[ad_1]

As we speak I current you an outline of trades made utilizing the Owl technique – sensible ranges for the EURUSD, GBPUSD and AUDUSD foreign money pairs for the week from April 10 to 14, 2023. After the vacations, the market appeared to be in a state of “restoration”, two days of the week had been virtually swallowed up by the “useless zone” and there weren’t many trades.

For comfort and well timed receipt of alerts I exploit the Owl Good Ranges Indicator. The principle buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to substantiate the development route of the upper timeframe.

EURUSD overview

Monday had solely a few unconfirmed alerts, Tuesday and Friday the market spent within the useless zone, and regardless of a number of alerts there have been no trades opened in keeping with the foundations of working with indicator.

GBPUSD overview

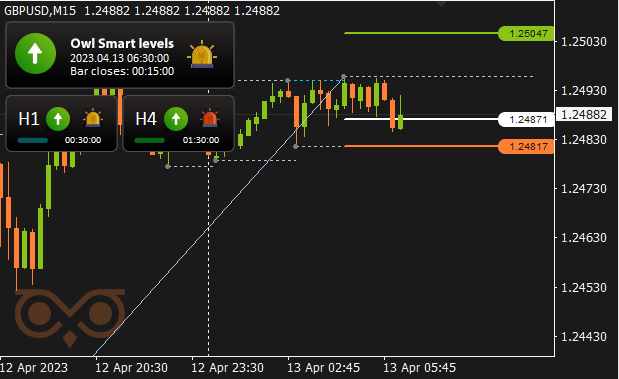

There have been no alerts on Monday, and the market spent Tuesday within the useless zone. The sign, on which the commerce was opened, was obtained on Thursday. Nonetheless the deal was loss-making and was closed by StopLoss.

Fig. 1. GBPUSD BUY 0.28, OpenPrice = 1.24871, StopLoss = 1.24817, TakeProfit = 1.25047, Revenue = -$15.

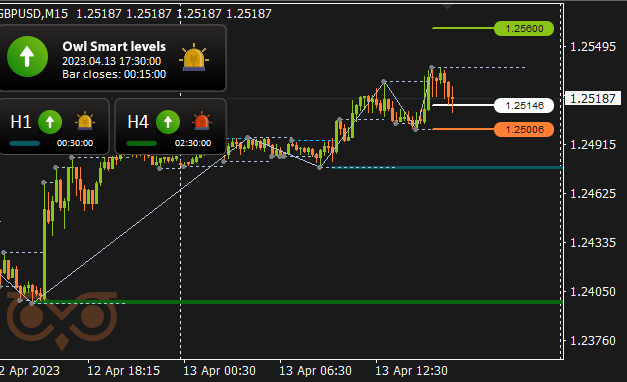

The following commerce was additionally opened for getting and in addition failed, being closed by the market at StopLoss.

Fig.2. GBPUSD BUY 0.12, OpenPrice = 1.25146, StopLoss = 1.25006, TakeProfit = 1.25600, Revenue = -$17.50.

The market was within the useless zone on Friday.

AUDUSD overview

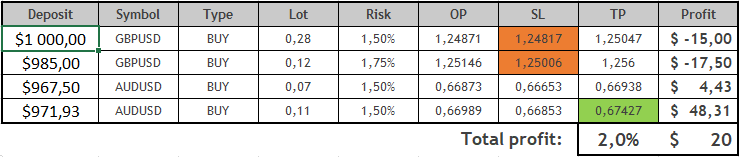

On AUDUSD foreign money pair a purchase commerce was opened on Wednesday. It needed to be closed “manually” after the massive arrow of the Owl Good Ranges indicator turned down, when market volatility elevated. The revenue was minimal.

Fig. 3. AUDUSD BUY 0.07, OpenPrice = 0.66873, StopLoss = 0.66653, TakeProfit = 0.67585, Revenue = $4.43

The final commerce this week, which was additionally opened for getting, was closed by TakeProfit and it has introduced a great revenue, turning the whole buying and selling of the final week into the revenue.

Fig. 4. AUDUSD BUY 0.11, OpenPrice = 0.66989, StopLoss = 0.66853, TakeProfit = 0.67427, Revenue = $48.31

Outcomes:

After a great revenue on trades opened because of the Owl Good Ranges indicator in February, on the development market, in March and April, on the worldwide flat market motion or “sideways” we will state a sure decline in profitability. The massive arrow of the indicator usually turns round and trades should be closed “manually” with a view to keep away from losses.

However, with the TakeProfit measurement, greater than 3 times the StopLoss measurement, buying and selling on the Owl Good Ranges indicator means that you can shut throughout such durations of market exercise each week with a comparatively small however nonetheless revenue!

See different opinions of the Owl Good Ranges technique:

I am Sergei Ermolov, observe me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.

[ad_2]