[ad_1]

At the moment’s financial calendar doesn’t comprise any important publications, and, almost definitely, the identical dynamics of the market and the greenback will proceed within the American buying and selling session.

Tomorrow, volatility out there, and particularly in quotes of Asian and commodity currencies, will improve instantly at the start of the buying and selling day, when necessary macro knowledge on Australia and China will likely be printed at 00:30 and 01:30 (GMT) (we wrote about this in in our yesterday’s overview of AUD/USD: profiting from the weak spot of the US greenback).

And at 13:30 will likely be printed contemporary (for December) knowledge on inflation within the US. And right here once more, a lower in indicators is predicted, which may be perceived by market contributors and sellers of the greenback as a sign to motion (for the necessary occasions of the week, see the Most Necessary Financial Occasions of the Week 01/09/2023 – 01/15/2023).

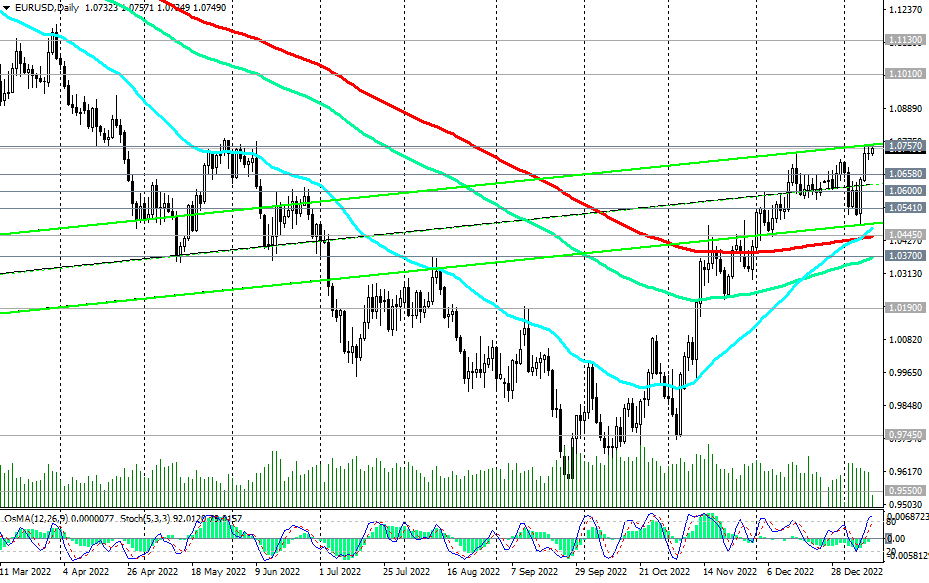

EUR/USD rose strongly on Friday and Monday after the discharge of weak PMIs within the companies sector of the US financial system, because of which the greenback fell right into a wave of sell-offs. Over the past 4 partial buying and selling days, this development was greater than 2%.

On the time of publication of this text, EUR/USD was buying and selling close to the 1.0750 mark, shifting within the medium-term bull market zone, above the help ranges 1.0540, 1.0445 in the direction of the important thing resistance ranges 1.1010, 1.1130, separating the long-term bullish development of the pair from the bearish one. Thus, above the help ranges of 1.0540, 1.0445, lengthy positions stay preferable.

In an alternate state of affairs, the EUR/USD pair won’t be able to interrupt above the native resistance stage of 1.0757, which it has touched 4 instances within the final 4 partial buying and selling days.

The primary sign for the resumption of gross sales could also be a breakdown of the native help stage of 1.0710, and a confirming one – a breakdown of the necessary short-term help stage of 1.0658.

Help ranges: 1.0710, 1.0658, 1.0600, 1.0540, 1.0500, 1.0445, 1.0370, 1.0190

Resistance ranges: 1.0757, 1.0800, 1.0900, 1.1010, 1.1130

[ad_2]