[ad_1]

Market reversals may be recognized based mostly on worth motion and worth patterns. That is usually the strategy utilized by most seasoned merchants. Nevertheless, newer merchants often discover it formidable to determine attainable development reversals based mostly on their observations.

Allow us to look into how we will use technical indicators, such because the Elliott Wave Oscillator and the Highest Highs – Lowest Lows SR indicator, to assist us objectively determine and ensure what worth motion is doing. The technique mentioned right here exhibits us a development reversal technique based mostly on the 2 indicators, which agrees with the ideas of a development reversal based mostly on worth motion.

Elliott Wave Oscillator Indicator

The Elliott Wave Oscillator (EWO) is a momentum indicator which was developed based mostly on the Elliott Wave Concept. Ralph Nelson Elliot, the writer of the Elliott Wave Concept, noticed that costs transfer based mostly on basic patterns. The idea means that merchants can anticipate the path of the subsequent worth motion based mostly on patterns and the place worth motion is in relation to the recognized patterns. Though the patterns are repeatable, market noise reminiscent of worth spikes and volatility might usually mislead merchants leading to mistimed reversal indicators. Because of this, Elliott developed the EWO to assist merchants objectively determine the market swings and reversals because it permits merchants to trace and observe worth oscillations whereas evaluating it to the oscillations on the EWO bars.

The EWO indicator makes use of two shifting common strains to calculate for the values that it plots, notably the 5-bar Easy Shifting Common (SMA) and the 34-bar SMA. Utilizing the values of the 2 SMA strains, it calculates for the distinction between the 5 SMA and 34 SMA strains. It then makes use of these values as a foundation for plotting its histogram bars. Thus the principle method for the EWO indicator is as follows:

EWO = 5 SMA – 34 SMA

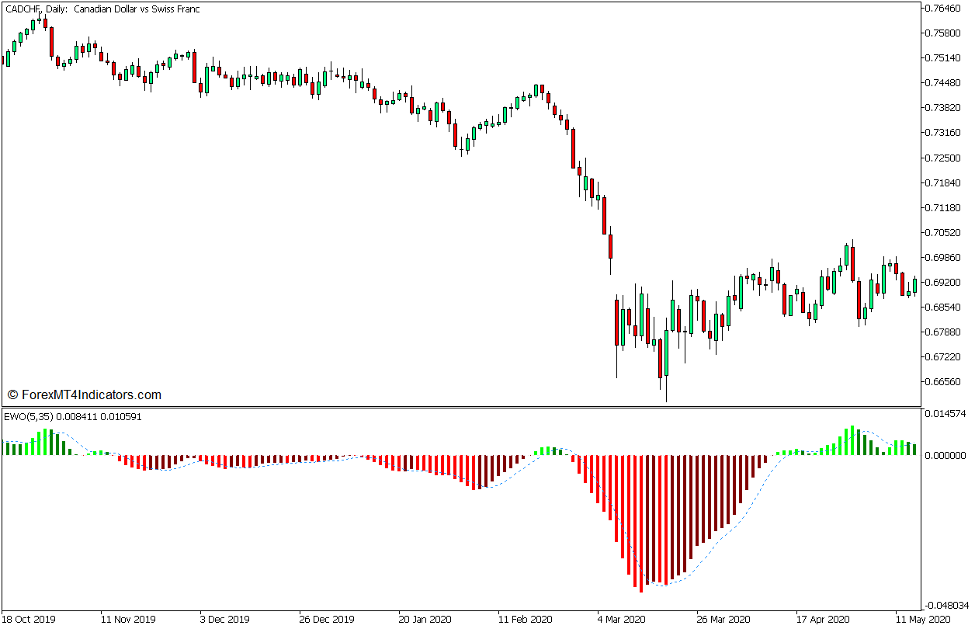

This model of the EWO modifies the colour of the bars to point the path of the development, in addition to the weakening or strengthening of the development. It plots lime bars each time it’s printing constructive values which have better worth than its previous bar, and inexperienced bars each time it’s printing constructive bars with lowering values. Then again, it plots purple bars each time it’s printing detrimental bars with lowering values, and maroon bars each time it’s printing detrimental bars with constructive values.

This model additionally has a function whereby the indicator would calculate for the shifting common of the EWO bars. It then plots the values of the shifting common as a dashed line which mimics the actions of the oscillator bars. This dashed line could also be used as a sign line.

Highest Excessive – Lowest Low SR Indicator

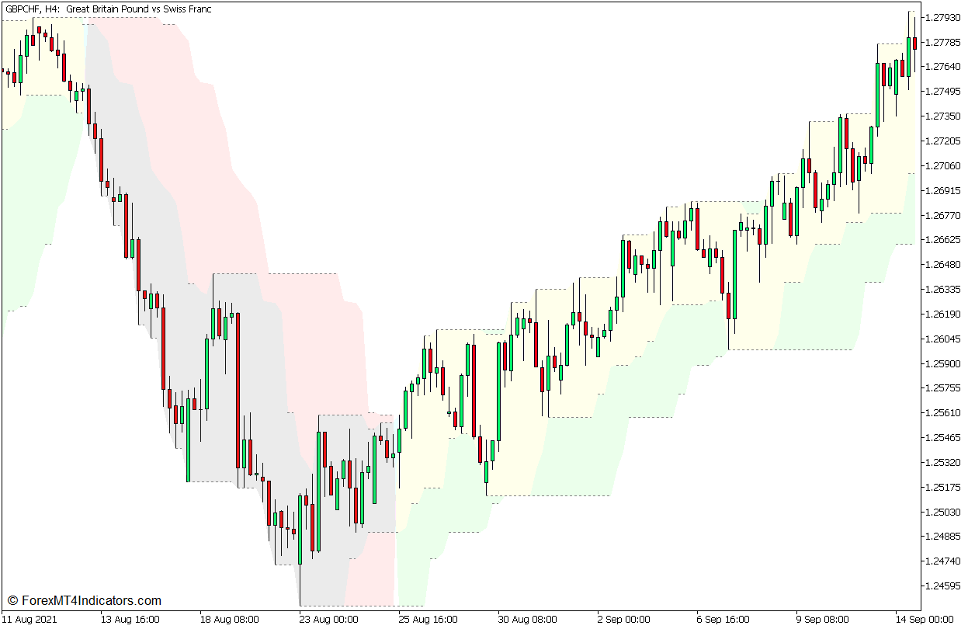

The Highest Excessive – Lowest Low SR Indicator is a customized technical indicator which was supposed to assist merchants determine assist and resistance ranges, in addition to development path based mostly on worth motion.

The initials “SR” truly imply “assist and resistance”. As its title suggests, the Highest Excessive – Lowest Low SR Indicator is a software which identifies assist and resistance ranges based mostly on the best highs and lowest lows. The indicator makes use of an algorithm which in contrast the highs and lows of worth so as to determine the best highs and lowest lows in a sequence of candles. The recognized highest highs and lowest lows are then used as a foundation for plotting dotted strains, that are the recognized assist and resistance ranges.

By the way, provided that worth motion can be utilized to determine development path, this indicator additionally has a function which helps merchants determine development path. It shades the realm between the assist and resistance ranges yellow and inexperienced to point a bullish development, and violet and pink to point a bearish development. This development path is predicated on worth motion breaking greater highs indicating an uptrend or dropping beneath decrease lows indicating a downtrend.

Buying and selling Technique Idea

Elliott Wave Oscillator Reversal Breakout Foreign exchange Buying and selling Technique is a development reversal buying and selling technique which is predicated on the Larger Highs – Decrease Lows SR and Elliott Wave Oscillator indicators.

The Larger Highs – Lowers Lows SR indicator is used to determine the reversal of worth swings. That is based mostly on the idea that development path may be recognized based mostly on worth motion breaking greater highs or dropping beneath decrease lows. To do that, we’d be observing for candles with robust momentum closing strongly past an recognized assist or resistance degree shifting towards the path of the present development. This motion would additionally trigger the indicator to shade its areas with a unique colour indicating a possible development reversal.

The Elliott Wave Oscillator is then used as a affirmation sign of the recognized potential development reversal. Development path and energy is recognized based mostly on whether or not its histogram bars are constructive or detrimental, in addition to the colour of the bars it plots.

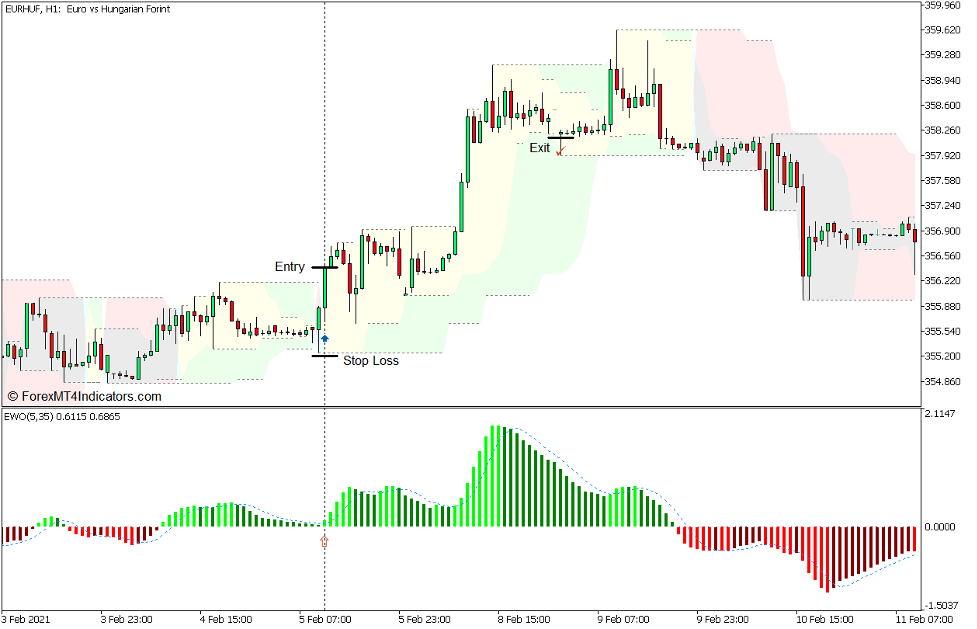

Purchase Commerce Setup

Entry

- A powerful bullish momentum candle ought to shut above a serious swing excessive resistance recognized by the Larger Highs – Decrease Lows SR indicator.

- The Elliott Wave Oscillator ought to plot a constructive lime bar which is above its sign line.

- Open a purchase order on the affirmation of those situations.

Cease Loss

- Set the cease loss beneath the assist degree recognized by the Larger Highs – Decrease Lows SR indicator.

Exit

- Path the cease loss one or two assist ranges behind worth motion till stopped out in revenue.

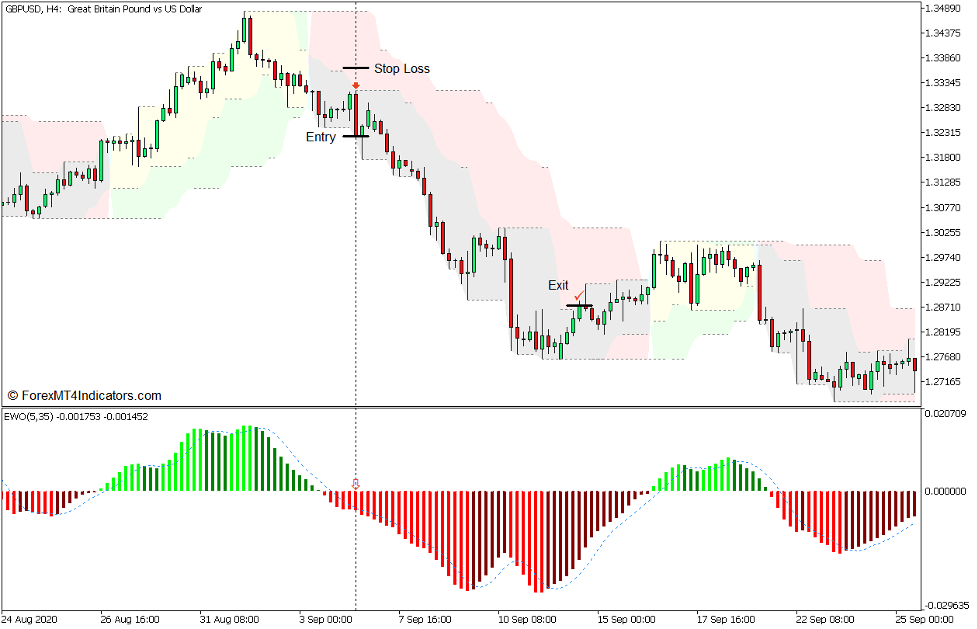

Promote Commerce Setup

Entry

- A powerful bearish momentum candle ought to shut beneath a serious swing low assist recognized by the Larger Highs – Decrease Lows SR indicator.

- The Elliott Wave Oscillator ought to plot a detrimental purple bar which is beneath its sign line.

- Open a promote order on the affirmation of those situations.

Cease Loss

- Set the cease loss above the resistance degree recognized by the Larger Highs – Decrease Lows SR indicator.

Exit

- Path the cease loss one or two assist ranges behind worth motion till stopped out in revenue.

Conclusion

Figuring out development reversals based mostly on the break of a swing excessive or swing low is an efficient methodology for recognizing development reversals. This technique simplifies the method of figuring out such reversal indicators utilizing technical indicators, leading to reversal commerce indicators which can be goal and logical.

This technique works greatest with the understanding of worth motion and its development reversal indicators. Merchants who can spot assist and resistance ranges based mostly on swing highs and lows would even be more practical in buying and selling one of these technique.

Foreign exchange Buying and selling Methods Set up Directions

Elliott Wave Oscillator Reversal Breakout Foreign exchange Buying and selling Technique for MT5 is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past knowledge and buying and selling indicators.

Elliott Wave Oscillator Reversal Breakout Foreign exchange Buying and selling Technique for MT5 offers a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 5 Buying and selling Platforms

#1 – XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

#2 – Pocket Choice

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 General Score!

- Routinely Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

set up Elliott Wave Oscillator Reversal Breakout Foreign exchange Buying and selling Technique for MT5?

- Obtain Elliott Wave Oscillator Reversal Breakout Foreign exchange Buying and selling Technique for MT5.zip

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Elliott Wave Oscillator Reversal Breakout Foreign exchange Buying and selling Technique for MT5

- You will note Elliott Wave Oscillator Reversal Breakout Foreign exchange Buying and selling Technique for MT5 is on the market in your Chart

*Word: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]