[ad_1]

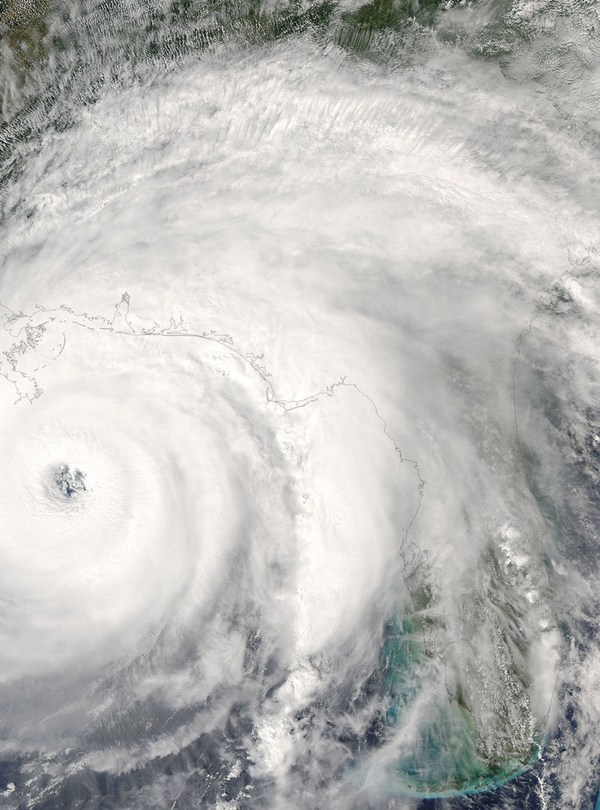

Extreme storms, tornadoes, floods, and mudslides have ravaged components of the nation throughout the previous few months. For those who had been a sufferer of a pure catastrophe in an space designated as a federal catastrophe by the Federal Emergency Administration Company (FEMA) the IRS has doubtless prolonged numerous federal tax deadlines and different aid for you. Victims from totally different states – together with areas in Alabama, Arkansas, California, Georgia, Mississippi, New York, and Tennessee – now have extensions to file numerous federal particular person and enterprise 2022 tax returns and make 2022 tax funds and will qualify for tax aid on the state degree as properly.

Nonetheless, there are lots of individuals who haven’t been impacted or dwell in states that don’t have an extension. You might be nonetheless required to file on April 18th or file for an extension by that date for those who dwell within the following states:

Alaska

Arizona

Colorado

Connecticut

Delaware

Florida

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

Even for those who dwell in one of many areas designated as a federally declared catastrophe, however you weren’t impacted and haven’t filed your taxes but TurboTax has you lined and might help you file earlier than the tax deadline.

If these storms impacted you, we wish you to know TurboTax is right here for you, and we need to preserve you updated with essential tax aid data that will assist you to on this time of want. Be aware: extension dates and federal and state necessities are depending on the state and county the place you reside or have a enterprise – see extra data for every state beneath.

Tax Reduction for Impacted Tax Filers:

What are the prolonged deadlines to file tax returns and make funds for every state?

Alabama

Key Takeaways:

- Federal and State Tax & cost deadlines are prolonged to October 16, 2023.

- To qualify, you need to have an deal with of file situated within the catastrophe space.

- This is applicable to federal and state tax returns and tax funds.

Federal Tax Reduction

In January, the IRS made an preliminary announcement that storm victims in components of Alabama would qualify for tax aid. In February IRS later additional prolonged the deadline to file numerous federal deadline particular person and enterprise tax returns and make tax funds till October 16, 2023.

The IRS is providing aid to any space designated by the Federal Emergency Administration Company (FEMA). Because of this people and households that reside or have a enterprise in Autauga and Dallas counties in Alabama qualify for tax aid. Different areas added later to the catastrophe space will even qualify for a similar aid.

State of Alabama Tax Reduction

The Alabama Division of Income (ALDOR) is providing tax aid to Alabama particular person taxpayers and companies in federally declared catastrophe areas in Alabama the place harm was attributable to extreme climate in January. The state tax aid mirrors IRS measures in the identical declared catastrophe areas.

Alabama taxpayers residing in areas designated as catastrophe areas by the federal authorities have till October 16, 2023, to file tax returns and make tax funds due on or after January 12, 2023, and earlier than October 16, 2023. The aid applies to all taxes administered by ALDOR (besides taxes and registration charges due below the Worldwide Gasoline Tax Settlement and the Worldwide Registration Plan).

Arkansas

Key Takeaways:

- Tax deadlines & cost deadlines are prolonged to July 31, 2023.

- To qualify, you need to have an deal with of file situated within the catastrophe space.

- This is applicable to federal and state tax returns and tax funds.

Federal Tax Reduction

The IRS introduced on April 3 that Arkansas storm victims have till July 31, 2023, to file numerous federal particular person and enterprise tax returns and make tax funds. Presently, tax aid is out there to any space designated by FEMA. Because of this people and households residing or proudly owning companies in Cross, Lonoke and Pulaski counties qualify for tax aid. Different areas added later to the catastrophe space will even qualify for a similar aid. Taxpayers in sure storm-impacted localities designated by FEMA will mechanically obtain the identical submitting and cost aid.

State of Arkansas Tax Reduction

The Governor of Arkansas by Govt Order prolonged the 2022 particular person state earnings tax submitting date and particular person state earnings tax cost date from April 18, 2023, to July 31, 2023, for these residing in Pulaski, Lonoke, and Cross counties. This extension consists of 2022 returns of Subchapter S Firms, fiduciaries and estates, partnerships and composite returns. The requirement for a written request for an extension is waived during this emergency.

California

Key Takeaways:

- Federal and State tax & cost deadlines are prolonged to October 16, 2023.

- To qualify, you need to have an deal with of file situated within the catastrophe space.

- This is applicable to federal and state tax returns and tax funds.

Federal Tax Reduction

The IRS introduced that victims of those California storms have till October 16, 2023 to file numerous particular person and enterprise tax returns and make sure tax funds. Presently tax aid is out there to any space designated by FEMA. Because of this people and households that reside or have a enterprise in Alpine, Amador, Butte, Calaveras, Del Norte, El Dorado, Fresno, Glenn, Humboldt, Imperial, Inyo, Kern, Kings, Lake, Los Angeles, Madera, Mariposa, Mendocino, Merced, Mono, Monterey, Napa, Nevada, Orange, Placer, Plumas, Sacramento, San Benito, San Bernardino, San Francisco, San Joaquin, San Mateo, San Luis Obispo, Santa Barbara, Santa Clara, Santa Cruz, Sierra, Sonoma, Stanislaus, Trinity, Tulare, Tuolumne and Yuba counties qualify for tax aid. Taxpayers in sure storm impacted localities designated by FEMA will mechanically obtain the identical submitting and cost aid.

State of California Tax Reduction

The Governor of California introduced that people and companies impacted by 2022-23 winter storms qualify for an extension to file their state tax return and pay taxes owed till October 16, 2023.

Georgia

Key Takeaways:

- Federal tax and cost deadlines prolonged to October 16, 2023

- State tax and cost deadlines prolonged to Could 15, 2023

- To qualify, you need to have an deal with of file situated within the catastrophe space.

- This is applicable to federal and state tax returns and tax funds.

Federal Tax Reduction

In January, the IRS made an preliminary announcement that storm victims in components of Georgia would qualify for tax aid. In February IRS later additional prolonged the deadline to file numerous federal deadline particular person and enterprise tax returns and make tax funds till October 16, 2023.

The IRS is providing aid to any space designated by the Federal Emergency Administration Company (FEMA). Because of this people and households that reside or have a enterprise in Butts, Henry, Jasper, Meriwether, Newton, Spalding and Troup counties in Georgia qualify for tax aid. Different areas added later to the catastrophe space will even qualify for a similar aid.

State of Georgia Tax Reduction

The newest announcement by the Georgia Division of Income states that sure deadlines for taxpayers have been prolonged till Could 15, 2023, for taxpayers impacted by extreme climate on January 12, 2023. This impacts Georgians in Butts, Crisp, Henry, Jasper, Meriwether, Newton, Pike, Spalding, and Troup counties.

People and companies whose information required for tax compliance are situated within the catastrophe space will obtain the prolonged deadline. This extension applies to return filings and tax funds.

It is strongly recommended that tax filers e-file with direct deposit, however in case you are an affected taxpayer submitting paper returns you must write: “January 12, 2023 Extreme Climate” throughout the highest of any varieties submitted to the Division.

Mississippi

Key Takeaways:

- Federal and State tax & cost deadlines prolonged to July 31, 2023.

- To qualify, you need to have an deal with of file situated within the catastrophe space.

- This is applicable to federal and state tax returns and tax funds.

Federal Tax Reduction

The IRS introduced that victims of the tough storms that occurred in components of Mississippi now have till July 31, 2023 to file numerous particular person and enterprise tax returns and make sure tax funds.

The tax aid postpones numerous tax submitting and cost deadlines that occurred beginning on March 24, 2023. In consequence, affected taxpayers that reside or have enterprise in Carroll, Humphreys, Monroe, and Sharkey counties have till July 31, 2023, to file returns and pay any taxes that had been initially due throughout this era.

State of Mississippi Tax Reduction

Mississippi will observe IRS extensions granted to victims of extreme storms, straight-line winds, and tornadoes that occurred from March 24, 2023 to March 25, 2023. Taxpayers who reside or have a enterprise in Carroll, Humphreys, Monroe, and Sharkey counties have till July 31, 2023, to file particular person earnings tax returns, company earnings and franchise tax returns, passthrough entity tax returns and quarterly estimated funds that had been initially due throughout this era.

The state of Mississippi will work with any taxpayer who resides elsewhere however whose books, information, or tax professionals are situated within the catastrophe areas.

New York

Key Takeaways:

- Federal Tax & cost deadlines prolonged to Could 15, 2023.

- To qualify, you need to have an deal with of file situated within the catastrophe space.

- This is applicable to federal tax returns and federal tax funds.

- For New York state tax returns and tax funds you need to file for an extension by April 18, 2023.

Federal Tax Reduction

The IRS introduced on March 24 that New York winter storm victims now have till Could 15, 2023 to file numerous particular person and enterprise tax returns and make sure tax funds.

The tax aid postpones numerous tax submitting and cost deadlines that occurred between December 23 and December 28, 2022. In consequence, affected people and companies in Erie, Genesee, Niagara, St. Lawrence and Suffolk counties could have till Could 15, 2023, to file returns and pay any taxes that had been initially due throughout this era.

State of New York Tax Reduction

For those who or your small business was affected by the blizzard of 2022 in Erie, Genesee, Niagara, St. Lawrence, and Suffolk counties and also you want extra time to file you’ll be able to request an earnings tax extension or company tax extension on-line. For those who need assistance submitting your extension contact the New York State Division of Taxation and Finance.

Tennessee

Key Takeaways:

- Federal tax & cost deadlines prolonged to July 31, 2023.

- To qualify, you need to have an deal with of file situated within the catastrophe space.

- This is applicable to federal tax returns and tax funds.

Federal Tax Reduction

The IRS has issued aid for Tennessee storm victims and so they now have till July 31, 2023 to file numerous federal particular person and enterprise tax returns and make tax funds. Because of this people and households that reside or have enterprise in Cannon, Hardeman, Hardin, Haywood, Lewis, Macon, McNairy, Rutherford, Tipton and Waynes counties qualify for aid.

State of Tennessee Tax Reduction

Whereas the state of Tennessee doesn’t have a person earnings tax, the Tennessee Division of Income has introduced an extension for these companies situated in a chosen catastrophe space. The Division of Income has prolonged the franchise and excise tax submitting and cost deadlines to July 31, 2023.

What do I have to do to assert the federal tax extension?

The IRS mechanically supplies submitting and penalty aid for Federal tax returns to any taxpayer with an IRS deal with of file situated within the catastrophe space. Taxpayers don’t have to contact the IRS to get this aid. Nonetheless, if an affected taxpayer receives a late submitting or late cost penalty discover from the IRS that has an authentic or prolonged submitting, cost or deposit due date falling inside the postponement interval, the taxpayer ought to name the quantity on the discover to have the penalty abated.

The tax aid is a part of a coordinated federal response to the harm attributable to the tough storms and is predicated on native harm assessments by FEMA. For data on catastrophe restoration, go to disasterassistance.gov.

If you’re not a sufferer, however you might be seeking to assist these in want, this can be a nice alternative to donate or volunteer your time to legit 501(c)(3) not-for-profit charities who’re offering aid efforts for storm victims.

Verify again with the TurboTax weblog for extra updates on catastrophe aid.

[ad_2]