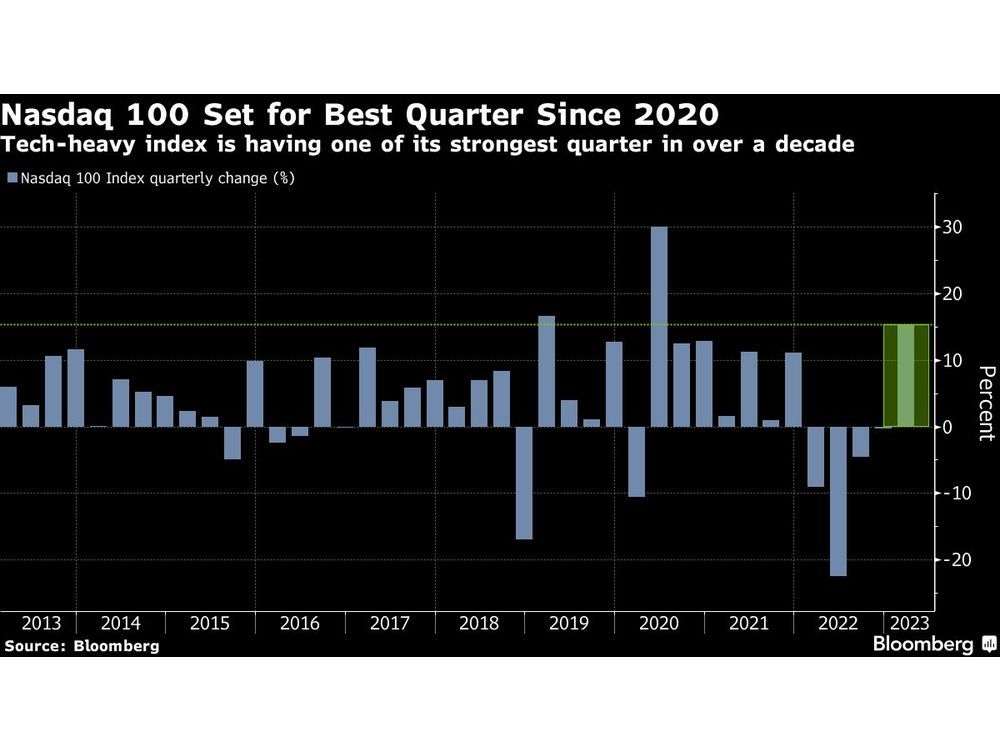

European shares climbed, partly catching up with a rally on Wall Avenue Wednesday that pushed the tech-heavy Nasdaq 100 right into a bull market amid bets {that a} peak in rates of interest is close to and financial institution turmoil will proceed to ease.

Article content material

(Bloomberg) — European shares climbed, partly catching up with a rally on Wall Avenue Wednesday that pushed the tech-heavy Nasdaq 100 right into a bull market amid bets {that a} peak in rates of interest is close to and financial institution turmoil will proceed to ease.

Commercial 2

Article content material

Expertise, actual property and retail shares led positive factors within the Stoxx Europe 600 Index, with Hennes & Mauritz AB hovering after the Swedish clothes firm’s first-quarter outcomes beat expectations. S&P 500 and Nasdaq 100 futures edged larger, as did a gauge of Asian equities.

Article content material

In Wednesday’s New York buying and selling, the Nasdaq 100 rose 1.9%, which cemented its 20% rebound from a low in December. The gauge, which incorporates Apple Inc., Microsoft Corp., and Amazon.com, closed on the highest degree since August in an indication traders are making ready for the Federal Reserve to finish its rate of interest mountaineering cycle and doubtlessly pivot to looser coverage later this 12 months.

Treasury yields ticked decrease, following muted buying and selling on Wednesday when the 10-year benchmark moved by the smallest margin in additional than a month. The greenback gave up an earlier advance after strengthening as traders digested the newest remarks by Fed officers and appeared forward to core PCE knowledge for clues on how the Fed’s subsequent transfer. Buyers now anticipate US charges to sit down round 4.3% by the tip of the 12 months, round 70 foundation factors decrease than the present degree.

Article content material

Commercial 3

Article content material

“The Fed stays in a really tough place,” wrote Chris Senyek of Wolfe Analysis in a observe. “With banks stabilizing, inflation nonetheless approach above goal, the labor market nonetheless traditionally robust, and the Fed desperately needing to rebuild credibility, our sense is that the FOMC will hike by 25 foundation factors on Could 3.”

On the European financial entrance, Spanish inflation plummeted as power prices retreated, although persistent underlying worth pressures underscored the dilemma for the European Central Financial institution because it weighs how a lot to boost rates of interest. March’s headline studying got here in at 3.1% — down from February’s 6% and far decrease than the three.7% median estimate in a Bloomberg survey of economists.

In Asia, traders digested a busy day of Chinese language earnings that included Agricultural Financial institution of China Ltd., Industrial & Industrial Financial institution of China Ltd., Financial institution of China Ltd., Financial institution of Communications Co., Air China Ltd., Nation Backyard Holdings, Citic Securities Co. and Nice Wall Motor Co.

Commercial 4

Article content material

“Analysts are revising up their earnings,” stated Audrey Goh, senior cross-asset strategist for Normal Chartered Wealth Administration, talking about Chinese language equities on Bloomberg Tv. “Consumption, mounted asset investments in addition to even the distressed property sector are beginning to present some indicators of life and restoration.”

Elsewhere in markets, oil held its drop as lagging US diesel demand overshadowed a disruption to shipments from Turkey. Gold steadied and Bitcoin hovered above $28,000.

Key occasions this week:

- Eurozone financial confidence, shopper confidence, Thursday

- US GDP, preliminary jobless claims, Thursday

- Boston Fed President Susan Collins and Richmond Fed President Thomas Barkin speaks at occasion. Treasury Secretary Janet Yellen additionally speaks, Thursday

- China PMI, Friday

- Eurozone CPI, unemployment, Friday

- US shopper revenue, PCE deflator, College of Michigan shopper sentiment, Friday

- ECB President Christine Lagarde speaks, Friday

- New York Fed President John Williams speaks, Friday

Commercial 5

Article content material

A number of the primary strikes in markets:

Shares

- The Stoxx Europe 600 rose 0.7% as of 8:22 a.m. London time

- S&P 500 futures rose 0.3%

- Nasdaq 100 futures rose 0.2%

- Futures on the Dow Jones Industrial Common rose 0.2%

- The MSCI Asia Pacific Index rose 0.2%

- The MSCI Rising Markets Index rose 0.3%

Currencies

- The Bloomberg Greenback Spot Index fell 0.2%

- The euro was little modified at $1.0842

- The Japanese yen rose 0.5% to 132.25 per greenback

- The offshore yuan rose 0.3% to six.8762 per greenback

- The British pound rose 0.2% to $1.2341

Cryptocurrencies

- Bitcoin rose 0.9% to $28,646.25

- Ether fell 0.2% to $1,799.54

Bonds

- The yield on 10-year Treasuries declined two foundation factors to three.54%

- Germany’s 10-year yield declined eight foundation factors to 2.25%

- Britain’s 10-year yield declined 4 foundation factors to three.43%

Commodities

- Brent crude rose 0.1% to $78.37 a barrel

- Spot gold rose 0.2% to $1,968.30 an oz

This story was produced with the help of Bloomberg Automation.

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We now have enabled e-mail notifications—you’ll now obtain an e-mail if you happen to obtain a reply to your remark, there’s an replace to a remark thread you observe or if a person you observe feedback. Go to our Group Tips for extra info and particulars on easy methods to alter your e-mail settings.

Be a part of the Dialog