[ad_1]

The drop in a key poverty measure to a historic low was a direct results of Congress rising the kid tax credit score in 2021 to make extra households eligible and assist them deal with COVID-19.

The coverage was significantly efficient in decreasing poverty within the Black neighborhood, based on researchers at Howard College, the College of Alabama, and the College of Wisconsin.

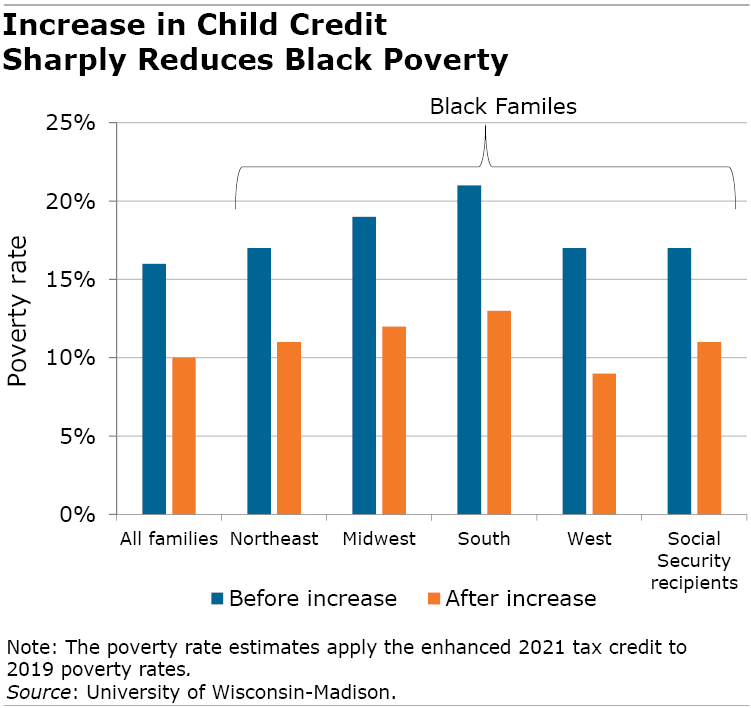

Black People’ poverty fee has all the time been a lot increased than the White fee. However the researchers present that the impact of a extra beneficiant baby tax credit score was to dramatically cut back Black poverty all around the nation. They overlaid the bigger tax credit score quantities and the expanded eligibility onto households’ 2019 monetary information to estimate what number of households rose above the poverty line in 2021.

Within the West, for instance, rising the credit score and increasing eligibility would trigger poverty to fall virtually in half, from 17 % of Black households in 2019 to 9 % in 2021. The White poverty fee within the western states would fall by a 3rd.

And within the South, house to greater than half of the nation’s Black inhabitants, the credit score would lower poverty from 21 % to 13 % – almost 40 %, in contrast with a 30 % decline in southern White households.

Congress raised the annual baby tax credit score in 2021 from $2,000 to $3,600 per baby underneath age 6 and to $3,000 for older youngsters and youngsters as a part of the American Rescue Plan throughout COVID. The credit score was additionally prolonged to very low-income households that don’t file a federal tax return and had been beforehand ineligible. The enhancements expired on the finish of 2021.

Black households bought an even bigger increase from the tax credit score as a result of the rise was bigger relative to their incomes, that are decrease than different households’ incomes, and since Black households had been much less more likely to be eligible previous to the 2021 enhancements.

The researchers’ estimates additionally confirmed giant reductions in poverty among the many 12 % of low-income households receiving some sort of Social Safety profit, together with a 59 % drop for very deprived households within the Supplemental Safety Earnings program.

Another excuse for the outsized affect is that Black households usually tend to be multigenerational with a grandparent on Social Safety who makes use of the month-to-month test to assist assist the grandchildren. A single mum or dad may additionally stay with them, however the households are typically extra impoverished than different households with youngsters, making a lot of them ineligible for the kid credit score. In 2021, when the credit score was prolonged to grandfamilies that don’t file returns, their estimated poverty fee fell by almost half, from 14 % to eight %.

To gauge the legislation’s affect on poverty, the researchers used two nationwide information units containing particulars on U.S. households, corresponding to their race, what number of youngsters are current, household earnings, and whether or not anybody will get Social Safety advantages. They assumed that 100% of all eligible youngsters obtained the credit score, which is increased than current estimates displaying that take-up was nearer to 75 %.

They measured poverty utilizing the Supplemental Poverty Measure, or SPM, which captures a full image of a household’s way of life by making an allowance for extra than simply money earnings. The SPM consists of authorities meals and housing subsidies and subtracts the quantity households spend on objects like taxes and medical care.

The improved baby tax credit have ended. However the researchers hope that displaying how they helped deprived households will encourage authorities companies to succeed in out and enroll extra households who’re eligible now however are slipping by means of the cracks.

To learn this research by Jevay Grooms, Madelaine L’Esperance, and Timothy Smeeding, see “Social Safety Interactions with Little one Tax Credit score.”

The analysis reported herein was derived in complete or partially from analysis actions carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t symbolize the opinions or coverage of SSA, any company of the federal authorities, or Boston School. Neither america Authorities nor any company thereof, nor any of their staff, make any guarantee, specific or implied, or assumes any authorized legal responsibility or accountability for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular business product, course of or service by commerce title, trademark, producer, or in any other case doesn’t essentially represent or suggest endorsement, advice or favoring by america Authorities or any company thereof.

[ad_2]