[ad_1]

The main target of merchants right now is the publication at 13:30 (GMT) of recent inflation knowledge within the US. Economists anticipate the patron worth index to drop to six.5% in December (from 7.1% in November) and core CPI to five.7% (from 6.0% in November), which confirms market expectations for additional decrease inflation within the US. If the information is confirmed and even softer, then an extra fall within the greenback, apparently, can’t be averted, we famous in our right now’s “Basic Evaluation“.

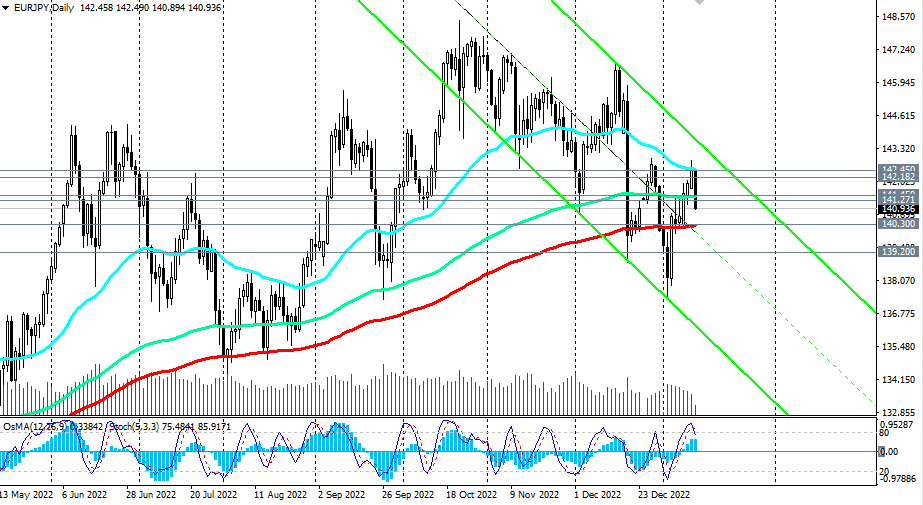

Towards the backdrop of demand for protecting property, the yen is strengthening right now, each towards the greenback and in cross-pairs, particularly, within the EUR/JPY pair. On the time of publication of this text, it’s buying and selling close to the 141.00 mark, storming the sturdy assist ranges 141.45, 141.27.

In case of additional fall, the goal would be the key assist degree 140.30. Its break and break of the essential long-term assist degree 139.20 will considerably enhance the dangers of EUR/JPY transition into the medium-term bear market zone, sending the pair to the important thing assist degree 131.70. A breakdown of the assist degree at 127.40 will full the pair’s transition to the long-term bear market zone.

Help ranges: 141.00, 140.30, 140.00, 139.20, 139.00, 138.00, 137.30, 137.00

Resistance ranges: 141.27, 141.45, 142.00, 142.18, 142.45, 143.00

[ad_2]