[ad_1]

The Worldwide Financial Fund (IMF) weblog is normally value studying. I subscribe to its electronic mail feed, because of which I noticed its forecast on rates of interest, remodeled the weekend.

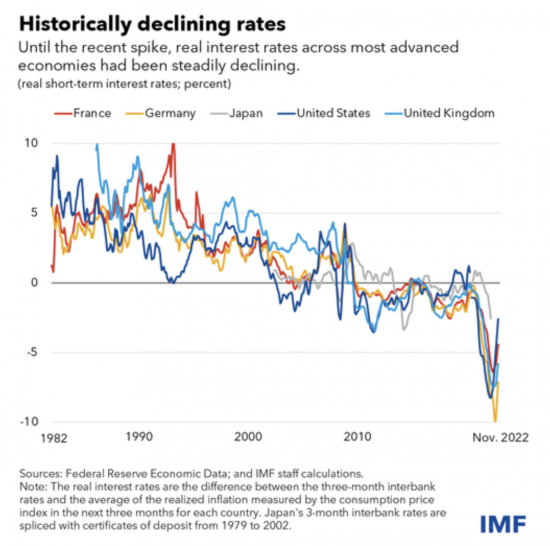

Because the authors of the IMF weblog word, historic actual (web of inflation) rates of interest have fallen closely over the previous couple of a long time:

The uptick of late is notable. The authors speculate on whether or not this may be sustained. They conclude it won’t be. They advised that the general stress in charges is downward:

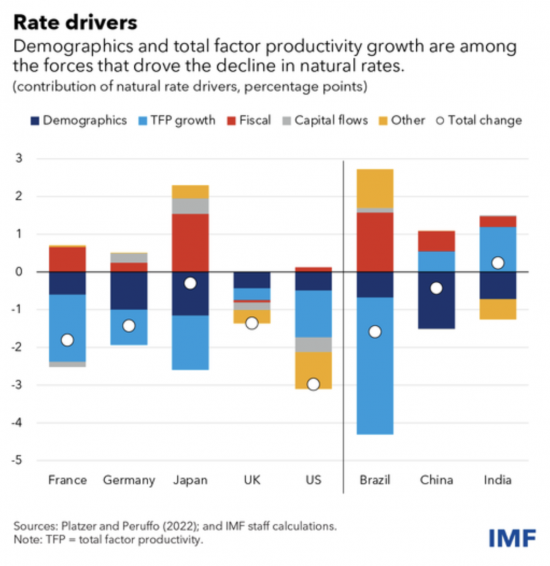

The first causes are twofold, of their view. One is the affect of demographics, which I’ll talk about in a second. The opposite is what they outline as whole issue productiveness progress (the overall quantity of output produced with all issue inputs within the financial system), which is declining in most international locations surveyed.

I’ve three ideas. First, in fact whole issue productiveness is declining. The capitalist financial system has run out of concepts as to what to do: innovation is quick disappearing and what there’s would require little issue enter (together with labour within the case of AI). The measure exhibits an financial system that isn’t offering solutions to satisfy wants. That’s very true when most wants which might be unmet must be addressed by the state in future since markets are incapable of delivering what’s required.

Second, the time period ‘demographics’ is, I feel, prone to be deceptive. The required time period is ‘inequality’. It could possibly be ‘intergenerational stress’. The very fact is that monetary wealth is rising on the earth. Most of that progress goes to those that are older. Like nearly all these with wealth, the best concern of these with that new wealth might be preserving it. They’ll because of this be intensely risk-averse. The consequence is that they are going to save in money, fuelling what’s already a glut in worldwide financial savings. After all actual rates of interest will fall because of this, no matter central banks just like the Financial institution of England wish to assume.

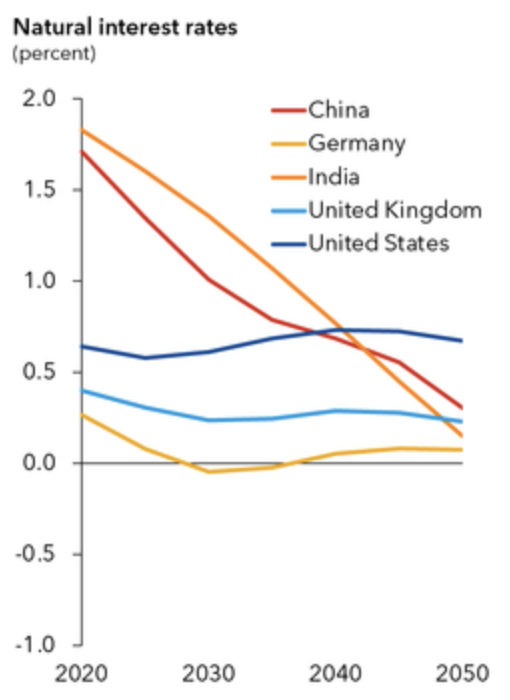

The IMF forecasts are attention-grabbing because of this. They counsel this:

In different phrases, rates of interest will monitor inflation within the UK. Inflation goes to tumble. So too will charges, regardless of the Financial institution of England says.

Until, in fact, they wish to create an epic monetary disaster.

I do not rule that out.

What I do know is that ultimately, the Financial institution of England must give in. Charges are going to fall. We can’t reside in a world the place there’s rising inequality and a glut of financial savings and have every other consequence.

[ad_2]