[ad_1]

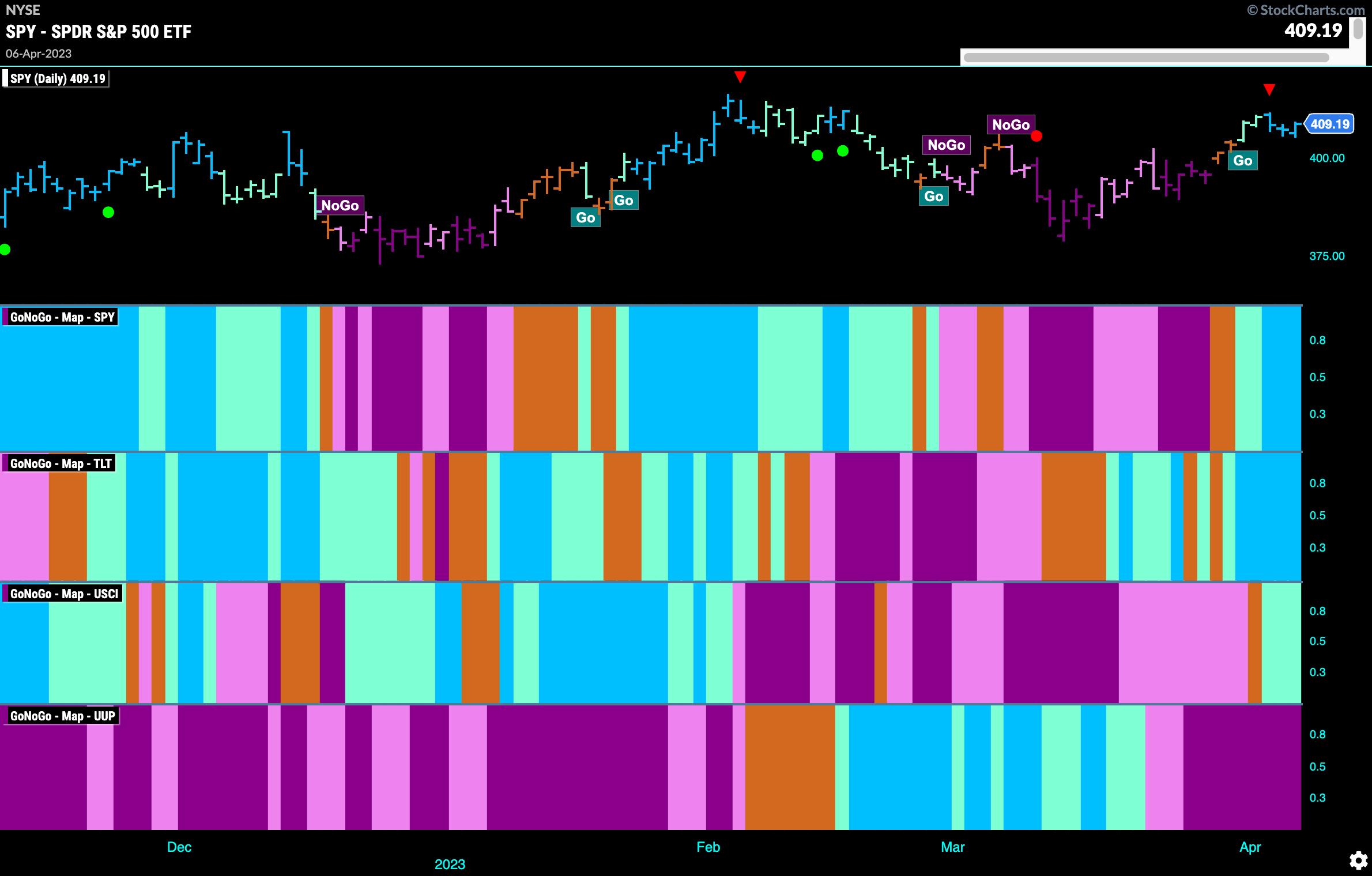

How is the general inventory market trying as of the top of final week? Let’s check out the GoNoGo Asset map beneath. Equities stay within the “Go” development as we begin the brand new week. Treasury bond costs are likewise in a powerful “Go,” and commodities have entered a weak aqua “Go” development. The greenback stays embroiled in a powerful “NoGo.”

Equities Paint Robust Blue “Go” Bars

After breaking out of the Max GoNoGo Squeeze per week in the past, there was a string of “Go” bars painted by GoNoGo Pattern. Whereas value failed to finish the week greater, it is seeing brighter blue bars as value tries to climb to check prior highs from earlier this 12 months.

The weekly chart exhibits the “Go” development stays in place with one other sturdy blue “Go” bar painted. These astute candlestick chartists will discover final week’s candle represents a “doji” (uncertainty) with the open and shut at comparable ranges. GoNoGo Oscillator exhibits that momentum is on the aspect of the “Go” development because it breaks out of a small GoNoGo Squeeze into constructive territory.

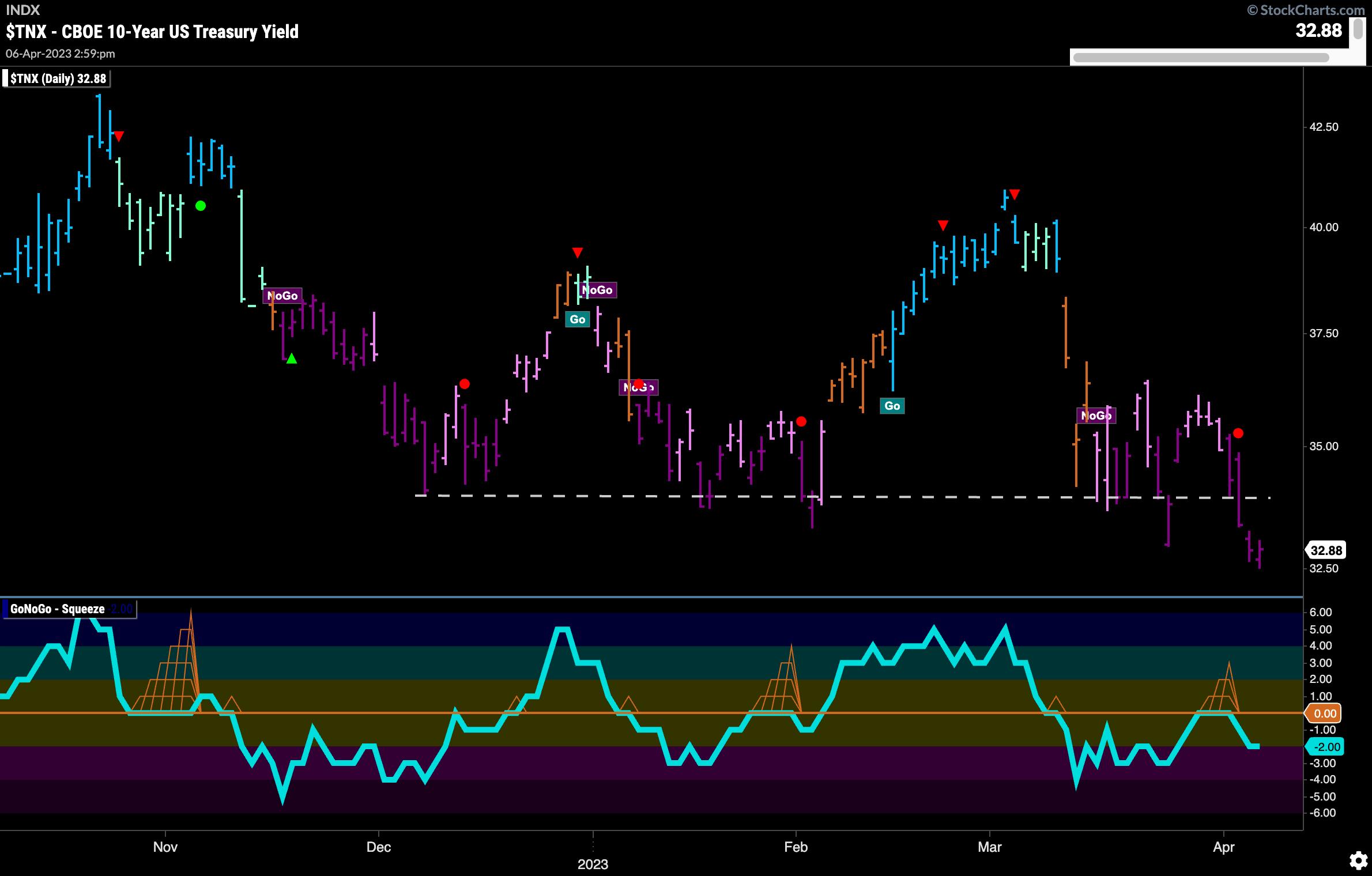

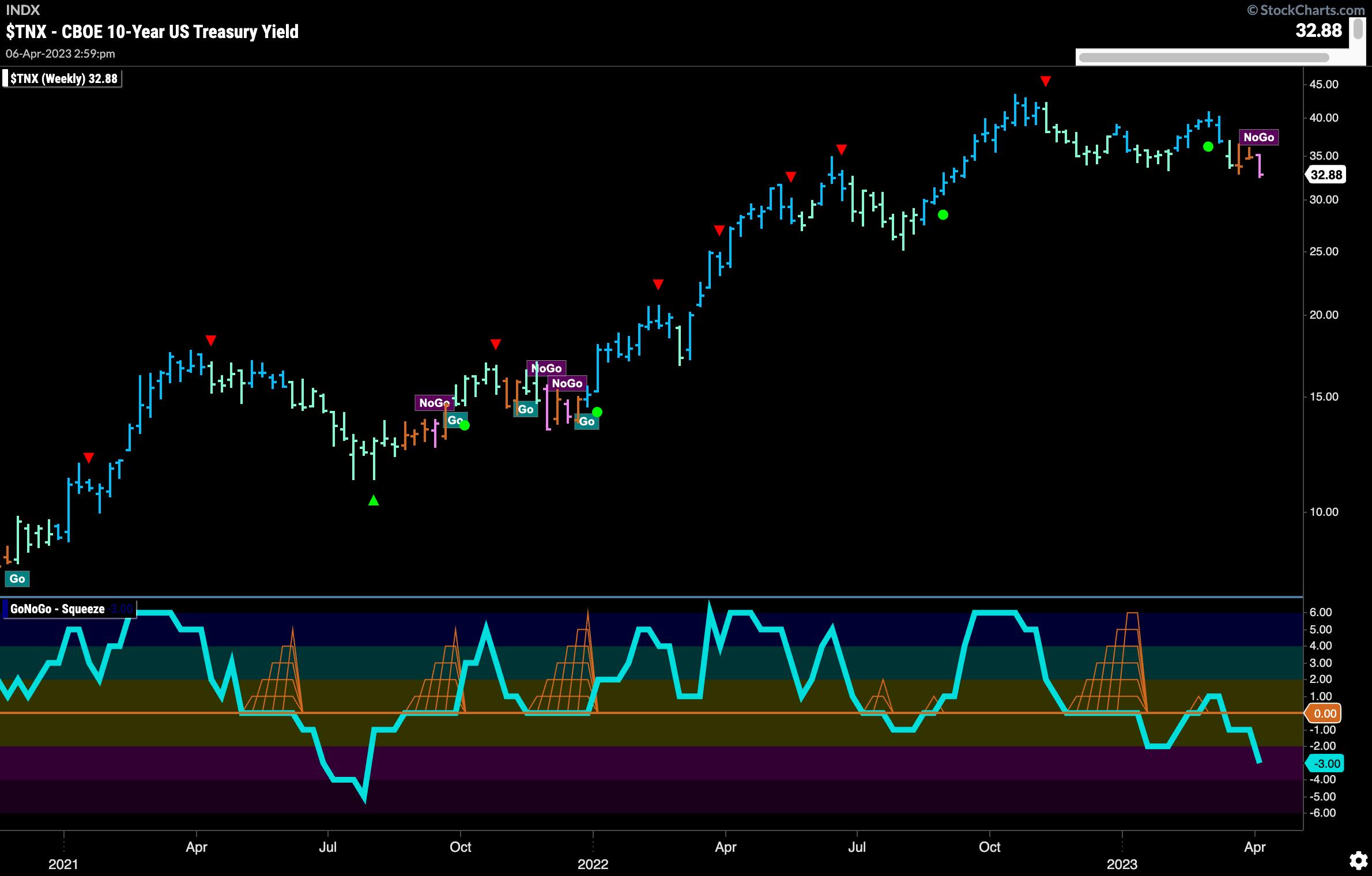

Treasury Charges Fall to New Lows

Treasury charges painted principally sturdy purple “NoGo” bars this week as value examined after which fell beneath horizontal help. As this occurred, GoNoGo Oscillator confirmed by testing the zero line from beneath after which being rejected, falling again into detrimental territory. This tells us that momentum is resurgent within the course of the present “NoGo” development.

The weekly chart now sees the development line up with that of the day by day periodicity. Final week noticed a primary pink “NoGo” bar as GoNoGo Pattern cycled out of “Go Fish” right into a “NoGo” shade for the primary time since late 2021. GoNoGo Oscillator is beneath zero and falling, confirming that momentum is on the aspect of this new “NoGo”.

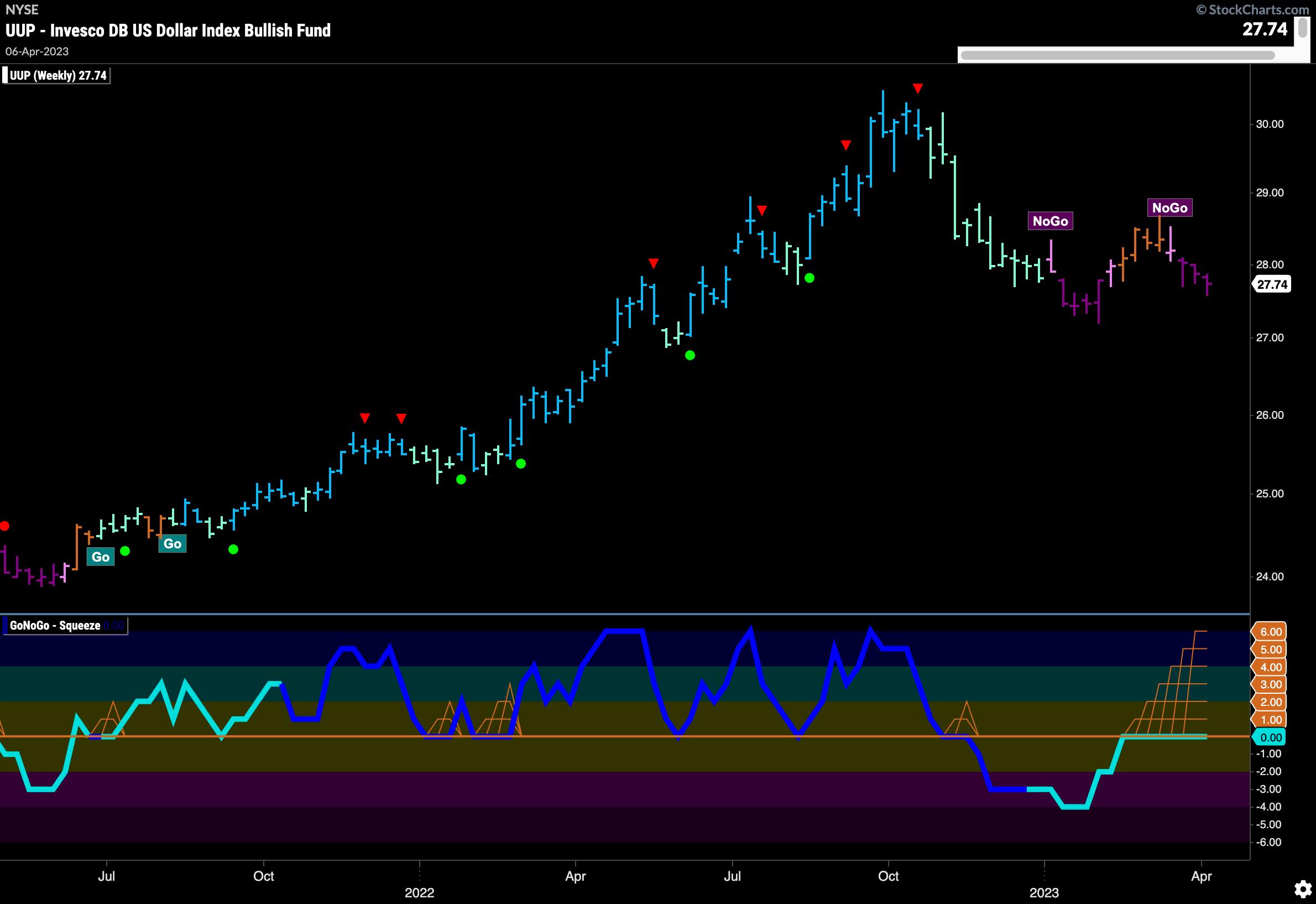

Greenback Continues in “NoGo” Pattern

GoNoGo Pattern painted uninterrupted sturdy purple “NoGo” bars this week as costs continued to maneuver decrease. In placing vary of the February lows, we are going to watch to see if these ranges are examined. GoNoGo Oscillator is in detrimental territory however not oversold.

The weekly chart exhibits little change from the place we had been final week. Costs have moved barely decrease. The GoNoGo Oscillator stays at zero and a Max GoNoGo Squeeze is in impact. Watch to see if costs check prior lows. This might be extra possible ought to the GoNoGo Oscillator fail on the zero line and get turned away into detrimental territory once more.

Oil’s Hole Larger Places Value at Resistance

America Oil Fund (USO) noticed a leap greater final week and a return to a pink “NoGo” bar. This value motion is testing the downward sloping resistance line that has been in place because the summer season of final 12 months. As value runs up towards resistance, so does GoNoGo Oscillator within the type of the zero line. Because it’s rapidly returning to that degree, it is best to look at to see if it will get rejected and despatched decrease or if it may break via into constructive territory. The second state of affairs must play out when you anticipate value to maneuver above its personal resistance.

Gold Units New Excessive

$GLD noticed a brand new excessive this week as GoNoGo Pattern painted constant sturdy blue “Go” bars after the Go Pattern Continuation Icon (inexperienced circle) that occurred midweek.The GoNoGo Oscillator fell to the zero line and located help instantly, bouncing again into constructive territory.

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and information visualization groups, directing each enterprise technique and product improvement of analytics instruments for funding professionals.

Alex has created and applied coaching applications for giant companies and personal shoppers. His instructing covers a large breadth of Technical Evaluation topics, from introductory to superior buying and selling methods.

Study Extra

Tyler Wooden, CMT, co-founder of GoNoGo Charts, is dedicated to increasing the usage of information visualization instruments that simplify market evaluation to take away emotional bias from funding selections.

Tyler has served as Managing Director of the CMT Affiliation for greater than a decade to raise buyers’ mastery and talent in mitigating market threat and maximizing return in capital markets. He’s a seasoned enterprise government centered on academic know-how for the monetary providers business. Since 2011, Tyler has offered the instruments of technical evaluation world wide to funding corporations, regulators, exchanges, and broker-dealers.

Subscribe to GoNoGo Charts to be notified every time a brand new submit is added to this weblog!

[ad_2]