[ad_1]

The markets started final week with a pointy pullback that pushed the broader Indices towards key assist, with many particular person shares breaking beneath assist. The drop occurred amid renewed banking fears after Tuesday, when San Francisco-based First Republic Financial institution (FRC) reported a droop of greater than $100 billion in deposits within the first quarter.

Know-how shares have been hardest hit, with Software program and Semiconductor shares down 3% Tuesday as buyers bought shares within the face of FRC’s instability. Heavy promoting on damaging information resembling final week will shake out weaker palms, however it might probably typically pave the way in which for a sustained rally afterward — if market situations are ripe, that’s.

The main Indices have been the truth is capable of finding assist, led by good points in mega-cap shares resembling Microsoft (MSFT) and Meta Platforms (META), who reported higher than anticipated earnings. Shares in different areas additionally drove the markets greater on Thursday and Friday after posting sturdy quarterly outcomes, whereas additionally guiding progress greater for the 12 months.

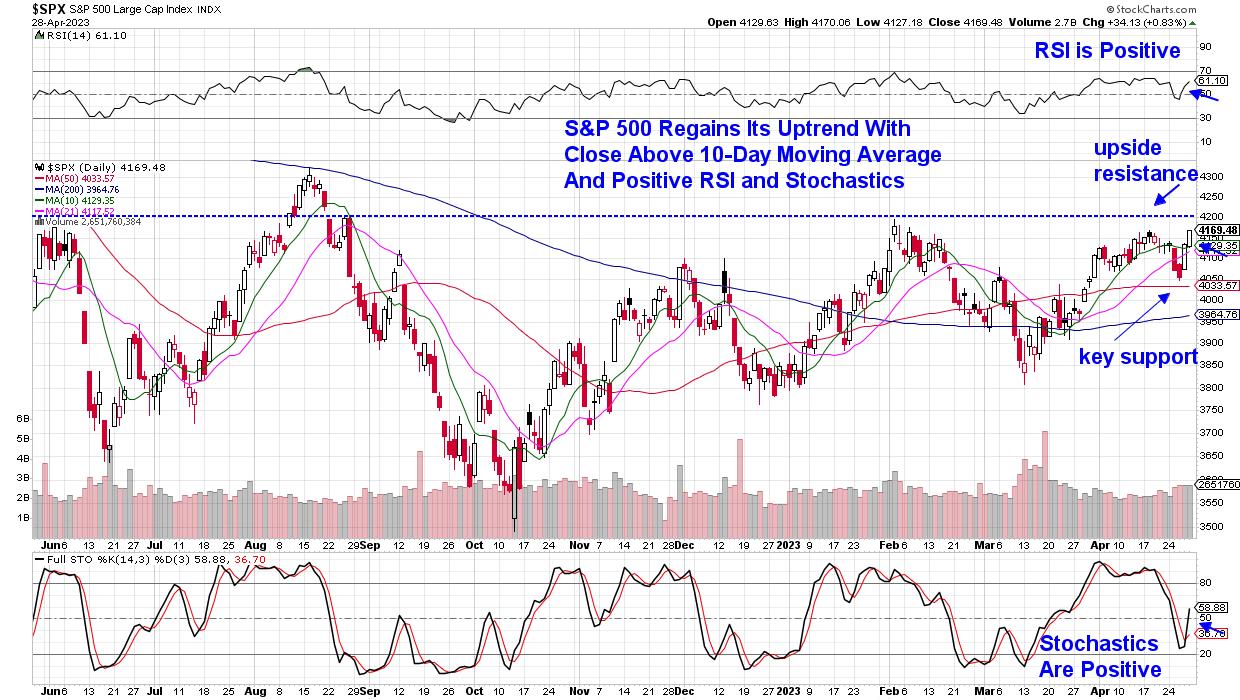

DAILY CHART OF S&P 500 INDEX

The broad-based rally later within the week not solely pushed the S&P 500 again into an uptrend, but it surely helped enhance breadth sufficient to inject some gas into the markets. Subsequent week will present some main hurdles, nonetheless, as we head into Wednesday’s FOMC assembly and Powell’s post-meeting speech.

At the moment, merchants are anticipating a ¼% hike within the Fed Funds fee whereas additionally looking out for information that the hike will probably be its final one. Current inflation reviews, resembling immediately’s core Private Consumption Expenditure (PCE) information — a intently watched report for the Federal Reserve — confirmed that inflation is drifting decrease, however total, it stays fairly sticky.

As highlighted within the S&P 500 chart above, 1200 is the subsequent space of resistance and, ought to we transfer above this degree on quantity, the present rally might last more. Along with subsequent week’s rate of interest determination, Apple (AAPL) is because of report earnings on Thursday after the markets shut, as will 800 different corporations as we head into one of many busiest weeks of earnings season.

If you would like to be alerted to any shift in my outlook for the broader markets, use this hyperlink right here to take a 4-week trial of my twice weekly MEM Edge Report for a nominal price. We stayed with the top quality shares on our report’s Urged Holdings Record final week, regardless of cracks in among the charts. These shares are actually poised to commerce a lot greater, and you may obtain fast entry to this listing in addition to in-depth sector and trade group evaluation.

Warmly,

Mary Ellen McGonagle MEM Funding Analysis

Mary Ellen McGonagle is knowledgeable investing guide and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to turn out to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra

Subscribe to The MEM Edge to be notified each time a brand new submit is added to this weblog!

[ad_2]