Marketable Securities + Accounts Receivable) / Present Liabilities

- Present Ratio – This CFO metric is usually used alongside the fast ratio when assessing the monetary well-being of an organization. Just like the fast ratio, it measures the power to cowl monetary obligations. Nonetheless, this monetary metric has an extended time horizon related to it, checking to see if an organization will pay its obligations inside one 12 months.

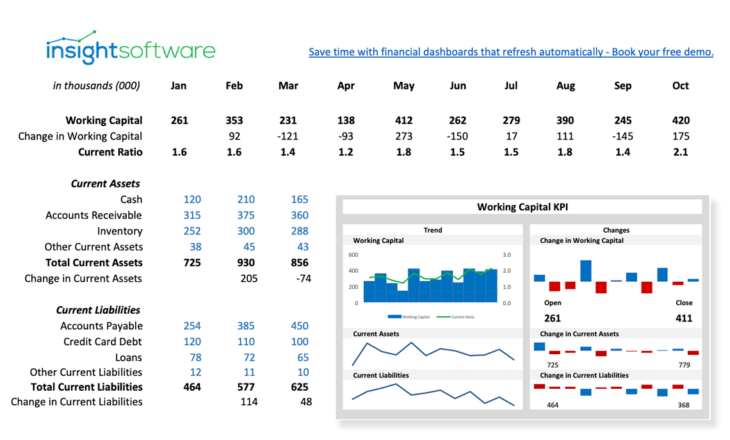

Get your personal customizable copy of the Present Ratio dashboard template right here. - Working Capital – Most CFOs wish to regulate the quantity of working capital their firm has, as this represents how a lot they’ve at their disposal for growth. This CFO metric is greatest used along with the working money movement KPI when contemplating aggressive development alternatives. Simply bear in mind, a money strapped firm will not be a wholesome firm.

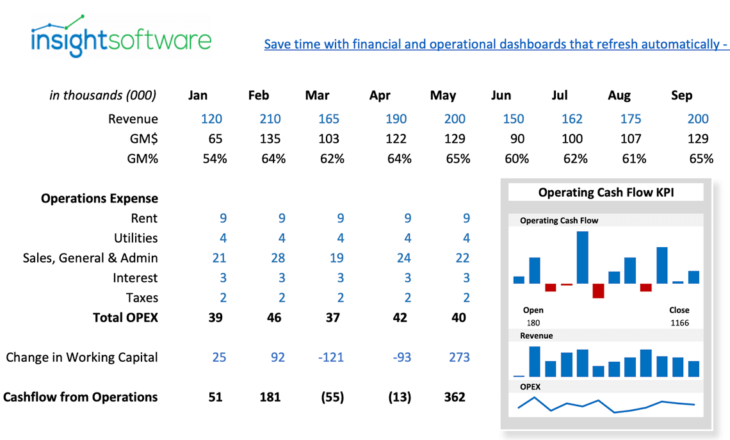

Get your personal customizable copy of the Working Capital dashboard template right here. - Working Money Circulation – As its identify implies, this monetary metric measures how a lot money movement is being generated from day-to-day operations. Because of the great amount of information that’s typically related to this metric, it’s best tracked utilizing CFO dashboard software program. As talked about earlier, CFOs use this data when making CAPEX choices. A optimistic money movement can be seen positively by collectors offering exterior financing for CAPEX.

Get your personal customizable copy of the Working Money Circulation dashboard template right here. - EBITDA & EBITDA Progress – Incomes Earlier than Curiosity, Taxes, Depreciation, and Amortization. This can be a crucial metric relating to CFO reporting every quarter. It’s typically used as an alternative to web earnings because it removes any bias attributable to strategic accounting. Most corporations make use of economic reporting software program to trace this monetary efficiency metric because it requires lots of knowledge crunching.

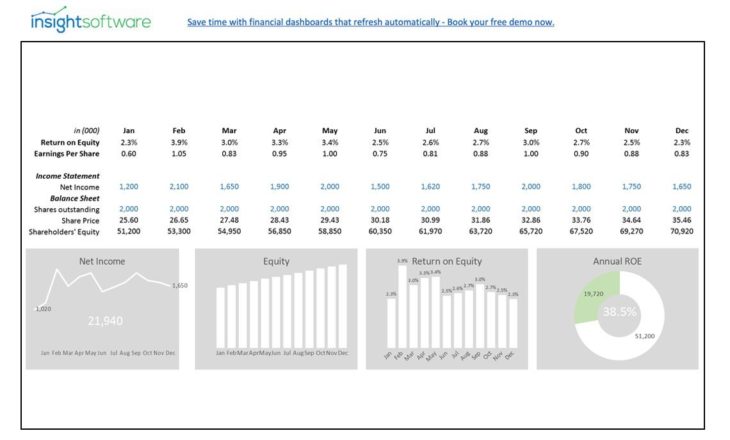

- Return on Fairness (ROE) – As an investor or enterprise proprietor, you care about how nicely your cash is being utilized. This CFO dashboard metric is designed only for that objective – it assesses the effectivity at which shareholders’ fairness is getting used. As such, this metric is extraordinarily essential for CFO reporting. CFOs, and buyers alike, will use this metric to match the monetary efficiency of corporations inside the similar business.

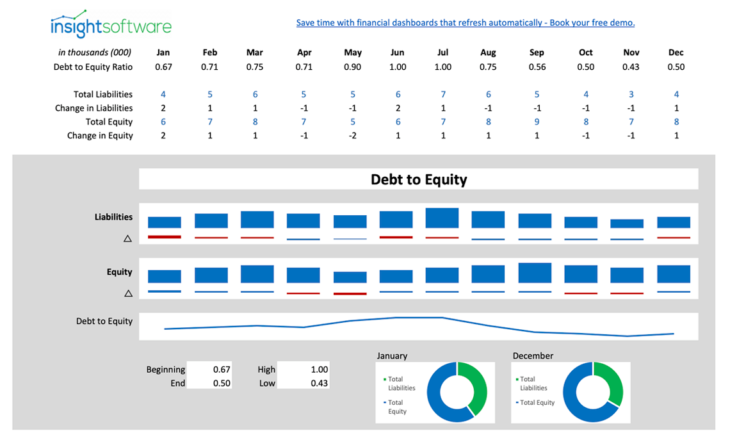

Get your personal customizable copy of the Return on Fairness dashboard template right here. - Whole-Debt-to-Fairness Ratio – This CFO metric compares the corporate’s liabilities to its shareholder’s fairness. Equally, you may consider this as evaluating how a lot you owe in your mortgage towards how a lot fairness you might have in your home. Chief Monetary Officers take note of this metric as it may be used to point when an organization has over-extended itself. Giant quantities of debt throughout growth is regular, however ought to an financial downturn happen, this might lead to chapter.

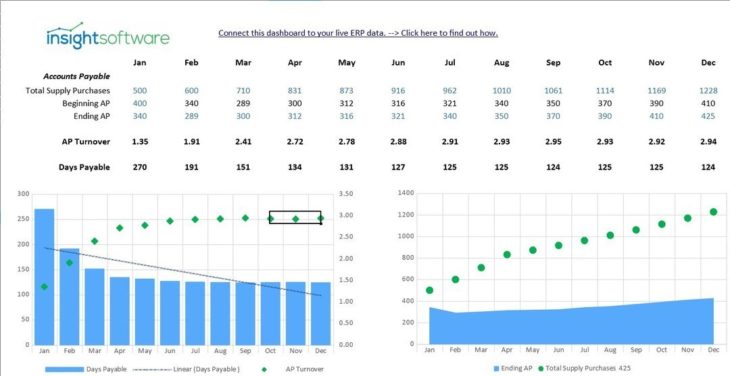

Get your personal customizable copy of the Debt to Fairness Ratio dashboard template right here. - Accounts Payable Turnover – This monetary metric is usually utilized by the CFO as a number one indicator of an organization’s monetary well-being. This CFO dashboard metric measures the period of time it takes an organization to pay its suppliers. A reducing ratio (that means the time to pay is getting longer) is likely one of the first indicators of money movement points. An growing ratio, alternatively, can point out that an organization’s useful resource allocation is inefficient, and that they could possibly be utilizing the cash for one thing higher.

Get your personal customizable copy of the AP Turnover Mannequin dashboard template right here. - Money Conversion Cycle (CCC) – Most CFOs just like the regulate the money conversion cycle efficiency metric because it measures the variety of days it takes to transform items again to money. That is extraordinarily essential relating to money movement evaluation and stock administration. This metric is definitely comprised of three different monetary metrics. As such, this can be very knowledge heavy and greatest tracked utilizing monetary KPI software program. CCC = Days of Stock Excellent + Days Gross sales Excellent – Days Payables Excellent

- Gross Revenue Margin – This CFO metric ought to be one of many key highlights on any C-level monetary dashboard. The gross revenue margin KPI is used to evaluate the monetary well being of an organization by inspecting its gross sales. To do that, it removes the price of items offered (COGS) from the income, and expresses this as a proportion of income. This successfully determines how worthwhile an organization is. A largely fluctuating gross revenue margin can typically be seen as an indication of poor administration.

- Earnings Per Share (EPS) – With regards to KPIs, nothing says reporting like EPS. This CFO reporting metric is considered one of two items of knowledge each investor needs to know. (The opposite essential determine being income). This metric actually appeals to buyers because it tells them how a lot cash every of their shares is making. It’s also a elementary metric that can be utilized to match corporations no matter business. EPS = (Internet Earnings – Most well-liked Dividends)/(Finish-of-Interval Widespread Shares Excellent)

- Compound Common Progress Fee (CAGR) – The compound common development price CFO metric is particularly essential relating to quarterly studies. All buyers wish to see firm development, whether or not it’s income or EPS. This efficiency metric calculates how a lot compound development (optimistic or unfavorable) the corporate has achieved over a particular interval. To additional reiterate the significance of those development figures, they’re typically displayed entrance and middle on CFO dashboard software program. CAGR = ((Ending Steadiness)/(Starting Steadiness))^(1/n)-1The place n is the variety of years over which the expansion occurred.

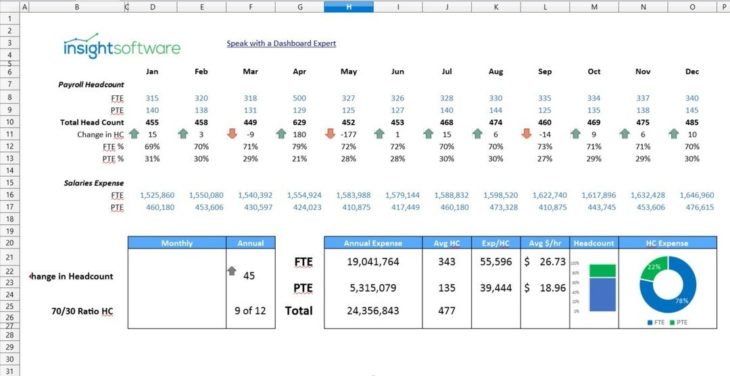

- Worker Rely – This CFO KPI tracks what number of full-time and part-time staff are on the payroll. This knowledge is usually used for 2 functions: figuring out efficiency metrics on a per worker foundation, and illustrating how labor prices are impacting monetary efficiency. CFOs will typically evaluate how monetary metrics carry out between full-time, part-time, and contract staff to see that are most value efficient.

Get your personal customizable copy of the dashboard template right here. - Curiosity Protection Ratio – At insightsoftware, that is considered one of our favourite CFO metrics. This metric is especially helpful as a result of it is ready to present perception into the monetary well being of an organization from two totally different views. It may be used to investigate the debt ranges of an organization in addition to the corporate’s profitability. If your organization is seeking to borrow funds for capital growth, this metric ought to be reviewed. Lenders will typically use the curiosity protection ratio when assessing their stage of threat with a mortgage. A excessive protection ratio represents a low threat mortgage, whereas a excessive ratio might lead to rejection. Curiosity Protection = EBIT/Curiosity Expense

Simply keep in mind that understanding which KPIs to make use of for a CFO dashboard is simply half the battle. The info gathering, processing, and visualization is simply as essential. With out correct software program, your finance crew and CFO would spend weeks gathering and crunching knowledge, solely to appreciate they’re making choices based mostly on outdated data. If this hasn’t satisfied you to make use of a dashboard software program resolution, we’ve some pattern CFO dashboards you can obtain and take a look at for your self.

Pattern CFO Dashboards

CFO dashboards are available in a wide range of totally different flavors, relying on what you wish to concentrate on. Nonetheless, all of our dashboards have one factor in widespread: they scale to the scale of your enterprise. This helps you get monetary savings in the long term as you may keep away from pricey software program migrations as your enterprise grows. Listed below are three totally different dashboards you can develop your enterprise with:

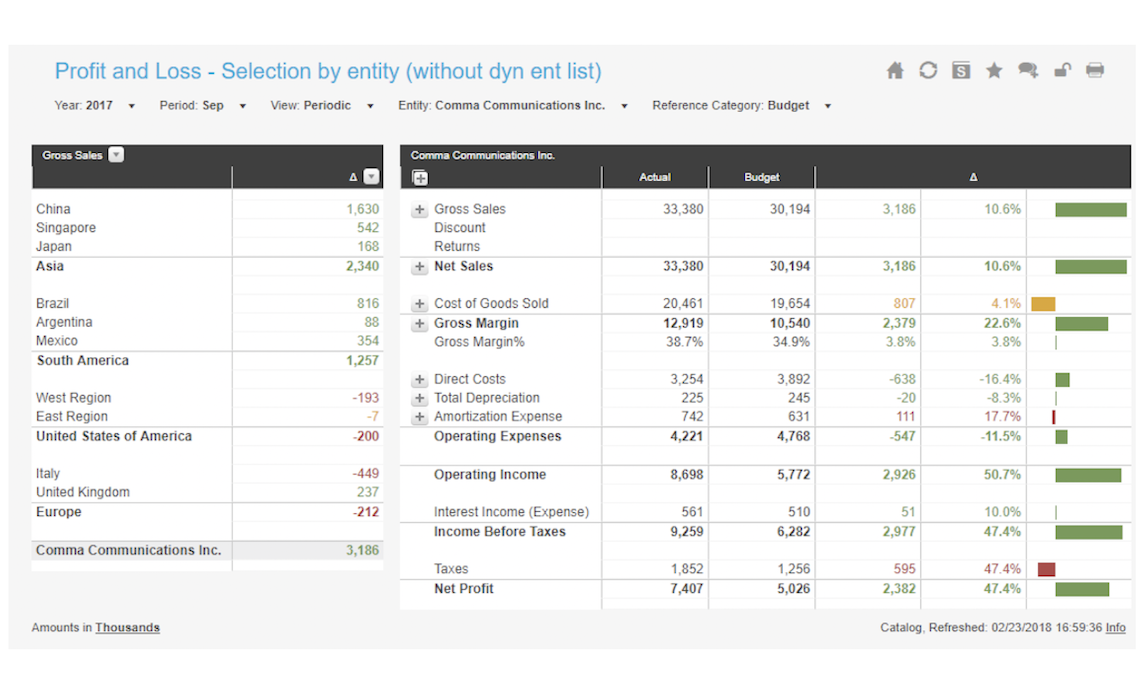

Revenue and Loss Dashboard

The primary dashboard we’ve focuses on revenue and loss. Don’t let the simplicity of the identify idiot you. That is on no account a easy dashboard. It has been constructed upon the concept that your group is layered with a fancy construction, involving 1000’s of information factors throughout totally different enterprise segments. This dashboard will routinely collect all of your knowledge and course of it, enabling simple visualization.

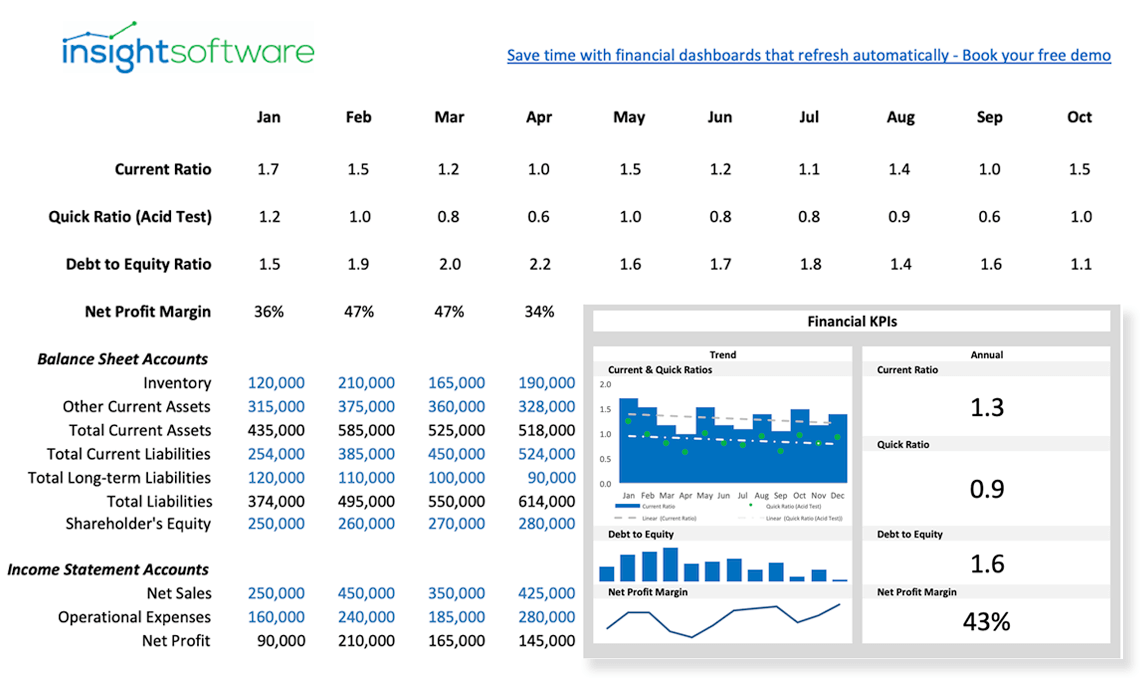

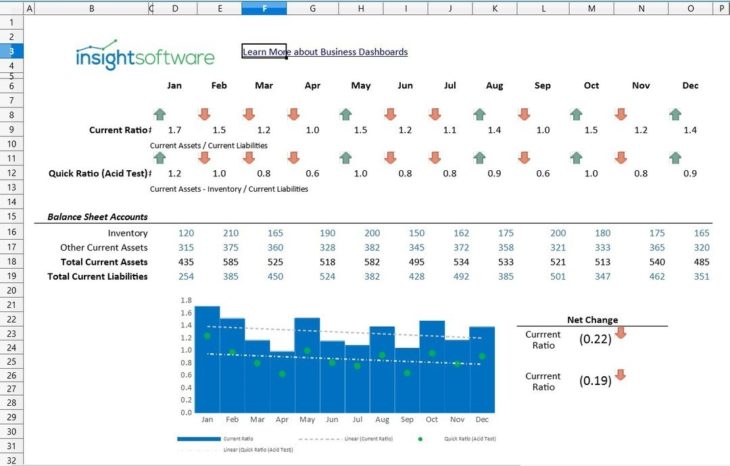

Monetary Ratios KPI Dashboard

Monetary ratios are the bread and butter of any CFO. These ratios are the fast checks that give perception into the monetary well being of your organization. This dashboard supplies a listing of conventional monetary ratios that require your consideration, and presents them in a easy and efficient method. This dashboard is the definition of data-driven determination making. Obtain a free copy of this Excel dashboard template right here.

Grasp Monetary Dashboard for CFOs & Finance Managers

If there’s any monetary metric or KPI you wish to analyze, this dashboard has it. You may pull up any monetary data you want with a pair clicks. Want monetary data for a gathering? No drawback. Wish to evaluation the quarterly report earlier than submitting it? Straightforward-peasy. This dashboard is an all-in-one resolution.

Hopefully you discovered one thing that piqued your curiosity within the CFO dashboards offered right here. Nonetheless, for those who didn’t discover the precise dashboard you needed, be happy to take a look at all of our pattern dashboards!

5 Issues To not do When Selecting a Monetary Reporting Resolution

[ad_2]