[ad_1]

Lately, gold costs have fluctuated dramatically within the world market, typically attracting the curiosity of buyers and speculators. Variables that influence gold costs embrace inflation, central financial institution financial coverage and geopolitical threats or recessions. You will need to keep in mind that excessive rates of interest drive up the price of credit score, which may deter buyers from buying belongings comparable to gold that don’t generate present revenue or curiosity.

Certainly, gold is usually seen as a hedge in opposition to inflation. When the worth of cash decreases, the worth of products and providers will increase, in flip growing the attractiveness of gold as a retailer of worth. Nevertheless, within the occasion of disinflation, the inducement to put money into gold will after all diminish. Gold might come beneath stress, if inflation declines, particularly if rates of interest proceed to rise.

Below such situations, investments that supply mounted returns, comparable to bonds or financial institution deposits, theoretically turn out to be extra engaging. Due to this fact, we will anticipate that gold costs might come beneath stress in a excessive rate of interest setting. And the prospect of additional rate of interest hikes continues to be excessive, each within the US and in Europe. The anticipated rate of interest for the Eurozone is at present near 4%, whereas for the Fed it’s 5.40%.

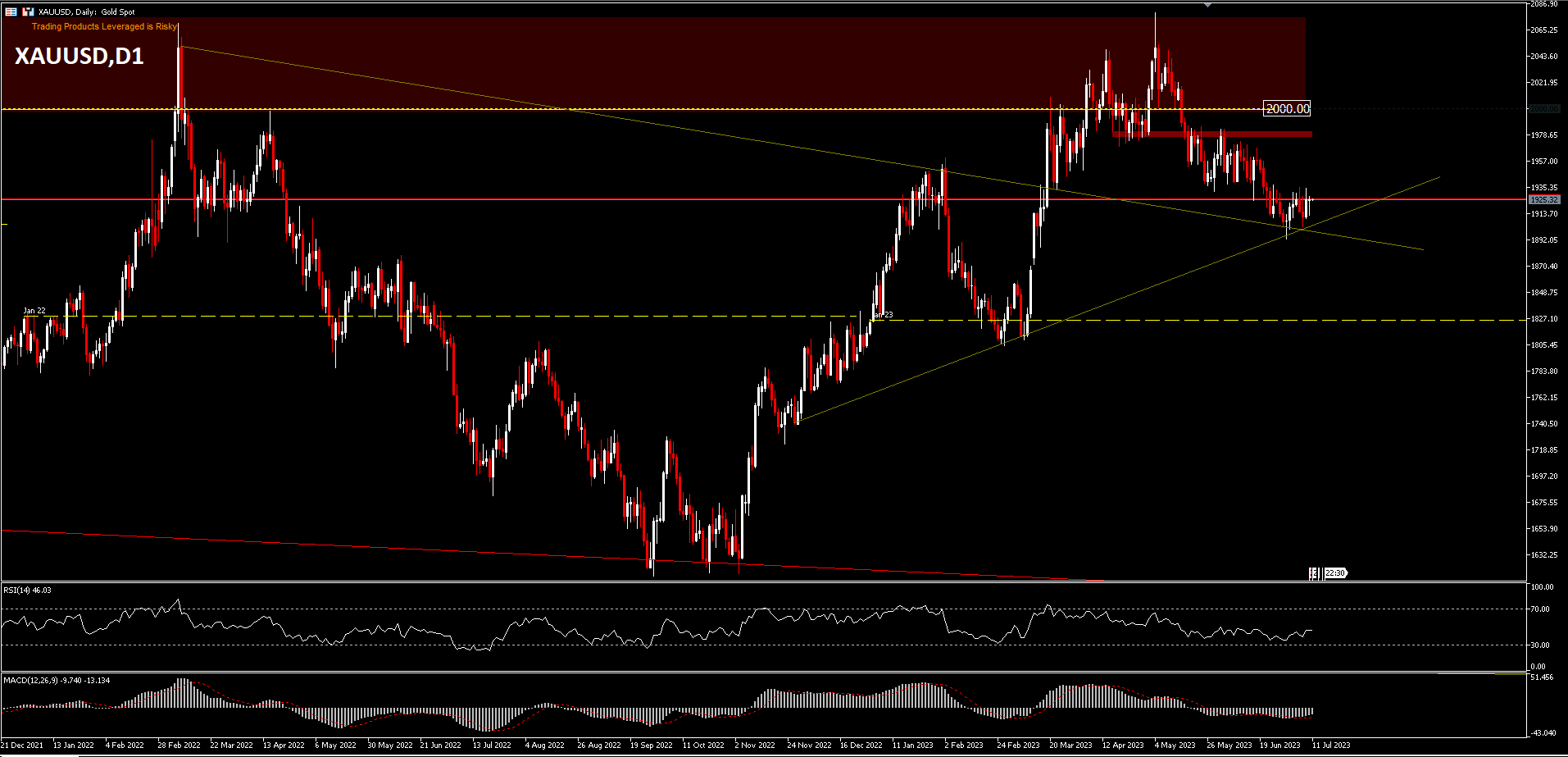

For those who take a look at the XAUUSD chart, the bounce across the $2000 degree has occurred thrice which appears to have been the resistance degree for the final three years. It could possibly be that this degree is a big stronghold, as the worth has by no means been capable of completely rise above that mark, whether or not on account of pandemics, wars, or the warmth of inflation. Gold costs might not appropriate under the $1600 degree till the tip of the 12 months, however gold might repeat previous patterns if extra components current, comparable to an surprising recession or peace, or decrease geo-political tensions. And nonetheless the primary set off for gold’s superiority might begin with USD weak spot, decrease rates of interest, or a recession that’s beneficial for gold.

In the meantime, in Monday’s buying and selling (10/07), gold costs fluctuated barely round $1920, as buyers balanced the potential of extra financial tightening in opposition to considerations a few slowdown on the planet economic system. Weak efficiency in Chinese language producer and shopper costs contributed to warnings of a stuttering restoration and the rising risk of deflation. The blended payroll report from the US confirmed that job development slowed, however wages grew strongly and the unemployment fee declined.

It’s anticipated that the upcoming US CPI report on Wednesday will present an extra replace on inflationary pressures. Though there are questions concerning the necessity for extra fee hikes past July, merchants anticipate the Federal Reserve to lift the funds fee by 25 foundation factors this month with a likelihood of round 92%. It’s anticipated that different necessary central banks such because the BOE, ECB and BOC will proceed to tighten their insurance policies.

In different information, extra international locations are repatriating gold reserves in anticipation of the influence of sanctions imposed by the West on Russia, in accordance with an Invesco survey of central banks and sovereign wealth funds. Final 12 months’s monetary market turmoil precipitated financial and financial authorities to rethink their methods, amid the fact of upper inflation and protracted geopolitical tensions. Greater than 85 per cent of the 85 sovereign wealth funds and 57 central banks that took half within the Invesco Examine consider inflation will now be larger within the coming decade. Gold and rising market bonds are seen pretty much as good devices. Nevertheless, the West’s freezing of virtually half of Russia’s $640bn gold and overseas change reserves seems to have triggered a shift.

Geopolitical considerations, mixed with alternatives in rising markets, additionally prompted some central banks to diversify over the greenback. There was a seven per cent rise in respondents who consider the rise in US debt can be destructive for the greenback, though most nonetheless see no various to it because the world’s reserve foreign money.

Almost 80 per cent of the 142 establishments surveyed noticed geopolitical tensions as the most important threat over the following decade, whereas 83 per cent cited inflation as a priority over the following 12 months.

Click on right here to entry our Financial Calendar

Market Evaluation Crew

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]