[ad_1]

Immediately I current you an summary of offers made utilizing the Owl technique – good ranges for the EURUSD, GBPUSD and AUDUSD forex pairs for the week from March 27 to 31, 2023. It was a brief week as a result of the monetary markets within the U.S., Britain and lots of European international locations didn’t work on Friday due to Good Friday.

For comfort and well timed receipt of indicators I take advantage of the Owl Sensible Ranges Indicator. The primary buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to substantiate the development route of the upper timeframe.

EURUSD evaluation

The market spent Monday within the lifeless zone, and the indicator supplied to open the primary commerce on Tuesday in the midst of the buying and selling day.

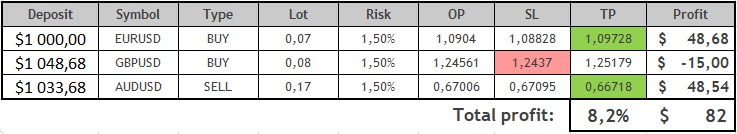

Fig. 1. EURUSD BUY 0.07, OpenPrice = 1.09040, StopLoss = 1.08828, Take Revenue = 1.09728, Revenue = $48.68.

The volatility was fairly excessive and the market began to maneuver downwards, focusing on the StopLoss degree, however “modified its thoughts” and took by storm the TakeProfit degree.

Typically, there have been no extra trades on EURUSD, and the chart spent Thursday within the lifeless zone.

GBPUSD evaluation

On Monday afternoon the market was within the lifeless zone, and later, even when the indicator confirmed a sign to open one or two trades, they needed to be cancelled because of change of the market route and closed manually, and the uncommon indicators needed to be skipped ready for the closing of the present commerce which was cancelled afterwards.

The clear sign to purchase, on which the commerce was opened, was obtained on Thursday. However then there was a pointy fall in worth, and the commerce was closed by StopLoss, bringing a lack of $15.

Fig. 2. GBPUSD BUY 0.08, OpenPrice = 1.24561, StopLoss = 1.24370, Take Revenue = 1.25179, Revenue = -$15.

AUDUSD evaluation

The commerce on AUDUSD was opened solely on Thursday. The sign of the Owl Sensible Ranges indicator on the market is proven in Fig. 3, in addition to the additional falling of the value with the crossing of TakeProfit degree.

Fig. 3. AUDUSD BUY 0.17, OpenPrice = 0.67006, StopLoss = 0.67095, Take Revenue = 0.66718, Revenue = $48.54.

The commerce was closed on TakeProfit and introduced a very good revenue.

Many markets didn’t work on Friday because of the vacation and there was no sense to commerce, even when there was a possibility to do it. Thus, there have been solely three trades in the course of the four-day buying and selling week.

Outcomes:

The week turned out to be brief, a bit hectic, because it usually occurs earlier than a public vacation, and with a small variety of not solely trades, however even indicators. Nonetheless, buying and selling with the assistance of the Owl Sensible Ranges indicator was profitable.

See different evaluations of the Owl Sensible Ranges technique:

I am Sergei Ermolov, observe me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.

[ad_2]