[ad_1]

The foreign exchange market may be very distinctive in comparison with most tradeable instrument markets. Sure, it’s the largest, and sure, it’s open 24 hours a day, 5 days per week, and though these components make it distinctive, there may be nonetheless one thing very distinctive to foreign currency trading that can not be present in every other tradeable instrument market.

The title “foreign exchange” in itself offers a touch as to what makes it very distinctive. “Foreign exchange” stands for international forex trade. Which means that the trade comes solely within the type of cash.

Most tradeable devices are traded based mostly on the trade of a tradeable instrument itself and cash, whether or not the tradeable instrument is a inventory, bond, choices or commodities. As such, the worth of the tradeable instrument relies on the provision or demand of the stated tradeable instrument. If demand for the commodity to be exchanged is excessive, then costs would go up. If demand is low, then value would drop. If individuals are promoting the stated tradeable instrument, thereby rising provide, then value would drop. Inversely if individuals are shopping for and just a few are promoting, thereby rising demand, then value would stand up.

The foreign exchange market one way or the other departs from this simplistic idea of a one-dimensional provide and demand. The currencies, which was the measure of provide or demand of different tradeable devices are actually the commodities being exchanged. Not solely that, each of the currencies which are being exchanged have its underlying provide and demand, making it a two-dimensional provide and demand.

For instance, if we’re to trade the Euro and the US Greenback, we might assume that the Euro has its underlying provide and demand, and that the identical is true for the US Greenback. Each gadgets being exchanged have a fluid worth. We couldn’t readily assume that if there’s a excessive demand for the Euro, then the worth of trade for the pair would rise. The demand for the US Greenback would additionally have an effect to the worth of the trade. If each currencies have a excessive demand, then it will be a tug of warfare between the 2 currencies, making value fluctuate extra typically.

That is what we name Forex Power.

Forex Power

So, what’s forex power?

Forex Power is principally the underlying demand of a forex whatever the quote forex being exchanged with it.

That is principally affected by the web worth coming out and in of the financial system which is utilizing the forex. Additionally it is affected by the elemental and financial components, which permit buyers to evaluate the worth of a selected financial system, aiding them of their choice on whether or not to put money into a selected financial system or withdraw their investments from it. Forex values don’t simply rise or drop for no cause. Traders trade for the forex in order that they could put money into the financial system utilizing the forex. That is the rationale why elementary information releases would typically trigger the worth of trade of the forex pairs which embody the forex affected by the information launch to spike.

For instance, the US Fed could announce a rise in rates of interest. This might be a really enticing proposition for buyers wanting greater returns on their authorities bond investments. For them to put money into such alternatives, they must trade for the US Greenback, driving the demand up. On this instance, let’s imagine that the US Greenback is gaining power towards different currencies.

This instance could appear sophisticated as a result of it touches on the realm of elementary evaluation. Nevertheless, there are methods by which we are able to assess the power or weak spot of a forex utilizing technical evaluation and technical indicators.

Forex Warmth Map Indicator

The Forex Warmth Map indicator is a customized technical indicator which helps merchants assess the underlying power and weak spot of every forex towards different currencies.

It compares the power of the currencies individually, permitting merchants to isolate which currencies are gaining power, and which currencies are weakening. It additionally compares forex power individually, which permits merchants to isolate which quote forex is the bottom forex strongest or weakest towards.

Earlier than we dive into how the Forex Warmth Map indicator works, allow us to first perceive the idea of Base Forex and Quote Forex.

Base Forex and Quote Forex

The Base Forex is the forex pair which is being exchanged with one other forex. In a foreign exchange pair, that is the forex discovered on the left facet of the pair.

The worth of the forex pair relies on this. If the worth of the foreign exchange pair is rising, then the Base Forex is strengthening. If the worth of the pair is dropping, then the worth of the Base forex is weakening.

For instance, on the EUR/USD pair, the EUR is the Base Forex, which is being exchanged with the USD. If the EUR/USD is rising, then the EUR is strengthening, whereas if the worth of the pair is dropping, then the EUR is weakening.

The Quote Forex then again, is the forex being exchanged with the Base Forex. That is discovered on the suitable facet of the forex pair.

The worth of the Quote Forex can also be inversely correlated with the worth of the foreign exchange pair.

On the identical EUR/USD pair, the USD is the Quote Forex. If the worth of the pair is rising, then the USD is weakening, whereas if the worth of the pair is falling, then the USD is strengthening.

Find out how to Use the Forex Warmth Map

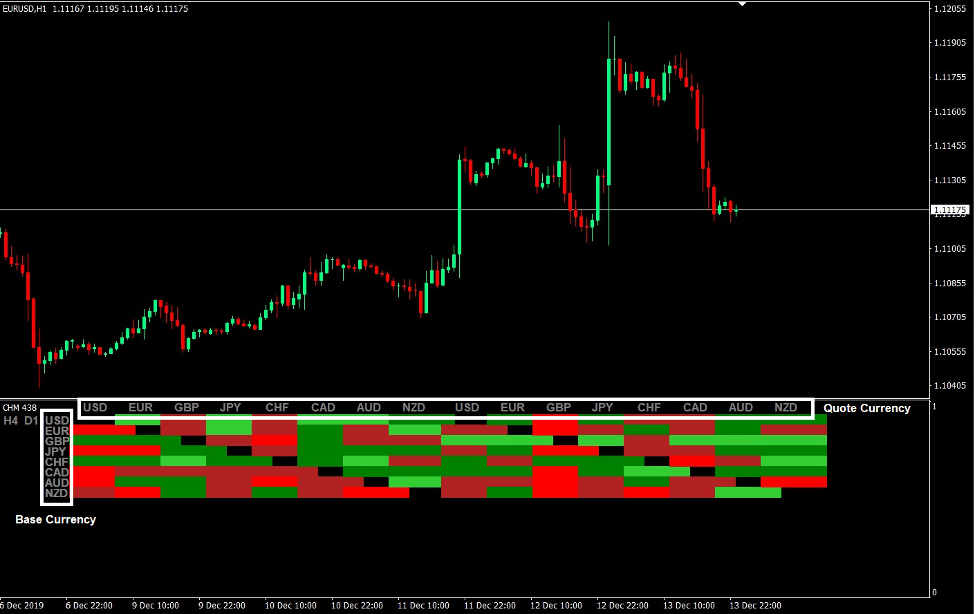

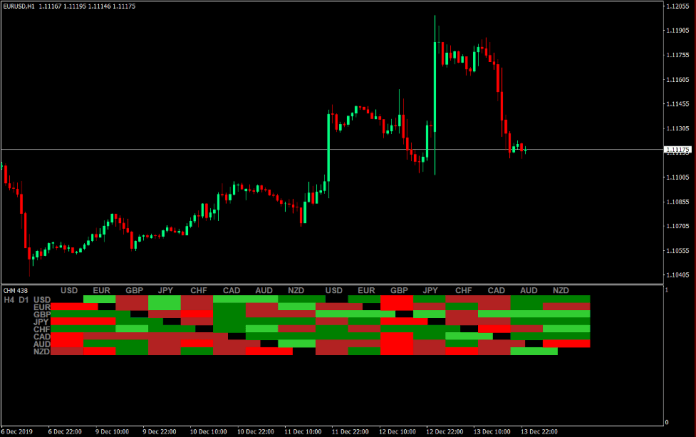

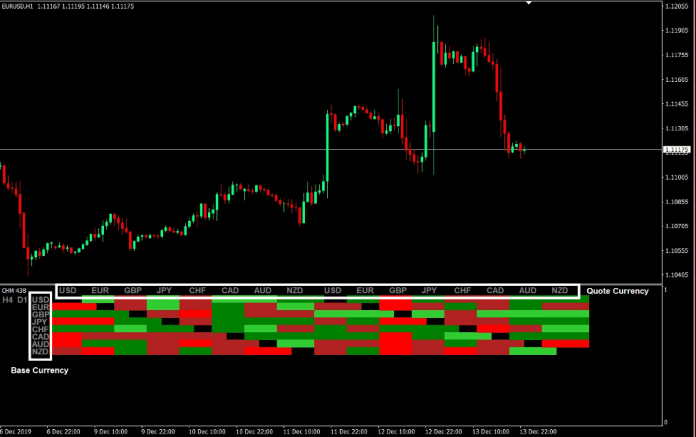

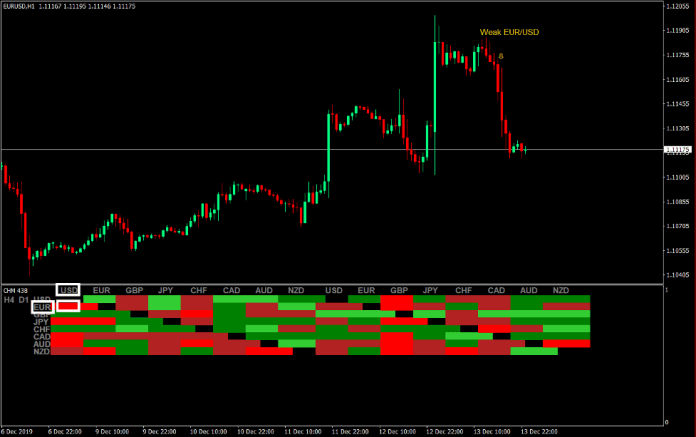

The Forex Warmth Map indicator identifies the power of a forex pair based mostly on the colour it plots for the pair.

Lime inexperienced bins point out a powerful uptrend, whereas inexperienced bins point out a weaker uptrend. Crimson bins point out a powerful downtrend, whereas fireplace brick bins point out a weaker downtrend.

It additionally identifies the Base Currencies on the left column, whereas the Quote Currencies are on the highest row.

To make use of the Forex Warmth Map indicator, we should first establish the Base Forex on the left column. Then, we match it with the Quote Forex from the highest row. The colour of its corresponding field identifies whether or not the pair is in an uptrend or a downtrend and whether or not the pattern is powerful or weak.

For instance, on the EUR/USD pair, the corresponding field is pink. Which means that the pair is in a powerful downtrend. It additionally implies that the EUR may be very weak towards the USD.

This enables us to establish which forex pair is shifting strongly, and which course to commerce.

This indicator additionally permits us to view in a single look, which forex pair is usually stronger in comparison with different pairs, and which of them are weaker. Merely depend whether or not the forex on the left column is stronger or weaker in comparison with the opposite pairs.

Figuring out Sturdy and Weak Currencies

- Discover the forex you’re assessing on the left column.

- Depend what number of currencies the forex you’re assessing is stronger and weaker towards based mostly on the colour.

- If the bins are principally lime inexperienced and inexperienced, the forex is powerful.

- If the bins are principally pink and fireplace brick, the forex is weak.

- The forex with the best variety of inexperienced and lime inexperienced bins is the strongest.

- The forex with the best variety of pink and fireplace brick bins is the weakest.

It’s best to pair the strongest forex with the weakest forex because the course of its pattern are typically stronger. Nevertheless, we should always nonetheless verify whether or not the forex pair itself is weak or sturdy.

Within the chart above, the GBP and CHF pairs are typically the strongest, whereas the AUD and NZD pairs are typically the weakest.

Conclusion

One of many foremost benefits of foreign currency trading is that merchants can merely pair the strongest and weakest forex and commerce it towards one another. This tends to provide a better win chance as its pattern tends to proceed. {Many professional} merchants use this method.

The Forex Warmth Map indicator simplifies the method of figuring out sturdy and weak currencies, in addition to the person power and weak spot of every forex pair. Merchants can simply use this indicator to establish which pair needs to be traded and by which course.

MT4 Indicators – Obtain Directions

Find out how to Commerce Primarily based on Forex Power is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to remodel the accrued historical past information.

Find out how to Commerce Primarily based on Forex Power offers for a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional value motion and regulate their technique accordingly. Click on right here for MT4 Methods

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Find out how to set up Find out how to Commerce Primarily based on Forex Power.mq4?

- Obtain Find out how to Commerce Primarily based on Forex Power.mq4

- Copy Find out how to Commerce Primarily based on Forex Power.mq4 to your Metatrader Listing / consultants / indicators /

- Begin or restart your Metatrader 4 Consumer

- Choose Chart and Timeframe the place you wish to take a look at your MT4 indicators

- Search “Customized Indicators” in your Navigator principally left in your Metatrader 4 Consumer

- Proper click on on Find out how to Commerce Primarily based on Forex Power.mq4

- Connect to a chart

- Modify settings or press okay

- Indicator Find out how to Commerce Primarily based on Forex Power.mq4 is out there in your Chart

Find out how to take away Find out how to Commerce Primarily based on Forex Power.mq4 out of your Metatrader Chart?

- Choose the Chart the place is the Indicator operating in your Metatrader 4 Consumer

- Proper click on into the Chart

- “Indicators record”

- Choose the Indicator and delete

Find out how to Commerce Primarily based on Forex Power (Free Obtain)

Click on right here under to obtain:

[ad_2]