[ad_1]

If UK authorities ministers have been to be believed the price of servicing UK authorities debt creates such a burden on its funds that austerity is required, together with with regard to public servants’ pay.

Because of this feedback like this come up on the weblog:

Hello Richard,

Lengthy-time reader, first time commenter. In a pub debate, a buddy of mine insisted that progress on this nation was being held again by the price of servicing authorities money owed, and that solely austerity in authorities spending might undo it.

While I perceive that plenty of authorities “money owed” (i.e. cash) are held by helpful issues like pension funds and overseas governments and the federal government debt has by no means, and can by no means, be paid off, it nonetheless seemed to be logical that servicing these money owed might drag on the capability for the federal government to develop the economic system.

What’s the MMT response to servicing authorities money owed, and the function of the present UK’s debt obligations in limiting/facilitating spending? Thanks.

So, I used the OBR’s newest forecast of debt servicing prices (which might be old-fashioned by Wednesday lunchtime, however will do for now) plus customary GDP deflator knowledge from the ONS month-to-month statistics pack to take a look at this difficulty.

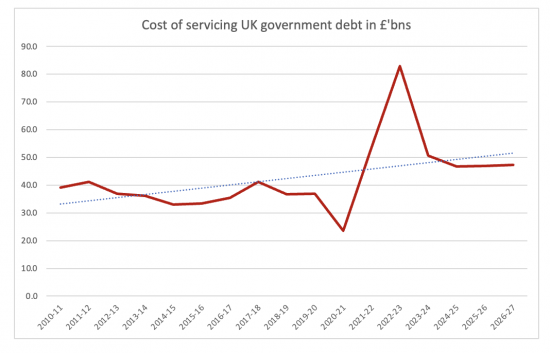

That is the precise price of debt servicing knowledge in unique costs, plus the Workplace for Price range Duty forecast to 2027:

I added the development line. It’s upward.

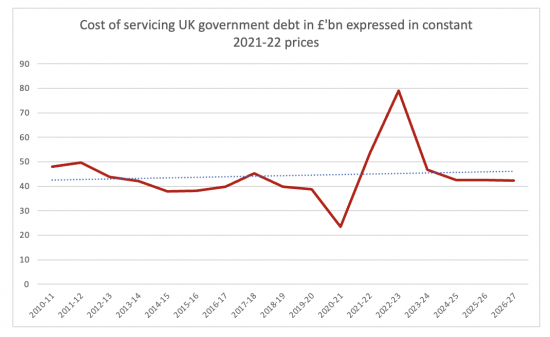

Then I restated in 2021-22 costs:

The sample is broadly comparable, however now the development line is rising solely very barely.

What is definitely fairly shocking is how secure that is, 2020 – 2023 excluded.

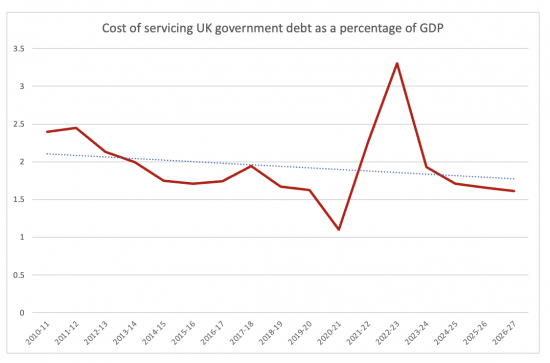

After that I acknowledged the info as a share of GDP to point the capability to pay:

The trendline is now downward. 2020 – 23 are nonetheless aberrational.

First, some observations earlier than drawing conclusions:

- Debt servicing prices in 2020-21 have been very low as a result of inflation just about disappeared in that yr and that meant the price of servicing index-linked bonds virtually disappeared as effectively.

- Debt servicing prices are excessive in 2022-23. That’s as a result of as 2021 closed inflation rose and it’ll not drop considerably till later this yr. Because of this, the claimed price of servicing index-linked bonds rose dramatically.

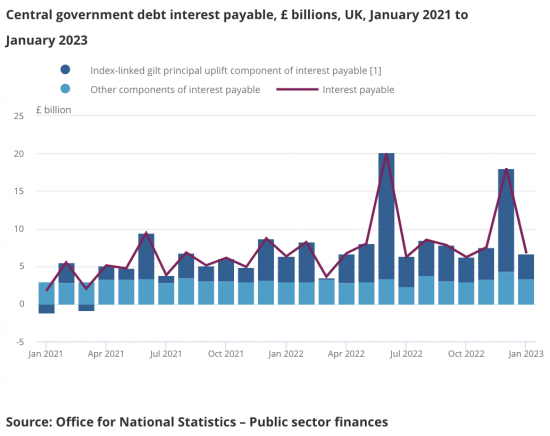

- I stress the claimed price is excessive. That this is because of index-linked bonds is made clear on this chart from the Workplace for Nationwide Statistics January public funds launch:

- Pale blue represents recurring customary gilt curiosity prices and darkish blue the distinctive prices of index-linked binds, displaying the shift from destructive prices in January 2021 to distinctive prices in January 2023.

- Nonetheless, it is very important word that these prices are estimates: the precise money due on these bonds is not going to, on common, be paid for 18 years: we’ve got that lengthy to save lots of up for the cost. If the funds have been unfold over that 18-year interval, as could be cheap, there could be no distinctive price in 2022-23.

- Be aware that forecast prices fall closely from 2023-24 onwards and as a declining development to GDP. That’s as a result of inflation is anticipated to fall to shut to zero from 2024 onwards, largely eliminating the price of index-linked bonds once more. There isn’t a motive to assume this forecast of low inflation is incorrect.

So, is there any motive to assume that debt servicing prices require austerity now? The easy reply is there’s none in any respect. The price of servicing authorities debt is a small a part of complete spending: the distinctive price in 2022-23 is because of exceptionally poor accounting which the federal government is not going to clarify in public, and that price is not going to recur. There’s then no motive to take it under consideration when planning future public spending.

As for the fashionable financial principle strategy to this: MMT means that the federal government needn’t borrow from exterior sources. It additionally means that rates of interest be saved as little as attainable to stop upward shifts of wealth inside society and to encourage funding.

MMT additionally acknowledges that rates of interest on authorities debt are set by authorities selection, regardless that they deny it.

MMT does, due to this fact recommend that this chosen debt servicing price is not any constraint on spending. And if the choice is made to pay it, MMT means that it’s wholly inexpensive and is not any constraint on different actions.

So, in abstract, if the Chancellor talks about this throughout the price range at this time and says it requires austerity he’s speaking complete nonsense. I might be much less well mannered, however that may do.

[ad_2]