[ad_1]

Powell stated yesterday about the identical factor as on Wednesday, however this time the market believed him extra, and the greenback went on a assured offensive this morning, persevering with yesterday’s nonetheless modest progress.

The euro is actively reducing as we speak each in the primary cross-pairs and towards the greenback. Printed this morning, macro knowledge for Germany and the Eurozone pointed to a unbroken decline in enterprise exercise.

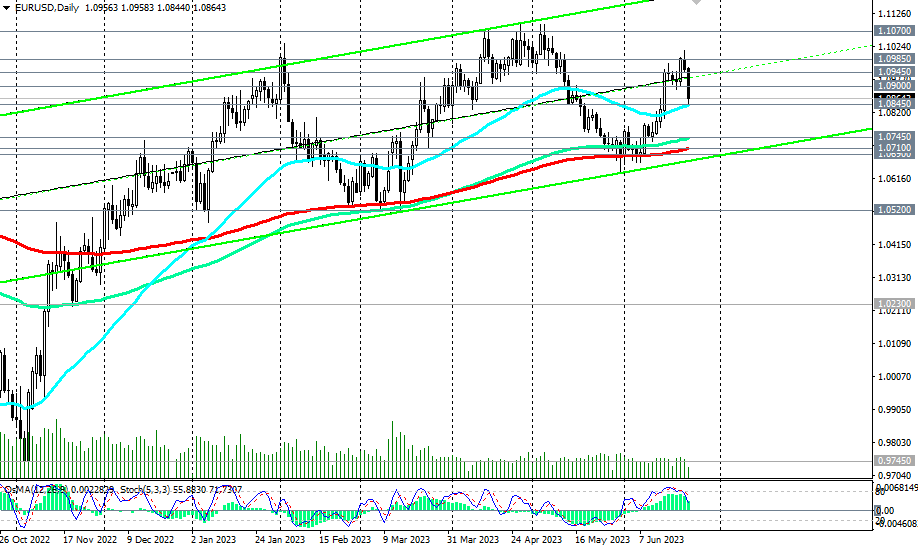

Nevertheless, given the medium-term uptrend of EUR/USD, the decline needs to be assessed as corrective for now, offering a possibility to enter new lengthy positions with the prospect of progress in direction of the resistance degree 1.1570.

Thus – shopping for from the degrees 1.0845, 1.0850. The breakout of the resistance degree 1.0900 (EMA200 on the 1-hour chart) will strengthen the constructive dynamics of EUR/USD, and the breakout of the resistance ranges 1.0945 (EMA144 on the weekly chart), 1.0985 will affirm our assumption.

Right now, the main focus of traders might be macro statistics on enterprise exercise within the manufacturing and repair sectors of the American financial system.

Preliminary PMIs (from S&P World) are anticipated to point out reasonable progress in June within the manufacturing sector and the composite indicator (48.5 and 54.4 vs. 48.4 and 54.3, respectively), whereas PMI within the sector companies decreased barely (to 54.0 from 54.9 in Might), whereas remaining above the worth of fifty, which separates the expansion of exercise from the slowdown. In Might, manufacturing PMI fell for the primary time this 12 months, suggesting {that a} extended cycle of rising rates of interest (learn: the price of borrowing for companies) is already hurting companies, pushing the financial system into recession.

If the info on enterprise exercise within the US seems to be higher than the forecast, this may improve the chance of one other Fed fee hike, which is able to positively have an effect on the greenback (markets are actually pricing in a 77% probability of a Fed fee hike in July).

Nevertheless, the PMI knowledge worse than the forecast will say in regards to the strengthening of financial issues within the US. This can be a adverse issue for the greenback.

Assist ranges: 1.0845, 1.0800, 1.0745, 1.0710, 1.0685, 1.0600, 1.0520, 1.0500

Resistance ranges: 1.0900, 1.0945, 1.0985, 1.1000, 1.1070, 1.1100

[ad_2]