[ad_1]

Suppose you could have opened a buying and selling account with $100,000. You made a deal and earned 1 thousand. That’s, your revenue on this commerce is 1 % of your capital. Fantastic.

Now, for instance you lose the identical $1,000 in your subsequent commerce. How a lot did you lose as a share? One? Incorrect reply. You misplaced 0.99 % on this commerce. As a result of 1,000 out of 100,000 is 1 %, whereas 1,000 out of 101,000 is just 0.99 %.

The compound curiosity

This seemingly small distinction results in large results if we deviate farther from the preliminary hundred %. On the one hand, that is nice. If the deposit grows, then every new revenue turns into increasingly in absolute phrases, even whether it is 1 % of your buying and selling account. That is referred to as compound curiosity. We observe the same impact when the share worth rises. The upper the value, the extra {dollars} that make up 1 % of its worth.

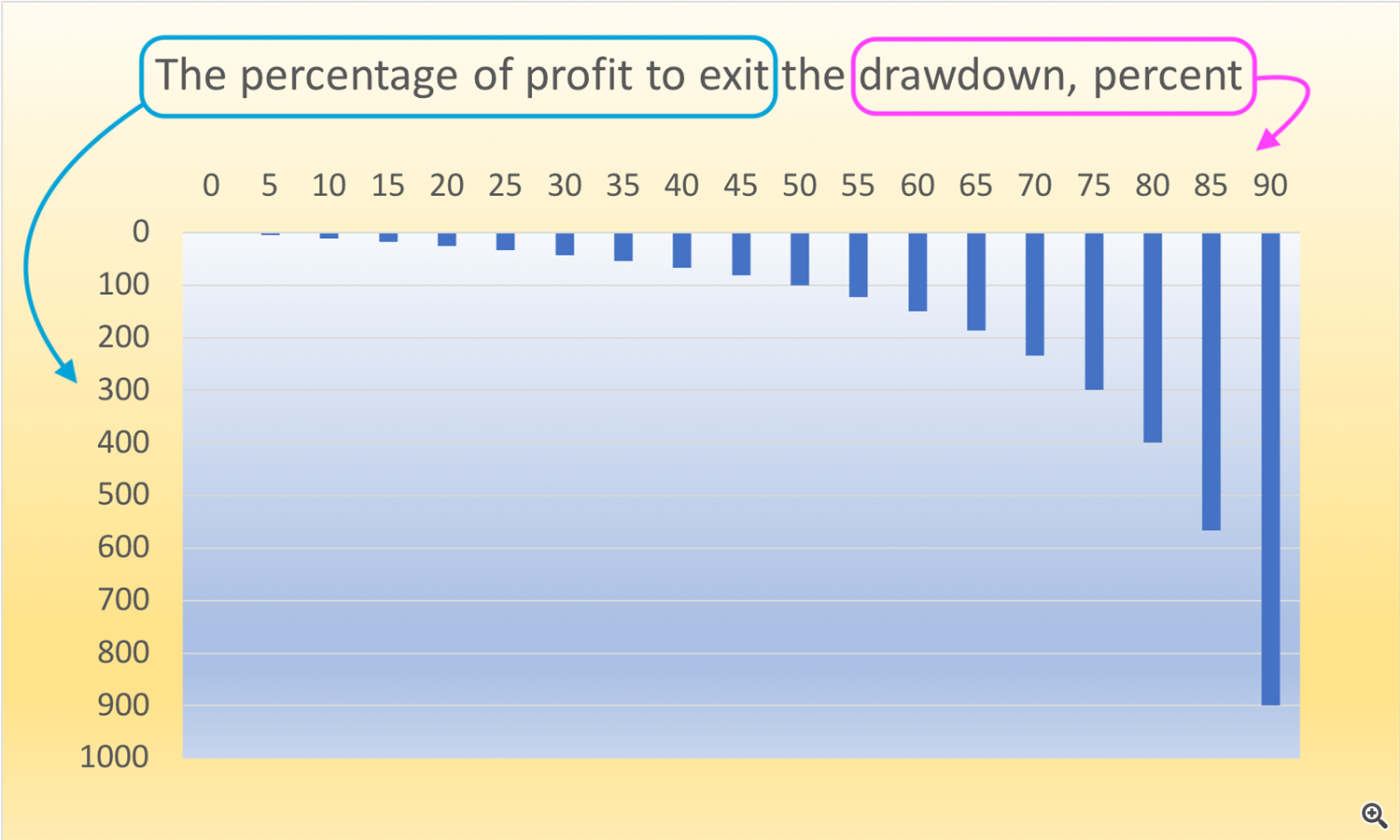

However, it isn’t so good anymore. Buying and selling will not be solely about income, there are additionally drawdowns. A drawdown happens from a collection of dropping trades. So the issue is that the deeper the drawdown, the tougher it’s to get out of it. That is purely mathematical.

Drawdowns

Let’s examine what is going on on. If every thing is obvious with small deviations from 100%, plus or minus somewhat, then with giant ones every thing is extra attention-grabbing. Let’s take an enormous worth. 30 %. If you happen to get into such a drawdown, then to get out it’s essential to make income of just about 43 %. It is rather severe. And if the drawdown has reached a price of fifty %, then you definately want 100% revenue to interrupt even.

Give it some thought. It’s a must to double up your deposit to win again a 50% loss. Truly, that is what drawdowns in buying and selling are harmful for. Subsequently, it’s affordable to carefully monitor the drawdown and take the required measures to deal with it in time.

My options: Vladimir Toropov’s merchandise for merchants

[ad_2]